Dades ba?siques 2012b_Capas_Ok:Dades bàsiques 2007

Anuncio

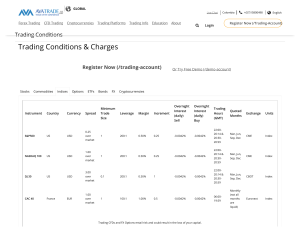

Dades ba?siques 2012b_Capas_Ok:Dades ba siques 2007 14/3/13 15:17 Página 24 Barcelona Stock Exchange Passeig de Gràcia, 19. 08007 Barcelona Phone (34) 93 401 35 55. Fax (34) 93 401 36 95 Internet: www.borsabcn.es E-mail: [email protected] fact sheet 2012 Barcelona Stock Exchange 14/3/13 15:17 Página 2 fact sheet 2012 Dades Generalgenerals data History Board of Directors The roots of the Barcelona Stock Exchange go back to the Middle Ages with the emergence of commodity exchanges at the time of the Commercial Revolution in Catalonia. The "Ordinacions" promulgated by King James I in 1271 is the oldest and most complete text regulating the role of the mercantile mediator. Chairman: Joan Hortalà i Arau Directors: Fernando Cánovas Atienza Pablo Cigüela Ibáñez Pedro Estruch Jané Enrique García Palacio Towards the middle of the nineteenth century, with the industrial boom and the birth of the first Catalan corporations, the trading of securities was started, with an active market in Barcelona where the role of the mediators was carried out by "Corredores Reales", forerunners of the later "Agentes de Cambio y Bolsa" (stockbrokers). Organization and operation Dades ba?siques 2012b_Capas_Ok:Dades ba siques 2007 José Luis Negro Rodríguez Pedro Perelló Pons General Manager: José Mª Antúnez Xaus Employees: 57 The Official Stock Exchange was created in 1915, its government and administration being entrusted, until 29 July 1989, to the "Colegio de Agentes de Cambio y Bolsa" (Stockbrokers´ Association). With the coming into force of Stock Market Act 24/1988 on 29 July 1989, the Barcelona Stock Exchange came under the control of the "Sociedad Rectora de la Bolsa de Valores de Barcelona, S.A.U.". In 2002 the Barcelona Stock Exchange, along with Iberclear and the other Spanish markets, formed the Bolsas y Mercados Españoles Group (BME). The organisation and members of the Barcelona Stock Exchange. A network at the service of investment. 2 Members 28 – Securities Companies – Credit Entities – Securities Agencies 16 10 2 3 Dades ba?siques 2012b_Capas_Ok:Dades ba siques 2007 Type of market Interconnected Stock-Market System Computer-assisted trading for stocks integrated in the Interconnected Stock-Market System. This system gives equal access to all members of the Spanish Stock Exchanges, to a single national market. More than 95% of the total volume traded on the Spanish stock markets is negotiated in this system. Trading hours: The most liquid shares are traded continuously from 09:00 to 17:30, with an opening auction between 08:30 and 09:00 and a closing auction from 17:30 to 17:35. 14/3/13 15:17 Página 4 Trading hours: There is an opening auction between 8:30 and 09:00 h. After this auction, there is a continuous trading from 09:00 to 17:35 h. Floor trading Electronic trading in stocks not integrated in the Interconnected Stock-Market System, included the Barcelona Stock Exchange Second Market for small and medium - sized corporations. Parallelly to the phone trading system there is a complementary electronic trading system where simple transactions can be carried out. Trading hours: Telephonic trading: 9 h. to 17 h. Electronic trading: from 9 h. to 16:30 h. Mercado Alternativo Bursátil (MAB) A Multilateral Trading Facility provided for the trading of securities that, due to the particular legal conditions the issuers are subject, or due to their size or special characteristics, require specific treatment for their trading, clearing, settlement and registration. Trading hours: First auction period: from 8:30 h. to 12 h. Currently the MAB has three distinct securities trading segments: First assignment of prices: 12 h. Less liquid shares are traded via a system based on two daily fixing at 12:00 and 16:00. Warrants A specialised segment of the Interconnected StockMarket System reserved for the trading of warrants, certificates and other products. Second auction period: from 12 h. a 16 h. Second assignment of prices: 16 h. Stock Market system for fixed income and public debt from 9:00 h. to 17:30 h. Exchange Traded Funds (ETFs) A special segment of the Interconnected Stock Market System dedicated to the trading of Exchange Traded Funds (ETFs). 