the role of information and trading volume on intradaily and weekly

Anuncio

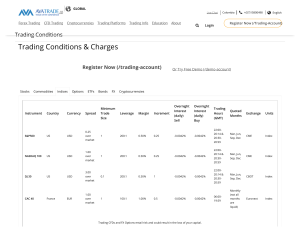

Departamento de Economía de la Empresa Working Paper 96-10 Universidad Carlos III de Madrid Calle Madrid, 126 Business Economics Series 01 January 1996 28903 Getafe (Spain) Fax (341) 624-9608 THE ROLE OF INFORMATION AND TRADING VOLUME ON INTRADAILY AND WEEKLY RETURNS PATTERNS IN THE SPANISH STOCK MARKET David Camino • Abstract _ The aim of this work is to document new results about intradaily and weekly effects in the Spanish stock market, relating the returns in the stock index, during trading and non trading hours, to the arrival of information and daily trading volume. Weekly and intraday patterns are examined using the index Ibex-35 transaction data. Twenty-three months oftransaction records of the Ibex-35, at 15-minutes intervals, were examined in an attempt to better understand the day­ of-the week effect and trading return patterns, to further characterize systematic weekly and intradaily price patterns. Several results were found: -There are cross-sectional differences in weekday patterns found in both trading and non­ trading period returns. These patterns are pervasive over time and for different trading volumes. We found a positive relation between opening volume and unexpected overnight volatility, which is reflected in a higher standard deviation of returns, during the first to first and half hours of trading. -There are significant weekday differences in intraday trading returns in the first four hours of trading. On Monday (and Wednesday) returns are negative, while on the other weekdays, returns in this interval, are positive. Key Words: Monday effect, Intradily returns in stock indexes, information and trading volume • David Camino, Departamento de Economía de la Empresa de la Universidad Carlos III de Madrid. 1.- Introduction. The aim of this study is to document new results about intradaily and weekly effects in the Spanish stock market, relating the returns in the stock index, during trading and non trading hours, to the arrival of information and daily trading volume. Weekly and intraday patterns are examined using the index Ibex-35 transaction data. The link between information and changes in assets prices is central to financial economics. A fundamental tenet of market efficiency is that investors react to new information as it arrives, resulting in price changes that reflect investors' expectations of risk and return. Recent studies in market microestructure (e.g., Berry and Howe, 1994) explore how price-volume relations are formed in financial markets, with emphasis on intraday and weekly trading. One of the most characteristics patterns in weekly trading patterns is the day-of-the­ week effect, an empirical regularity which refers to the observation than equity returns are not independent from the day of the week. More specifically, the day-of-the-week effect has been refered to the observed negative average return from Friday c10se to Monday c1ose. For convenience this anormality has been labeled the Monday effect. Several papers have identified and attempted to explain the Monday effect, but to no avail. The effect was first documented by Osborne (1962), and has subsequently been examined by numerous studies, including those of Cross (1973), French (1980), Gibbons and Hess (1981), Lakonishok and Levi (1982), French and RolI (1986), Harris (1986) and Admati and Pfleíderer (1988), among many others. The purpose of this paper is, therefore, to more fully characterize the day-of-the­ week effect by studying intraday returns of the index Ibex-35 of the Spanish stock market, measured over 15-minute intervals to show that they differ by weekday and trading volume. These data have made possible the simultaneous analyses of, both, the cross­ sectional and intertemporal characteristics of the effects. Previous studies have stablished the value of both types of analyses, yet none has determined whether cross-sectional and intertemporal effects interact. This study shows that patterns in time-descomposed returns vary by trading volume. Use of data by 15-minutes interval also allows a more precise characterizacion of the timing of systematic return patterns within the trading day. The remainder of the paper is organized into five sections. Sectíon 2 briefly describes the data set of the paper and explain how the index Ibex-35 was formed and how it works in practice, mimeting the Spanish stock market. Section 3 relates to the • evidende of the non-trading weekend and Monday effects. Section 4 describes the cross­ sectional analysis of the decomposition of the daily close-to-close return into trading and non-trading periods. Section 5 links both effects to daily trading volume. Finally, a summary is provided in Section 6. 2.- Data description: The index Ibex-35. During 1988 and 1989 a survey on the Spanish stock investment industry was completed and a series of studies to create an index (Fiex-35), which would act the underlying instrument for stock index derivatives to be traded in Spain, were under way. On November 1991 the index Fiex-35 changed its name to Ibex-35, only to be designated as the Official Stock Index for Spain. Ibex-35 is a capitalization-weighted index comprising the 35 most Iiquid Spanish stocks traded on the continuous and computerized system (CATS) and in December 29, 1989 the index was given the value 3,000.00 at the closing of the market on that date. Ibex-35 was designed to fulfil the following three requirements: (i) to behave as a good market indicator, (ii) to be difficult to manipulate, (iii) to be calculated continuosly and published in real-time. The index is an accurate substitute of a diversified portfolio of the Spanish stock market and, as a result, Ibex-35 and the Madrid General Stock Index (IGBM), has shown a very c10se correlation (98%), since January 1988 (see chart 1). Ibex-35 covers, as well, over 75% of market capitalization and almost 78% of the total market turnover, with less than 10% of the stocks traded on the Madrid Stock Exchange. Data for this survey has been computed during the twenty-three months between February 1992 and December 1993. For each of the 447 different trading days in the sample period the date, time (15 minute intervals), index value and daily trading volume are, therefore, used. Returns have been computed as [(VtNt-1) - 1] * 100, where Vt is the closing value of the index on day t, and Vt-1 is the c10sing value of the index on the previous day that the Exchange was open. Thus, returns labelled 'Monday' cover the three day period from Friday closing to Monday closing, in the absence of holidays, and have not