CENTRAL GOVERNMENT DEBT

Anuncio

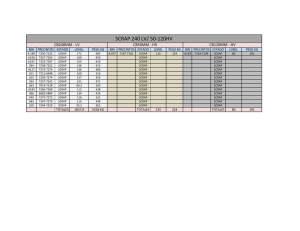

CENTRAL GOVERNMENT DEBT www.tesoro.es BLOOMBERG: TESO REUTERS: TESORO MONTHLY BULLETIN ABOUT CENTRAL GOVERNMENT DEBT MARKETS Num. 234 May 2014 Baa2 / BBB / BBB+ MARKET OVERVIEW CENTRAL GOVERNMENT FINANCING PROGRAM [january-May 2014 (*)] Nominal amounts in million Euros Effective amounts in billion Euros 300 SPANISH CENTRAL GOVERNMENT YIELD CURVE ANNUAL DEBT REDEMPTIONS (*) 6.0 160,000 Letras 232.2 Bonos and Obligaciones 250 120,000 200 129.3 112.4 4.0 Foreign Currency 100,000 150 5.0 140,000 PERFORMANCE ANNUAL FORECAST Other Debt 3.0 80,000 102.9 60,000 55.0 39.8 32.4 (*) Includes 23 billion euros to be transferred to the Regional Liquidity Fund (FLA) (**) Includes foreign currency issues and other debts Source: General Secretariat of the Treasury and Financial Policy. May 31st 2014 years 0.0 2044 2041 2040 2037 2036 2034 2033 2032 2031 2030 2029 2028 2027 2026 2025 2024 2023 2022 2021 2020 2019 2018 2017 0 Bonos & Obligaciones Issuance (**) 2016 Letras del Tesoro Issuance 2015 Total Net Issuance 1.0 20,000 2014 Total Gross Issuance April 30 th 2014 40,000 50 0 May 31st 2013 2.0 72.5 100 (*) Year 2014: Redemptions June-December Source: General Secretariat of the Treasury and Financial Policy. 0.25 0.50 1 3 5 10 15 30 Source: Bloomberg. AUCTIONS MAY AUCTIONS RESULTS Nominal amounts in million Euros BID (1st ROUND and 2nd ROUND) STOP-OUT-RATE (%) ALLOTED (1st ROUND and 2nd ROUND) AVERAGE RATE (%) ALLOTED (2nd ROUND) % 8,000 7,000 3.524 5,000 2.988 4,000 2.968 3,000 1.671 1.055 2,000 0 0.318 0.295 0.370 0.362 0.560 0.552 0.608 1.648 3.514 0.598 L3 L6 L9 L12 B 2.10% B 2.75% O 4.0% O 3.80% O 5.15% 08/22/14 May 20 11/21/14 May 13 02/20/15 May 20 05/15/15 May 13 04/30/17 May 8 04/30/19 May 22 04/30/20 May 8 04/30/24 May 22 10/31/28 May 8 9-month Letras 02/20/15 5-year Bonos 2.75% 04/30/19 10-year Obligaciones 3.80% 04/30/24 May 8 May 8 May 13 May 13 May 20 May 20 May 22 May 22 2,982.9 4,999.8 9,101.7 3,274.6 6,340.0 3,259.4 3,797.6 5.5 Auction (1) 3,164.7 4,839.7 2,749.5 4,836.4 8,568.0 3,274.6 6,065.7 2,934.8 3,362.5 5.0 Second round 27.3 548.6 233.3 163.4 533.7 - 274.3 324.6 435.1 1,027.0 3,012.0 1,327.6 1,363.4 3,846.7 924.6 2,865.0 1,861.4 2,428.6 1,993.5 4.0 Amount allotted 3.5 Auction (2) 999.7 2,463.5 1,094.3 1,200.0 3,313.0 924.6 2,590.7 1,536.8 3.0 Second round 27.3 548.6 233.3 163.4 533.7 - 274.3 324.6 435.1 Stop-out price (excoupon) 103.030 111.640 118.160 - - - - 105.060 106.880 Stop-out price 103.100 111.780 120.900 99.807 99.389 99.920 99.578 105.260 107.160 1.0 Stop-out rate (%) 1.055 1.916 3.524 0.370 0.608 0.318 0.560 1.671 2.988 0.5 Weighted average rate (%) 1.039 1.900 3.514 0.362 0.598 0.295 0.552 1.648 2.968 Previous stop-out rate (%) 1.036 2.139 3.869 0.380 0.565 0.340 0.482 1.678 3.073 Bid to cover ratio (1)/(2) 3.166 1.965 2.513 4.030 2.586 3.542 2.341 1.910 1.687 CENTRAL GOVERNMENT DEBT MAY 2014 1.5 1.039 3-month Letras 08/22/14 5,388.3 2.0 1.900 12-month Letras 05/15/15 May 8 2.5 1.916 6-month Letras 11/21/14 3,192.0 4.5 6,000 