XII Iberian-Italian Congress of Financial and Actuarial Mathematics

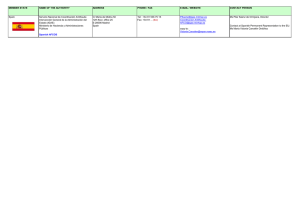

Anuncio