- Ninguna Categoria

Foreign MLPs

Anuncio

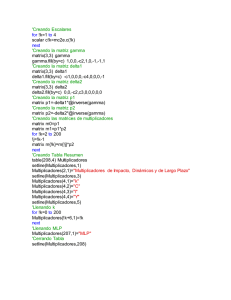

Foreign MLPs Using foreign energy-related assets to attract yield-oriented investors Opp Energy companies around the globe are taking notice of the growth and success of master limited partnerships (MLPs) in the United States. The foreign MLP/YieldCo is one way for foreign companies to benefit from this unique yield-based structure. pportunity Since the debut of the US MLP structure in the early 1980s, more than 120 publicly traded MLPs have been introduced to the market, providing capital to companies with assets that generate “qualifying income” at a lower cost and giving investors a higher-than-typical yield. When evaluating the historical MLP market, successful market participants (which have ranged from the traditional midstream (e.g., pipeline or gathering system MLPs) to upstream, downstream, propane, coal and a variety of other activities) have generally shared certain necessary characteristics — namely: • They have relatively stable earnings and cash flow, along with longer-termed contracted arrangements — allowing for predictable distributions. • They have financially and commercially strong sponsors, often with retained assets (either directly or indirectly) that could be “dropped” (i.e., transferred) into the MLP in the future. • They have assets that can be strategically packaged (e.g., a pure-play MLP) to provide an attractive offering to public markets. • They have an MLP treated as a pass-through entity for US federal income tax purposes in which at least 90% of the MLP’s gross income is “qualifying income” — that is, derived from certain activities in natural resources, real estate or commodities, among others. The success of these energy-oriented MLPs in attracting investors has drawn the attention of companies outside of the US that are eager to raise capital. Companies with foreign assets are increasingly looking to adopt similar business structures — similar to the traditional domestic US MLP structure — that may allow access to the rich yield-oriented investor base for companies listed in the US. The first companies to pursue these structures were international shipping companies. Because shipping companies literally have “floating” assets, depending on the geographical location and type of activity, they often have a limited US federal income tax footprint. Moreover, these first-movers had stable, long-term contracts, strong sponsors and a clear story to present to the market. The same holds true for foreign companies with other types of offshore assets such as drilling rigs. Several foreign MLPs with these types of offshore assets have gone public over the last few years, and in 2014, the first foreign MLP with fixed assets located primarily in foreign countries went public. This trend is expected only to increase in popularity. How foreign MLPs are structured How does the structure work outside the US? Basically, a foreign MLP is a yield-driven company (YieldCo) formed outside the US (typically a low-tax jurisdiction), with units or shares traded on a US stock exchange. Further, most foreign MLPs are organized as limited partnerships or limited liability companies in a lowtax jurisdiction such as the Republic of the Marshall Islands, which has a variety of similarities to a US entity (e.g., legal or regulatory), and has no significant entity-level tax liability. Importantly, regardless of the structure chosen, foreign MLPs typically (although not always) elect to be treated as corporations for US federal income tax purposes. The benefit of this election is two-fold: (a) as a corporation for US federal income tax purposes, the foreign MLP does not have to meet the “qualifying income” rules with respect to its operations; and (b) tax-exempt and foreign investors may be more interested in making investments in the entity, as such investors generally prefer investing in entities that are treated as corporations for US federal income tax purposes (for a variety of US federal income tax reasons). Foreign MLPs 1 Advantage The primary constraints are that the foreign MLP’s assets must produce a stable stream of cash flows over time — this is a market requirement as opposed to a technical or tax requirement. Further, detailed tax and economic modeling is often required to understand and quantify the tax consequences to the investors of the international operations, including, but not limited to, the “tax shield” provided to investors (i.e., the ratio of taxable income to distributed cash). A foreign MLP with significant (or exclusive) offshore operations can mitigate its US federal income liability tax by either (a) the lack of US operations or contacts or (b) deductions for depreciation or other offsets. The actual organizational structuring typically involves the sponsor company forming either a limited partnership or a limited liability company (the foreign MLP). The foreign MLP’s asset is often its ownership of a wholly owned (or jointly owned) operating company, which owns the cash-producing assets — for example, offshore drilling platforms, terminals or storage facilities. The operating company (or other lower-tier entity) is oftentimes the entity that incurs the debt; however, most foreign (and US) MLPs have debt at the MLP level as well — all based on operational and commercial considerations. Similar to the ownership of a US-formed MLP, the ownership of a foreign MLP/YieldCo is split between the sponsor company (or companies) and public investors. The specifics of that split are determined prior to the initial public offering (IPO), based on the optimal size of the offering and the MLP’s capital structure. The sponsor often retains the portion