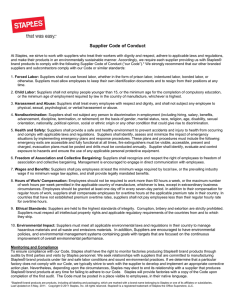

supplier development, production environment and - Littec

Anuncio