4 Trading days • Risk capital segment. January 1 May 1 • Growing companies segment. Trading hours: from 9 h. to 16:30 h. A Multilateral Trading Facility for shares issued by entities based in Latin-American countries and previously listed on a Latin-American Stock Exchange. Telephonic trading, assisted by screens with information on Catalonia Public Debt. Forms of trading are identical to those available on the market of entries in the CADE (Central de Anotaciones de Deuda del Estado) and all technical procedures have been developed along the same lines. Trading Monday to Friday 2012 featured, 256 trading days. Latin-American Market (LATIBEX) Catalonian Public Debt Market Trading hours: From 9:00 h. to 17:35 h. • Investment Companies with Variable Capital (SICAV) and hedge funds in the form of companies (SIL) segment. Electronic trading of fixed income and public debt within the Stock Market system. Trading hours: Products traded: options and futures on stock indices and shares. Trading hours: Opening auction: From 8:30 h. to 11:30 h. Continuous trading: From 11:30 h. to 17:30 h. Options and futures market All Barcelona Stock Exchange members have access to the options and futures market on variable income. Public holidays in 2013 March 29 December 25 April 1 December 26 Transactions All operations are cash transactions, although creditbased operations are allowed in the case of certain stocks. Trading on credit In accordance with the Ministerial Order of 25/3/1991 and the rules established by the Barcelona Stock Exchange, once the investor has provided a cash guarantee of 25% of the total amount involved in the transaction, Securities and Stock Exchange Companies as well as other financial institutions may 5 Dades ba?siques 2012b_Capas_Ok:Dades ba siques 2007 14/3/13 15:17 Página 6 BCN Profit-30 Index BCN INDEXCAT Index This is a Barcelona Stock Exchange index composed of the shares of the 30 most profitable companies in the IBEX 35®. The index is calculated by weighting each equity according to the quarterly profits declared by the companies concerned. This is a Barcelona Stock Exchange index composed of the shares of the 15 Catalonia-based listed companies with the highest stock market capitalisation adjusted for floating capital. The index is weighted by capitalisation. Date and base: 1-1-2001 = 10,000. BCN PER-30 Index grant a credit in cash in the case of purchases, and a loan of share certificates in the case of sales, against payment of interest. Credit may be granted for up to three and a half months. Trading on credit may only be done for a minimum cash value of 1,200 euros. The Barcelona Stock Exchange accepts trading on credit for 34 of the most important stocks. Settlement Settlement of daily transactions is carried out three working days later. 6 This is a Barcelona Stock Exchange index composed of the shares of the 30 lowest price/earning ratio (PER) companies, in the IBEX 35®. The index is calculated by weighting each equity according to the PER. Date and base: 1-1-2001 = 10,000. BCN ROE-30 Index This is a Barcelona Stock Exchange index composed of the shares of the 30 highest earning/equity ratio (ROE) companies, in the IBEX 35®. The index is calculated by weighting each equity according to the ROE. Date and base: 1-1-2001 = 10,000. Stock market indices BCN MID-50 Index BCN Global -100 Index This is the official index of the Barcelona Stock Exchange. It is a trade-weighted index, made up of the 100 most traded companies on the Barcelona Stock Exchange. This is an index on the Barcelona Stock Exchange, which is representative of the average segment of the Spanish stock market. It is a simple index comprising the 50 companies included in the IBEX MEDIUM CAP® and IBEX SMALL CAP® Indices. Date and base: 1-1-1986 = 100. Date and base: 1-1-1994 = 4,000. rate ranging from 21% to 27%1 determined by the following bands: Date and base: 1-1-2001 = 10,000. From taxable base Charge Up to taxable Rate base 0 - 6,000,00 21% 6,000.00 1,260.00 24,000.00 25% 24,000.00 5,760.00 Thereafter 27% Spanish