Business Strategies, Abilities and Paths of Two Argentinian Family

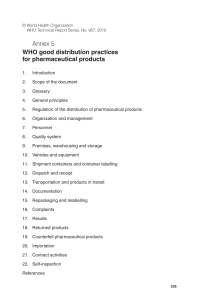

Anuncio

Business Strategies, Abilities and Paths of Two Argentinian Family Laboratories By Mónica Campins and Ana Pfeiffer∗ (CEEED-FCE-Universidad de Buenos Aires) [email protected], [email protected] XIV International Economic History Congress. Helsinki 2006 Session number 40: Innovation and Networks in Entrepreneurship Organizers: Mary B. Rose and Paloma Fernández Pérez 1 This paper is the result of several investigation projects carried out in Buenos Aires University (UBA) within the UBACyT Program. We would like to take this opportunity to thank María Inés Barbero and Paloma Fernández Pérez, who read this paper and made useful observations. 1 Abstract: This paper analyzes the business experience of two Argentinean family laboratories through the XX century: La Fármaco Argentina Ltd. and Roux-OCEFA Ltd. The development of both companies has been studied in order to identify and compare the competences gained throughout their history and the capacities they have acquired to be able to face the changes in the legal and productive environments. This research has given careful consideration to the evolutionary perspective of these companies and to the family business framework, in order to analyze the changes that took place in the companies as a result of internal processes of learning, improvement and selection. We have also found another kind of internal processes that resulted in radical innovations, insofar as they marketed original products and carried out daring and, at that time, “state-of-the-art” scientific researches. We also put special emphasis on the people behaviour in connection with the legal framework and their relationships with the scientific and academic environment. The great significance achieved by the scientific and technical networks in both laboratories is the result of one of the habitual and important activities performed in the pharmaceutical sector, due to the weight of the research work and to the development required by this sector; and to the regulations enforced by the national health authority. The ability to stay in the market for almost one hundred years in such a peculiar atmosphere as the Argentinean one -uncertain and favourable at the same time-, suggests that these laboratories managed to adapt themselves and to make capital out of their experience, incorporating it in routines that were passed on to the following generations. These competences, which represented an advantage until the 90’s, have not necessarily helped the laboratories face the changing conditions of the new scenario determined by the opening of the domestic market and the coming into effect of the drugs patent regulation. 2 Introduction This paper analyzes and compares the business path of two Argentinian laboratories through the XX century: La Fármaco Argentina Ltd. and Roux-OCEFA Ltd. The selection of these two laboratories is the result of a previous survey conducted by the same research team among thirty laboratories with different sizes and sources of capital. In addition, one or more interviews were made to the directors or the owners of the companies. As regards La Fármaco and Roux-OCEFA, the events recounted by their owners led to a second phase which focused on the comparison of these two companies, based on public documentation that confirmed or not what they had said. It should also be born in mind that the resource of the oral history as an additional method used in the field work was useful to gather all the scattered information and to show tacit routines and capabilities, as well as the peopleinstitutions relationship in their daily tasks. Within the pharmaceutical industry of domestic capital, these two companies shared certain common features: both were family companies, almost centenarian, medium-large sized and had a good position in the local market. The ability to stay in the market for almost one hundred years in such an unstable atmosphere as the Argentinian one, suggests that these laboratories managed to make capital out of their experience, incorporating it in routines that were passed on to the subsequent generations. These competences, which represented an advantage until the nineties, did not necessarily help the laboratories face the changing conditions of the new scenario determined by the opening of the domestic market and the coming into effect of the patent law. The paths of these laboratories have been analyzed in order to verify if these competences represented an advantage or if they became a burden when they got to the end of the XX century. The adaptation process underwent by these laboratories due to the influences and constraints of the legal framework and the relationships with the scientific and academic environment were issues taken into account. The importance of these political and technical-scientific networks required special attention, due to the influence of R & D (Research and Development) and the health authority regulations over this industry. The paper was carried out in three different stages: in the first stage, information about the pharmaceutical industry and sector was gathered from the INDEC (National Institute of Statistics and Census) and the business chambers. Then, a field work with interviews to 3 businessmen and managers including previous ones was carried out in order to obtain information about their own activities and the firm`s performance. These interviews were based on an open thematic guideline oriented towards the reconstruction of the firm history: the origin of the company and the evolution of the stockholding, the generational transition, the organizational structure, the productive path and the survival strategies. The data provided by the interviewees was contrasted and completed with other pieces of information about management obtained from different sources such as articles of association, reports and stocktaking, Board of Directors` minutes, presentations and other documents from the Corporate Records Office. In the second stage, the histories of both laboratories were written and subsequently, their performances were compared according to three proposed axes: the strategies, abilities and paths of both companies. In the conclusion, an observation was made about the impact of some of the decisions taken, the effectiveness of the gained abilities in both firms and the path influence during the nineties. The study presented follows the alternative approaches to the model that focuses on the big modern company (Scranton 1997; Zeitlin 2003; Gatto and Yoguel 1993). The theoretical framework combines both the evolutionary view of the firm (López 1996) and the family business subject matter (Colli and Rose 2003; Colli, Fernández and Rose 2003). On the one hand this approach allowed to focus on the learning processes, the creation of competences and the search for possible solutions to daily problems that are generally the origin of innovations in the companies. (Nelson 2002) These processes have a tacit dimension which is difficult for other companies to imitate or to transfer.(Coriat and Dosi 1996). On the other hand, the approach from the family business` point of view also allowed to take into account certain issues related to the management and the ownership of the firm. Along with the development of the managerial business, the family companies still have a great importance in many national economic systems due to their valuable contribution to the generation of employment and wealth. Family firms in Argentina, according to the information obtained by the Argentinian Institute of Family Business of Flores University, produce 50% of the GDP and they employ 6 out of 10 employees. On several occasions 4 they were thought to be just PyMEs (Small and Medium-sized Business), but the firms that are managed by a member of the family, that maintain certain control over the stockholding and that have been run at least by two family generations include much more than that. They represent around 80 to 90% of all the Argentinian companies. Although there is not only one definition of what a family business is because they may vary according to the cultural, institutional and economic conditions in different countries, the studies conducted by Andrea Colli, Paloma Fernández Pérez and Mary Rose define family business according to a certain degree of coincidence between property and