Obligaciones 5.15% 10/31/28 Amount bid 6.0 9,000 Obligaciones 4.0% 04/30/20 Auction date 6.5 10,000 1,000 3-year Bonos 2.10% 04/30/17 0.0 Source: General Secretariat of the Treasury and Financial Policy. MONTHLY BULLETIN, no. 234. May 2014. Note: Data compiled as at 05/31/2014, unless otherwise specified 1 Num. 234 May 2014 MONTHLY BULLETIN ABOUT CENTRAL GOVERNMENT DEBT MARKETS TURNOVER CENTRAL GOVERNMENT TURNOVER evolution Turnover APRIL 2014 Daily average in million Euros 2012 2.80% vs March 2014 2013 16.75% vs April 2013 2014 80,000 70,000 DISTRIBUTION BY COUNTERPARTY DISTRIBUTION BY TRANSACTION TYPE Daily average as at 04/30/2014 Daily average as at 04/30/2014 60,000 Transactions between Account Holders: 32,909 mill. Euros Outright transactions: 24,963 mill. Euros Transactions with Third parties: 34,336 mill. Euros Repo transactions: 42,283 mill. Euros 50,000 51.06 % 62.88 % 40,000 30,000 37.12 % 48.94 % 20,000 10,000 0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Source: Bank of Spain. OUTRIGHT TRANSACTIONS IN BONOS AND OBLIGACIONES BETWEEN ACCOUNT HOLDERS OUTRIGHT TRANSACTIONS IN LETRAS BETWEEN ACCOUNT HOLDERS Nominal amounts in million Euros Nominal amounts in million Euros Electronic market 160,000 Second tier 140,000 35,000 120,000 30,000 100,000 25,000 80,000 20,000 60,000 15,000 40,000 10,000 20,000 5,000 0 M13 J Source: Bank of Spain. J A S O N Electronic market 40,000 D J F M A14 0 M13 J Source: Bank of Spain. J A STRIPPING ACTIVITY Nominal amounts in million Euros Gross stripping Second tier S O N Strips outstanding (right hand scale) Reconstitution 3,000 D J F M A14 60,000 2,500 50,000 2,000 40,000 1,500 30,000 1,000 20,000 500 10,000 0 M13 J J A S O N D J F M A14 0 Source: Bank of Spain. MONTHLY BULLETIN, no. 234. May 2014. Note: Data compiled as at 05/31/2014, unless otherwise specified CENTRAL GOVERNMENT DEBT MAY 2014 2 Núm. 223 Junio 2013 MONTHLY BULLETIN ABOUT CENTRAL GOVERNMENT DEBT MARKETS Num. 234 May 2014 DEBT PORTFOLIO DISTRIBUTION BY HOLDERS Nominal amounts in million Euros as at 05/31/14, except non resident holdings Registered holdings of non stripped Central Government Debt (*) As at 04/30/14 Market value Third parties holdings Nonresident holdings (*) 100% 80% 90% 12098 O 4.75 07/30/14 16,395.1 763.1 16,510.7 8,081.6 5,695.3 Bonos and Obligaciones del Estado 121P3 B 3.30 10/31/14 21,800.5 345.6 22,065.4 8,783.8 6,046.1 Non-marketable Debt & others (*) 12916 O 4.40 01/31/15 20,975.8 637.8 21,526.4 7,023.8 4,311.2 Int’l issues in euro-legacy currencies & foreign currency debt 122G0 B. Int. Vble.(**) 03/17/15 1,500.0 -- 1,500.0 977.6 448.2 60% 123T1 B 2.75 03/31/15 10,540.3 -- 10,736.4 5,535.0 4,062.9 50% 122F2 B 3.0 04/30/15 20,971.3 350.2 21,442.7 10,204.1 5,171.6 123L8 B 4.0 07/30/15 20,180.3 247.3 20,972.3 9,745.1 7,822.8 70% 40% 123P9 B 3.75 10/31/15 15,484.6 86.0 16,162.2 9,103.0 8,270.0 30% 120G4 O 3.15 01/31/16 20,638.5 573.8 21,501.2 10,275.4 6,933.9 20% AVERAGE LIFE OF THE DEBT PORTFOLIO 122X5 B 3.25 04/30/16 21,221.2 1,158.7 22,231.7 11,395.4 7,456.2 123W5 B 3.30 07/30/16 