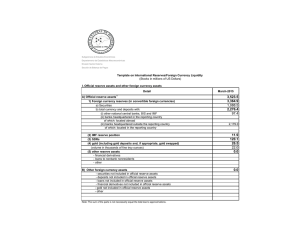

No. 531 - Banco de la República

Anuncio