been expressed as daily average equivalents. The value of Ibex-35 is available in real-time through several information vendors and trades continously from 11 .00 to 17.00 hours and is calculated by dividing the total index capitalization at moment (t) by the total index capitalization at moment (t-1), according with the following equatíon: Index (t) = Index (t-1) * [Capitalization (t)/Capitalization (t-1)] + J (t) where, "s" "t" Shares (s,t) Price (s,t) Value Capitalization Index (t) J (t) = = = = = = = = stocks; s = 1, , 35 time numer of shares "s" at "t" last price paid for "s" at "t" value of shares (s,t) * price (s,t) sume of "s" values at "t" index value at "t" adjustment for stock issues In order to ensure that the 35 stocks that form Ibex-35 are the most Iiquid ones, the index is revised every six months coinciding with the natural semesters, ie. January and July. The 35 stoks and their weight in the index for the first semester of 1995, are listed in the following table: [Here Table 1] 3.- Evidence of the dav-of-the-week effect. Evidence of the day-of-the-week effect in stock prices has generally been obtained from studies of daily close-to-close returns in broad market indexes. Although these studies conclusively identify sistematic return patterns -in particular, the negative Monday returns­ they are unable to fully explain their cause. In an effort to shed additional Iight on the phenomenon, studies of open-to-close, close-to-open, midday and time dissagregated returns have been undertaken [e.g., Prince (1982), Rogalsky (1984), Keim and Stambaugh (1984), Smirlock and Starks (1986)). ... "....- - - - . - - - - - - - - - . - - - - - - - - - - r - , - 1.- - - - -." -----------------------­ Prince (1982) examined daily returns in the Dow Jones 65 Stock Composite Index, to conclude that the negative Monday effect appears primarily in the close-to-close returns, and only to a lessor extent in returns measured from intraday prices. Although he concludes that the effect may be caused, at least partly, by systematic high Friday closing, he fails to interpret other anormalities. Rogalsky (1984) descomposes daily close-to-close returns into trading and non­ trading day returns in the S&P500 Index, to discover, in contrast to Prince's paper that all the average negative returns from Friday close to Monday close documented in the Iiterature for stock market indexes occurs during the non-trading period from Friday close to Monday open. In addition, average trading day returns (open to close) are identical for all days of the wee k. Keim and Stambaugh (1984) examined the daily close-to-close returns of ten market value decile portfolios. They found that the day-of-the-week effects characterize the returns of all size portfolios and that the effects may be more pronounced for small firms. In particular, they showed that close-to-close returns are large for small firms on Fridays. Smirlock and Starks (1986) analized (from January 1963 to December 1983) hourly returns of the DJIA, to found that intraday patterns related to the day-of-the-week effect have changed over time. In the last part of the sample, they found negative returns early in the day on Monday and positive returns later on. Jaffe and Westefield (1985) and Condoyanni et al. (1987) among others, have examined the extent to which the day-of-the week effect in markets other than the US may be attributable to correlation (contemporaneous or lagged) between their returns and returns in the US markets. Using classical statistical analysis Jaffe and Westefield (1985, p.441) concluded that investors confront a day-of-the-week effect in their respective stock markets that is independent of the day-of-the-week in the USo The weekdays' pattern of close-to-c1ose returns in this sample period is similar to that observed in previous studies, as the mean of Monday close-to-close return of the Ibex­ 35 porfolio is negative. Nevertheless, there is an important difference as Wednesday close­ to-clos~ return is also negative, in contrast to the other mean weekday returns, which are positive. The negative returns accrue during non-trading or c1ose-to-open periods, in contrast to the open-to-close trading period that has a positive return for all days of the week (although only slightly positive on Mondays). • 4.- Trading and non-trading period returns and volatilities. The issue of information driving market relationships is as old as economics. Recently, the role of prívate information has received greater attention (see e.g. Berryand Howe, 1994). One thrust of current research attempts to explain the higher return volatility during trading hours than during nontrading hours that is documented in several studies. French and RolI (1986), for instance, ofter three explanations for higher tradillg hours volatility: first, public information is greater during trading hours; second, private information is generated during trading hours by informed investors; and third, pricing errors during trading hours increase volatility. Harris (1986) studies of intraday patterns using transaction data show, however, that the major part of stock price moves occurs in the first 45 minutes of trading each day. To analize that, we provide greater detail on the trading versus nontrading periods of Ibex-35 in Table 1 and Chart 2 and present mean returns and return volatility that are similar to the results of French and RolI (1986), as we find that the volatility of returns is considerably greater during trading periods that during non-trading periods. Moreover, the pattern of volatility, as measured by the standard deviation of returns by 15-minute periods is U-shaped (see Chart 3), with a strong decrease in the first trading hour of the day (from 11.00 to 12.00) and more levered during the rest of the trading day, for all days of the week. The U-shaped patterns observed here have been previously documented both for return data [Harris (1986) and Wood, Mclnish and Ord (1985)] and trading volume [Jain and Joh (1988) and Foster and Viswanathan (1993)] .. French and RolI's (1986) finding of much higher variances during trading periods may be attributed to the large move in prices during the first hour of the trading day, as a consequence of information arrival while markets are closed. In the case of Spain, Bergés and Soria (1990) also studied the open-to-close and c10se to-open volatility of the Spanish Stock Market during the Gulf crisis, to conclude, as well, that volatility was higher during non-trading periods. However, if we exclude this first hour of trading of the trading-period variances and include it in the non-trading period, as it is due to information accrued overnight, variances