Stock Exchanges Index IBEX 35® This is the official index for the continuous market of the Spanish Stock Exchanges. It is an index weighted by market value, made up of the 35 most traded companies on the continuous market of the four Spanish Stock Exchanges. Date and base: 1-1-1990 = 3,000. FTSE Latibex Top Index This is the Latin-American Stock Market index, weighted according to the market value of the main companies listed. Date and base: 12-30-2002 = 1,000. Dividends and profit-shares paid out by resident companies attract an allowance of €1500 annually. The allowance does not apply to dividends and profitshares paid out by collective investment institutions or by securities or units listed on a regulated market as defined by Directive 2004/39/EC of the European Parliament and of the Council of 21 April 2004 on markets in financial instruments if such securities or units were acquired within the two months prior to the date on which such income was paid or if within two months after such date a transfer takes place of securities of the same type. Withholding of 21%2 of gross dividends, to be deducted from the personal income tax charge. Tax Regime Dividends and General Meeting attendance bonuses Dividends, General Meeting attendance bonuses and profit-sharing qualify as investment income, and must generally be added to the "savings" category of the taxable base of personal income tax (Impuesto sobre la Renta de las Personas Físicas), which is taxed at a Interest Interest generally forms part of the "savings" category of the taxable base, which is taxed at a rate ranging from 21% to 27% depending on the taxable band that applies. 1 Tax rates established on a temporary basis for the periods 2012 and 2013 under Royal Decree-Law 20/2011. 2 See Note 1 7 Dades ba?siques 2012b_Capas_Ok:Dades ba siques 2007 Exceptions aside, gross interest income is subject to a withholding of 21%, to be deducted from the personal income tax charge. Capital gains and losses Ley 16/2012 (Fiscal Consolidation Act 2012) introduced major changes to the tax treatment of gains and losses on transfers, which differs on the basis of the length of time over which the gain/loss arose. Gains and losses on asset sales arising over a period of more than 1 year form part of the "savings" category of the taxable base, which attracts the tax bands set out above; such gains and losses may only be set off against other amounts within the same category. Unused losses may be set off against gains arising in the four years following. Gains and losses on asset sales arising over a period of less than 1 year form part of the general category of the taxable base, which attracts the general scale of tax bands, ranging from 24.75% to 52%/56%; such gains and losses may only be set off against other amounts within the same category. 8 Unused losses may be set off against other income forming part of the general category of the taxable base, up to a limit of 10%. Any unused portion of the loss may be set off against other income arising in the four years following, subject to that same limit. The Fiscal Consolidation Act 2012 provides a 14/3/13 15:17 Página 8 transitional regime for unused losses as at 31 December 2012. This general tax regime also applies to capital gains on sales and redemptions of shares and units of collective investment institutions. However, such gains or losses sometimes go free of personal income tax if the proceeds are reinvested in the acquisition of other shares or units of collective investment institutions, where the newly purchased shares or units preserve the value and acquisition date of the sold/redeemed shares or units. exemptions available under Spanish tax law. The investor must produce proof of domicile. However, the Ley del Impuesto sobre la Renta de los No Residentes (Non-Resident Income Tax Act) allows an exemption for income obtained by nonresident individuals or entities from the sale of securities or the redemption of units in investment funds taking place on a Spanish regulated market without the involvement of any permanent establishment in Spain if such individual or entity is resident in a state that has in