Trade balance – External demand is gaining momentum

Anuncio

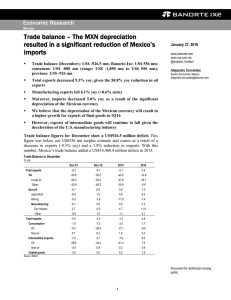

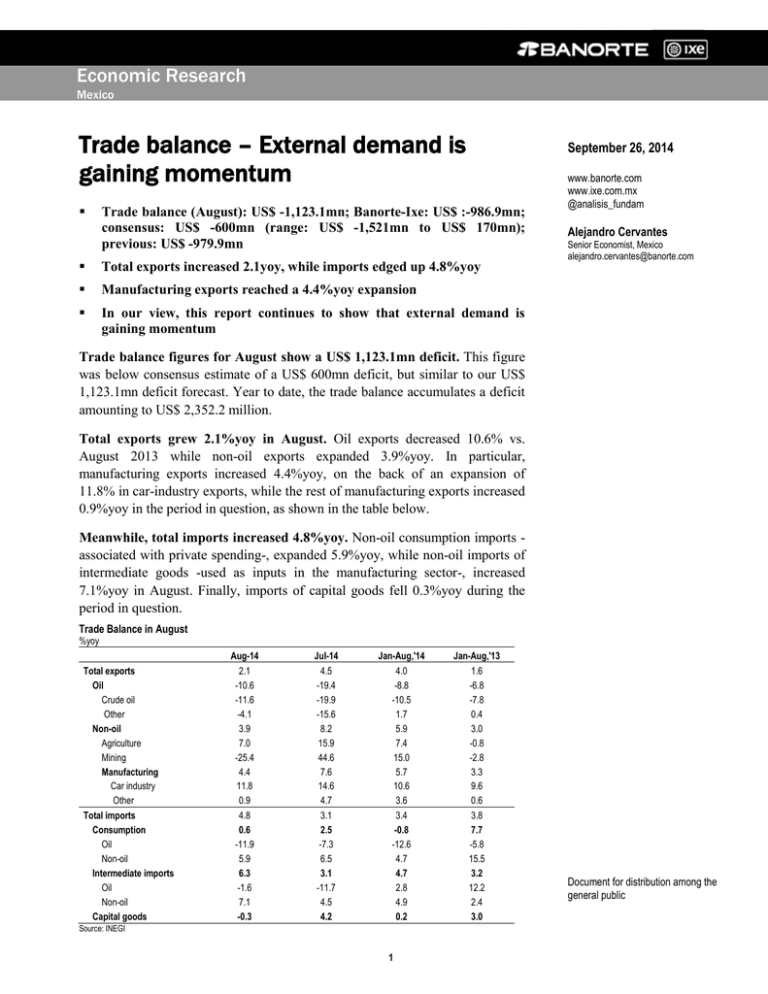

Economic Research Mexico Trade balance – External demand is gaining momentum Trade balance (August): US$ -1,123.1mn; Banorte-Ixe: US$ :-986.9mn; consensus: US$ -600mn (range: US$ -1,521mn to US$ 170mn); previous: US$ -979.9mn Total exports increased 2.1yoy, while imports edged up 4.8%yoy Manufacturing exports reached a 4.4%yoy expansion In our view, this report continues to show that external demand is gaining momentum September 26, 2014 www.banorte.com www.ixe.com.mx @analisis_fundam Alejandro Cervantes Senior Economist, Mexico [email protected] Trade balance figures for August show a US$ 1,123.1mn deficit. This figure was below consensus estimate of a US$ 600mn deficit, but similar to our US$ 1,123.1mn deficit forecast. Year to date, the trade balance accumulates a deficit amounting to US$ 2,352.2 million. Total exports grew 2.1%yoy in August. Oil exports decreased 10.6% vs. August 2013 while non-oil exports expanded 3.9%yoy. In particular, manufacturing exports increased 4.4%yoy, on the back of an expansion of 11.8% in car-industry exports, while the rest of manufacturing exports increased 0.9%yoy in the period in question, as shown in the table below. Meanwhile, total imports increased 4.8%yoy. Non-oil consumption imports associated with private spending-, expanded 5.9%yoy, while non-oil imports of intermediate goods -used as inputs in the manufacturing sector-, increased 7.1%yoy in August. Finally, imports of capital goods fell 0.3%yoy during the period in question. Trade Balance in August %yoy Total exports Oil Crude oil Other Non-oil Agriculture Mining Manufacturing Car industry Other Total imports Consumption Oil Non-oil Intermediate imports Oil Non-oil Capital goods Aug-14 2.1 -10.6 -11.6 -4.1 3.9 7.0 -25.4 4.4 11.8 0.9 4.8 0.6 -11.9 5.9 6.3 -1.6 7.1 -0.3 Jul-14 4.5 -19.4 -19.9 -15.6 8.2 15.9 44.6 7.6 14.6 4.7 3.1 2.5 -7.3 6.5 3.1 -11.7 4.5 4.2 Jan-Aug,'14 4.0 -8.8 -10.5 1.7 5.9 7.4 15.0 5.7 10.6 3.6 3.4 -0.8 -12.6 4.7 4.7 2.8 4.9 0.2 Source: INEGI 1 Jan-Aug,'13 1.6 -6.8 -7.8 0.4 3.0 -0.8 -2.8 3.3 9.6 0.6 3.8 7.7 -5.8 15.5 3.2 12.2 2.4 3.0 Document for distribution among the general public In our view, this report continues to show that external demand is gaining momentum. As we have argued throughout our publications, 2Q14 was the turning point for economic activity on the back of a more dynamic external demand coupled with an incipient pick up of private consumption. In this context, the first figures associated with the Mexican manufacturing sector in 3Q14 suggest that the growth momentum of the external demand will continue throughout the second half of 2014, which will have a positive impact on the overall growth dynamics of the Mexican economy. Disclaimer The information contained in this document is illustrative and informative so it should not be considered as an advice and/or recommendation of any kind. BANORTE is not part of any party or political trend. 