may be much more appropiate. This adjustment, according to Berry and Howe (1994, p. 1333) "would reduce the trading period variances and increase the non-trading period variances, diminishing support for French and RolI's (1986) private information hypothesis." Several new observations emerge. Decomposition of close-to-close returns into trading and non-trading periods indicates that the negative Monday and Wednesday close­ to-close return accrues before the market opens, while for the rest of the days, although the close-to-open negative returns are still important, they are not enough to overcome the negative returns observed during non-trading hours. To further investigate systematic week day differences in open-to-close returns, means were computed, by 15 minutes intervals, of the returns wich accrue within the trading day. The results are presented in Table 2 and cumulative means are plotted by weekday in Chart 4. There is a striking similarity, in the trading pattern, between Monday and the other weekdays in the last two hours of trading (from 15.00 to 17.00). However, the mean return for Ibex-35 in the morning interval between 11.00 and 15.00 hours, is strongly negative on Mondays (-0.124%) and slightly negative on Wednesdays (-0.034%), while in the other weekdays it is positive (0,01 %, 0.132% and 0,087%). The weekday pattern observed in this two periods of trading is pervasive both through time and through the cross-section volume. A closed examination of intraday means for Ibex-35 reveals that the evolution of prices during the trading day is not uniform on any of the weekdays. Mean intraday returns at the beginning and end of the trading day (first and last 15-minutes periods) are five to ten times larger in absolute value that returns that accrue in the middle of the day. These casual observations are confirmed by previous research (see e.g., Harris, 1986). To summarize, there are week days differences in the pattern of intraday returns . within the first three hours of trading. Later in the day, no such week differences are apparent. Further decomposition of the trading-period returns into a series of 15-minute intraday returns reveals that there are only significant differences among weekdays after the first 15-minutes of trading. On Monday mornings (and more slightly, also on Wednesdays) prices trend to drop, while on the other weekdays, they remain steady or rises. Otherwise, price patterns are similar on all weekdays. The most striking similarity is a strong tendency for prices to rise in the first and last 15-minute periods of trading. The latter result might suggest that, apparently, the return-generating processes for the first few and last transactions of the day are different from those which generate the mid-day transaction returns. The results indicate that there are systematic time-series patterns in mean intraday returns which are common to all the weekdays. Even within weekday trading periods, prices do not evolve at equal rates. Further research will be necessary to identify the origin of these patterns and to determine whether traders can profit by considering time-of-day effects when planning their transactions. 1 .' 5.- Trading volumen and the day-of-the-week effect. Unlike previous research this paper analyzes trading and non-trading period returns by daily trading volume, that will act as a measure of market activity. We measure trading volume as the amount traded on Ibex-35 on a given period of time, in five blocks (from less than 10 to more than 25 thousand million Ptas.). The results (Table 3 and Chart 5) show that although the mean close-to-open and Monday and Wednesday close-to-close are both negative, their magnitudes vary by trading volume. For small volumes (Iess than 15.000 million Pesetas) total c10se to c10se returns are negative, but for larger volumes the c1ose­ to-open and open-to-c1ose returns increases with volume and turns to positive values. Trading volume differences in the decomposition of negative Monday c1ose-to-close return may have implications for theories which try to relate negative Monday returns to macroeconomic information. If macroeconomic information generated over the weekend were the cause of negative Monday returns, why would that information be fully incorporated ¡nto the indexes when markets open trading on Monday, but not in cases when trading volume is larger. The same results can be observed for the remaining days of the week, except on Wenesday. Overnight c1ose-to-open returns are negative, when next day trading volume is small, but turns to positive for larger volumes. It appears unlileky that the day of the week effect would be related to macroeconomic information, unless that information affects nexts day trading volume. To test for cross-sectional differences among returns during the trading day for various trading volumes, an analisys of 15-minutes period returns and volatilities, similar to those used to analyze the day-of-the-week effect, was conducted (see Table 4 and Chart 6). The intraday mean pattern returns by volume are very similar to those observed for the different days of the week, with an increase of returns during the first and last 15 minutes of trading. However, there is a c10se correlation between trading volume and the mean return of Ibex-35, reflecting the fact that higher demand increases the index value. For trading volumes over 25.000 million Ptas., the returns on Ibex-35 are much higher at any time of the trading day, that for lower trading volumes, with a strong increase at the begining of the day (first 30 minutes), reflecting the arrival of information prior to market openning (see Chart 8). The U-patterns of volatility during the day, for different trading volumes, are very similar to those obtained for daily trading returns. There are no sharp differences in the standard deviation ofreturns among trading volumes, but during the first hour and a half of trading, volatility is much higher than during the rest of the day, as the arrival of new information to the market makes prices more difficult to predict (Chart 7). --------------------------,-,----------------------------­ The size decomposition in trading volume by week day close-to-open and open-toclose returns (see Table 5) can explain the differences mentioned above. In almost every case, returns are higher during trading hours (open-to-close) every day and for every trading volume, reflecting lower expectations of investors during non-trading hours, due to the lack of information. Another important characteristic of the market, is that returns almost uniformily increased with trading volume, during trading and non~trading hours, as a consequence of increased demando 6.