management. This relationship may vary from the exclusive leadership of the owner to the fact of keeping the minimum amount of stocks necessary to control the management of the company. The family business focuses on the trust granted by the loyalty networks, based on family ties as a way of coping with the uncertainty of the market in the stages of rising industrialization. So, it is understandable that the family role in the definition of the succession strategies as a way of ensuring the continuity of the internal power of the group is a determining aspect in this kind of company (Colli, Fernández Pérez and Rose 2003). The sharing of the wealth and the integration of the descendants are also a key issue in these firms, which anticipate the problem of succession as a critical moment when changing over from one generation onto the other. These crises may not always be negative, however, they usually give rise to a generational conflict which brings about certain issues such as the continuity of the "firm trade”, the future income of the rest of the family and the heir designation, his training and position within the company. Apart from the family relationship and the cultural contacts there are other links which are useful to explain the performance of these companies, such as the ability to establish political contacts in order to obtain favourable business conditions or the entire network of relationships based on merely economic reasons such as technological transfer agreements or distribution agreements. With regard to labour relationships, field works show the lack of professional development policies among them. Usually, the personnel path in family companies is not the result of an objective method to measure performance, in which the family loyalty system and the personal contacts are a priority for the promotion of employees. In family companies 5 developing in intensive- knowledge sectors, the number of professional managers of family origin, usually adds another requirement demanded to hold internal power positions: a family hierarchy is defined within the organigram, which pushes to the bottom those who do not have closely-related qualifications to obtain jobs with less decision-making power (Colli, Fernández Pérez and Rose 2003). Finally, women`s role in family firm constitutes another interesting issue because of their low performance in managment, and its importance with respect to the extension of the trust networks. (Colli, Fernández Pérez and Rose 2003). Regulations and Characteristics of the Argentinian Pharmaceutical Sector The set of regulations over this industry expressed itself in two different ways: the 1864 Patent Law ( #111) and the official code or Argentinian Pharmacopoeia, first edited in 1870. The former law specifically prohibited the registration of pharmaceutical products and the necessary processes to obtain them probably to protect public health. The later established the characteristics of the drugs, the pharmaceutical formulas, medicines and the analytical methods for the quality test of the final product. This code was periodically re-edited in order to adjust to the latest advances and it was actually the only quality control performed by each local company. In 1938, as a way to encourage innovation, a new resolution improved the law of 1864 acknowledging patent rights for the procedures of drugs production 2 World War I gave rise to the problem of supplies and the need to overcome external shortage of medicines by local production. It was within this context that the Argentinian government created in 1914 the Bacteriological Institute dependent on the Ministry of the Interior. This Institute had two purposes: on the one hand, it performed studies on immunity, medical entomology and parasitology, and on the other hand, it produced serum, vaccines and organotherapeutic products. It had the most updated technologies, which allowed the institute to perform quite advanced microbiological researches. The Bacteriological Institute received glands from the local slaughterhouse and it distributed its products to public hospitals at no 2 This regulation did not have the intended effect, since mostly local companies developed medicine`s copies or duplications of international innovations with little changes in the procedure for registering a new product. 6 charge. A short time after J.J.R. Mc Leod, Frederick Banting and Charley Best won the Nobel Prize for the discovery of insulin, this institute managed to create it in Argentina3. In the 1940s the local pharmaceutical industry benefited from the regulations imposed by the national government, which improved the Customs’ rights and established controls for the import of medicines. This scenario gave a fresh impetus to the national substitute industry, leading to an increased production of insulin and to an improved production of antibiotics. Later, the Peronist government (1946 - 1955), worried about public health, established a powerful national health authority by setting up the Ministry of Health. The national production of drugs continued in the hands of the Malbrán Institute (former Bateriological Institute). In 1947 the EMESTA company was created by the State and its purpose was the acquisition of medicine through bidding in order to distribute them in public hospitals 4. Despite the increasing national regulations the State did not practise, an effective control over the pharmaceutical industry, except for the administrative order and particularly the pricing control. A technical control of installations, machinery, hygienic conditions and control of raw materials or finished products was inexistant. The foreign companies always counted on the support, information, advice and resources from their head offices. But national companies only relied on what they could achieve within the country, based on international information. We can assume that the lack of regulations must have turned the production into a random task in small and medium-sized companies.5 In the period 1949-1976 the domestic economy became unsteady, going through consecutive periods of growth and recession. Thus, the State promoted stop and go policies trying to avoid the negative effects of economic cycles; these measures were often contradictory so, social actors were often affected. After the nine year of peronist pricing control policy, the free – price strategy in medicine was adopted during the postperonist era (1956-1963). In 1964, during Illia`s administration, an important law was passed in the Congress, it was known as Oñativia Law after the National Health Minister. It focused on public health defence above all other rights including intellectual property and it considered medicines as a 3 Luis Baliarda, La Industria Farmacéutica Argentina, Buenos Aires, Editorial Médica Panamericana, 1972 In this way, the price of 15 medicines that were intended to be sold at low price was controlled. Among them, were hormones, analgesics, vitamins, hypotensive drugs, antiseptics and bronchopulmonary dilators. 5 Brovelli, M: “La industria farmacéutica argentina y el control técnico de la autoridad sanitaria” and Cruz and Brovelli, “La industria farmacéutica argentina y el control técnico de la autoridad sanitaria” in the first National Symposium for drugs and medicines comptrollers, Buenos Aires, 1971. 4 7 “social good”. The Oñativia Law regulations tried to set up again the control of prices and also established different production, distribution and advertising controls. The price structure was analyzed and international laboratories were obliged to justify their cost composition of their medicines. Due to the fact that they did not cooperate the government decided a frostbite of prices that would be applied retroactively until the governmental study was finished. This decision brought about a strong conflict between national government and pharmaceutical industry that stimulated the opposition against the president during those days. In 1966 a military insurrection overthrew President Arturo Illia administration and General Onganía, as new president, established free prices in medicines after 33 months of frostbite in the middle of a persistent inflation6. In 1968 the military government created the National Institute of Pharmacology and Bromatology –inspired on the Oñativia Law- in order to analyze and control the production of medicines and foods. These new tasks increased the bureaucratization of the proceedings to approve new medicines7. During the inflation period, this bureaucratization postponed the new products approval that allowed increasing prices and gave place to the corruption of businessmen and governamental employees to get a fast track. It is likely that economic unstability and difficulties in accepting proceedings were responsible for the selling of some local laboratories to international firms at the end of the decade.8 The local conditions helped to develop a concentrated9 pharmaceutical market dominated by great multinational laboratories and a considerable number of big, medium and small national companies.10 This participation of domestic capital companies and foreign laboratories helped some argentinian firms to grow and build modern competitive skills during the eighties, if we take into account the international standards of R & D and the quality control of the multinational laboratories. Although this performance was possible 6 Between 1949-1963 the average annual inflation rate was around 26% and between 1963-1973 reached 29%. 