place a double taxation treaty with These deferral rules do not apply if the proceeds of sale or redemption of shares and units of collective investment institutions are made available to the taxpayer in any form. Nor do the deferral rules apply if the sale or redemption concerns shares in the equity of a collective investment institution qualifying as a listed investment fund (ETF). Spain with an information exchange clause. Under most of the treaties to which Spain is a signatory the final tax rate in the source country is 15% for dividends and 10% to 15% for interest. The person under an obligation to pay in a 21% withholding on the gain is sometimes the shareholder/unitholder making the sale or redemption. International double taxation. Here, the tax regime is shaped by the existence of a double taxation treaty between Spain and the investor's country of residence and by the various Wealth Tax Royal Decree-Law 13/2011 reinstated within the Spanish tax system the Impuesto sobre el Patrimonio – wealth tax – limited in time to the tax years 2011 and 2012.3 The Fiscal Consolidation Act 2012 extended the life of wealth tax to the tax year 2013. Subject to the above, dividends and profit-shares obtained without the involvement of a permanent Taxable gains on the sale or redemption of shares or units in collective investment institutions are subject to a withholding of 21%, except if the collective investment institution qualifies as a listed investment fund (ETF). Documentados) and from value-added tax (Impuesto sobre el Valor Añadido). establishment in Spain by individuals resident in another member state of the European Union or in a country or territory with which an information The reintroduction of wealth tax places taxable persons under a duty to report their assets and rights at year-end. wance of €1500. Under the Ley 19/1991 (Wealth Tax Act), fixed-income securities, equity securities and investment fund units must be measured as follows: Exemption from value-added tax and transfer - Fixed-income securities: exchange agreement is extant attract a tax-free allo- tax Outside certain statutory exceptions specifically involving transfers of title to land, sales of securi- Securities representing assignments to third parties of own capital (treasury bills, bonds and debentures, etc.) are measured at their average quoted value in the fourth quarter of the year. ties, exchange-traded or otherwise, are exempt from transfer tax/stamp duty (Impuesto sobre Transmisiones Patrimoniales y Actos Jurídicos 3 The Madrid regional government applies a 100% rebate, so taxpayers effectively go free of wealth tax. 9 Dades ba?siques 2012b_Capas_Ok:Dades ba siques 2007 14/3/13 15:17 Página 10 Règim la inversió Foreignde Investment estrangera Regime Foreign investment in Spain is governed by Royal Decree 664/1999 of 23 April concerning foreign investment. Persons holding title to foreign investments A foreign investment in Spain, to qualify as such, must be held by a non-resident individual or legal person domiciled overseas. - Equity securities: Securities representing a share in the equity of any form of entity listed on a regulated market, other than a collective investment institution, are measured at their average quoted value in the fourth quarter of the year. - Collective Investment Institutions: Securities representing a share in the members' funds or equity of a collective investment institution are measured at their net asset value at the date of accrual of the tax (31 December). Foreign investments in Spain arise in the following ways: Foreign investment in Spain, and disinvestment, is deregulated. However, the deregulated regime may be suspended: - The Council of Ministers may suspend the generally applicable deregulated regime were investment affects activities impinging on the exercise of government powers, or on public order, public safety or public health. Here, investment becomes subject to prior government authorization. - Activities directly relating to national defence require prior government authorization and are subject to a special regime. - Shareholdings in Spanish companies. - Creation or expansion of a branch network. - Subscription for and acquisition of tradable securities representing borrowings issued by residents. - Shareholdings in investment funds registered with the Comisión Nacional del Mercado de Valores, the Spanish securities market regulator. - Acquisition of real property in Spain. - Creation or formation of, or shareholdings in, joint ventures, foundations, economic interest groupings, cooperatives and partnerships. 