- Surnrnary and concluding rernarks. This paper examined trading and non-trading period returns and volatilities of the Index Ibex-35, at 15-minutes intervals, in an attempt to better understand the day-of-the week effect and trading return patterns, related to the timing of information arrival and daily trading volume, during trading and non-trading hours. Twenty-three months of the complete transaction records of the Ibex-35 were examined to further characterize systematic weekly and intradaily price patterns. Several results were found: -There are cross-sectional differences in weekday patterns found in both trading and non-trading period returns. These patterns are pervasive over time and for different trading volumes. We found a positive relation between opening volume and unexpected overnight volatility, which is reflected in a higher standard deviation of returns, during the first to first and a half hour of trading. -There are significant weekday differences in intraday trading returns in the first four hours of trading. On Monday (and Wednesday) returns are negative, while on the other weekdays, returns in this interval, are positive. -There are systematic intraday return patterns which are common to all of the weekdays. Returns are very large at the beginning and the end of the trading day. Returns are, also, very similar during the last two trading hours. -It is unlikely that the weekend effect, in this sample, is caused entirely by high Friday closing prices, but for new information arriving and accumulated during the weekend. ~-~--------------,----------r-----------'----- Trading strategies based only on these weekly and intradaily patterns would, usually, not be profitable beca use of transaction costs. However, further research will be necessary before any conclusions can be made on this respecto ,-,-'--------------------,------------------------------ References - Admati, A. R. and Pfleider, P. (1988) "A theory of intraday patterns: Volume and price variability"; The Review of Financial Studies 1, pp. 3-40. - Bergés, A. and Soria, P. (1990) "Los precios de las acciones dentro y fuera de horas de mercado"; Información Comercial Española; Diciembre; pp. 179-186. - Berry, T.D. and Howe, K.M. (1994) "Public Information Arrival"; The Journal of Finance Vol. XLIX N°4; pp. 1331-1346. - Brown, S.J. and Warner, J.B. (1980) "Measuring Security Price Perfomance"; Journal of Financial Economics 8; pp. 250-258. - Brown, S.J. and Warner, J.B. (1985) "Using daily stock returns: The Case of Event Studies"; Journal of Financial Economics, 14; pp. 3-31. - Condoyanni, L., O'Hanlon, J. and Ward, C.W.R. (1987) "Day of the week effect on stock returns: International Evidence"; Journal ofBusiness Finance and Accounting, 14; pp. 159174 - Cross, F. (1973) "The Behaviour of Stock Prices on Fridays and Mondays"; Financial Analysts Journal 29; November-December pp. 67-69. -Easton, S.A. and Fatt, R. (1994) "An investigation of the robustness of the day-of-the week effect in Australia"; Applied Financial Economics, Vol. 4 N° 2; pp. 99-110. - French, K. (1980) "Stock Returns and the Weekend Effect"; Journal of Financial Economics 8; March; pp. 55-69. - French, K.R. and RolI, R. (1986) "Stock return variances-The arrival of information and the reaction of traders", Journal of Financial Economics 17, pp. 5-26. - Foster, F.D. and Viswanathan, S. (1993) "Variations in trading volume, return volatility and trading costs: Evidence on recent price formation models", Journal of Finance 48, pp. 187-211 - Gibbons, M. and Hess, P. (1981) "Day of the week Effects and Asset Returns"; Journal of Business 54; October, pp. 579-96. II - Harris, L. (1986) "A transaction data study of weekly and intradaily patterns in stock returns", Journal of Financial Economics 16, pp. 99-117. - Jain, P. and Joh, G. (1988) "The dependence between hourly prices and trading volume"; Journal of Financial and Quantitative Analysis, 23; pp. 269-283 - Jaffe, J. and Westefield, R. (1985) "The week-end effect in common stock returns: The international evidence"; Journal of Finance, 41; pp. 433-454 - Keim, Donald B. and Stambaugh, R. (1984) "A further investigation of the weekend effect in stock returns, Journal of Finance 39; pp. 819-40. - Lakonishok, J. and Levi, M. (1982) "Weekend Effects on Stock Returns: A Note", Journal of Finance 37; June pp. 883-89. - Osborne, M.F.M. (1962) "Periodic structure in the Brownian motion of stock prices", Operations Research, 10, pp. 345-79. - Prince, P. (1982) "Day of the week effect: Hourly data. Manuscript (University of Chicago, IL). -Olfield G. and Rogalsky, R. (1980) "A Theory of Common Stock Returns over Trading and Non-trading Periods", Journal of Finance, pp. 729-751 - Rogalsky, R. (1984) "New findings regarding day of the week returns over trading and non-trading periods; Journal of Finance 39, pp. 1603-14. - Smirlock, M. and Starks, L. (1986) "Day of the week and intraday effects in stock returns"; Journal of Finance Economics, 17; pp. 197-210. - Wood R.A., Mclnish, T.H. and Ord, J.K. (1985) "An investigation of transaction data for NYSE Stocks"; Journal of Finance, 40; pp.723-741 -----------------,----------------------------- ..... _--_.. , C) ro :2 I IGBM IB[X 35 I 150 04/01/88 200 250 I r'" , 350' 300 I I 400 02/01/89 , " I I I IU Ir. 11 "1., 08/01/92 1 \ .M _IBEX35 07/01/91 1 .. I I • ..- . IJlM.'r' I I 30/12/92 Mayo 1984 I( 28/12/93 I I l. I DEL IGBM Y DEL IBEX35 ~ Ul I ~I J' _IGBM 04/01/90 I I \f I I I I Enero 1988 - ca tv1PARAD,A I EVOLUCION I I I , I 1500 2000 2500 3000 3500 4000 4500 ro - W t-1 x Lf) -0,19332 -0,04566 -0,16704 -0,0522 -0,04235 0,586422 0,453186 0,563359 0,53835 0,563378 DES. STD. LUNES MARTES MIERCOL. JUEVES VIERNES 0,792733 0,841611 0,846387 0,955381 0,772356 0,001458 0,157795 0,08629 0,273255 0,261685 1,088371 1,016717 . 1,073736 1,189948 0,957475 -0,19079 0,112661 -0,0803 0,223525 0,219244 Cier.-Aper. Aper.-Cier. Cier.-Cier. -0,09976 0,156974 0,058099 0,29902 0,723715 1,168041 0,546827 0,850715 1,080759 MEDIAS LUNES MARTES MIERCOL. JUEVES VIERNES MEDIA VARIANZA DEV.STD. MEDIA Y DESVIACiÓN STANDARD POR DIA DE LA SEMANA C) ro :2 I IGBM IB[X 35 I 150 04/01/88 200 250 I r'" , 350' 300 I I 400 02/01/89 , " I I I IU Ir. 11 "1., 08/01/92 1 \ .M _IBEX35 07/01/91 1 .. I I • ..- . IJlM.'r' I I 30/12/92 Mayo 1984 I( 28/12/93 I I l. I DEL IGBM Y DEL IBEX35 ~ Ul I ~I J' _IGBM 04/01/90 I I \f I I I I Enero 1988 - ca tv1PARAD,A I EVOLUCION I I I , I 1500 2000 2500 3000 3500 4000 4500 ro - W t-1 x Lf) -0,19332 -0,04566 -0,16704 -0,0522 -0,04235 0,586422 0,453186 0,563359 0,53835 0,563378 DES. STD. LUNES MARTES MIERCOL. JUEVES VIERNES 0,792733 0,841611 0,846387 0,955381 0,772356 0,001458 0,157795 0,08629 0,273255 0,261685 1,088371 1,016717 . 