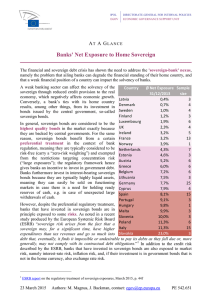

Banking on Politics

Anuncio