7 Baliarda, L.: Op. Cit. The 90% of the proceedings took between three and twenty-one months to be approved by Public Health. 8 Baliarda, L.: op.cit. In 1968 argentinian laboratories controlled more than 50% of the market, around 1970 it was reduced to 48%. 9 The 20 first-rate firms control the 43% of the domestic market 10 Among the 20 first-rate firms of the domestic market, there were thirteen foreign laboratories and seven Argentinian laboratories in 1969. 8 thanks to the additional protection that the lack of patent regime provided to the national industry the same development did not happen in other areas such as the automobile industry, in which the multinational firms did not have to deal with strong local competitors. During the nineties the Argentinian economic system suffered radical changes. The privatization policy, the economic opening, the economic deregulation and the peso convertibility set out a new scenario unknown, to most of the local businessmen who had to adapt themselves, in a short time, to the demands of the international market. A crucial step was the creation of the ANMAT (National Administration of Medicines, Foods and Medical Technology) in 1992, as a substitute for the National Institute of Pharmacology and Bromacology. It is a decentralized nationwide organization that has the authority to close down those companies which do not comply with the prevailing regulations. For the pharmaceutical industry, the main function of the ANMAT was shown in the implementation and the compliance of the GMP regulations (Good Manufacturing Practices), which approved this activity in accordance with international standards. One of the results of these changes was the remarkable increase of the pharmaceutical exportations in the ninenties, which occupied the fifth place among the MOI (products of industrial origin).11 Another initial step was the sanction of the Pharmaceutical Patent Law in 1995, as a substitute for the 111Law passed in 1864. This new law came into effect in October, 2000 to grant the laboratories a grace period to complete reforms and it recognized the intellectual property of the pharmaceutical products. The acknowledgement of these patents was the response to the request made by the multinational companies in the country. In the emerging countries, the patent issue gave rise to a heated criticism from the governments and from the threatened local businessmen. In Argentina, this debate focused on the resistance of the national groups to acknowledge absolute intellectual property rights, protecting the local compulsory licensing because of national interest reasons. The new drugs patent law did not recognize this principle, this was its most serious deficiency and it meant a defeat against the pressure made by the powerful international laboratories supported by their governments. As shown in chart 1, the pharmaceutical industry of Argentinian capital led the sales in the field until the year 2000, when the medicines importation by the transnational companies 11 Kosacoff, B. Et altri Press: “Hacia una estrategia exportadora”, Universidad de Quilmes press, Buenos Aires. 9 changed that trend. The lack of a patent law for medicines products had given, until that year; an additional protection to the national companies which competed successfully in the local market supply. These laboratories relied on the protection provided by their well known brands which identified the quality of their medicines and their strong promotion teams (APM) who reached the physicians` offices offering new products. Chart 1 Distribution of the Argentinian pharmaceutical market between national and foreign laboratories in 1990 - 2000 Dollars $2.500,0 $2.000,0 $1.500,0 $1.000,0 $500,0 $- M 90 91 92 93 94 95 96 97 98 99 0 Years Multinational companies National companies Chart based on data provided by the pharmaceutical sector associations As shown in chart 2, which registers the evolution of the major 20 firms in the local market, during 1970-1995 the relative participation of the national companies and the concentration of the sector. The excellent performance achieved by the Argentinian laboratories was the most remarkable characteristic of the local pharmaceutical industry compared with other Latin American countries. 10 Chart 2 Evolution of the relative participation of the major 20 pharmaceutical firms between 1970-1995 Argentinian Foreign % of laboratories laboratories market total 1970 Number of 7 13 laboratories % of the market 14,2% 28,6% 42,8% 1984 Number of 10 10 laboratories % of the market 25% 21,9% 46,9% 1995 Number of 13 7 laboratories % of the market 34,3% 18,9% 53,2% Chart based on data provided by the pharmaceutical sector associations The small and medium-sized companies in the pharmaceutical sector represented just over 85,5% of the firms, produced 37,5% of the medicines and used 36% of the total manpower according to the 1994 National Economic Census data. This allows us to assert that the local pharmaceutical market was concentrated on the major firms. From the studies of pharmaceutical companies of domestic capital we could state that many of them started as multifamily firms that quickly became public limited companies but never quoted on the Stock Exchange. Some of them reached the category of big company because of the sales level and the number of employees, although the shareholding was kept in the hands of the family members. History of Roux-OCEFA Ltd. laboratory Roux-OCEFA Ltd. Laboratory was founded in 1941 as OCEFA (Argentinian Business and Finance Organization) Laboratory by Mr. Julián Augusto Roux. This company did not include the family name in its commercial name from the beginning because its founder was a member of another company named Millet & Roux. This firm 11 had been founded in Argentina in 1909 and it acted as a representative of French pharmaceutical laboratories importing serum and surgical material. Julián Augusto Roux belonged to the first generation of the family which came to Argentina. He was not a typical immigrant, he came to work as a business representative of the Clin Comar French Laboratory. He settled in Argentina and he acted as a representative of other companies up to 1909, when he went into partnership with Mr. Honoré Millet and founded the above mentioned firm. He was born near Paris and he was a young man with business studies and working experience in matters related to the production and distribution of pharmaceutical products in his country. OCEFA Ltd. Laboratory did not begin as a family business, it was set up with the contribution of various shareholders who did not have a family relationship. Since 1943, Mr. Julián Augusto Roux held the post of trustee, and from 1948 until his death he was the President of the firm. The transition from the first to the second generation combined three requirements: educational, training and power which succeeded each other in a sequential way. The obtaining of the professional degree12, the business management performance and the concentration of an important quantity of shares in the hands of the heir. The practice of assigning the youngest family members and making them assume increasing responsibilities was carried out by several family members, both men and women. Nevertheless, the women's role was pushed into the background. Women did not hold those key university degrees that men had and they generally played formal or non decision making roles, compared to the family male shareholders. The stability in the trustee and managenial positions was highly notorious: between 1941 and 1985 the general manager position was held only by two people: Mr. Guillermo Blanco and Dr. Zenón Lugones, renowned professionals in the pharmaceutical sector, both at the business as well as the scientific-academic levels. As regards Mr. Blanco, he had an active participation as leader of the Pharmaceutical Chamber in the seventies. Dr. Zenón Lugones 12 According to argentinian regulations pharmaceutical laboratories require a pharmacist with university degree as Laboratory Technical Director and it could be said that most of the family firms had a pharmacist or at least, chemist, biochemists or physicians among their offsprings who had professional training in the “firm trade”. 