2 GRUPO FINANCIERO BANORTE S.A.B. de C.V. Research and Strategy Gabriel Casillas Olvera Raquel Vázquez Godinez Chief Economist and Head of Research Assistant [email protected] [email protected] (55) 4433 - 4695 (55) 1670 - 2967 Economic Analysis Delia María Paredes Mier Julieta Alvarez Espinosa Alejandro Cervantes Llamas Katia Celina Goya Ostos Julia Elena Baca Negrete Livia Honsel Miguel Alejandro Calvo Dominguez Rey Saúl Torres Olivares Lourdes Calvo Fernández Executive Director of Economic Analysis Assistant Senior Economist, Mexico Senior Global Economist Economist, U.S. Economist, Europe [email protected] [email protected] [email protected] [email protected] [email protected] [email protected] (55) 5268 - 1694 (55) 5268 - 1613 (55) 1670 - 2972 (55) 1670 - 1821 (55) 1670 - 2221 (55) 1670 - 1883 Economist, Regional & Sectorial [email protected] (55) 1670 - 2220 Analyst, Mexico Analyst (Edition) [email protected] [email protected] (55) 1670 - 2957 (55) 1103 - 4000 x 2611 Fixed income and FX Strategy Alejandro Padilla Santana Juan Carlos Alderete Macal Santiago Leal Singer Head Strategist – Fixed income and FX FX Strategist Analyst Fixed income and FX [email protected] [email protected] [email protected] (55) 1103 - 4043 (55) 1103 - 4046 (55) 1103 - 2368 Equity Strategy Manuel Jiménez Zaldivar Victor Hugo Cortes Castro Marissa Garza Ostos Marisol Huerta Mondragón José Itzamna Espitia Hernández María de la Paz Orozco García Director Equity Research Analyst Telecommunications / Media Equity Research Analyst Senior Equity Research Analyst – Conglomerates/Financials/ Mining/ Chemistry Senior Research Analyst – Food/Beverages Equity Research Analyst – Airports / Cement / Infrastructure / Fibras Analyst [email protected] (55) 5004 - 1275 [email protected] (55) 5004 - 1231 [email protected] (55) 5004 - 1179 [email protected] (55) 5004 - 1227 [email protected]. (55) 5004 - 1266 [email protected] (55) 5004 - 5262 Corporate Debt Tania Abdul Massih Jacobo Hugo Armando Gómez Solís Idalia Yanira Céspedes Jaén Director Corporate Debt Analyst, Corporate Debt Analyst, Corporate Debt [email protected] [email protected] [email protected] (55) 5004 - 1405 (55) 5004 - 1340 (55) 5268 - 9937 Head of Wholesale Banking Managing Director – Private Banking Managing Director – Corporate Banking Managing Director – Transactional Banking Managing Director – Asset Management [email protected] [email protected] [email protected] [email protected] [email protected] (55) 5268 - 1659 (55) 5004 - 1453 (81) 8319 - 6895 (55) 5004 - 1454 (55) 5268 - 9004 Wholesale Banking Marcos Ramírez Miguel Luis Pietrini Sheridan Armando Rodal Espinosa Victor Antonio Roldan Ferrer René Gerardo Pimentel Ibarrola