International migration, capital flows and the global economy: a long

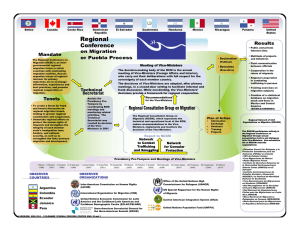

Anuncio