12 was Dean of the Faculty of Pharmacy and Biochemistry at the University of Buenos Aires on two opportunities: firstly, in the sixties and secondly, in the eighties during Arturo Illia and Ricardo Alfonsin`s National administration respectively. Another remarkable detail is the preponderance of pharmacists and biochemists in the Board of Directors, in the eighties there were constituted by four chemist-pharmacists out of seven members. For many years, the emblematic product of the laboratory was the catgut or suture thread. At the beginning, Roux imported it from France and then he started to produce it in Argentina when the European supply began to fail. OCEFA laboratory was a pioneer in the technological updating of the production methods of this thread, which is obtained from cattle and sheep guts. To the initial advantage of the stockbreeding raw material supply the Argentinian laboratory added the pharmaceutical know-how, which improved the productive processes up to the point of obtaining a standardized, sterile and homogeneous product. Until 1942 the laboratory developed an investigation and production line of antibiotics in limited quantities that was interrupted in a short while. The process developed by Roux from the surface fermentation was superseded by the North American Squibb, Pfizer and Merck Laboratories in 1944, when they improved the deep fermentation process for the production of penicillin. In 1947 Squibb laboratory obtained additional benefits from the Peronist government to install a production plant in the province of Buenos Aires (Pfeiffer and Campins 2004). Up to the sixties parenteral solutions were bottled in glass jars. Then, Roux introduced the plastic technology with an innovative technique which used low density polythylene because of its complete chemical inertia, very similar to that of the glass. Consequently, the hygienic and glass sterilization problem was solved. In this way, Roux OCEFA became the first and most important national company with parenteral solutions production, with a close to 90% supremacy in the market.13 The technological capacities developed for the production of plastic containers for serum and parenteral solutions paved the way for other lines of similar products: so, the laboratory became a pioneer in the production of bags for blood transfusions that were manufactured 13 Interview carried out by the authors of this work to Dr. Juan Goin, Technical Director of the laboratory, Buenos Aires, June 1999. 13 until 1990 partly with traditional methods and then were exported to Uruguay and Paraguay. From that date onwards, the competition with worldwide foreign firms and the reduction of prices for imported goods affected the performance of the firm in this line and the importation of these biomedical materials began to take place. At the end of the nineties the company became a local representative of the blood bags imported form Germany and Japan. Before the opening of the market in the early nineties and the patent law for pharmaceutical products, a local laboratory in Argentina usually created medicines with drugs that had been investigated and patented by foreign firms. The most common way of obtaining updated information was the scientific magazines, and in the last decade, the Internet. The national laboratories had a subscription to the most important scientific magazines, from which they took valuable information and made decisions about new product launchings in the local market. Another usual practice of the firm during the prosperous years was the allocation of profits and donations for this kind of “scientific research purposes” to the Roux-OCEFA Foundation. 14 From forties to the seventies Roux-OCEFA Laboratory was among the top 10 local laboratories; and from 1985 to the late nineties the company dropped to the middle of the ranking mostly due to the settling of new competitors in the local market. Roux-OCEFA Laboratory served two submarkets: the hospital and the private pharmaceutical ones. The former had been the most important one up to that moment. Laboratory products were also sold in drugstores both prescribed or over-the-counter medicines. In this submarket the firm adopted the same strategy as the competitor, that is to say, advertising in the media along with the promotion through medical representatives who regularly visited physicians’ offices. In order to counteract the market fluctuations, the company tried to balance its sales in the two submarkets it served: the hospital (surgical and parenteral solutions division) and the individual pharmaceutical consumption (pharma division). So as to compensate for its sales decrease in the hospital sector since the nineties, the laboratory began a diversification 14 Interviews to Dr. Julián Roux (III) carried out by the authors of this work, Buenos Aires, March and August 1999. 14 strategy which consisted in the launching of its own products with a renowned efficacy, plus some minor innovations. At the end of the 1990s the Roux family was able to cope with the selling of shares of the firm and was trying to obtain short-term co-marketing agreements with foreign laboratories. In a very real sense the firm had a favourable profile due to its productive know-how and its prestige in the local market. History of La Fármaco Argentina Ltd. Laboratory La Fármaco Ltd. was founded in 1905 in Buenos Aires city. At first, it produced a veterinary product called Sarnol, which revolutionized the livestock mange treatment. It was a new product that had been discovered and developed in 1903 by Dr. Miguel Puiggari, a chemist and pharmacist of Catalan origin. His father had come to Argentina in 1851. The company was set up by a group of well known pharmacists from Buenos Aires who went into partnership with Miguel Puiggari. In 1908, the business expanded and began to produce human medicines with the investment of two new associates: Mr.Julio Gómez Palmés and Mr.Carlos Menéndez Behety. The former was a businessman and landowner who belonged to a family of politicians and eminent citizens in Patagonia territories. The latter was one of the most important Argentinian farmers from a powerful family who also involved in the business activity. Although the Puiggari family was not the laboratory main associate they developed, during three generations, the succession strategy. The sons who were chemists, physicians, pharmacists and ingeneers, joined their father in the technical management of the firm, then they held the position of managers or directors, and finally, after their father’s death, the eldest son would probably become president of the company.15 It was an almost natural succession, which took place smoothly without any obstacles or inconveniences. 16 Another practice was also implemented by incorporating relatives as partners into the business. During the company’s last stage, the majority of the associates without a family bond had already been removed; nevertheless, the transition from the third to the fourth generation 15 Interview to Dr. Hugo Miguel Puiggari carried out by the authors of this work, Buenos Aires, June 1999. We did not find family clashes in any of the consulted documents (Company reports, Corporate Records Office documents and the interview to Hugo Miguel Puiggari). 