of the IPO not sold to the public (which generally includes subordinated interests and common units) and often a 0% to 2% stake in the MLP that represents full ownership of the general partner (GP) (and which receives the incentive distribution rights (IDRs) that effectively represent the right to increasing cash flows above certain economic performance thresholds). These features oftentimes mirror the structural characteristics of a traditional US-formed MLP. 2 Foreign MLPs The GP manages the day-to-day aspects of the MLP and its operating company. It typically has its own executive team and board of directors, both of which are appointed by the sponsor (and subject to numerous rules and restrictions as to composition and makeup). As one would expect, a number of variances and options are involved in the design and structure of a non-US MLP — as the structure is not a “one-size-fits-all” structure — but the scenario described above is most common. Advantages of non-US MLPs Foreign MLPs/YieldCos share many of the key characteristics of a traditional US-formed MLP: • Minimal tax liability • Cash-producing operating assets • Often stable, long-term contracts • Ability to attract investors with consistent (and growing) distributions of cash But unlike US-formed MLPs, foreign MLPs/YieldCos have no restrictions on asset or income composition. Consequently, additional operational flexibility may result. Additionally, distributions by foreign MLPs/YieldCos (that elect to be classified as a corporation for US federal income tax purposes) to shareholders can be reported via a Form 1099 versus the more complex Schedule K-1 that is required from MLPs that are classified as partnerships for US federal income tax purposes, which can be a major consideration for companies and investors alike. And since foreign MLPs are typically considered foreign private issuers (FPIs) under US securities law, they may receive certain filing accommodations or exemptions. ge These benefits may make it extremely attractive for overseas energy companies to create foreign MLPs, particularly with offshore assets that have limited local tax obligations. Still a market for yield-oriented investments Can foreign MLPs expect the welcome reception that other energy partnerships have received from the US market? The answer, of course, depends on the nature of the offer and the value of the underlying assets. But, in general, there are no signs that the equity markets have grown tired of yield-oriented offerings. Despite the growth in the number of MLPs in the market, there is still an abundance of capital chasing yield-based investments in what has proven to be a long-term, low-interest-rate environment. That trend will likely continue for years to come, especially as more members of the Baby Boomer generation retire and begin seeking income-oriented investments. With yields that can hit the 7% to 8% level, foreign MLPs can provide an attractive option for individual retail investors and even institutional funds — strong predictable income from a diversified portfolio of lower-risk, high-quality assets. In fact, the market for these types of investments has never been larger; today, total market capitalization for MLPs is estimated to be more than US$600 billion. In short, there is still plenty of opportunity for overseas companies — particularly those in the energy industry with income-producing offshore or transportation assets — to participate in the US capital markets through a foreign MLP. Foreign MLPs 3 Value MLPs can unlock value The IPO journey For most overseas companies, an obvious benefit to forming a foreign MLP is access to a lower cost of capital. Companies considering a foreign MLP should anticipate that once a decision has been made to move forward with the IPO, the IPO process will take six months to a year. It’s important that companies prepare properly and make informed decisions along the way. As with any IPO, the preparation and allocation of are critical resources during the IPO process. For example: But there are other advantages, too. Creating a separate entity to hold specific, related assets can improve the investment profile of both the MLP and the sponsor company, increasing the value of non-core assets to the parent company. And unlike a full spin-off, the sponsor retains operational control over the foreign MLP’s assets and continues to reap the benefit of regular cash distributions through its continued ownership in the MLP. Further, the sponsor may be able to raise equity at a higher valuation multiple than it may be able to under its existing structure, as the yield-based investment market may pay a premium for the structural benefits and the promise of yield. At the time of the IPO, the foreign MLP’s sponsor also receives a unique claim to future cash flow through the IDRs. As discussed above, the IDR typically allows the GP to receive an increasing share of cash distributions as those distributions increase over time. As the foreign MLP’s yield increases over its originally stated minimum quarterly distribution, the GP may earn a higher percentage of the incremental gain (often up to 50%). Forming a foreign MLP can also help create a well-defined exit strategy for specific assets, by attracting the attention of strategic investors such as other energy companies or even private equity funds. Separating the assets into their own entity makes it easier for potential suitors to identify opportunities and analyze their value. In summary, the foreign MLP approach allows overseas companies to access US capital, increase the valuation multiple of their assets and, ultimately, unlock value. 