Reporte de estado del proyecto - Inter

Anuncio

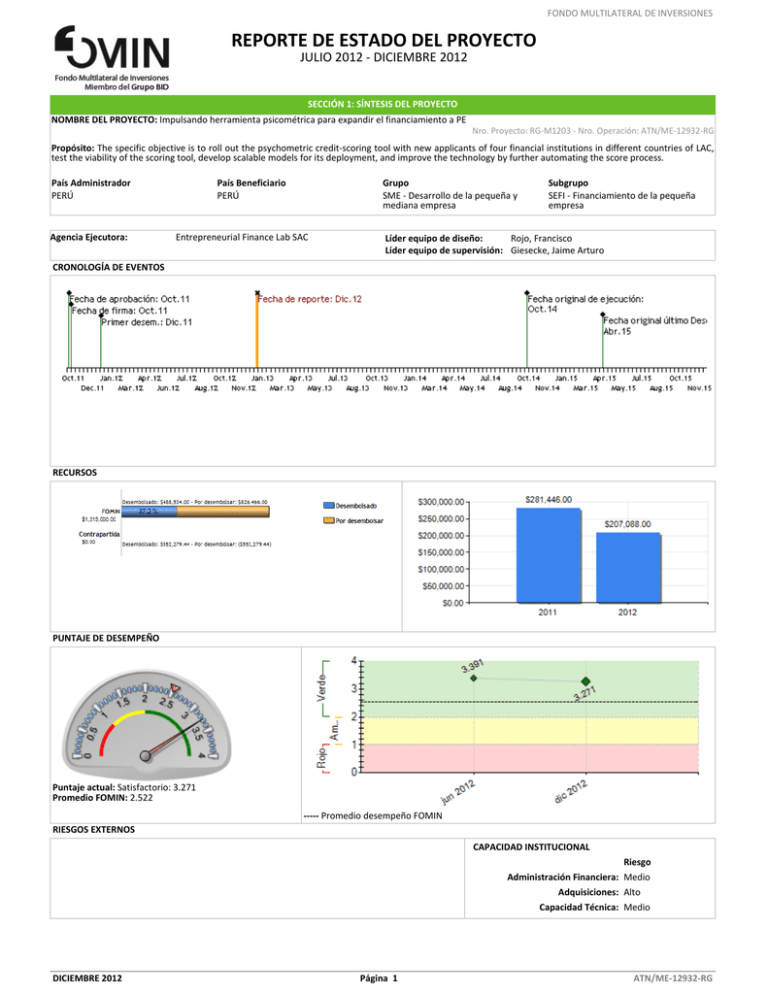

FONDO MULTILATERAL DE INVERSIONES REPORTE DE ESTADO DEL PROYECTO JULIO 2012 - DICIEMBRE 2012 SECCIÓN 1: SÍNTESIS DEL PROYECTO NOMBRE DEL PROYECTO: Impulsando herramienta psicométrica para expandir el financiamiento a PE Nro. Proyecto: RG-M1203 - Nro. Operación: ATN/ME-12932-RG Propósito: The specific objective is to roll out the psychometric credit-scoring tool with new applicants of four financial institutions in different countries of LAC, test the viability of the scoring tool, develop scalable models for its deployment, and improve the technology by further automating the score process. País Administrador PERÚ Agencia Ejecutora: País Beneficiario PERÚ Grupo SME - Desarrollo de la pequeña y mediana empresa Entrepreneurial Finance Lab SAC Subgrupo SEFI - Financiamiento de la pequeña empresa Líder equipo de diseño: Rojo, Francisco Líder equipo de supervisión: Giesecke, Jaime Arturo CRONOLOGÍA DE EVENTOS RECURSOS PUNTAJE DE DESEMPEÑO Puntaje actual: Satisfactorio: 3.271 Promedio FOMIN: 2.522 ----- Promedio desempeño FOMIN RIESGOS EXTERNOS CAPACIDAD INSTITUCIONAL Riesgo Administración Financiera: Medio Adquisiciones: Alto Capacidad Técnica: Medio DICIEMBRE 2012 Página 1 ATN/ME-12932-RG FONDO MULTILATERAL DE INVERSIONES ---- Promedio de riesgo FOMIN: 0.639 SECCIÓN 2: DESEMPEÑO Resumen del desempeño del proyecto desde el inicio We have been successful in signing multiple banks to join the project, all with the intention of using EFL to help them penetrate previously inaccessible parts of the SME market. More banks will sign soon (or have signed) and will start testing in quarters 1 and 2. The major challenge has been the speed at which banks scale in the SME segment. This is something that we can influence but not control. For many reasons, banks have risk analysis and service delivery structures that are resistant to change. The major risk to the project (and to EFL) is that banks pay for the service, implement it, but grow very slowly with low volumes. We are mitigating this by - Speaking about scale requirements from the first conversations - Improving the description of bank responsiblities in the contract - Including a "Letter of Commitment" step that makes banks put their commitment into print - Creating and disseminating weekly reporting on volumes - Organizing supervisory committees ahead of time to review progress towards scale The project has a high chance of achieving its goals, it just may take more than 4 banks. The major focus is on designing our processes and service level to include more banks. Not all banks will be successful (CEOs leave, strategies change, markets change, internal politics evolve) so we need to a) increase the chances of success in all banks (using the bullet points above) and b) spread our bets. Comentarios del líder de Equipo de Supervisión De acuerdo con los comentarios de la Agencia Ejecutora For the next PSR cycle, we are requesting the executing unit present the proposed changes in the tariffs and subsidies to serve a greater number of financial institutions; to propose an action plan to work the sustainability strategy; and to improve the quality of beneficiaries reported in system information. Resumen del desempeño del proyecto en los últimos seis meses The major success of the semester have been in terms of business