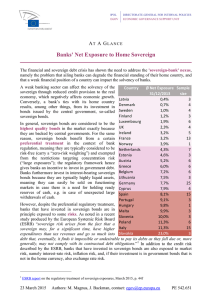

FDI in the Banking Sector: Why borrowing costs fall while spread

Anuncio