1,073736 1,189948 0,957475 -0,19079 0,112661 -0,0803 0,223525 0,219244 Cier.-Aper. Aper.-Cier. Cier.-Cier. -0,09976 0,156974 0,058099 0,29902 0,723715 1,168041 0,546827 0,850715 1,080759 MEDIAS LUNES MARTES MIERCOL. JUEVES VIERNES MEDIA VARIANZA DEV.STD. MEDIA Y DESVIACiÓN STANDARD POR DIA DE LA SEMANA ., LUNES I MARTES I lil I I I MIERCOLES I I I JUEVES I CIERRE(-1)-CIERRE I I ~ APERTURA-CIERRE DIAS y HORAS DE COTIZACION I r I ~ CIERRE(-1)-APERTURA 02 ' - I I PORCENTAJES MEDIOS Febrero 92-Diciembre 93 - -0,1 o 0,1 0,2 0,3 VIERNES I RENTABILIDADES DIARIAS DEL IBEX35 I I ., LUNES I MARTES I lil I I I MIERCOLES I I I JUEVES I CIERRE(-1)-CIERRE I I ~ APERTURA-CIERRE DIAS y HORAS DE COTIZACION I r I ~ CIERRE(-1)-APERTURA 02 ' - I I PORCENTAJES MEDIOS Febrero 92-Diciembre 93 - -0,1 o 0,1 0,2 0,3 VIERNES I RENTABILIDADES DIARIAS DEL IBEX35 I I • .... MED.ACU llfolES MARTES MlERCOL. JUEVES VIERNES O O O O O 0.588422 0.318139 0,453188 0.3118124 0.583358 0.378501 0.538988 0,418513 0,583378 0,472311 DES. STO. LlfoIES MARTES MlERCOl. .AlEVES VIERNES 1ND1145 1ND1215 -0.00108 0.020551 0,143358 IND1230 O,022D95 0.007577 0.1I875l18 0,111112 0,035148 -0.0152 0.0011888 0.047813 O,1Dl1879 0,1185252 0,183017 0,173483 0,210053 0.184558 0,188888 -0.00081 0,0178D9 0.132898 IND1300 -0.01475 -0.00578 -0.00888 0.007807 -0.00077 0,002982 -0,00575 -0,00249 0,022831 -0,011878 -0.00155 0.013709 0.117085 IND1245 -0.03878 0.011178 0.030828 0.111472 0,092832 -0.05151 -0.05727 0.001201 0.009107 0.030062 0.033024 0.105724 0.103233 0.115583 0.10l1805 0.148328 0.0lla078 0.108048 0,128551 0.11l8808 O,1255l18 0,133711 0.127232 0.088853 0.158329 0.109431 0,153829 0,141584 0,135307 0.18428 -0,02518 -0.03729 -0,02158 -0.01005 0,001118 0,002483 -0,00818 -0.01895 -0,01878 -0.0072 -0,00223 0.002583 0.028122 0.0301118 0,02738 -0.00438 -0.00549 0,033947 0.033913 0,184247 0,184158 1ND1200 0.258587 0,18045 0,148054 0,14834 0.242423 0,174178 0.201853 0,201182 0,140835 0.305788 0.258511 0,270842 0,257488 O,222l183 0,174351 -o.OO8S8 -0.03757 -0.02182 -0,01324 0,012937 0.008738 0,017538 0,005718 -0.00445 -0.0137 -0.00098 -0.00978 0,1185179 0,044141 0,255302 0,210099 IND1130 0.094412 0,084848 0.047278 0.052778 O,D3DlI82 0,017823 0.054075 0.1187012 0.075751 O,D95Il81 0,1128 0,118318 0.02517 0,020721 0,007024 0.094412 0,052778 0,054075 0.D95Il81 0,02517 -0,18332 -o.045l18 -0.18704 -o,05Il85 -0,04235 MEDIAS LlfoIES MARTES MIERCOL. JUEVES VIERNES 0.11841 0,147538 0.384104 1ND1115 -0.08945 0.289125 0.548923 MEDIA VARIANZA DEV.STD. INDII00 MEDIA Y DESVlACION STANDARD DE LOS RENDIMIENTOS INDMOUALES y AC\JMJLADOS IND1330 -0.00491 0.ooaa74 0.0942 IND1345 0.081019 0.078545 0.105578 0.117448 0,113844 -0.07332 -0.08728 0,005242 -0,00521 0.022423 0.012041 0.088057 0.092735 O,D95507 0,111801 0.075019 O,D9lI884 0,135882 0.1111815 0,107583 IND1415 -0,08389 -0.08018 -0.09287 0,011819 0.002538 0,002994 -0.01182 -0.0127 -0.01482 0.098848 0.104818 0.108945 0.D95828 0.097212 0,085984 IND1445 1ND1500 1ND1515 1ND153O 0.014458 0,018947 0.137848 1ND1545 1ND1815 0.002511 -0.0009 0,017583 0.022842 0.1328 0,151138 1ND1800 1ND1845 IND1700 0,01287 0.0Il2019 -0.011823 0,019828 0,022297 0,025851 0,140813 0,148321 0,180158 1ND183O 0.078181 O,088D37 O,Il83838 0,094717 0,133851 O,0871l81 0.07_7 0,1181084 0,078021 0.091378 0.112701 0.097852 0,085823 0,188777 0,12948 -0.07493 -0.07018 0.000792 0.054494 0.08012 0.158838 0,004582 0.001731 0,085384 0,181434 0.183994 0,272385 0.10_1 0,181978 0,28188 0,11941 0,14471 0,151178 0,133898 0,153243 0.111l8ll9 0,194_ 0,181277 0,120423 0.150419 0.14175 0.144139 0.10859 0.128882 0.159385 0.11214 0.184092 0.1511187 0.130187 0,124212 0,171511 0,140318 0,149337 0,158147 0.125422 0,121482 0,148709 0.144812 0,148238 0.1_78 -0.10805 -0.12079 -0.1244 -0.1171 -o,1D902 -o.D9857 -0.08081 -0.08548 0.0050D9 0.014133 O,009ll97 0,015852 0.0432 0.051437 O,Il88D91 0.071749 -0.01031 -0.02884 -0,03434 -0.02258 -0,0083 -0,011182 O,DD95 -0.0288 0.1118877 O,I2D904 0,132048 0.1saaaa 0.213413 0,225175 0,211179 0.181545 0.084009 0.088488 0.0lI8834 0.081454 0,083859 0.107911 0,102124 0.107_ 0,0711823 0.074_ 0.081837 0,113102 O,D90883 -0.01537 -0,01274 -0,00381 0.0D7302 0.008079 0.009454 0.018755 -0,00484 0,010527 0.004752 0.07D9l18 0.00247 0.009125 -0,00414 0.005855 0,027248 0,008238 0,018854 0,003858 -0.01725 0,005825 0.088519 0.004505 -0.01832 -0,0077 0,011784 -o,D04D2 0,018297 -0.00232 0,02012 -0,00482 -0.00285 0.083854 -0.00307 0.014028 0.011145 O,D28837 0.054528 0,011782 -0,014 -o,D2863 -0,02011 0,00258 0,108391 -0.00198 0.002458 O,Ill10388 -0.00538 0.0022Il8 0,024252 -0.00579 0,005713 0,001045 0.053085 O,I000D3 -0.0028 -0.001I87 -0,00078 0.009322 0,017802 0,007958 0,007812 0.008943 0,008453 0,0174118 0.08921l8 0.DlI8384 O,0945l18 0.1l8D331 0,132241 IND1430 0,073582 0.073783 0,1182584 0.074278 0.088058 0.1187284 0.108238 0,13147 O,Il88488 0,081825 -0,00847 -0,00251 0.003185 -0.00385 -0.00078 -0,00212 0,007869 0,005127 0,001284 -0.01123 0.00108 -0.00288 0,010032 0,008814 0.100158 0,081328 IND1400 0.070482 0.084377 O,0702ll8 0.1187173 0,107547 0,083894 0.102269 0.1S8054 0.1118827 0.078193 -0,01805 -0.01388 0,003585 -0,00387 -0.01045 0,008207 -0,01118 -0.01038 -0,02388 -0.01718 0.008879 0,004114 -0,0133 0,018294 -0.01587 -0,01219 -0.00229 0,011818 0,010323 0,107779 0.1018D3 IND1315 • .. I I 1// --/ I ~ I I I I I MARTES VIERNES JUEVES Febrero 92-Dlclem bre 93 ---- Lunes ~ Mlere . ~ - Mar tes Viernes Jueves I - IND1600 I MIERCOLES IND1300 IND1400 IN·D1500 HORA y DIA DE LA SEMANA I --- I LUNES IND1200 I I ~ ----- ~ '"' -- I PORCENTAJES ·-0,2 IND1100 -O , 1 O 0,1 0,2 0,3 (Datos diarios con intérvalos de 15m.) IND1700 I RENDIMIENTOS ACUMULADOS MEDIOS DEL IBEX ., \ I¡ .-lI I I I I I I I +n I 1 I , I I JUEVES LUNES IND1200 I I , I ' I I ' , . ==t==------- -= I " -----*- VIERNES --+- MARTES ,/, ~)( Ps I .' I , ' I I IND1600 , --*- MIERCOLES I === ~ ± ~ . ~--* k I;C IND1300 IND1400 IND1500 HORA y DIA DE LA SEMANA , ,---. "~'>s::t ;~l---=t=+--~ Febrero 92-Dlclembre 93 --B-- IN D1100 -0,21 - O, 1 I oF ~ o ~ ~ O1 s~~_~ , 0,2 0,3 PORCENTAJES ACUMULADOS (Datos diarios con intérvalos de 15 m.) I ~( x --¡ I A IND1700 , i I Jj / .. I RENDIMIENTOS ACUMULADOS MEDIOS DEL IBEX "*" «< I I I t I I \Va' lIS" I I I I , ~ r f,3 40 I , I -t I -----l I I -----*- JUEVES IND1300 I --1--- I I ' IND1400 Periodos I VIERNES MARTES I , I ~ MIERCOLES IND1600 1 ~, IND1700 -'_'L--...LI--+1---!1L--...L----.L, IND1500 , ~~~~~ I I I I LUNES IND1200 Febrero 92-Dlclembre 93 --B-- I I IN O D110 O 0.11 I O2 ~ ~<x I 0.3 I I I \ \'¡-\\ 0.4 \1\'-: , I Desviación Standard I 0.5 I 'i" 0.6 (Datos diarios con intervalos de 15 m.) EVOLUCION DE LA VOLATILIDAD DEL IBEX35 ~ .. -0,01545 0,094349 0,080771 0,234602 0,617576 0,665975 0,753311 0,869763 0,820245 1,113764 MEDIAS Menos de 10 -0,2363 De 10 a 15 -0,15515 De 15 a 20 -0,04046 De 20 a 25 -0,08812 Más de 25 0,127224 DES. STD. Menos de 10 De 10 a 15 De 15 a 20 De 20 a 25 Más de 25 En miles de millones de Ptas. 0,416249 0,487879 0,551826 0,644038 0,649055 0,156974 0,723715 0,850715 -0,09945 0,299125 0,546923 MEDIA VARIANZA DEV.STD. 0,856212 1,028283 1,138538 0,90975 1,239272 -0,25113 -0,05968 0,041452 0,144965 0,74495 0,058099 1,168041 1,080759 Cier.