Mercado de Títulos de Renta Variable

Anuncio

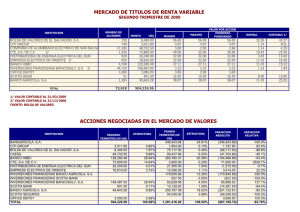

MERCADO DE TITULOS DE RENTA VARIABLE PRIMER TRIMESTRE DE 2009 NÚMERO DE ACCIONES INSTITUCION BANAGRICOLA, S.A. 2/ BOLSA DE VALORES DE EL SALVADOR, S.A. CITI GROUP COMPAÑIA DE ALUMBRADO ELECTRICO DE SAN SALVAD CTE, S.A. DE C.V. DISTRIBUIDORA DE ENERGIA ELECTRICA DEL SUR 2/ EMPRESA ELECTRICA DE ORIENTE BANCO HSBC INVERSIONES FINANCIERAS BANCO AGRICOLA, S.A. INVERSIONES FINANCIERAS SCOTIA BANK, S.A. 2/ INVERSIONES FINANCIERAS BANCOSALV, S.A. SCOTIA BANK SCOTIA SEGUROS BANCO AGRICOLA, S.A. TOTAL 7,367 1,191 600 31,623 70 960 667 10,467 4,584 25 18,864 864 1,201 6,587 85,070 MONTO US$ 346,543.68 75,117.00 1,854.00 90,437.46 2,800.00 21,455.00 15,396.00 283,760.37 170,845.68 637.50 62,628.48 15,129.00 54,045.00 250,767.09 1,391,416.26 MINIMO 47.04 60.00 3.09 2.50 40.00 22.00 23.00 27.11 37.27 25.50 3.32 16.50 45.00 38.07 MAXIMO VALOR POR ACCION PROMEDIO PONDERADO 47.04 64.95 3.09 2.90 40.00 23.00 24.00 27.11 37.27 25.50 3.32 19.50 45.00 38.07 47.04 63.12 3.09 2.86 40.00 22.36 23.09 27.11 37.27 25.50 3.32 17.63 45.00 38.07 NOMIAL 11.43 32.00 1.14 19.43 3.43 11.43 11.43 11.43 11.43 1.14 8.00 11.43 11.43 10.00 1/ VALOR CONTABLE AL 31/12/2009 2/ VALOR CONTABLE AL 30/06/2008 FUENTE: BOLSA DE VALORES ACCIONES NEGOCIADAS EN EL MERCADO DE VALORES INSTITUCION BANAGRICOLA, S.A. CITI GROUP BOLSA DE VALORES DE EL SALVADOR, S.A. CAESS BANCO HSBC CTE, S.A. DE C.V. DISTRIBUIDORA DE ENERGIA ELECTRICA DEL SUR EMPRESA ELECTRICA DE ORIENTE INVERSIONES FINANCIERAS BANCO AGRICOLA, S.A. INVERSIONES FINANCIERAS SCOTIA BANK INVERSIONES FINANCIERAS BANCOSALV, S.A. SCOTIA BANK BANCO AGRICOLA, S.A. AFP CONFIA SCOTIA SEGUROS TOTAL PRIMER TRIMESTRE/09 US$ 346,543.68 1,854.00 75,117.00 90,437.46 283,760.37 2,800.00 21,455.00 15,396.00 170,845.68 637.50 62,628.48 15,129.00 250,767.09 54,045.00 1,391,416.26 ESTRUCTURA 24.91% 0.13% 5.40% 6.50% 20.39% 0.20% 1.54% 1.11% 12.28% 0.05% 4.50% 1.09% 18.02% 0.00% 3.88% 100.00% CUARTO TRIMESTRE/08 US$ 248,324.16 5,100.00 334,568.21 507,363.65 813,736.16 15,755.00 134,435.30 67,123.27 1,142.10 111,210.04 12,889.50 212,735.16 4,900.00 535,095.00 3,004,377.55 ESTRUCTURA 8.27% 0.17% 0.00% 11.14% 16.89% 27.09% 0.52% 4.47% 2.23% 0.04% 3.70% 0.43% 7.08% 0.16% 17.81% 100.00% VARIACION ABSOLUTA 98,219.52 (3,246.00) 75,117.00 (244,130.75) (223,603.28) (810,936.16) 5,700.00 (119,039.30) 103,722.41 (504.60) (48,581.56) 2,239.50 38,031.93 (4,900.00) (481,050.00) (1,612,961.29) VARIACION RELATIVA 39.6% -63.6% 100.0% -73.0% -44.1% -99.7% 36.2% -88.5% 154.5% -44.2% -43.7% 17.4% 17.9% -100.0% -89.9% -53.69% CONTABLE 1/ 30.17 42.03 N.D. 4.55 25.99 13.26 18.40 19.05 25.52 23.75 1.84 15.57 31.36 26.11