oecd/wto trade in value added (tiva) indicators united kingdom

Anuncio

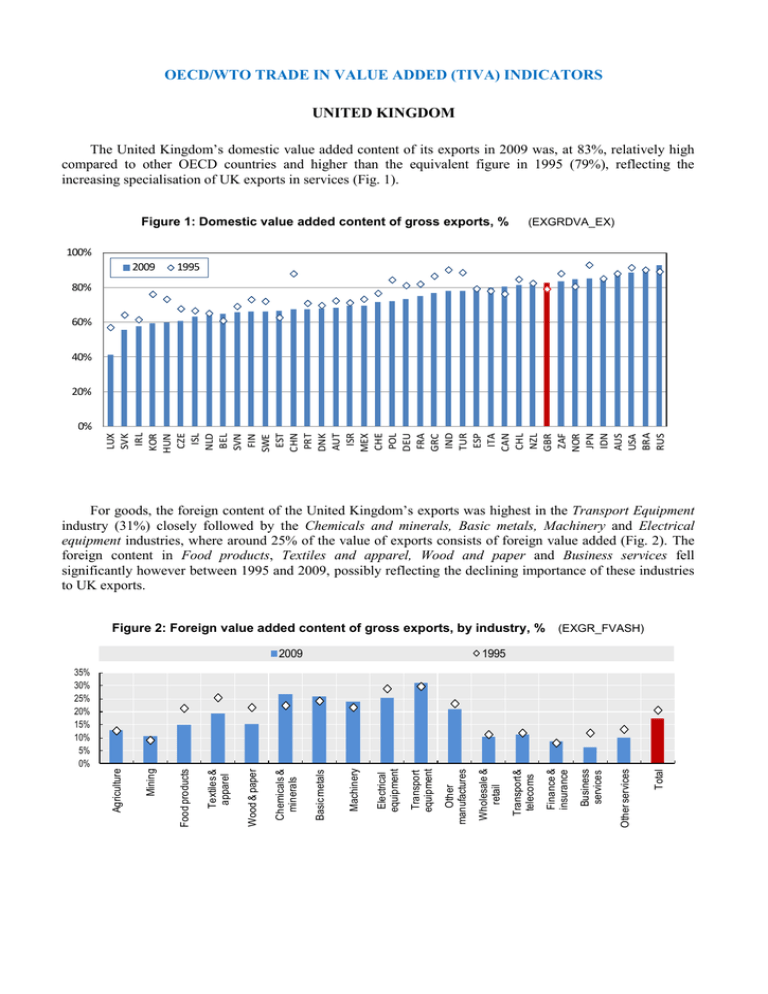

OECD/WTO TRADE IN VALUE ADDED (TIVA) INDICATORS UNITED KINGDOM The United Kingdom’s domestic value added content of its exports in 2009 was, at 83%, relatively high compared to other OECD countries and higher than the equivalent figure in 1995 (79%), reflecting the increasing specialisation of UK exports in services (Fig. 1). Figure 1: Domestic value added content of gross exports, % (EXGRDVA_EX) 100% 2009 1995 80% 60% 40% 20% LUX SVK IRL KOR HUN CZE ISL NLD BEL SVN FIN SWE EST CHN PRT DNK AUT ISR MEX CHE POL DEU FRA GRC IND TUR ESP ITA CAN CHL NZL GBR ZAF NOR JPN IDN AUS USA BRA RUS 0% For goods, the foreign content of the United Kingdom’s exports was highest in the Transport Equipment industry (31%) closely followed by the Chemicals and minerals, Basic metals, Machinery and Electrical equipment industries, where around 25% of the value of exports consists of foreign value added (Fig. 2). The foreign content in Food products, Textiles and apparel, Wood and paper and Business services fell significantly however between 1995 and 2009, possibly reflecting the declining importance of these industries to UK exports. Figure 2: Foreign value added content of gross exports, by industry, % Total Other services Business services Finance & insurance Transport & telecoms Wholesale & retail Other manufactures Transport equipment Electrical equipment Machinery 1995 Basic metals Chemicals & minerals Wood & paper Textiles & apparel Food products Mining 35% 30% 25% 20% 15% 10% 5% 0% Agriculture 2009 (EXGR_FVASH) The share of intermediate imports used to produce exports was highest in Basic metals products (53%); while around 35% of imported intermediate Mining, Machinery, Transport equipment and Textiles and apparel products were subsequently being exported (Fig. 3). Shares fell between 1995 and 2009 for quite a few import categories, notably Electrical equipment, mirroring the significant fall in the industry's share of overall value added exports (7% in 2009 compared to 14% in 1995). Figure 3: Share of imported intermediate inputs that are exported, by import category, % (REI) 2009 1995 60% 40% Total Other services Business services Finance & insurance Transport & telecoms Wholesale & retail Utilities Other manufactures Transport equipment Electrical equipment Machinery Basic metals Chemicals & minerals Wood & paper Textiles & apparel Food products Mining 0% Agriculture 20% Nearly one-fifth of the total value of UK exports of Transport equipment originated in other European countries, about the same as in 1995 (Fig. 4). However, other European transport equipment manufacturers contributed less in 2009 (2.5%) than in 1995 (3.0%) while the shares provided by North American transport equipment manufacturers rose nearly 1 percentage point (pp). The foreign content of UK Transport equipment provided by business services increased notably too, again driven by an increase in North American input. Figure 4: Foreign value added in Transport equipment, by originating region and industry, % East and S.E. Asia Europe North America Other regions South America 5.0 4.0 3.0 2.0 1.0 0.0 1995 2009 1995 2009 1995 2009 1995 2009 1995 2009 1995 2009 1995 2009 1995 2009 1995 2009 1995 2009 Mining Chemicals & minerals Basic metals Electrical Transport Wholesale Transport & Finance & equipment equipment and retail telecoms insurance Business services Other [Figure 4 illustrates how the TiVA infrastructure can be used to focus on the origins of foreign value added in the output of a particular sector in a particular country]. The UK-US bilateral trade relationship is stronger in value added terms than in gross terms (Fig. 5), There is more UK value added exported to the US and the US is the UK’s main source of value added imports. Meanwhile, the importance of nearby trading partners such as Ireland and Netherlands is reduced. Figure 5a: Exports, partner shares, in gross and value added terms (as a % of total), 2009 Gross exports (EXGRSH) 25.0 Domestic value added in foreign final demand (FDDVASH) 20.0 15.0 10.0 5.0 0.0 USA DEU FRA ITA ESP IRL NLD JPN CHN CAN BEL SAU CHE AUS IND Figure 5b: Imports, partner shares, in gross and value added terms (as a % of total), 2009 Gross imports (IMGRSH) Foreign value added in domestic final demand (FDFVASH) 20.0 15.0 10.0 5.0 0.0 USA DEU FRA CHN ESP ITA NLD NOR JPN IRL BEL RUS CAN POL CHE The domestic value added embodied in exports and intermediate imports embodied in exports, combine to reveal notable differences in United Kingdom’s trade balance positions with some of its major trading partners (as recorded in the OECD-WTO TiVA database). In value added terms an increased surplus with the United States is apparent for 2009 (Fig. 6). Surpluses with Ireland and Switzerland are smaller however, partly reflecting the presence of UK output (notably services) in the exports of these countries to third countries and Irish and Swiss output in UK exports. The UK bilateral trade deficit is smaller with France, Spain, Norway and China in value added terms than in gross terms, partly reflecting the lower domestic value added content of these countries' exports relative to the UK. Figure 6: Bilateral trade balances, USD million, 2009 2009 Gross Trade surplus/deficit (TSGR) 2009 Value Added surplus/deficit (TSVAFD) 20,000 10,000 0 -10,000 -20,000 -30,000 USA SAU IRL AUS SGP CHE FRA NLD ESP DEU NOR CHN In value added terms about 58% of the United Kingdom’s exports reflected services in 2009. This is higher than the OECD average (48%) driven in large part by the relatively high dependency of the UK on exports of services products in gross terms (Fig. 7), and was 16 pp higher than in 1995. The service content of manufactured goods was comparable to other large European economies, at about 30% in 2009 (Fig. 8). Figure 7: Services content of gross exports, 2009 90.0 Domestic content 80.0 Foreign content (EXGR_*_SV; SERV_VAGR) Total 1995 70.0 60.0 50.0 40.0 30.0 20.0 10.0 Foreign service contents LUX GRC ISL IRL GBR BEL ESP DNK FIN IND PRT SWE ISR Figure 8: Services content of gross exports, by industry, 2009 AUT EST FRA CHE USA ITA DEU NZL TUR SVN NLD POL JPN HUN CZE AUS SVK ZAF KOR BRA CAN RUS NOR CHL MEX IDN CHN 0.0 (EXGR_*_SV; SERV_VAGR) Domestic service contents 1995 Total 40% 30% 20% Other manufactures Transport equipment Electrical equipment Machinery Basic metals Chemicals & minerals Wood & paper Textiles & apparel Mining Agriculture 0% Food products 10% The information included in this note is based on the May 2013 release of the Trade in Value Added (TiVA) database. The data can be accessed from www.oecd.org/trade/valueadded. For further information, please contact us ([email protected]).