-Aper. Aper.-Cier. Cier.-Cier. MEDIA Y DESVIACiÓN STANDARD POR VOLUMEN I L 1)<1 I I I DE 15 A 20 I , I I CIERRE(-1)-CIERRE I DE 20 A 25 I I I ~ APERTURA-CIERRE EFECTIVO NEGOCIADO DE 10 A 15 1 . . CIERRE(-1)-APERTURA MENOS DE 10 Febrero 92-Dlclembre 93 -0,4 -o ,2 ° I I 0,4' 0,2 I I 0,6 PORCENTAJES MEDIOS 0,8 ,----- - - - . , 1 - - - - (Volumen negociado enmifes de millones) MAS DE 25 I RENTABILIDADES DIARIAS DEL IBEX35 I • ... 0,418248 0.487878 0,551828 0,844038 0,848055 O O O O DES. STO. _ do 10 00 10.15 00 15. 20 0020.25 Mb do 25 MED.ACUM. _dolO 0010.15 00 15.20 0.20.25 0,21081 0,18888 0,148531 0,108782 0,101223 0,208832 0,185857 0,148383 0,188348 0,113748 0,278801 0,20341 0,185083 0,251258 0,188412 0,278327 0,242542 0,183882 0.158848 0,_784 0,323531 0,275081 0,285188 0,188484 0,172858 0,083584 O,D99888 0,134818 0,118372 0,155735 0,080745 0,054185 0,057738 0,088247 0,083887 0,100833 0.085555 0,108232 O,oeoe7 0.075831 0,107128 0,014017 0,085871 0,10281 0,085411 0.0581 0,_233 0.08522 0,128748 0,104823 0,057752 0,085732 O,O183ll3 O,1011l82 0,1_ 0,107278 0,101828 0.122523 0,133812 0.242702 0,_7 0,115838 0,134385 0,130852 0,201527 0,10584 0,138017 0,101204 0,080242 0,127851 0,122831 0,111114 0,174487 0,14832 0,142882 0,182474 0,1375 0,13851 0,104378 O,I388ll3 0,188442 0,22278 0,213873 0,188082 0,201844 -0,13721 -0,1183 -0,1258 -0,11771 -0,12288 -0,12881 -0,01584 O,ooe311 0,017412 0,01147 0,005801 -o,ooeoe 0,005151 0,083718 0,002418 0,02215 0,022417 0,002383 -0,01321 -0,01111 0,080388 0,12233 0,122018 0,147535 0,184818 0,234878 0,08825 0,114788 0,081838 0,118301 0,134125 0.178801 0,157085 -0,00488 -0,00711 0,113885 -0,01388 0.0132D8 O,0ee587 -0,0158 0.002085 0,081488 0,02552 0,037083 O,ll50281 -0,00383 0,033298 0,112044 INDI545 1ND18OO IND1815 1ND18JO 1ND1845 1ND1700 0,01287 0,082018 -0,0008 -0,00823 0,014458 0.002511 0,018847 0,017583 0.022842 0,018828 0,022287 0,025851 0,1328 0,151138 0,1_13 0,148321 0,180158 0,137848 -0,00172 -0,00823 0,014378 -0,00488 -0,00845 -o,OO4e8 -0,00585 -0,00078 -o,ooe3 O,ooee81 -0,0008 O,01Dee3 0,018808 -0,00824 0,001887 -0,01888 -0,00048 -0,0118 -0,00501 -0,00215 0 , _ O,ooeeol 0,004534 0,011181 -0,008 -0,00587 -0,01838 -0,01099 0,002454 -0.00145 0,012527 0,010844 0,001001 0 , _ 0,013207 0,027325 0,020332 -0,00033 -0,02002 -0,01818 -0,01002 -0,01213 -0,00781 -0,00233 -0,01573 -0,00254 -0,00804 0,033805 0.044878 0.02553e 0,007541 -0,00031 -0,0181 0,017873 0,001858 0,028802 0,002_ -0,00308 O.ooee54 -0,00788 - 0 , _ 0,017818 -0,00418 0 , _ 0,030285 0,084448 0,085508 0,088552 0,08424 0,088148 0,099203 0,081878 0,1018 0,09974 0,018802 0,178341 0,14818 0,085381 0,081874 0.088174 0,_588 0,1099 0,083581 0,088432 0,088838 0,170838 O,I08ll33 0,134558 0,107148 0,178437 0,008838 0,012081 -0.04118 -0,00207 0,020573 1ND1515 IND15JO 0.008322 0.017802 0,008453 0.017488 O,oeo:l31 0,132241 0,027008 0,001418 -0,08581 -0,08131 -0,10258 -0,13298 -0.13803 -0,12808 -0,12781 -0,13804 -0,12158 -0,12885 -0,1381 -0,14077 -0.14871 -0,14748 -o,14l108 0,018875 0,008058 0,002748 0,001438 0,023445 0,024583 0,025818 0,038087 0,028132 0,031728 0,011887 0,011382 -0,00042 -0,00544 -0,00758 -0,00112 0,001777 0,037318 -0,00384 -0.00188 0,000844 -0.02884 -0,00881 0,00185 -0,03821 -0,0588 -0,08858 -0,08713 -0.08858 -0.05808 -0,04542 -0,04442 -0,03811 -0,02481 0,085207 0,108445 0,137817 0,128208 0,08887 0,08211 0,081522 0,088458 0,071274 0,081258 0,048523 0,040808 0,038275 0.022545 0.020002 O,Olosea 0,044511 0.273202 0,305848 0,350544 0,54558 0,482088 0,027008 -0,02558 -0,08733 -0,0254 -0,01128 -0,03037 -0,00307 0.018875 -0.01082 -0.00831 0,004588 0.018007 0.001217 0,001323 0,037318 -0,04125 0,002081 0,00252 -0.02758 0,017038 0.011851 0,085207 0,041238 0,031172 -0,01141 -0,03854 0,0031 -0,00125 0,2711311 0 , _ 1 0,002114 - 0 , _ 0,014887 -0,00011 -0,03008 Vobnen en mllel de mllones de Ptas. -0,2383 -0,15515 -0,04048 -0,05812 0,121224 INDll00 INDII15 IND1130 1ND1145 1ND1200 IND1215 IND12JO IND1245 INDI300 1ND1315 IND1330 IND1345 IND1400 IND1415 IND14JO IND1445 1ND1500 -0,0028 -0.00087 -0.00078 -0.09945 0,00108 -0,00288 0.0841 -0,00098 -0.00878 -0.00438 -0,00548 -0.00108 -0.00155 -o.oooel -0.01218 -0,00228 -0.00481 0.288125 0,147538 0.085178 0.044141 0.033847 0,033813 0.020551 0,013708 0,017808 0,011818 0,010323 0.ooee74 0.010032 0.ooee14 0.007858 0,007812 0 , _ 3 0,0842 0,100158 0,081328 0,088208 0,088384 0,084588 0,548823 0,384104 0,255302 0,210088 0,184247 0,184158 0,143358 0,117085 0,132888 O,10m8 0,101803 MEDIAS _dolO 00 10.15 00 15.20 00 20. 25 Mb do 25 MEDIA VARIANZA DEV.5TD. MEDIA Y DESVIACIóN STMlD DE LOS RENDIMIENTOS NORMAlES Y AC1.MJLADOS f I I I Menps djl 10 I I -- Más de 25 ¡.......-- I I IND1700 I / / ./ ~ ~ IND1600 I ~ De 15 a 20 I ~ IND1300 IND1400 IND1500 VOLUMEN NEGOCIADO I De 15 a 20 De 20 a 25 I r-- De 10 a 15 De 10 a 15 IND1200 I ~ De 20 a 25 Más de 25 Menos de 10 Febrero 92-Dlclembre 93 I - r--- ~ r------.. I~ ( I -0,2 IND1100 o 0,2 0,4 0,6 0,8 PORCENTAJES (Datos diarios con intervalos de 15 m.) RENDIMIENTOS ACUMULADOS MEDIOS DEL IBEX I I I Menos de 10 I ,-, -= Jt' ........... ~ . IND1200 I "~ 1-- ~ ~ ~ Febrero 92-Dlclem bre 93 --e-- De 20 a 30 -0,2 IND1100 -0,1 ~ I~ f / / r--... I 1 ~ '-- I /l. ~~ ~ I 1 - I ~ ,-, IND1400 I w ~ ,-,. / I ,-, -= ~ ~ I ----*- Más de 30 -+- De 10 a 15 ~ I IND1600 I -+--- De 15 a 20 I "" I 71" IND1700 I ../ ~/ /~ ~~ )b -V ~// ~ IND1500 I ~ ~ VOLUMEN NEGOCtADO IND1300 I ,1. ,-, -= ~ PORCENTAJES ACUMULADOS & O 0,1 0,2 0,3 0,4 0,5 0,6 (Datos diarios con intervalos de 15 m.) RENDIMIENTOS ACUMULADOS MEDIOS DEL IBEX ~ • .. r ~--f~~+~~~~~~~~~4 r I De 20 a 25 Menos de 10 ~ Más de 25 -+- De 10 a 15 --*- De 15 a 20 IND1200 IND1300 IND1400 IND1500 IND1600 VOLUMEN NEGOCIADO (en miles de millones Febrero 92-0lclembre 93 --B- IND1100 IND1700 01----...L.-----l------'--t--L..----'------'------+---L-L..----'------t----'-----'--L..---t------'------'------'--t-----'--------'------'----1 0,1 I I 1---------=~~~~*--__I__---_I_---_I__-___=_+___4~~~f::__J I I O, 2 , I I--------'~~~-+-------t I I I 0,3 \ I I I 1\ \ \ I I 0,4 \\ I I 1\ I I 0,5 I I I ~< f Desviación Standard 0,6 0,7 (Datos diarios con intervalos de 15 m.) EVOLUCION DE LA VOLATILIDAD DEL IBEX 35 MEDIA DE LOS RENDIMIENTOS POR DIAS y VOLUMEN NEGOCIADO Cier.