- Ninguna Categoria

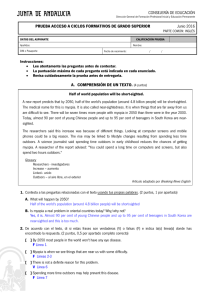

Stock characteristics and market myopia

Anuncio