17,107.6 -- 18,017.9 10,502.8 7,741.4 YEARS 123J2 B 4.25 10/31/16 21,181.9 -- 22,872.2 10,120.3 6,604.2 120J8 O 3.80 01/31/17 21,453.4 1,227.9 23,075.1 11,370.8 8,015.1 124I2 2.10 04/30/17 16,181.4 -- 16,679.9 11,431.9 8,217.9 12783 O 5.50 07/30/17 20,085.8 1,552.9 22,826.9 11,372.0 7,056.5 123R5 B 4.75 (**) 09/30/17 3,902.4 -- 0.0 -- -- 123Q7 B 4.50 01/31/18 19,491.9 950.1 21,761.5 12,447.6 8,551.3 121A5 O 4.10 07/30/18 18,942.4 890.7 21,052.6 11,067.2 7,272.4 Insurance Companies 124B7 3.75 10/31/18 19,477.7 236.8 21,401.0 14,488.7 8,748.2 Credit Institutions 124V5 2.75 04/30/19 19,485.6 -- 20,592.0 9,551.2 6,189.6 121L2 O 4.60 07/30/19 18,109.8 1,340.6 20,808.2 9,924.7 5,748.3 121O6 O 4.30 10/31/19 21,161.1 914.0 24,054.9 9,388.1 5,813.0 122D7 O 4.00 04/30/20 22,584.7 781.6 25,351.6 11,614.3 8,164.4 122T3 O 4.85 10/31/20 18,387.2 1,403.0 21,513.8 8,518.1 6,445.3 123B9 O 5.50 04/30/21 24,001.9 559.7 29,081.0 12,154.7 9,291.4 123K0 O 5.85 01/31/22 19,001.9 353.9 23,569.9 13,860.0 9,657.5 123U9 O 5.40 01/31/23 17.435,5 -- 21.166,2 12.765,0 9.694,3 123X3 O 4.40 10/31/23 17.859,0 -- 20.178,0 12.443,2 9.353,2 121G2 O 4.80 01/31/24 15,050.9 335.3 17,580.7 7,728.7 4,858.4 6.50 6.35 6.00 5.50 5.00 4.50 2014 2013 2012 2011 2009 2010 2008 2007 2006 2005 2003 2004 2002 2001 2000 4.00 Source: General Secretariat of the Treasury and Financial Policy. International issues foreing currency denominated Millions Security Coupon Maturity (%) date Next coupon payment Annual coupons Outstanding € Equiv. US $ Equiv. Note ¥ (*) 20,000 3.133 04/17/17 10/01/14 1 144.6 196.7 Note ¥ (*) 20,000 3.100 04/21/17 04/21/15 1 144.6 196.7 Note ¥ (*) 20,000 2.915 12/02/30 06/02/14 2 144.6 196.7 Note $ (*) 2,000 4.000 03/06/18 03/06/15 1 1,469.8 2,000.0 Note £ (*) 200 5.250 04/06/29 04/06/15 1 246.0 334.7 Total (*) Swapped Source: General Secretariat of the Treasury and Financial Policy. 2,149.6 2,924.8 124W3 O 3.80 04/30/24 21,185.8 -- 22,868.2 13,761.5 9,936.8 126A4 O€i 1.80 (**) 11/30/24 5011.25 (***) -- 5,145.0 3,556.2 -- 122E5 O 4.65 07/30/25 14,241.2 636.1 16,389.7 6,964.5 3,722.1 123C7 O 5.90 07/30/26 13,968.3 168.7 17,742.8 7,018.1 4,430.1 124C5 O 5.15 31/10/28 10,861.9 -- 12,895.2 7,790.2 4,027.1 11868 O 6.00 01/31/29 18,263.6 3,694.8 23,600.2 7,521.1 4,638.2 *2014 Households & non-financials Pension & Mutual Funds and other financial entities Source: Bank of Spain. letras del tesoro Nominal amounts in million Euros as at 05/31/14, except non resident holdings Maturity date Outstanding volume Market value ES0L01406203 06/20/14 13,949.3 13,947.5 8,308.0 7,118.7 ES0L01407185 07/18/14 7,797.7 7,794.6 6,878.1 5,994.5 Security Third parties holdings Non-resident holdings(*) ES0L01408225 08/22/14 7,757.7 7,753.5 6,332.7 3,618.9 ES0L01409199 09/19/14 6,508.6 6,504.3 4,757.9 3,386.0 ES0L01410171 10/17/14 7,900.2 7,891.8 4,769.1 4,044.7 ES0L01411211 11/21/14 7,304.5 7,294.2 5,036.5 3,693.7 ES0L01412128 12/12/14 4,771.6 4,763.2 3,340.9 2,470.7 ES0L01501235 01/23/15 5,078.9 5,065.7 3,062.0 1,528.7 07/30/32 14,853.4 2,766.2 19,168.5 6,501.0 4,726.1 01/31/37 