-Aper. Aper.-Cier. Cier.-Cier. MEDIA VARIANZA DEV.STD. -0,0992 0,299146 0,546943 0,156974 0,723715 0,850715 0,058099 1,168041 1,080759 MEDIAS LUNES < 10 LUNES 10-15 LUNES. 15-20 LUNES 20-25 LUNES> 25 -0,37538 -0,17618 -0,02754 -0,07375 0,100823 -0,05778 -0,00517 -0,18888 0,39405 0,290344 -0,43277 -0,17885 -0,21502 0,319388 0,392205 MEDIAS MARTES. < 10 -0,18745 MARTES. 10-1 -0,05083 MARTES.15-20 0,035754 MARTES.20-25 0,067012 MARTES> 25 -0,03692 -0,09242 0,205012 0,200825 0,135485 0,39011 -0,27959 0,154731 0,238058 0,202148 0,352565 MEDIAS MIERC. < 10 MIERC. 10-15 MIERC. 15-20 MIERC.20-25 MIERC. > 25 -0,19548 -0,27026 -0,04519 -0,32486 0,213055 -0,05468 -0,06759 0,12142 0,183151 0,589468 -0,24756 -0,33719 0,075455 -0,14352 0,805519 MEDIAS JUEVES < 10 JUEVES 10-15 JUEVES 15-20 JUEVES 20-25 JUEVES> 25 -0,08553 -0,17286 -0,09239 -0,06738 0,23352 0,08236 0,132713 0,035474 0,296067 0,907705 -0,00285 -0,03774 -0,05406 0,217578 1,140664 MEDIAS VIERNES VIERNES VIERNES VIERNES VIERNES -0,15075 -0,09142 -0,09135 0,07139 0,081307 0,208814 0,217818 0,180534 0,139698 0,548912 0,058262 0,126477 0,089883 0,209627 0,629753 < 10 10-1 15-2 20-2 >25 ---------------.~---------r__-------------------- " CIERRE(-1)-APERTURA Tramos de S mil millones (de «10 a '25) _ MIERCOLES JUEVES VIERNES _ APERTURA-CIERRE OlAS Y VOLUMEN DE COTIZACION . MARTES -IL.-..L.,-~:,....-Lr-Lr--L,..L-,-<~,.-L,--Lr..L.-'-r--L,.--L-,L,-...L.,--L.,-J-T-L-,...L,...L-,~~~~...L.r-~~,.--L-.- v / LUNES - O,4 0,4 0,6 J/ 1 -/ PORCENTAJES MEDIOS (Por volumen de· cotización) RENTABILIDADES DIARIAS DEL IBEX35 '= • .. ~,1I745 ~,05013 0,281551 0,251121 ~,08239 ~,07108 AJEVES2G-25 JUEVES. 25 0,135811 0,342283 O O lLHES2G-25 lLHES.25 VlERNES2G-25 VIERNES' 25 VlERNES1~2O MEDIAS ACUlI. VIERNES < 10 VIERNES 11).15 AJEVES2G-25 AJEVES'25 AJEVES1~2O MEDIAS ACUM, JUEVES < 10 JUEVES 11).15 MEDIAS ACUlI. MIERC. < 10 MIERC.lI).15 MIERC.15-2O MIERC.2G-25 MIERC.• 25 MARTES.2G-25 MAftTES'25 MARTES.l~2O MEDIAS ACUlI. MARTES. < 10 MARTES. 11).15 0,001524 ~,ool ~,01757 ~,ooJ03 ~,15781 ~,OoI1l8 0,182_ 0,271713 ~.lm7 ~,00I38 ~,14554 ~,02517 0,071271 0,037414 ~,­ 0,271511 0.514151 ~,05251 0,111282 0,203742 0,403451 ~,I0281 O,1022M 0,011118 0,405418 O 0.013554 00,_1 O 0,005728 O ~,18518 O 0,241873 0,300581 0,281551 ~,OI318 O,Ofl5482 ~,03213 0,108102 0,108753 0,421454 ~,0551 ~,01l77 0,107717 0,081774 O,2I8lM3 ~,05I11 ~,254ll 0.183111 ~,15101 0,208174 ~,07308 0,1114I22 0,01713I ~,11845 0,007171 ~,30157 ~,0I151 ~,00I338 ~,­ 0,_1 0,241782 O,02IlM 0,021543 0,0015717 0,225713 0,417771 ~,17088 0,103331 ~,05007 0,423171 O,II588l1 0,283515 ~,03781 0,024117 0,017752 0,011388 0,238117 0,4310114 ~,08722 0,102213 ~,07871 0,031711 0,17711I2 0,31"2 ~,11717 0,037143 ~,OoI248 O,255e8I 0,035411 0,011253 0,1411I54 0,003418 0,25171 0,371217 ~,0I231 0,100lM3 ~,08I22 0,0511001 0,137551 0,337107 ~,05783 ~,14588 ~,1413 0,288025 0,27118 0,088137 0,000051 ~,17121 0,015711 0.121131 ~,31312 O,08IJ03 0,3_ 0,125813 O,38N84 ~,23815 0,012232 ~,Ollll23 ~,0378 0.010001 0,020501 0,071255 0,0011421 0,001177 0,113114 0,031125 0,022181 0.270334 0,207712 0,317515 ~,11331 0,111817 ~,00I781 0,08074 0,410717 ~,O:lOll ~,10217 -0,07128 O,3035e7 ~,10775 0,07202 ~,OI023 ~,31311 0,054831 0,1314111 ~,2S357 0,015153 ~.13432 O,032lI83 -0,02114 0,02534 0,005355 0.00771 0,014711 0,000114 0.00537 ~,oooll 0,01538 0,071108 ~.02858 0,257701 ~.00I251 0,007211 0,118211 0,000043 0,214317 0,311313 ~,leoe7 0,_2 ~,03475 0,0011132 0,141125 0,005887 0,214111 0,311753 ~,11588 0,127488 .0,127383 ~,0I335 ~,ONOoI ~,05I75 ~,lI88I7 ~,08831 O,02llll2 0,120334 0,_ ·0,08181 0,088581 -0,08125 0,330742 ~,Ol133 ~,3ON3 0,0700157 0,141387 ~,J0371 0,02158 ~,10571 ~.01213 ~,ON7 ~,O3111 0,020481 0,005471 ~,02l13 0,001I55 ~,00721 O,OOll533 ~,0041 ~,00038 O,oose55 ~.01351 ~,02521 ~,OOIlI8 ~.00I854 0,021515 O,ooooe7 ~,02711 ~,0115 ~,02821 ~,OI431 0,035372 0,114171 0,4_ 0,358855 ~,0I117 0,074333 ~,00221 ~,31oo7 0,100211 0,151123 ~,27522 ~,­ 0,038848 O,011J03 0,025512 -0,11413 0,011718 0.014141 ~,OoI807 0,001241 ~,05213 ~,031 0,014131 0,017812 ~,00222 0,027417 0,018824 0,012181 ~,02Ol1 ~,ooe51 ~,02301 ~,02073 0.0015831 -0,00111 O,DlN34 0,01083 ~,OoIOI 0,021711 0,003148 0,018343 0,022334 0,027858 0,0011 ~.01113 ~.02757 ~,00531 0,001141 ~,0141 0,025258 0,_ ~,oo221 ~,015111 ~,IOOll1l 0._ ~,OO488 0,054087 0,131013 0,_ 0,211115 ~,14725 O,oeeoo2 ~,02l71 0,0017875 0,474118 ~,12803 ~,lMI8I ~,0I3N 0.314255 ~,0I751 -0.01313 0,082757 ~,3081 0,021335 0,208183 ~.21824 ~,10711 ~,00274 ~,00174 ~,0I5l11 -0,01088 ~,01354 0,007815 0,0111I31 0,053534 0,00113 ~,03838 0,021185 ~,00105 ~,00I271 ~,OO535 ~,02111 ~,02lO2 0,020731 0,0010111 0,010181 ~,oo28 0,004001 0,071224 ~,0218 ~.00783 ~,Ol552 ~,00I55 ~.171104 0,013951 ~,OO523 ~,OII38 0,005321 0,021708 ~,OI284 0,010141 ~,O2ll54 ~,03l37 ~,00I1 O,ooee74 0,01142 ~.00481 INDl345 ~,OII31 ~,02l48 ~,0281 0,010323 0,101103 ~,00221 1ND13JO ~,00745 0,011111 0,107771 ~,01218 1ND1315 0,027717 0,017108 0,13_ ~,oooel INDl300 ~,03218 ~,23088 0,011112 ~,0772 0,021815 0,0012358 0,005428 0,051782 ~,oo1l1 ~,05118 0,073471 0,013105 ~,oo107 ~,02814 -0,00031 -0,00123 -O,05lW8 ~,01808 ~,01111 0,03207 0,0010388 0,051131 ~,­ O,OlOOll1l ~,01113 ~,031158 ~,O:105e 0,007102 ~,007111 ~,01202 ~,oosee 0,013708 0,117085 ~,oo155 IND1245 ~,07881 ~,oosee ~,oo703 0,020551 0,143351 ~,OOlO1 INDIno ~,l5e52 0,211552 ~,211111 0,_5 0,088711 ~,21551 0.141411 0._2 ~.154D1 -0,07011 O,02381l1 0,033181 ~,0314 0,0015118 0,011532 ~,OI548 0,055507 ~,00057 ~,00I347 ~,oo711 ~,00N7 ~,O3:lO3 ~,05I75 ~,10188 0,011121 0,033515 0,0011215 0,0017551 0,00185I ~,OoII13 ~,00223 ~,0l151 ~,10187 ~,11287 ~,00I14 0,001572 0,033813 0,1""51 ~,00548 1ND1215 ~,O3548 0,0012021 0,000087 0.108107 -0,12722 0,221332 0,412272 ~,OoI287 0,139037 0,242141 0.455807 ~,07107 ~,11115 0.211184 ~,21422 0,_1 ~,­ 0,253435 0,_ ~,12053 0,0011857 ~,00751 0._ ~.OoIlll ~,07175 0,030112 ~,OoI171 .0,03425 0,008482 0,110048 0,011111 0,011103 ~,00I518 ~,0I181 ~,03424 0,001_ -0,03281 0.322215 ~,07821 0,053721 0.023714 ~,­ 0,347551 0,381781 ~,0335 O 0,251121 O O O O O O O O O 0,_ ~,0321 0,080173 0,080711 O O O l~ES11).15 O,OU"'84 0,081423 0,017114 0,02474 ~,18518 0.152205 ~,00I25e 0,241873 ~,02101 ~,IOlJ18 0,005728 0,07138 O,0I1J07 ~,02IOl 0,08173 0,_ 0,013554 0,_1 0,101707 ~,02807 ~,02828 O,03N12 0,008547 0,072393 0.052451 ~,OIl ~,08775 0,_ ~,15075 0,1_21 O,OO8lM ~,02025 0,011574 ~,­ ~,OI757 ~,03488 0,05218 0,0114808 ~.02221 ~,O1027 ~,00I31 0,02150I ~,OO8Il ~,OI828 O,00ll538 ~.00I882 0,03131 ~,Ol813 ~,00I15 ~,01813 ~,02888 0,033847 0,114247 ~,OO431 INDI200 ~,08877 ~,I0333 ~,02588 ~.