16 15 set out the problem of succession due to the great amount of family members within the company. It seems likely that this was one of the issues that led to the sale of the firm in 1998. Wives and sisters who played a precise and necessary role in the organization were guarantors of the heirs’ succession rights. Sometimes, from their director’s role, they only fulfilled the legal formality of helping to quorum without getting involved in the company’s main issues.17 The company’s activity focused mainly on three related businesses: the veterinary line, medicines for human use and health and care products. The first was the company’s starting point which gave its prestige for having developed a novelty such as Sarnol and other similar products. As regards medicines for human use, this was the first company that produced soluble tablets which were provided to Public Institutions such as the Naval Department of Health, Military Department of Health and the State Police. Due to the shortage of supplies that took place during World War I, the company began to produce some medicines similar to the imported ones, gauze and sterilized cotton. Such undertaking required the installation of a special section in the factory. At that moment, the third business of the company emerged. It was related to the manufacturing of health and care products, made of fats and oils obtained form the local market. This was not a minor matter, in fact, it was its main advantage. In the twenties Dr. Fernando Modern, bacterilogist of the Bacteriological National Institute and University professor at UBA, and Miguel Puiggari (h.) founded the Biological section in La Fármaco. This initiative widened the human medicines production with tablets based on lactic ferments and other preparations. Research work on serum and insulin began. Later on, in the thirties, making use of the national raw material, the production of insulin was undertaken.18 Some time after that, adrenaline, protamine, hepatic extracts and serum for medical usage were produced. The delayed action insulin was manufactured until the 1960s, when the facilities of the biological laboratory were sold to Eli Lilly, the first worldwide competitor in insulin.19 17 Minutes of the Board’s meetings and the shareholders’ meetings. The insulin had been prepared for the first time in our country by Dr. Alfredo Sordelli in the Bacteriological Institute dependent on the Argentinian government, some months after its discovery in Canada by Mc. Leod, Banting and Best in the twenties. (Interview to Antonio Somaini, eminent pharmacist and ANMAT’s technical consultant ) 19 Interview to Hugo Miguel Puiggari in Buenos Aires, June 1999. 18 16 In the early seventies, the company definitely abandoned its pharmaceutical profile and strengthened the production of health and care products. Taking advantage of its other prestigious brands it undertook the production of wax creams, toothpastes, soaps with additives, deodorants, sunblocks, body creams, talcum powder and other cosmetic products. To sum up, the strategies from La Fármaco were various and of different kinds during the ninety three years the Puiggaris ran the company. At the beginning La Farmaco broke through with its own pharmaceutical innovation: the tick pesticide Sarnol. There had never been such a product in the world before. It was the result of Dr. Puiggari’s research. The strategy of innovation was repeated three years later when the Technical Director undertook the production of human medicines, such as the various solubles, and finally in the thirties, when it began the production of insulin. Until the late forties La Farmaco maintained this innovative strategy and strenghtened the seeking of quality products that allowed the company to create competitive advantages and to reach a ranked position in the local market. The reinvestment policy which meant using its own resources could have been constant through the evolution of this society, so we deduced that it was an important aspect in La Farmaco business culture. It was a reasonable and modernizing policy based on the productivity increase without debts; and thus, the capitalization of profits. In the sixties, La Farmaco carried out big changes. It sold its biological laboratory to Eli Lilly and it was focused on the mass market products abandoning its sole pharmaceutical profile some years later.20 Simultaneously, the Puiggari’s managed to concentrate most of the block of shares in the power of the enlarged family. La Fármaco focused on the mass production of health and care and veterinary products. In order to carry out that task, it invested in modern machinery, built a new plant in the province of Buenos Aires and developed a strong force in marketing and advertising. During the nineties, the laboratory showed to have obtained good profits, it was not in debt and it made well known branded products. Nevertheless, the marketing system through powerful supermarkets was posing a threat that would be difficult to face. So, in 1998 the 20 Reports and stocktaking of La Fármaco Industrial y Comercial Ltd. from 1966. 17 owners decided to sell the company to the huge North American firm Alberto Culver & Company. With it, the last Argentinian soap producer disappeared. 18 Comparative Study of both laboratories’ business paths La Fármaco and Roux-OCEFA The rich histories of Roux OCEFA and La Fármaco allowed us to reconstruct networks, practices and organizational routines of the companies, and also to consider the innovative processes they undertook in different stages. As an introduction, it can be asserted that a common feature between the founders of the two laboratories was found out: they both had experience and reputation in the pharmaceutical work. These qualities were useful to differentiate one from the other and to be successful against other competitors. The Roux name was very pretigious among the scientific environment; it was linked to health care. As regards the Puiggaris, they had an excellent academic and scientific reputation in Buenos Aires University and in National Medicine Academy as chemists and pharmacists. 21 Nevertheless, each of them were experts on different aspects of this activity. As regards the Roux family, its background was linked to their participation in local netwoks of imported drugs marketing. The Puiggaris specialized in the production of medicines from their know-how as pharmacists in the city of Buenos Aires. The origins of these laboratories would confirm once more that the pharmaceutical industry in Argentina started out of these two initiatives: pharmacists and businessmen. (Pfeiffer, A; Campins M 2002) With regard to the ownership of the block of shares, both companies started as an association of some investors to subsequently turned into family companies, in which a family (Puiggari in one case and Roux in the other) concentrated the most of the capital during the seventies. However, this strategy shared by both firms was fulfilled by means of different practices. In the former family the procedure of issuing shares prevailed and they profited from this capital rise to assign members of the extended family as shareholders.22 In the latter family the shareholding control in the hands of the nucleus family through the 21 Dr. Pedro Pablo Emilio Roux (shared the same surname with the founder of the Argentinian laboratory) had excelled as disciple of Dr. Louis Pasteur in France. In 1984, along with Dr. Boehring, he discovered the effectiveness of the diphtheria antitoxin. In this way, the biological era in the human fight against epidemics began. Since 1899 Dr. Roux’s serums were sold in Argentina. It is possible that the laboratories which shared such a name of repute had from the beginning some advantage over other health professionals. The prestige of the Puggiari surname in the academic environment dated back to the activities introduced by the founder as responsible the Argentinian Pharmacopoeia’s first edition and the creation of the Phd. in Pharmacy in the Faculty of Medicine of the University of Buenos Aires at the end of the 19 th century. 22 Brothers and sisters-in-law, cousins, aunts and uncles were also included. 