15,994.4 3,091.6 16,955.5 8,513.2 6,951.8 120N0 O 4.90 07/30/40 13,373.9 2,801.4 15,550.3 5,887.1 4,399.5 121S7 O 4.70 07/30/41 11,807.3 4,634.3 13,295.3 5,388.0 3,568.3 ES0L01504106 04/10/15 3,650.3 124H4 O 5.15 (**) 31/10/44 4,807.2 -- 5,755.7 3,975.7 2,615.8 ES0L01505152 05/15/15 3,846.7 659,966.7 32,502.1 735,598.7 358,750.5 242,656.1 79,140.6 79,015.8 Duration of outstanding strippable debt (in years): 5.27 2013 Spanish official institutions 12411 O 5.75 (*) Non residents third parties holdings as at 04/30/14 (**) As at 05/31/14 the stripping has not been authorised (***) Updated by inflation as at 05/31/2014 2012 Non-residents 12932 O 4.20 Total 2011 2003 2002 0% 2001 7.00 10% 2000 (*) Includes loans and assumed debt in euros and euro-legacy currencies 2010 83.9% Outstanding Stripped volume (stripped volume (only principals are stripped included) principals) 2009 Letras del Tesoro Maturity date 2008 Security 2007 10% 2006 5.8% 2005 0.3% BONOS AND OBLIGACIONES DEL ESTADO 2004 Central Government Outstanding Debt ES0L01502209 02/20/15 7,053.5 7,028.6 4,634.7 1,112.0 ES0L01503132 03/13/15 3,521.4 3,509.3 2,334.4 1,406.6 3,635.2 2,288.8 900.5 3,827.8 1,914.5 -- 53,657.3 35,274.9 Total Duration of outstanding Letras (in years): 0.40 (*) Non residents third parties holdings as at 04/30/14 MONTHLY BULLETIN, no. 234. May 2014. Note: Data compiled as at 05/31/2014, unless otherwise specified CENTRAL GOVERNMENT DEBT MAY 2014 3 MONTHLY BULLETIN ABOUT CENTRAL GOVERNMENT DEBT MARKETS Num. 234 May 2014 TECHNICAL CHARACTERISTICS OF SPANISH CENTRAL GOVERNMENT DEBT Main features of Letras del Tesoro, Bonos and Obligaciones del Estado 3, 6, 9 & 12-month Letras Face value Interest 3 & 5-year Bonos 10, 15 & 30-year Obligaciones € 1,000 € 1,000 At a discount Annual coupon Method of issuance Auction Auction Minimum bid € 1,000 € 1,000 FINAL DATE FOR BIDS: Market members Auction date Auction date Non members One trading day before the auction One trading day before the auction Settlement date Three trading days after the auction Three trading days after the auction PAYMENT DATE Market members Settlement date Settlement date One trading day before settlement One trading day before settlement The yield (difference between the transfer/redemption and acquisition/subscription price) is taxed as savings income at a rate of 21%(1) and no withholding tax is applied. The coupon is taxed as savings at 21%(1). A withholding tax of 21% is applied. The yield (difference between the transfer/redemption and acquisition/subscription price) is taxed as savings at 21%(1) and no withholding tax is applied, except in the “coupon washing” case. Taxation Non members Residents Personal income tax Corporate income tax Yield of all Treasury securities is taxed according to the “accrued interest” principle and no withholding tax is applied with the exception of “coupon washing” cases to which will be applied a withholding tax of 21%. Non residents (1) Income obtained from Spanish Debt instruments by non-resident individuals or by legal entities that do no operate