development and implementation. In terms of business development, we are finally gaining significant traction in Brazil - a large but challenging market. In terms of implementation, we have been rolling out EFL at a larger scale in Peru and for the first time in Costa Rica and preparing the groundwork for Guatemala (launch in the first week of Feb 2013). the result is that millions of dollars to hundreds of previously inaccessible entrepreneurs are now being lent out against the EFL tool. There are still very few "bad loans" in the portfolios, meaning that test adaptation will take more time. In essence, we have to use a regional base model until we have more "bad loans" that will help us create customized models. We plan to launch 2 more banks within 6 months - one in Guatemala and one in Brazil. We also plan to sign one more bank, hopefully in Brazil. Our efforts are firmly focused on: - Model Performance: As we start getting data back, we can start to customize the model. The goal is to have each bank strat to benefit from customization. - Improved Implementation: Taking lessons learned to the next implementations. The goal is to average faster growth in the next banks to launch, than in the previous banks. - Targeting Big Banks: The participation of a large bank *could* put EFL's test and loan volume numbers on a fundamentally different growth curve. Comentarios del líder de Equipo de Supervisión De acuerdo con los comentarios de la Agencia Ejecutora We help EFL to clarify the concept of the psychometric model to another NGO and potential partners. SECCIÓN 3: INDICADORES E HITOS Indicadores Propósito: The specific objective is to roll out the psychometric creditscoring tool with new applicants of four financial institutions in different countries of LAC, test the viability of the scoring tool, develop scalable models for its deployment, DICIEMBRE 2012 Línea de base Intermedio 1 Intermedio 2 Intermedio 3 P.I1 Number of financial institutions (FI) implementing the psychometric methodology on a pilot basis 0 P.I2 Number of SMEs that have access to finance thanks to the psychometric analysis tool. 0 P.I3 Amount of US dollars that are channeled to SME by the partnered FI thanks to the psychometric analysis tool. 0 P.I4 The models have been improved and have a special customization depending the region/country and industry to Página 2 Planeado Logrado 4 Oct 2014 2000 Oct 2014 20000000 Oct 2014 3 Oct 2012 178 Oct 2012 3928506.71 Oct 2012 No Estado ATN/ME-12932-RG FONDO MULTILATERAL DE INVERSIONES and improve the technology by further automating the score process. Componente 1: Promotion of the psychometric tool to Financial Institutions (FI) identification of potential implementing FIs which the entrepreneur belongs. P.I5 The methodology is automated, so at least 5,000 tests could be processed per day and scores can be turned around in under 3 hours. P.I6 The prediction capability of the methodology and its potential to reach otherwise excluded SMEs is evaluated, documented and disseminated. C1.I1 Number of countries where a regulatory and legal analysis of the methodology appropriateness was conducted C1.I2 Number of FIs that are aware of the psychometric methodology and its benefits Oct 2014 Oct 2014 No Oct 2014 0 Oct 2011 0 2 Oct 2012 100 Oct 2012 6 Oct 2012 1 Oct 2012 4 Oct 2013 200 Oct 2013 12 Oct 2014 6 Oct 2014 Peso: 20% C1.I3 Number of FI that received a custom made presentation of the methodology. 