10 Restriction on foreign investment - Special regimes also apply to foreign investment in Spain in relation to air transport, radio broadcasting, minerals and raw materials, strategic minerals and mining rights, television broadcasting, gambling and telecommunications. Reporting foreign investment disinvestment from Spain Foreign investment in/disinvestment from Spain must be reported to the Ministry of Economy and Finance's Investment Registry for administrative, statistical and economic purposes. Investment originating in countries or territories qualifying as tax havens, however, are subject to ex ante reporting – except, for the purposes with which we are concerned here, if such investment targets tradable securities that have already been issued or publicly offered on a regulated market. Specific registration with the stock exchange is not required. The following persons must report investments/disinvestments: - As a rule, the non-resident owner of the investment. - In particular: • An investment in tradable securities must be reported by an investment service entity, a credit institution or another financial institution holding an authorization or mandatorily involved in subscription for or sale of securities or acting as the depositary or manager of acquired securities. • The Spanish company attracting the investment if the shares are registered. • The investment fund management company if the transaction involves a Spanish investment fund. Protector de l’inversor The Investors´ Ombudsman The person appointed by the Barcelona Stock Exchange to protect and safeguard the rights and legitimate interests of investors and process any complaints made in relation to the operations carried out on the Barcelona Exchange against the Exchange itself or the Companies and Stockbrokers who are members. 11 Dades ba?siques 2012b_Capas_Ok:Dades ba siques 2007 14/3/13 15:17 Página 12 700 BCN INDEXCAT Base 1-1-2001 = 10.000 650 2012 in figures This is calculated daily, in real time. 550 500 Spanish stock exchanges indices 450 This index, together with the IBEX MEDIUM CAP® and IBEX SMALL CAP® indices, is calculated daily, in real time. 30-12-11 14-01-12 29-01-12 13-02-12 28-02-12 14-03-12 29-03-12 13-04-12 28-04-12 13-05-12 28-05-12 12-06-12 27-06-12 12-07-12 27-07-12 11-08-12 26-08-12 10-09-12 25-09-12 10-10-12 25-10-12 09-11-12 24-11-12 09-12-12 24-12-12 400 IBEX 35® Base 1-1-1990 = 3,000 Índexs de la Borsa Barcelona Stock de Barcelona Exchange indices 2012 BCN GLOBAL-100 Listing changes (number of issuers) On 12-31-2012 = 8,167.50 BCN Global-100 Base 1-1-1986 = 100 BCN PROFIT-30 Base 1-1-2001 = 10,000 FTSE Latibex TOP Base 30-12-2002 = 1,000 New listings Exclusions A general index and nine sectorial indices are calculated daily, in real time. This is calculated daily, in real time. This is calculated daily, in real time. Market value On 12-31-2012 = 10,476.23 On 12-31-2012 = 4,442.40 Year low: 459.11 (07/24) Year high: 683.73 (02/09) 03/31/2012: 608.44 06/29/2012: 550.67 09/28/2012: 600.11 12/31/2012: 644.24 BCN PER-30 Base 1-1-2001 = 10,000 BCN Global-100 Yearly Base 1-1-2012 = 100 On 12-31-2012 = 15,772.46 A general index and nine sectorial indices are calculated daily, in real time. BCN ROE-30 Base 1-1-2001 = 10,000 On 12-31-2012 = 99.27 This is calculated daily, in real time. This is calculated daily, in real time. On 12-31-2012 = 14,676.95 A general index and eight sectorial indices are calculated daily. On 12-31-2012 = 1,655.80 Activitatof del mercat Activity the stock borsari market Listed securities – Fixed income: Catalonia Public Debt and other Public Funds Debentures 47 94 – Variable income: Shares 126 This is calculated daily, in real time. – Listed Corporations 143 On 12-31-2012 = 11,267.56 1 11 Million euros Catalonia Public Debt and other Public Funds Debentures Shares Total BCN MID-50 Base 1-1-1994 = 4,000 BCN Global-100 Historic Base 1-1-1963 = 100 12 600 On 12-31-2012 = 12,150.64 18,547 6,326 532,601 557,474 Valor devalue les noves admissions Market of new listings Public Funds Debentures Shares Total Million euros 4,357 2,326 4,697 11,380 13 Dades ba?siques 2012b_Capas_Ok:Dades ba siques 2007 New capital issues 14/3/13 33 – For cash 5 – Scrip issues 28 – For cash 4,503 Million euros – Scrip issues 1,712 Million euros Trading volume Volum negociat 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 0 Largest corporations Societats de major according to their market value capitalització PER Effective Million euros 55,013 1,608 133,930 190,551 30% Variable Income 70% 14 Página 14 Stock Exchange ratios 12-31-2012 Number of new capital issues Catalonia Public Debt and other Publics Funds Debentures Shares Total 15:17 Fixed Income 133.930 56.621 Div/P % Sector P/E Yield Electricals 8.31 7.63 20.05 8.72 Banks Chemicals 9.58 6.73 Cement, Building and Real Estate 13.46 5.22 Iron and Steel 28.14 2.71 Food, Agric. and Forestry 18.22 2.95 Textiles and Paper 29.11 1.74 Trade and Finances 9.60 3.69 Service and Sundry 11.16 7.33 General Barcelona Stock Exchange 14.73 7.43 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 (Million euros) Industria de Diseño Textil “INDITEX” 65,761 Banco Santander 62,959 Telefonica 46,375 Banco Bilbao Vizcaya Argentaria 37,924 Iberdrola 25,753 Repsol 19,264 Endesa 17,861 Gas Natural SDG 13,589 CaixaBank 11,383 Abertis Infraestructuras 10,120 Amadeus It Holding 8,256 Ferrovial 8,215 Grifols 7,784 Mapfre 7,129 ACS Actividades de Construcción y Servicios 5,991 Banco de Sabadell 5,845 Red Eléctrica Corporación 5,046 Banco Popular Español 4,927 Zardoya Otis 4,161 Enagás 3,853 Societats Most traded de major corporations contractació 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 (Million euros) Banco Santander 30,188 Banco Bilbao Vizcaya Argentaria 18,606 Telefónica 17,903 Industria de Diseño Textil “INDITEX” 13,304 Repsol 11,533 Iberdrola 7,866 Amadeus It Holding 3,168 Abertis Infraestructuras 2,834 Ferrovial 1,922 Enagás 1,880 Red Eléctrica Corporación 1,858 Banco de Sabadell 1,523 Banco Popular Español 1,289 Gas Natural SDG 1,163 Distribuidora Internacional de Alimentación 898 CaixaBank 895 Mapfre 773 Bankia 761 ACS Actividades de Construcción y Servicios 735 Grifols 637 15 14/3/13 15:17 Página 16 Barcelona Stock Exchange services and products Dades ba?siques 2012b_Capas_Ok:Dades ba siques 2007 Trading assistance The Barcelona Stock Exchange has an integral communications network which allows its members access to the following markets: - Interconnected Stock-Market System. - Fixed Income and Public Debt Trading System. - Options and Futures market (variable income). Settlement, deposit and back-office services The Barcelona Stock Exchange also provides services in the following areas: - Clearing and Settlement Systems (SCLBARNA). - Deposit Management Service (SGD). - Administration systems. Transmission of book entries. Control of issuers´ financial operations. Transaction register. Shareholder register. Accounting register of non-listed shares, etc. The Electronic Trading Centre Parquet Electrònic Centrally located and equipped with the most advanced technology, the Electronic Trading Centre is the new gateway to the major national and international markets, as well as a point of reference for broker-dealing and channelling investments, since it permits simultaneous trading on a large number of markets, as well as the direct interaction of investors. 