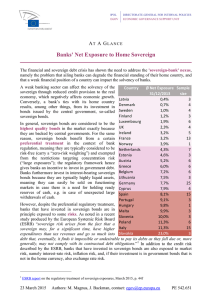

Working Paper N.º 0505. The role of global risk aversion in

Anuncio