Consultation on Financial Crisis and Trade: Towards an

Anuncio

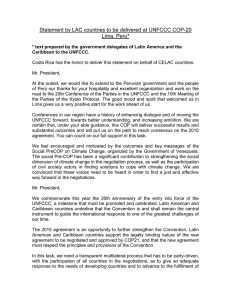

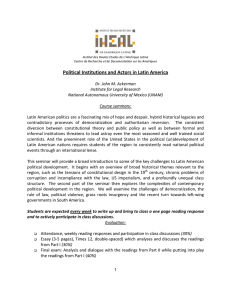

Sistema Económico Latinoamericano y del Caribe Latin American and Caribbean Economic System Sistema Econômico Latino-Americano e do Caribe Système Economique Latinoaméricain et Caribéen Consultation on Financial Crisis and Trade: Towards an Integrated Response in the Latin America/Caribbean Region Aldo Caliari, Director del Center of Concern Reunión de Consulta sobre Crisis Financiera y Comercio: Hacia una Respuesta Integrada en América Latina y el Caribe Caracas, Venezuela 1 y 2 de septiembre de 2009 SP/RCCFC:HRIALC/Di N° 2-09 Copyright © SELA, septiembre de 2009. Todos los derechos reservados. Impreso en la Secretaría Permanente del SELA, Caracas, Venezuela. La autorización para reproducir total o parcialmente este documento debe solicitarse a la oficina de Prensa y Difusión de la Secretaría Permanente del SELA ([email protected]). Los Estados Miembros y sus instituciones gubernamentales pueden reproducir este documento sin autorización previa. Sólo se les solicita que mencionen la fuente e informen a esta Secretaría de tal reproducción. CONFÉRENCE DES NATIONS UNIES SUR LE COMMERCE ET LE DÉVELOPPEMENT UNITED NATIONS CONFERENCE ON TRADE AND DEVELOPMENT Consultation on Financial Crisis and Trade: Towards an Integrated Response in the Latin America/ Caribbean Region Dates: September 1‐2, 2009 Venue: SELA (Caracas) Participation and audience: officials from governments of the region in charge of finance and trade portfolios, intergovernmental organizations, academics, selected NGOs. Goals: 1) To assess the role that trade structures and their linkages with finance have played in the unfolding of the crisis in Latin American/ Caribbean countries and ensure such assessment is included in the responses. 2) To explore the practical applications that an integrated approach to trade and financial policies could have on improving specialised policy‐making on both the trade and the macroeconomic and financial fields, domestically and internationally. Themes: Financial markets and specialization in international trade: the case of commodities Financial markets have traditionally played a prevailing role in influencing the international division of labor and the determination of comparative advantages, with profound consequences in the trade profile of Latin American countries, their dependence on natural resources and industrialization opportunities. The dual nature of raw materials as tradable goods and financial assets poses serious challenges in the region. This dynamic is becoming clear in the trade channels through which the effects of the crisis are materializing in the countries of the region. How can the trade concerns of countries in the region be more effectively placed upfront in the design of policy and regulation towards financial markets? Financial and exchange rate volatility and trade The crisis has shed new light on the limited effectiveness of the global monetary and financial system to provide for the stability of exchange rates. Such stability is a central element in any trade‐led development strategy, tending to affect in a more profound way small and non‐diversified economies. The utilization of a domestic currency, the US dollar, as the primary international trading currency exacerbates such difficulties and the exposure to exchange rate fluctuations. What are the domestic and regional options for countries in the region to achieve an exchange rate more favorable to trade and development? What options to diversify markets and export products? What consequences would such options have on the financial stability of the countries in the region? Role of trade and investment in capital accumulation for development The financial crisis downturn in exports is affecting the income of countries in the region but, even in benign times, these countries were struggling to turn trade into a source of capital accumulation at the domestic level. What policies are needed in order to restore the broken link between trade and the accumulation of capital domestically? What are the relevant policies needed to create an enabling environment for industrialization on issues such as exchange rates, fiscal, investment, transfer pricing and debt management? The role of “aid for trade” in addressing trade disadvantages Recent proposals at the multilateral level have intensified the debate on the need for Aid for Trade. What is the real scope of Aid for Trade and in which environment can it yield the best results? What proportion of Aid for Trade should go to finance productive capacities and infrastructure? What are the consequences for financial, disbursement, measurement and monitoring mechanisms? Fiscal space for infrastructure, indebtedness and trade A trade‐led development strategy cannot succeed without strong investment in infrastructure. But deep reforms in Latin America to incentivize private participation and their disappointing results, have demonstrated the limitations of resort to private investment and the irreplaceable character of public investment. In turn, greater resort to public investment requires an expansion of fiscal space, with consequences for public debt and fiscal deficits, a toll call in times of financial crisis. Therefore, the expected gains from investment in trade‐related infrastructure should be evaluated with maximum caution. How should investment in trade‐related infrastructure be balanced with a sustainable public debt profile? What instruments can be proposed for such balancing? What are the consequences for the design of public –private partnerships? Trade capacity and access to credit The existence of a level playing field for trade continues to be illusory as developing countries suffer of unfavorable conditions in access to credit, including trade credit, compared with developed ones, a fact that affects especially the SMEs. The financial crisis is only deepening these asymmetries. In many countries building export capacity continues to be hindered by the unreliable conditions in access to credit suffered by companies that produce for an export market. What policies are recommended to promote more favorable access to credit for export‐oriented production? How are ongoing proposals for reform of the banking supervisory and regulatory framework going to affect such access? What lessons should be drawn for the liberalization of financial services?