0 Clasificación: Muy Satisfactorio C1.I4 Number of detailed project proposal for the implementation of the methodology developed and presented to FIs 0 Componente 2: Adjustments of the psychometric tool and scoring automation C2.I1 The psychometric model’s ability to predict credit performance improves by at least .025 AUC Oct 2014 C2.I2 Functioning extranet for score reporting with audited security Oct 2012 Peso: 20% Clasificación: Satisfactorio C3.I1 Number of FI implementing the methodology following the implementation plan developed by EFL. Peso: 40% C3.I2 Number of SMEs that are tested with the psychometric methodology 0 Oct 2011 0 C3.I3 Number of FIs that have a calibrated and tested model that they could continue to implement for new SME lending. A mainstream implementation proposal is presented to each FI. 0 C4.I1 number of study cases documented and disseminated (one Componente 4: Dissemination of the of each partnered FI) lessons learned for potential scale-up of psychometric risk evaluation C4.I2 Academic study to promote the innovation in the 0 Clasificación: Satisfactorio Peso: 20% 10 Oct 2013 4 Oct 2013 C2.I3 Database integration with front-end scoring platforms and EFL suppliers resulting response download and partner score calculations into the EFL database without requiring any manual intervention C2.I4 End-to-end audit of EFL systems and processes by a reputable external agency provide an approval in security confidence to the system C2.I5 Development of a standardized EFL Application Programming Interface (API) for score reporting to partner systems, that would allow them to automatically feed scores into their internal systems. Componente 3: Implementation of the psychometric tool psychometric field related to entrepreneurial finance is developed and disseminated C4.I3 Number of external media stories about EFL 1 Oct 2012 250 Oct 2012 3 Oct 2013 1500 Oct 2013 0 Hitos Conditions Prior Latin American Coordinator is hired FI accepted to pilot the methodology with new clients The psycometric tool is automated FI accepted to pilot the methodology with new clients SMEs have access to finance thanks to the psychometric analysis tool. FIs accepted to pilot the methodology with new clients SMEs have access to finance thanks to the psychometric analysis tool. Oct 2013 Oct 2013 No Dic 2012 Oct 2014 No Dic 2012 4 Oct 2014 1 Oct 2014 0 Oct 2011 3 Oct 2012 264 Nov 2012 22 Dic 2012 14 Dic 2012 No Dic 2012 Si Jul 2012 No Dic 2012 4 Oct 2014 8000 Oct 2014 4 Oct 2014 10 Oct 2014 Clasificación: Satisfactorio H1 H2 H3 H4 H5 H6 H7 H8 Si Dic 2012 3 Dic 2012 309 Oct 2012 En curso Finalizado Finalizado Finalizado Finalizado En curso En curso Dic 2012 Dic 2012 Dic 2012 4 Dic 2012 En curso Planeado Fecha de cumplimiento Logrado Fecha alcanzada Estado 3 1 1 1 3 500 4 1200 Abr 2012 Abr 2012 Oct 2012 Abr 2013 Oct 2013 Oct 2013 Abr 2014 Jul 2014 3 1 2 0 0 0 0 0 Dic 2011 Oct 2011 Abr 2012 Dic 2012 Dic 2012 Dic 2012 Dic 2012 Dic 2012 Logrado Logrado Logrado FACTORES CRÍTICOS QUE HAN AFECTADO EL DESEMPEÑO [No se reportaron factores para este período] SECCIÓN 4: RIESGOS RIESGOS MÁS RELEVANTES QUE PUEDEN AFECTAR EL DESEMPEÑO FUTURO Nivel Bajo Acción de mitigación The project will hire psychometricians to adjust the model to the local culture and develope additional tools to be continually improving the predictive power