16 Trading and settlement Contractació i liquidació Order routing service (SGO) A routing system (with automatic interface with the SIBE), allowing Stock Exchange members computerized reception, transmission and confirmation of orders to be traded on the continuous market and the traditional floor. It also features a system for publication and matching of deals, as well as real-time information on market prices and trading volume. Information available All Information concerning the Barcelona Stock Exchange and other Spanish and International markets is available via the services provided, according to the agreements reached with Infobolsa. NetStation. This platform provides real time information on the most relevant national and international variable income, fixed income, derivatives, commodities, money markets, currencies and investment funds. This service also provides eco- nomic and financial information, forecasts and consensus of all equities included. In addition, it provides real time news from the most prestigious national and international agencies. The NetStation platform has a powerful built-in professional Technical Analysis tool with more than 40 indicators and oscillators. Web Terminal. This service, aimed at non-professional investors, is based on the new Rich Internet Application concept and supports the latest “FLEX” technologies that allow the reception of information in real time with the same power and reliability as conventional terminals. Without the need to install any new applications on their computer, the user can receive automatically updated information on the Spanish Continuous Market, the main international indexes, the Spanish futures market (MEFF), the German futures market (Eurex) as well as currencies and news. Web Terminal also features a chart analysis tool and allows user customisation of pages and portfolios. World Integrated Feed (WIF) Data Flow. A digital data flow is available to clients whereby they can receive and process financial information from the national and international markets in either real time, delayed or at close of trading, via a single connection. ASP Services. Make it possible to insert financial information components or tools (tickers, national and international markets tables, advanced graphics, real time or delayed user portfolio updates, currency calculators, etc. into any webpage. All components and tools inserted do not affect the corporate image of the webpage in question. 17 Dades ba?siques 2012b_Capas_Ok:Dades ba siques 2007 Mobile Devices. This service makes it possible to offer end users real time, recorded or close of trading updates on the share prices of equity traded on the national and international markets via mobile devices and/or terminals with i-mode technology (mobile phones, Blackberry, PDA’s, IPAD etc.). 14/3/13 15:17 Página 18 Services for the general public and issuers All Departments of the Barcelona Stock Exchange are open to the public to deal with any questions about the stock market and the securities traded on it, as well as any questions brought up by listed corporations. Specialised services for small and medium sized companies Apart from the Second Market for Small and Medium sized Companies the Barcelona Stock Exchange has set up a sertes of complementary services designed to encourage new companies to enter the stock market. These services are as follows: - Publishing of operations carried out on unlisted stocks. - Book keeping under the book entry system, of the accounts record of unlisted stocks. Library Publicacions Publications Periodical publications: Market Price Bulletin. Includes daily information on prices and trading volume as well as information on securities traded. This is available free of charge, from 19.00 onwards at www.borsabcn.es. The Library consists of a collection of books and journals on financial and economic subjects, including mainly data on national and foreign stock exchanges, corporate finance, security analysis and portfolio management. Annual and audit reports of listed corporations are available to the public in the library. Visits to the Stock Exchange Quarterly and Biannual Information. Comprises financial statements and other relevant economic information on listed corporations. It is available at www.borsabcn.es. There is a daily service of organized visits which, in 2012, catered for 13.415 visitors, mainly university students and students from high schools. The Barcelona Stock Exchange Annual Report. Features a complete statistical annex. It is available at www.borsabcn.es. Information Leaflets (free). Fact Sheet 2012 (Spanish, Catalan and English). 