4 Foreign MLPs • Has management reviewed the critical milestones of the IPO journey, including setting up a project management office (PMO), coordinating accounting and regulatory matters (with a focus on audit readiness) and developing capabilities for investor relations? • Is the company prepared to meet all accounting and reporting deadlines, bolster the governance and oversight function and maintain and improve stakeholder communication? • Has management considered accelerating the financial reporting process by reviewing closing and reporting processes and preparing a prioritized list of improvements and an implementation plan? • Does the company have the right resources to prepare and document financial statements and related footnotes, management discussion and analysis, selected historical financial data and other key materials? • Does the company’s documentation have a uniform set of accounting policies and procedures to enable consistent application of standards? • Does the company have an experienced, knowledgeable team in place to respond to comment letters from regulators in a timely, accurate and thorough manner? Proper tax planning is also essential. Thoughtful, effective tax planning leaves more cash available for distributions and often translates into a lower-yield and high valuation. It can also have a significant impact on the after-tax rate of return to the sponsor. For foreign MLPs, there are several key considerations: When it comes to telling their story, potential sponsors should focus on the foreign MLP’s customer base and the length and strength of its existing contracts. Customer creditworthiness is also important — investors want to know that agreements will be honored. • Minimizing US tax liabilities (considering the passive foreign investment company rules, among other rules) Of course, growth prospects for the foreign MLP are also critical, especially as they relate to the ability to increase distributions. Does the sponsor company have a plan for dropping future assets into the public structure? Are there opportunities for the foreign MLP to acquire additional assets or grow organically? If investors can see a clear path to growth over the next 5 to 10 years, the IPO is much more likely to be a success. • Minimizing tax liabilities in the jurisdictions where assets are located • Minimizing withholding taxes associated with the regular movement of funds from local country operations up to the ultimate investors Companies should also review their existing debt covenants and identify whether they will need to obtain consent from lenders to create the foreign MLP. This may be a lengthy process outside the US where lenders are less familiar with yield-oriented business structures. Finally, when making the decision to proceed with a foreign MLP, foreign companies should not be intimidated by the U.S. Securities and Exchange Commission (SEC) or the SarbanesOxley Act. There is a great deal of precedent for foreign companies on the US stock exchange (with well-defined processes and leading practices) receiving approval and following related regulations. In addition, some foreign MLPs may qualify as emerging growth companies and thereby be subject to reduced disclosure and compliance requirements. For overseas executives, there is a great deal to learn and understand about the foreign MLP, and detailed tax and economic modeling can often be helpful in analyzing the economic viability and benefits of the structure. But one thing should be clear: there may be distinct advantages to this structure that can help your company become more competitive across a wide range of measures. Why EY EY has extensive experience in helping senior executives understand the benefits — and challenges — that the MLP (both US and foreign) structure offers. Our teams can help you understand the complexities of this structure and make a well-informed strategic decision — one that can help your management team to increase value and stimulate growth in the years to come. Foreign MLPs 5 EY | Assurance | Tax | Transactions | Advisory About EY EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities. EY refers to the global organization, and may refer to one or more, of the member organizations of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com. How EY’s Global Oil & Gas Sector can help your business The oil and gas sector is constantly changing. Increasingly uncertain energy policies, geopolitical complexities, cost management and climate change all present significant challenges. EY’s Global Oil & Gas Sector supports a global network of more than 10,000 oil and gas professionals with extensive experience in providing assurance, tax, transaction and advisory services across the upstream, midstream, downstream and oil field subsectors. The Sector team works to anticipate market trends, execute the mobility of our global resources and articulate points of view on relevant sector issues. With our deep sector focus, we can help your organization drive down costs and compete more effectively. © 2015 EYGM Limited. All Rights Reserved. EYG No. DW0542 1506-1562606_SW ED None This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific advice. Contact us Greg Matlock MLP Leader Ernst & Young LLP [email protected] +1 713 750 8133 Deborah Byers Partner Ernst & Young LLP [email protected] +1 713 750 8138 Connect with us Visit us on LinkedIn Follow us on Twitter @EY_OilGas See us on YouTube ey.com/oilandgas/MLP

Anuncio

Descargar

Anuncio

Añadir este documento a la recogida (s)

Puede agregar este documento a su colección de estudio (s)

Iniciar sesión Disponible sólo para usuarios autorizadosAñadir a este documento guardado

Puede agregar este documento a su lista guardada

Iniciar sesión Disponible sólo para usuarios autorizados