of the tool. Responsable Project Guest 2. It is not possible to increase predictive power of the psychometric tool with additional data and test components. Bajo Psychometricians will be contracted to make adjustments of the test content and modelling procedures, taking into account the local context, and continue to improve the quality and accuracy of the tool as more information becomes available from the partner FIs. Project Guest 3. Political and economic environment in the country where partnered financial institutions are located are not conducive to SME financing Bajo The project will work with financial institutions in different countries Project Guest 1. Predictive power of the tool is not sufficient for profitable lending in Latin America and the Caribbean as is in Africa. NIVEL DE RIESGO DEL PROYECTO: Bajo NÚMERO TOTAL DE RIESGOS: 3 RIESGOS VIGENTES: 3 RIESGOS NO VIGENTES: 0 RIESGOS MITIGADOS: 0 SECCIÓN 5: SOSTENIBILIDAD DICIEMBRE 2012 Página 3 ATN/ME-12932-RG FONDO MULTILATERAL DE INVERSIONES Probabilidad de que exista sostenibilidad después de terminado el proyecto: P - Probable FACTORES CRÍTICOS QUE PUEDEN AFECTAR LA SOSTENIBILIDAD DEL PROYECTO [No se reportaron factores para este período] Acciones realizadas o a ser implementadas relativas a la sostenibilidad: We are starting to increase pricing for pilots based on conversations with the IDB to test the long-term willingness to pay on behalf of financial institutions to confirm the viability of the business model. SECCIÓN 6: LECCIONES PRÁCTICAS 1. EFL has to adjust to the implementation calendar to account for the slowest part of the approval chain: the General Counsel. We can potentially charm a CEO into saying "yes", invigorate a head of SME into thinking big, help a CRO understand how new information can help him or her do their job better, and inspire a loan officer to reach more clients than he would have previously considered. However, we have not found a way to get a General Counsel to move any faster. Their incentives are not aligned with innovation and they are (understandably) very nervous about external parties working with bank data. There are many things we can do in terms of security and contracts to ameliorate their concerns, but thoughtful contracting is a necessary and important part of a bank's processes and cannot be "sped up". To get a project signed by a bank, EFL as to have high quality and prompt legal advice in addition to lots of patience as we wait for the bank's reply. 2. To be successful, you have to work with multiple banks because any individual bank may run into problems, including many problems that are external to EFL. At BBVA Bancomer, the EFL Champion CEO left, the head of SME left and the project manager left. At Bancredito, the EFL Champion CEO left and the project manager left. At BanBif, the entire team is still there. But it is very difficult to know a) if/how/when bank strategy or organization design will be severely disrupted and b) if the disruption will help or hurt the project. The result is that no bank has 100% probability of success, even they express commitment, promise to invest, and deposit the copayment. Consequently, the project will need more than the original # of banks to reach the goals in terms of loan value and # of clients. DICIEMBRE 2012 Página 4 Relativa a Design Autor Miller, Jared Implementation Miller, Jared ATN/ME-12932-RG