19 male descendants was imposed from the beginning.23 This concentration process coincided in both cases with the "golden years” as regards business expansion and the firms’ profits. Another important aspect is the common immigrant condition of the founding partners. The need to establish trust and loyalty bonds between newcomers with the same nationality was essential to reduce the common market risks caused by the incipient industrialization and the social conflicts in Buenos Aires at the beginning of the 20th century. Both Mr. Roux and Dr. Puiggari moved in and found business opportunities in this city, which was house to a great number of immigrants at that time.24 Mr. Roux and Dr. Puiggari went into partnership with French compatriots and Spanish compatriots or descendants. As regards the characteristics of these family companies, there is in both cases a common feature in the domestic capital laboratories: they were family companies that early became public limited companies, although they never quoted on the Stock Exchange and they remained being managed as family businesses . This procedure, which seemed to be an idiosyncrasy of the Argentinian companies (Schvarzer, J 1995), would support the viewpoints of A. Colli, P. Fernández and M. Rose with regard to the influence of the culture and the common values in the characteristics acquired by family companies in different societies. (Colli, Fernández and Rose 2003) The organizational structure of both companies focused on the figure of the founder and his descendants. The authority of this businessmen originated with their professional training, which provided them with all the necessary information about the know-how of this industry. This seems to confirm the opinions of Colli, Fernández and Rose in relation to the family companies in intensive-knowledge industries, in which the internal power is held by professional managers who are members of the family and who establish a hierarchical relationship with their relatives within the company. In the case of La Fármaco, this happened with Dr. Puiggari's male descendants; and in Roux-OCEFA with the male descendants of Julián Augusto Roux. 23 Between 1962 and 1972 a slow transfer of part of the Roux-OCEFA patrimony was made to two Uruguayan ghost companies, which were denounced in the Tribuna newspaper to be property of Roux. This operation benefited his son Julián Andrés but it was detrimental to his daughter. The Corporate Records Inspector demanded an explanation from the Board about that possibly fraudulent operation. 24 At the end of the 19th century and at the beginning on the 20th, 30% of the Argentinian population was foreign. (Di Tella 1985) and in the city of Buenos Aires this proportion reached to three quarters of male adults in 1919, according to Benjamín Villafañe in “Nuestros males y sus causas”. 20 On the other hand, the prolonged continuity of managers in leading positions was another quality observed in both laboratories. Although it is possible to assume that the above mentioned stability in management would create a favourable and reliable environment for the learning transfer and for the creation of joint routines with the new generations, it is also likely that these structures would result into a change-resistant attitude. The recruitment of managerial positions was generally carried out following direct or inlaw family relationships. Nevertheless, it was noticed that in the case of Roux there was a greater willingness to assign important positions to distinguished professionals who did not belong to the family. In the decision making process there was a predominance of certain specific routines of the pharmaceutical sector, which were different from those of other industries. The role of the Technical Director was essential to define “the firm’s trade” in pharmaceuticals, to promote innovations, and above all, it was crucial in the process of launching new products. In both firms, this position was held by eminent professionals who belonged to the cream of the academic research area in Argentina, as the three generations of Drs.Puiggari in La Fármaco and Drs. Lugones and Goin in Roux - OCEFA. So, another common feature they had was the technical-scientific networks built by both laboratories. The first Puiggari was an eminent chemist who got his degree in Barcelona and who was Professor and Dean at the Faculty of Physical and Biological Sciences, as it was mentioned before. His son, Miguel Puiggari, was also a notable academic and member of the National Medicine Academy who was related to the medical researchers of those days such as the bacteriologist Dr.Fernando Modern. Dr.Zenón Lugones and Dr. Juan Goin from the RouxOCEFA Laboratory held office as well as teaching positions and were also members of the faculty board at the Faculty of Pharmacy and Biochemistry at the University of Buenos Aires. This made the circulation of scientific information and the recruitment of first level professionals easier. In both laboratories, the transition from the first to the second generation combined three requirements which succeeded each other in a sequential way: the university qualifications followed by a business management training and the concentration of an important quantity of shares in the hands of the heir. The practice of assigning the youngest members of the 21 family and to make them take increasing responsibilities was carried out with several family members, both men and women, in the two companies. Generally, women appeared as shareholders and they became visible since their husbands’ death. In many cases, they fulfilled the legal formality of helping to quorum at the Board of Directors or at the Shareholders Meetings. However, this equality of opportunities was only apparent, and it conflicted with an irrelevant action in decisive business matters as shown in the Minutes of the Board of Directors or the Shareholders’ Meetings of the firm. This women’s dependent role in business was probably due to the traditional structure of the family power in the local society, women only looked after the housework and they were left out of the business activities and higher education. According to the interviewees’ opinion, the generational transitions were gradual processes with no difficulties, which favoured the offsprings` incorporation into the companies. However, in the case of Roux-OCEFA, the appearance of the two Uruguayan investing companies makes us assume that sometimes the succession process was carried out by fraudulent means. Herix Ltd. and Inversora Lusitana Ltd.25 received great quantities of shares from the laboratory as a payment for some owed royalties. The Corporate Records Inspector distrust inspired by this kind of transactions corroborated the suspected fraud by which the family estate was transferred in favour of the son and in detriment to the daughter. When the interviews were carried out in Roux, the transition from the second to the third generation was on course, with the characteristics mentioned before. In this case, the elected one was the founder’s grandson, a pharmacist and biochemist who held office as the Quality Control Manager; while his sister, a psychologist, was holding a less important position in the Human Resources area. In La Fármaco, we also observed another key feature connected with the last generation. The pharmaceutical profession disappeared in the fourth generation, which took to study Management or Marketing, adding a new rationality to the business culture. A significant difference was observed in the means used by both families to solve the problem of the heirs’ participation in the ownership of the firm. While in Roux-OCEFA a 25 Herix S.A. e Inversora Lusitana S.A recibieron importantes cantidades de acciones del laboratorio como forma de pago por royalties y regalías que se les adeudaban. 