18 19 Barcelona Stock Exchange Members Dades ba?siques 2012b_Capas_Ok:Dades ba siques 2007 20 14/3/13 15:17 Securities Companies Página 20 Credit Entities ACA S.A., S.V. Av. Meridiana, 27, 3ª planta 08018 – Barcelona Office Phone: 93 390 49 00 Stock E. Phone: 93 401 35 55 GVC Gaesco Valores, S.V., S.A. Doctor Ferran, 3-5 08034 – Barcelona Office Phone: 93 366 27 27 Stock E. Phone: 93 401 36 00 Banco Alcalá, S.A. Paseo de Gracia, 7, 4º B 08002 – Barcelona Office Phone: 93 521 55 00 Stock E. Phone: 93 401 35 55 Banco Mediolanum, S.A. Av. Diagonal, 668-670 08034 – Barcelona Office Phone: 93 253 54 00 Stock E. Phone: 93 401 36 66 Agentes de Bolsa Asociados, S.V., S.A. Av. Diagonal, 453 bis, 6ª planta 08036 – Barcelona Office Phone: 93 270 25 35 Stock E. Phone: 93 401 35 23 Interdín Bolsa, S.V., S.A. Paseo de la Castellana, 93, planta 11 28046 - Madrid Office Phone: 91 555 57 61 Stock E. Phone: 93 401 35 55 Banco Bilbao Vizcaya Argentaria, S.A. Pl. Cataluña, 5 08002 – Barcelona Office Phone: 93 404 38 00 Stock E. Phone: 93 401 35 45 CaixaBank, S.A. Av. Diagonal, 621-629. Torre 2 08028 – Barcelona Office Phone: 93 404 60 00 Stock E. Phone: 93 401 35 55 Ahorro Corporación Financiera, S.A., S.V. Av. Diagonal, 640, 1º. D 08017 – Barcelona Office Phone: 93 366 24 00 Stock E. Phone: 93 401 35 55 Inverseguros, S.V., S.A.U. Pedro Muñoz Seca, 4 28001 - Madrid Office Phone: 91 426 38 20 Stock E. Phone: 93 401 35 55 Banco de Sabadell, S.A. Príncipe de Vergara, 125 28002 – Madrid Office Phone: 91 782 90 00 Stock E. Phone: 93 401 35 55 Cortal Consors, Sucursal en España Ribera del Loira, 28, 4ª planta 28042 - Madrid Office Phone: 91 209 50 50 Stock E. Phone: 93 401 35 55 Auriga Global Investors, S.V., S.A. Av. Diagonal, 468, 3º C 08006 – Barcelona Office Phone: 93 445 68 70 Stock E. Phone: 93 401 35 55 Link Securities, S.V., S.A. Rambla Volart, 96, entresuelo 08041 – Barcelona Office Phone: 93 456 57 61 Stock E. Phone: 93 401 36 87 Banco Espirito Santo de Investimento, S.A., Sucursal en España Serrano, 88 28006 – Madrid Office Phone: 91 400 54 00 Stock E. Phone: 93 401 35 55 Deutsche Bank AG, Sucursal en Londres Winchester House, 1. Great Winchester Street London, EC2N 2DB, United Kingdom Office Phone: +44 (20) 75 45 8000 Stock E. Phone: 93 401 35 55 Banesto Bolsa, S.A. S.V. Gran Via de les Corts Catalanes, 583 08011 – Barcelona Office Phone: 93 214 45 43 Stock E. Phone: 93 401 35 55 Mercavalor, S.V., S.A. Velázquez, 64-66, 7º Izquierda 28001 - Madrid Office Phone: 91 770 98 70 Stock E. Phone: 93 401 35 55 Bankia Bolsa, S.V., S.A. Serrano, 39 28001 - Madrid Office Phone: 91 436 78 00 Stock E. Phone: 93 401 35 55 Mirabaud Finanzas, S.V., S.A. Pl. Francesc Macià, 7, 1ª. planta 08029 – Barcelona Office Phone: 93 556 98 00 Stock E. Phone: 93 401 37 52 Caja 3 Bolsa S.V., S.A. Doctor Val-Carreres, 12 50004 - Zaragoza Office Phone: 976 718 999 Stock E. Phone: 93 401 35 55 Renta 4, S.A., S.V. Paseo de Gracia, 77, 5ª planta 08008 – Barcelona Office Phone: 93 304 19 00 Stock E. Phone: 93 401 36 44 C.M. Capital Markets Bolsa, S.V., S.A. Av. Josep Tarradellas, 8 -10 08029 – Barcelona Office Phone: 93 410 76 15 Stock E. Phone: 93 401 35 20 Santander Investment Bolsa, S.V., S.A. Paseo de Gracia, 5 08007 – Barcelona Office Phone: 93 401 11 00 Stock E. Phone: 93 401 35 51 Banco Inversis, S.A. Av. Diagonal, 640 08017 – Barcelona Office Phone: 93 238 48 50 Stock E. Phone: 93 401 35 55 Société Générale, Sucursal en España Paseo de Gracia, 56, 7º A 08007 – Barcelona Office Phone: 93 272 27 50 Stock E. Phone: 93 401 35 55 21 Dades ba?siques 2012b_Capas_Ok:Dades ba siques 2007 14/3/13 15:17 Página 22 Securities Agencies Eurodeal, A.V., S.A. Av. Diagonal, 640, 6ª planta 08007 – Barcelona Office Phone: 93 228 78 00 Stock E. Phone: 93 401 36 48 Gestión de Patrimonios Mobiliarios, A.V., S.A. Rambla de Catalunya, 98, 8º 2ª 08007 – Barcelona Office Phone: 93 242 78 62 Stock E. Phone: 93 401 35 55 For any further information, please contact: 22 Departments of Markets and Information and Study, Publications and International Relations Barcelona Stock Exchange Passeig de Gràcia, 19 08007 - Barcelona Tlfs. (34) 93 401 36 84 – (34) 93 401 36 68 Fax (34) 93 401 36 95 – (34) 93 401 36 25 23