­ 0,_1 0,020878 ~,02528 ~,02815 0,000531 -0,01021 -0,001241 0,041141 0,210088 ~,00I71 1ND1145 ~,08142 ~,08135 0,23352 ~,003 ~,Oleoe 0,001335 0.011878 0,152411 0,005482 lLHES.I~2O MEDIAS ACUlI. l~ES< 10 MEDIAS VIERNES < 10 VIERNES 11).15 VIERNES 1~2O VI!RNES2G-25 VIERNES' 25 ~,OO303 ~,D1553 ~,I72ll8 AJEVES1~2O ~,00I518 0,213055 ~,27021 ~,32411 ~,0551 ~,OIl77 0,107717 0,081774 0'-3 ~,1_ MEDIAS JUEVES <10 AJEVES 11).15 0,114422 ~,07308 ~,03371 ~,0I123 O,023Oll4 -0,07788 0,024752 ~,0321 0,211582 0.D5N80 0,135811 0,342283 0,053721 0,023714 ~,0I780 O,oooe54 ~,0I111 0,015178 0,255302 ~,_ INDInO 0,_ 0,080173 0,080711 0,0141 0,147531 0,3141001 IND1115 MEDIAS MIERC. < 10 MIERC.ll).15 MIERC.I5-2O MIERC.2G-25 MIERC. '25 MARTES.2G-25 MARTES' 25 0,035754 0.017012 0.015718 MEDIAS MARTES, < 10 MARTES. 11).15 MAftTES.l~2O 0,100123 l~ES·25 lllNES2G-25 lLHES.l~2O l~ES11).15 ~,37531 ~,17111 ~,02754 ~,07375 0,21llI125 O,5ol8823 VARIANZA DEV.STD. MEDIAS lLHES < 10 ~,llIllM5 MEDIA 1ND1100 MEDIA DE lOS RENDIMIENTOS POR DIAS Y VOLUMEN NEGOCIADO ~,0I101 0,2811111 ~,Ol035 ~,13308 0,055711 0,141331 0,2071 0,411II17 ~,14711 0,012181 ~.02l74 0,057351 0,451214 ~,1358 ~,O3305 ~,01344 0,313953 ~.0I101 0,011832 ~,21212 ~,01071 0,_52 0,182839 ~,13821 ~,01001 ~,28131 0,00731 ~,03243 ~,OO531 0,001121 0,013255 0,_33 0,31082 ~,14317 0,0017247 0,103148 0,008408 0,202182 0,411174 ~,12013 0,081843 ~,03107 0,030315 0,413218 ~,1384 ~,01084 ~,10024 0,327245 ~,0I185 0,008345 ~,OIl23 ~,2811 0.1111I1 0,111575 ~,02l7 ~,27855 ~,1_ 0,014151 ~,OlO51 0,01871 ~,OoI00I8 ~,00147 ~,02014 ~,00481 0,014752 0,027231 ~,00432 0,012023 ~,02341 0,ססOO11 ~,oosel ~,oooel ~,027001 0,022101 ~,oo348 ~,0221 0,018228 0,013282 ~,Ol258 ~,00545 ~,00847 ~,Oll31 0,011713 0,027428 ~,oo72 ~,OllO8 O,ooee14 0,011321 ~,oo218 IND1415 0,013133 0,001314 ~,00I17 0,000184 ~,0003 0,027177 0,00235 -0,01013 -0,01348 ~,01175 0,003117 ~,03111 ~,00717 ~,OOJ07 0,00101 0,010032 0,100151 IND1400 • 0,003228 0,081331 0,032134 .0,17245 0,314111 0,08183 -0,10015 0,184451 0,451331 ~,00I742 0,033543 0,4111111 ~,13081 ~,00154 ~,08842 0,084741 ~,­ 0,311505 ~,OW7 ~,m31 0,080331 O,1311lM ~.2llO81 ~,031KlO ~,11011 O,OO4lMI ~,02l71 0,022725 ~,01252 0,015812 0,_ ~,00774 0,013871 ~,Ol501 ~,01135 ~,0211 0,007125 O,OOll513 0,008408 0,003227 ~,01574 ~,02811 0,0154 O,OO:lOll 0,002217 0,320833 ~.1I180 0,053872 0,084381 0,0018137 0,200724 0,482358 ~,08083 0,105134 ~,0I114 0,413131 ~,OJ022 ~,02042 ~,14713 ~,07712 O,J07112 ~,05778 0,003112 0,081888 ~,28OlltI O,141l125 0,_ ~,022Ol ~,OO81 0,0013538 0,071145 ~.13315 0,273371 ~,1_ 0._1 0,304113 0,031187 0.oese18 0.011I77 0,218332 ~,035IlI 0.1111118 0,_ 0,_ -0,01882 0,215357 0,108131 ~,03483 0.318875 ~.08821 0,037141 0,041087 0.011121 0.51211 0,*131 O,lMIOO4 0,141353 ~,01472 ~,Ol0015 0,417271 ~,01575 0,415071 ~,05* 0.453371 ~,03031 ~,14857 ~,0I139 ~,13581 ~,02415 ~,01272 ~,I35n ~,05755 0,271122 ~,0l131 0'-1 0.012103 0.148101 ~,25213 0,11718 0,013714 ~,2noe ~,_1 ~,11712 0._ 0._ 0.011817 ~,O3251 ~,00138 0.145301 0,011341 0,_ 0,030157 0,02021 0,022201 0,_ ~,0327 0.000111I ~,ool34 ~,01511 ~,OI072 0,028331 0,001772 0.038521 0,_ 0.030887 0.022811 ~.01112 0.003834 0.017102 0.017_ 0,132241 1ND15JO 0,01_ 0.110217 ~,2I211 0,027125 -0,_ 0.141274 ~,03111 -0,18155 ~,03111 O,0211lll2 0,002584 ~,OOI17 0,007352 0,_3 0,0013I 0,033142 0,003974 0.0I1m ~,0013 O,lM3284 O,0121l15 0,005458 ~,oo1l1 0.010388 0._ ~.­ 0,022271 0,015523 ~.14172 0,_ 0,011153 0,_ 0,001322 O,DlIIM53 0.0lI0331 1ND1515 ~,07t77 0.271412 ~,oml 0,0114714 ~,0074 -0,25122 0.085e24 0.17_ O,lO588l1 ~,281 ~,05305 ~,30883 ~,18181 ~.01N5 0,001421 0,01774 0,007141 ~,Olm -0,_ 0,004202 0,022111 0,014833 0,022321 ~,03882 ~,OI021 ·8,2E-05 ~,00075 ~,­ ~,03147 ~.01882 0,002785 ~,01101 0,028171 0.028718 ~.01001 ~,OII83 0,008528 ~,0l121 0,_3 0,_ ~,ooo71 1ND1500 ~,00251 ~,leo7 ·0,00121 ·0,00184 0,017003 0.0100112 0,001217 ·0,01373 0,023705 0,015715 0,001273 0,021021 ·0,05390 0,021lW8 ~,02818 ~,OlllM 0,021283 ~,00312 0,001423 0,017148 0,007224 0,03317 0,015517 0,014831 ~,02155 ~,OoI811 ~,00712 ~,02052 ~,02212 0,007112 0,081* ~,oooe7 INDl415 ~,01133 ~,01127 ~.01388 0,0071158 0,088201 ~,0021 INDt430 0,348154 ~,08DIll 0,017771 0,071171 0,084718 O,5e25e7 0,137124 0,_3 0,342124 0,_1 0,088771 0,502171 ~,14507 ~,01871 ~,IOo102 0,232421 ~,0318 0,011888 0,182838 ~,2388I 0,212274 0,021125 ~,28813 ~,02041 ~,18812 ~,18754 ~.07042 0,351117 0.0- 0,_ 0,050001 0,020171 0,102241 0,021701 0,330177 o.elO727 O,03lllW8 0,0511137 0,450737 ~,14881 ~,15048 ~,0213 0,010227 0,013171 0,031837 0,001385 0,322541 0,2411II2 0.711187 ~,lM484 0,020123 O,05IB58 0,02527 0,052413 O,35l1113 0,_ 0,071441 0,01504 0.72133 0,22134 ~,OI801 o,omee 0.108114 0.015711 0.072188 0.471581 0,178113 0,251335 ~,07113 0,002471 0,0018527 0,030113 0,552118 0,_ ~,00041 0,01278 0.111235 0,534053 0.5_ ~,lNI ~,17171 -0,15182 -0,15214 O,~07 0,07817 0,135148 0,_ ~,23481 0,208578 0,2178 0,\11041 0.142381 0,_74 0,0127011 0,131757 0,035413 0,_74 O,lIlM037 0,512351 0,11214 O,l22Nl ~,007l7 ~,ll58I2 0,204183 0,1_ 0,134331 0,410327 ~,01322 ~,18831 0,383205 0,282512 0,37_ 0,153402 ~,05I ~,OOI73 0,135112 O,108D1l1 0,114188 0,070217 0,071871 0,080233 0,082228 O,107IM2 0,0010138 0.225374 0,051185 0,071104 O,GC1I287 0,103111 0.101185 0,141737 0,125522 0,003511 0,041885 O,0I5lI2 0,101137 0,007114 0,125318 0,011141 0,13911 0,082018 0,025851 0,110151 1ND1700 ~,31475 ~,11114 ~,01434 O,I1I11B5 ~,­ 0,041773 0,051385 0,018757 ~,_7 0,034885 ~,00212 0,002157 0,024251 ~,Ol881 O,08DIl23 ~,Ol811 ~,01711 ~,Ol218 0,012337 0,010I28 ~,Ol808 0,014502 ~,0217 O,Il25I04 O,Ol07t5 0,003725 0,004371 ~,oo137 0,01217 0,022217 0,148321 1ND1N5 0,_ 0,213771 0,07_ 0,014188 0,1551M3 ~,21321 0,127781 O,35777t ~,31813 ~,Oleoe -0,11471 O,lMID11 0,037072 ~,02255 ~,OllN ~,OO371 0,010133 ~,02532 ~,02407 ~,03358 . 0,022821 ~,015301 ~,Ol407 ~,00811 0,013108 0,011775 -O,lM342 ~,Olnl 0,005517 ~,00I1 O,l:lO101 O,ooee24 0,002204 ~,0031 ~,Ol385 0,018121 0,1401113 ~.00I23 IND11JO 0,084171 ~,11553 ~,14287 O,OOO2U 0,327188 0,_ O,osese2 0,172253 ~,20715 0,231873 0,111874 ~,11081 ~,OO411 ~.32133 0,071112 ~,- ~,OoI113 0,033175 ~,01174 0,05747 ~,08402 ~,07115 ~,00I338 0,000047 0,078187 ~,Ol088 0,00752 0,054122 ~,Ol512 0._ 0,0017712 ~,01471 ~,02151 0,01_ ~,0301 ~,01737 ~,00217 ~,02708 0,021517 0,022lU2 0,151131 ~,OOOI 1ND1115 0.073284 0,183711 0,012412 ~,22 -0,_ 0,_ 0,1_1 0,0_ 0,0101118 0,001I033 0.01817 ~,0017 0,030271I ~,02117 0,_1 0,011181 0,07111 ~.01215 ~,00I314 ~,03551 ~,OoI581 ~,01284 ~,05213 0,051158 ~,00541 ~,OoI588 0,000127 0,0018317 O,0I31ll3 ~,ooeel 0,0181182 0,027385 0,117831 ~,01533 0,000571 0,0011831 0.002511 0,0175113 0.1321 INDUIOO 0,050121 0,027108 ~,00024 ~,02111 0,021138 ~.00ll53 0,_3 0,037131 0,080223 0,035583 ~,00835 ~,0213 ~,D382 ~,OI413 0,013818 0,018281 0,001313 ~.035N 0.0015013 ~,Oll55 0.021073 ~,0005 0,014151 0,0111947 0,137148 1ND1545