22 system similar to a male primogeniture was designed, in La Fármaco most of the shares were distributed between a male heir and a minority of other members of the family. The lack of a patent law until the year 2000 promoted the creation of a market in which pharmaceutical products competed for launching new medicine brands with limited or relative originality. However, it must be admitted that under that protection a solid local pharmaceutical industry was developed and that it was possible to create some innovative projects and to improve business abilities that acted as barriers against other local competitors. From the analysis of both productive paths, it was possible infer internal processes that resulted in some radical innovations which helped the launching and marketing of original products after daring and “high tech” scientific investigation. Since the end of the 19th century the European medical science had been discovering new ways of fighting infectious illnesses that threatened people’s lives in big cities. Until the advent of antibiotics in the forties, serum and vaccines were the only therapeutical means which doctors had to cure illnesses such as diphtheria, tetanus, pneumonia and smallpox. The researches carried out by Pasteur, von Behring, Roux and others arrived in America without restrictions (Galambos, L. 1997), and according to the scientific publications of those times, the microbiology and epidemiology in Argentina were markedly influenced by the French school studies. The first attempts to continue these researches were made with the incentive of the National State Health Policies through the creation of the Health Department (1891) and the Microbiology Institute (1914). A solid nucleus of knowledge was created by these institutions, plus the Departments of Epidemiological Clinic, Pharmacology, Biological Chemistry, Analytic Chemistry and Microbiology of the University of Buenos Aires and the public hospitals. The links between those institutions and the industry pioneers generated an exchange of knowledge and a rotation of professionals from the public to the private sector26, leading to a dynamic system of information circulation that allowed the achievement of innovations that were “highly technological” at that moment. The capacity to build this kind of 26 Sometimes, this rotation was spontaneous but on other occasions, when political reasons led to the emigration of local scientists from State to private companies or to foreign countries, it was traumatic. 23 technical-scientific networks was another common quality of the studied laboratories which has already been outlined. The most remarkable innovations from La Fármaco Laboratory was the tick pesticide “Sarnol” that revolutionized the treatment for livestock diseases. Later developments such as “La Fármaco Insuline” and “OCEFA Penicillin” represented medical advanced researches as well. It is important to emphasize the fact that these industries were linked to the agricultural and stockbreeding raw material, for which Argentina had been developing comparative advantages since the end of the 19th century. It is also important to stress the fact that these findings, which could have promoted new learnings, were left unfinished when some new processing technologies as the depth fermentation used in the Squibb’s penicillin and the Eli Lilly’s best purified insuline were introduced into the country. There also appeared some new learnings which resulted in adjustments and improvements of the operating methods in both firms, as the constant updating in the production of soaps and veterinary products branded La Fármaco.27 As regards Roux-OCEFA, these learnings led to the improvement of the suture thread production and to the perfection of the plastic technology for the production for solutions containers. The changes made since 1960 represent another significant aspect of the evolution of these laboratories. Based on the changing regulatory environment and the new foreign competitors28 some disruptive decisions were taken. Regarding this subject, this could be closely connected with what Nelson calls the “search for better operating methods” caused by threatening situations provided by the environment and which drive the firms to make changes that are often risky. Each laboratory adopted a different new profile: on one hand, La Fármaco's evolution went from being part of a medical, veterinary and health care specialities mixture to focusing only on the last two sectors, producing mass consumption products and well-known brands. It began this strategy by selling the biological laboratory to Eli Lilly in 1965, in this way, it lost its purely pharmaceutical identity, and know-how, which was its protective barrier. Roux-OCEFA, on the other hand, kept its specifically pharmaceutical identity, although it was redefined. Since the sixties, it acquired a more clear profile as a health system (public 27 Other renowned brands of the laboratory were: Véritas, Aromas del Cairo and Tinkal In 1958 during Dr. Arturo Frondizi’s Administration a new law on foreign investments was passed. It allowed the refund of foreign capital through dividens. 28 24 and private) supplier, developing new technological techniques for the production of solutions containers and transfusion bags which, together with suture thread, allowed the company to maintain its market leadership in that field until the nineties. The testimonies of the businessmen in question showed the persistence of the paternalist way of treating the employees, in which the recognition of the personal loyalty prevailed over an objective system of individual performance assessment. Within a workers and employees' protection system, social benefit programmes were included, which were previous to 1930 and to the pass of the comprehensive laws of retirement and annual paid holidays. While Roux developed health programs for its employees, La Fármaco provided social and cultural activities in a club it founded. All these internal policies certainly created labour relations based on the mutual commitment between employees and businessmen, which strengthened the family authority and the loyalty to the company. As regards the financing policy, the answer of the interviewees was practically the same, since they upheld the choice of a conservative opinion regarding debts: none of them would ask for a loan to a bank. Both Dr. Julián Roux and Dr. Hugo Puiggari stated that it was thanks to that attitude that they were able to successfully survive inflationary periods. The conservative attitude of the firms did not mean that they were companies which did not take any investment risks. In both cases we could observe a persistent strategy of technological processes improvement and a need to begin new developments risking capital, as it was verified during many decades of their productive paths. It seemed that the term “conservative” belonged to the decision of not getting into credit bank and not to the productive investment strategy. Finally, facing the opening of the domestic maket and the demand to compete with big transnational companies and imported goods in the nineties, the strategies adopted by both firms were different and it is more likely that these were linked with their own path. Whereas La Fármaco could not manage to face fierce competition29 and was forced to sell the firm to the multinational company Alberto Culver & Company, Roux-OCEFA managed to accomplish the necessary adaptations to keep most of the shares as property of the family and to sign co-marketing agreements with foreign companies. 29 The circuit of distribution of health and care products forced La Farmaco to compete with huge international companies in supermarkets 25 Conclusion This research confirmed a characteristic observed at the beginning of the study in a general way: the fact that the laboratories of Argentinian capital are mainly family companies that quickly became Public Limited Companies, although they never quoted on the Stock Exchange and continued to work as private family businesses. Nevertheless, none of the two laboratories began their activity as one-family companies, they began as firms with various associates or multi-families and they acquired the one-family nature in the course of its evolution. From this study, it could be also asserted that the business culture of the companies working in intensive- knowledge industries is the result of various factors, which combine internal capacities of the firm with external requirements because of the regulations of the sector. Within the characteristics set by this sector, the professional and procedural regulations were determining since the beginning. Another determinant characteristic was the fact that until the coming into effect of the patent law in the year 2000, local laboratories relied on an additional protection in the domestic market. This additional protection was beneficial, since the competition among laboratories was based on launching new products rather than producing original medicines. This study was useful to corroborate once more the ways of industrialization in the pharmaceutical sector. The first national laboratories emerged from importers and foreign firms representatives, or from the know-how of some pharmacist entrepreneurs at the beginning of the 20th century. In both cases, the social contacts and the scientific and academic networks they joined were useful to build more secure scenarios and to share quality information among its members. Likewise, it could be asserted that the studied laboratories came along with the innovative cycles of the pharmaceutical industry since the beginning of the 20th century until 1950. The relatively