through a permanent establishment in Spain, will not be subject to tax in Spain. Rising to 25% on the portion of taxable income between € 6,000 and € 24,000 and to 27% on the portion of taxable income over € 24,000.Source: General Secretariat of the Treasury and Financial Policy. PRIMARY DEALERS AND REFERENCE PAGES FOR SPANISH GOVERNMENT DEBT ENTITY TYPE OF PRIMARY DEALER (PD) BONDS AND STRIPS MARKET LETRAS MARKET BLOOMBERG REUTERS PAGE PAGE BANCO COOPERATIVO ESPAÑOL Letras PD BANKINTER Bonos, Obligaciones and Letras PD 34-91-339-78-42 34-91-339-78-42 BKT BARCLAYS Bonos, Obligaciones and Letras PD 44 207 773 8940 44 207 773 9631 BXEG BBVA Bonos, Obligaciones and Letras PD 34-91-537-82-37 B.N.P. PARIBAS Bonos, Obligaciones and Letras PD 33 142 980 868 BANKIA Bonos, Obligaciones and Letras PD 34-91-423-50-21 CAIXABANK Bonos, Obligaciones and Letras PD 93-404-63-05 CRÉDIT AGRICOLE Bonos, Obligaciones and Letras PD 44 207 214 6133 CECABANK Bonos, Obligaciones and Letras PD CITIGROUP Bonos, Obligaciones and Letras PD CREDIT SUISSE Bonos, Obligaciones and Letras PD 34-91-595-67-33 34-91-532-92-29 44 207 986 9340 44 207 888 6451 34-91-537-82-85 BBGX BPET 34-91-423-92-85 44 207 214 6133 34-91-596-57-01 BARCEGB 0#E4TSY=BPGL ENTITY TYPE OF PRIMARY DEALER BONDS AND STRIPS MARKET (PD) LETRAS MARKET BLOOMBERG PAGE DEUTSCHE BANK Bonos, Obligaciones and Letras PD 44 207 545 6451 49 69 9103 2853 DABB COMMERZBANK. AG Bonos, Obligaciones and Letras PD 44 207 475 6707 49 69 136 87 732 CBET GOLDMAN SACHS Bonos, Obligaciones and Letras PD 44 207 774 8112 GSGB HSBC FRANCE Bonos, Obligaciones and Letras PD 33 1 40 70 71 72 HSED 16 JP MORGAN Bonos, Obligaciones and Letras PD 44 207 779 3400 33 1 53 40 10 93 REUTERS PAGE EUROGOV HSBCBONO1 HSBCBONO2 JPMES01/02 CAJM CAJAMADRID NATIXIS Bonos, Obligaciones and Letras PD CAIXA CAIXA NOMURA Bonos, Obligaciones PD 44 207 103 56 09 CALY CALYON BANCO SANTANDER Bonos, Obligaciones and Letras PD 34-91-257-20-40 34-91-257-20-65 BSGB BSST ROYAL BANK OF SCOTLAND Bonos, Obligaciones and Letras PD 44 207 085 2214 44 207 678 4254 RBSS ABNSPAST01 SSBEURO01 SOCIETÉ GÉNÉRALE Bonos, Obligaciones and Letras PD 33 1 42 13 46 34 33 1 42 13 71 02 SXGV SGGOVT CSBONDAA MORGAN STANLEY & CO. INTERNATIONAL PLC Bonos, Obligaciones and Letras PD 44 2076779335 MSEG MSXL CECA CGEG CSEG CECA 33 1 58 55 13 21 NXIG4 IXISBONOS1 IXISBONOS2 NOMX NOEB • Spanish Tresuary pages in: Bloomberg: TESO Reuters: TESORO • For further information, please contact: Mrs. Concepción Aldea del Pozo • E-mail: [email protected] • Address: Pº del Prado, 6 - 28014 Madrid • Tel.: +34 91 209 96 89 • Web: http://www.tesoro.es Baa2 / BBB / BBB+ This Bulletin refers exclusively to marketable debt issued by the Central Government, except otherwise indicated. The information included in this booklet has been compiled and verified to the best of our knowledge. The possibility of any factual mistake can, however, not be excluded. MONTHLY BULLETIN, no. 234. May 2014. Note: Data compiled as at 05/31/2014, unless otherwise specified CENTRAL GOVERNMENT DEBT MAY 2014 4