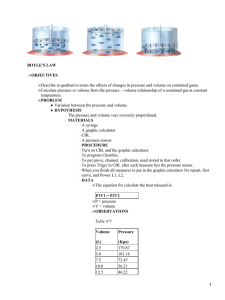

CBL - Annual Report 2015 - Central Bank of Liberia

Anuncio