free flow of information within the scientific networks, (international, public and private ones) the availability of prestigious professionals within the staff and the productive investment increase were crucial in the creation of radical innovations during those years. It is also possible that from that moment onwards the increasing governmental 26 interventions regarding the university policy promoted a divorce between science and local industry. The chances of rotation of high standing professionals from the Public University to the Industry became less frequent, this was based on political persecution.30 The increasing costs in research and development and the competition with the foreign hightech had their own influence on the modification of the innovative strategies in the Argentinian laboratories. This would explain the transition from radical innovations in the first half of the 20th century to incremental innovations in technology and finally, in the search for mere marketing improvements, as the initial advantages were disappearing. As regards the internal learning processes of the firms, it was observed that both companies developed a business culture based on traditional practices. That was shown in the importance given to the surname reputation, the weight of the networks among fellow citizens, the search for a heir dynasty, the secondary role of women and the family mandate of being conservative with respect to bank credit. The last point is not insignificant if we take into account the instability of the Argentinian economic policy from 1950. It also explains, to a great extent, the relatively successful performance of these two companies, which, by the end of the nineties, still managed to be economically sound. The field work also confirmed another characteristic of the intensive-knowledge industries regarding the relationship between the specific profession and the internal power to define a family hierarchy within the company. However, it was observed that the search for managers and directors within relatives is not inevitable in medium sized family companies, as it was the case of Mr. Blanco, Dr. Lugones and Dr. Goin in Roux-OCEFA. Finally, we can come to the conclusion that the organizational capacities and routines together with the accumulated previous inverstments allowed these companies to face the globalization scene in a different way. In Roux-OCEFA, the strategy of differentiation strengthened its pharmaceutical know-how and it became an advantage that allowed the company to establish new co-marketing agreements, to became a representative of foreign firms and to obtain licenses. However, it had to compete with big international producing companies and it lost internal market share along with its monopoly. In La Fármaco, the 30 The emigration of the best scientists due to political persecutions dismantled a lot of state investigation centres during tose years. Some of these professionals hid themselves in private industries while the majority decided to leave abroad. Never did they return 27 lost of its pharmaceutical identity in the seventies faded its most valuable inheritance, the specific know-how as medicines producers. The company went in for the production of health and care products, and it had to compete since 1991 with powerful multinational companies in big supermarkets. That would explain its takeover in 1998, made by a transnational laboratory which belonged to that area. The practice of incorporating family members became an insoluble problem, this is the reason why it was better to sell the company in favourable conditions and to ensure the patrimony to the rest of its members rather than confronting the fragmentation of the capital. Roux solved this problem by concentrating the wealth and leaving the problem of the family inheritance with the following generation. There are still some pending issues that deserve the continuation of the study about the evolution of family companies in Argentina from the network theory in order to analyse the connections of these firms with political networks and to reveal their influence on the different political and legal frameworks in the country. Bibliography Campins, M.; Pfeiffer, Ana (2004): La Producción de Medicamentos durante el Peronismo y el Conflicto con los Laboratorios Massone. ¿Problema tecnológico o político? In Ciclos Magazine, year XIV, Vol. 14, No. 27, Buenos Aires. Cignoli, Francisco (1947): Historia de la Asociación Farmacéutica y Bioquímica Argentina, 1856-1946, Asociación Farmacéutica y Bioquímica Argentina Press, Buenos Aires. Colli, Andrea & Rose Mary B.(2003) Family firms in Comparative perspective in Franco Amatori y Geoffrey Jones, Business History around the World, Cambridge University Press. 28 Colli, Andrea & Fernández Pérez, Paloma & Rose Mary B.(2003) “National Determinants of Family Firm Development Family Firms in Britain, Spain, and Italy in the Nineteenth and Twentieth Centuries” in Enterprise & Society Volume 4, Number 1, March, pp. 28-64 Coriat, Benjamín & Dosi, Giovanni (1996): Aprendiendo a Gobernar y Solucionar Problemas: Sobre la Co-Evolución de Capacidades, Conflictos y Rutinas Organizacionales. Revista Buenos Aires Pensamiento Económico, No. 1. Galambos, Louis with Jane Elliot Sewell (1997), Networks of Innovation. Vaccine Development at Merck, Sharp & Dohme, and Mulford, 1895-1995, Cambridge University Press. Gatto, Francisco and Yoguel, Gabriel (1993): Las Pymes Argentinas en una Etapa de Transición Productiva y Tecnológica, en Bernardo Kosacoff (ed y otros), El Desafío de la Competitividad, la Industria Argentina en Transformación. CEPAL Press-Alianza, Buenos Aires. Gatto, Francisco and Yoguel, Gabriel (1989-1993): La Problemática de las Pequeñas y Medianas Empresas Industriales: Algunos Aspectos Metodológicos Aplicados al Caso Argentino, Programa CFI-CEPAL-PRIDRE, Documento de Trabajo 18, Buenos Aires. Kantis Hugo editor (Abril 1998): Desarrollo y Gestión de Pymes: Aportes para un Debate Necesario, Instituto de Industria de la Universidad Nacional de Gral. Sarmiento. Korol, Juan C. and Gutiérrez, Leandro (1988): La Historia de Empresas y Crecimiento Industrial en Argentina. El Caso de la Fábrica Argentina de Alpargatas, in Desarrollo Económico Nro. 111, vol. 28, October-December. Kosacoff, B. Et altri Press (1995): Hacia una Estrategia Exportadora, Universidad de Quilmes Press, Buenos Aires. López, Andrés (1996): Las Ideas Evolucionistas en Economía: An Overview. Revista Buenos Aires Pensamiento Económico, No. 1. Martínez Nogueira, Roberto (1984): Empresas Familiares, Análisis Organizacional y Social, Ediciones Macchi, Buenos Aires. Martínez Nogueira, Roberto (June 1990): El Perfeccionamiento de la Gerencia Argentina: las Tareas Pendientes, Revista de la Información, Buenos Aires. Nelson, Richard (2002): On the Uneven Evolution of Human Know-how, Conference at the University of Bocconi, Milán. 29 Pfeiffer, A.; Campins, M. (2002): Cien Años de Industria Farmacéutica en la Argentina (1900-2000), Secretaría de Investigación CBC-UBA. Scranton Philip (1997) Endless Novelty: Specialty Production and American Industrialization, 1865/1925: An Overview, Rutgers University, Princeton University Press. Schvarzer, Jorge (1995) “Grandes Grupos Económicos en la Argentina. Formas de Propiedad y Lógicas de expansión”, in Bustos P. (ed.) Mas Allá de la Estabilidad. F. Ebert, Buenos Aires. Yoguel, Gabriel (1998): El Ajuste Empresarial frente a la Apertura: la Heterogeneidad de las Respuestas de las Pymes, in Revista Desarrollo Económico, número especial otoño, vol. 38. Zeitlin, J ((2003)): Productive Alternatives. Flexibility, Governance, and Strategic Choice in Franco Amatori and Geoffrey Jones, Business History around the world, Cambridge University Press SOURCES Revista Farmacéutica Argentina 1856-1960 Revista Industria y Química 1930-1990 Clarín and La Nación newspapers La Fármaco commemorative publications by Dr. Miguel Puiggari and Dr. Miguel Puiggari (Jr.) Roux- OCEFA Ltd. files from the Corporate Records Office La Fármaco Ltd. files from the Corporate Records Office Annual reports from La Fármaco Argentina Ltd. and Roux-OCEFA Fiftieth anniversary of La Fármaco Argentina Ltd. (1955) General catalogue of La Fármaco Argentina Ltd. (1919) INTERVIEWEES Managers of the companies Key informants: Dr. Hugo Miguel Puiggari Dr. Antonio Somaini Engineer Miguel José Puiggari Dr. Rubén Rondina Dr. Julián Roux Professor Dr. José Laureano Amorín Dr. José Alberto Goin 30