Descargar Formato de Presentación

Anuncio

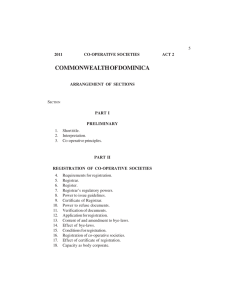

Guía de Elaboración D o c u m e n t o s c i e n t í fi c o s 29,7 cm Consideraciones generales: 2,5 cm • • • • • • • Tamaño de página: Formato A4 (29,7 x 21 cm). Márgenes: superior, derecho e inferior: 2,5 cm; izquierdo: 3 cm. Tipografía: Times New Roman. Disposición de texto: 2 columnas. Sangría: 1,2 cm Interlineado: 1,5 líneas. Numeración de páginas: Números arábigos y deben ubicarse al pie de la página, en la esquina derecha. Texto 10 pts. regular • Extensión del documento: 8 - 12 páginas Agricultural Economics Research Review Vol. 28 (No.2) July-December 2015 pp 351-357 DOI: 10.5958/0974-0279.2016.00013.6 Research Note A Efficiency of Kisan Credit Card (KCC) Scheme in Karnataka: A Comparative Study of Commercial and Co-operative Banks§ C Department of Agricultural Economics, Professor Jayashankar Telanagana State Agricultural University, Rajendranagar, Hyderabad-500 030, Telanagna b Department of Agricultural Economics, University of Agricultural Sciences, Raichur-584 104, Karnataka B La secuencia de preparación del documento será la siguiente: S.M. Jainuddina*, G.M. Hiremathb and Suresh S. Patilb a A Título: Deberá ser lo más conciso posible, con un máximo de 15 palabras, reflejando el contenido del trabajo, además debe ser traducido al inglés. Texto: 16 pts. negrita. B Autor(es): Nombre y apellidos. Texto: 12 pts. negrita. D Resúmenes: Cada artículo se acompañará de dos resúmenes, uno en castellano (Compendio) y uno en inglés (Abstract), que no excedan de 250 palabras en cada caso. Texto: titular 11 pts. negrita, cuerpo 10 pts. regular. E Palabras claves: Máximo cinco (5) palabras que tengan relación directa con el tema tratado en el artículo, tanto en castellano como en inglés. Texto: titular 10 pts. negrita, cuerpo 10 pts. regular. F Clasificación JEL (Q#): Introducir código de acuerdo con el sistema usado por la revista Journal of Economic Literature (JEL), con relación a la sección: “Q Economía agraria y de los recursos naturales; Economía de medio ambiente y de la ecología”. Texto: titular 10 pts. negrita, cuerpo 10 pts. regular. 3 cm 21 cm C Institución a la que pertenecen: Nombre de la institución, departamento, cargo, ciudad. Texto: 10,5 pts. regular D E Key words: KCC, cost of credit, efficiency of credit, number of KCCs renewed, farm credit JEL Classification: Q14, Q16, Q13 G The 12th Five-Year Plan seeks to achieve 4 per cent growth in the agricultural sector through development of new technologies. The introduction of new technologies has led to intensive use of inputs resulting in manifold increase in the requirement of credit. To address the credit needs of resource-poor farmers, the Government of India introduced Kisan Credit Card (KCC) Scheme in August 1998 with the objective of providing timely and adequate credit to the farmers in a cost-effective and flexible manner. Three agencies enstrusted to implement the KCC Scheme were * Author for correspondence G Introducción: Incluye breve revisión bibliográfica pertinente al trabajo y a los objetivos del mismo. La introducción debe finalizar con un párrafo en la que se planteen los objetivos. Texto: titular 12 pts. negrita, cuerpo 11 pts. regular. H Datos y métodos: Descripción breve de la metodología planteada, dando énfasis a los métodos originales o a las modificaciones importantes a técnicas o equipos conocidos. Los procedimientos analíticos y estadísticos deben ser descritos claramente. Texto: titular 12 pts. negrita, cuerpo 11 pts. regular. F Introduction Email: [email protected] § This paper has been extracted from M.Sc. thesis entitled “Performance of Kisan Credit Card (KCC) Scheme in Karnataka: An Economic Analysis” submitted by the first author to the University of Agricultural Sciences, Raichur, in 2013. commercial banks, cooperative banks and regional rural banks (RRBs). Among these three agencies, the commercial banks have issued highest KCCs (45.33%), followed by cooperative banks (40.30%) and RRBs (14.37%) up to March 2012. Among these states, Uttar Pradesh, Maharashtra and Andhra Pradesh are leading in the issue of KCCs. In Karnataka, the KCC Scheme is being implemented by all the three agencies since its inception and it stood 7th in the issuance of KCCs as at the end of March 2012. With this background, the present study was taken up with the objective of assessing the efficiency KCC scheme among the implementing institutions. Data and Methodology H The study was conducted in the Bellary district wherein the density of KCCs distribution per operational holding was found to be highest among the districts of the north-east Karnataka region. From 2,5 cm 2,5 cm Abstract To provide timely and adequate credit to the farmers in a cost-effective and flexible manner, the Kisan Credit Card (KCC) Scheme was introduced in 1998-99. The present study has analysed the efficiency of KCC scheme in the Bellary district of Karnataka among the designated financial institutions. The efficiency of KCC scheme has been estimated by two approaches: (i) cost of credit approach, and (ii) number of KCC cards renewed. The study has revealed that the cost as percentage of loan amount was higher in borrowing from commercial banks (8.54%) than from co-operative banks (2.81%). There is not much difference in the number of KCCs renewed and the percentage of recovered amount in both the financial institutions. Guía de Elaboración D o c u m e n t o s I J Resultados: Se describirán, en forma lógica, objetiva, exacta y de manera fácil de comprender e interpretar las tendencias más relevantes del trabajo, las cuales pueden ser expresadas principalmente en forma de cuadros y figuras, los cuales deben ir insertos en el texto. Texto: titular 12 pts. negrita, cuerpo 11 pts. regular. c i e n t í fi c o s the district selected, 10 commercial and 10 cooperative (Primary Agricultural Cooperative Society) banks were selected based on the number of KCCs distribution. From the selected banks, top three branches each of commercial banks (SBI Sirguppa, SBI Sirgeri and SBI Kamalapur) and co-operative banks (PACS Sirguppa, PACS Sirgeri and PACS Kamalapur) were identified for selection of KCC card holders. From each seleceted bank branch, 30 farmers representing small and large categories were selected making the sample size of 180 farmers. For the study both primary and secondary data were used. The primary data relating to borrowing, repayments, interest cost of borrowing and non-interest costs were collected from 90 KCC holders of commercial banks and co-operative banks. The secondary data related to the number of KCCs issued, amount sanctioned, scale of finance for different crops and interest rate were collected from the concerned bank officers. Tablas: El título de las tablas se escribirá alineado a la izquiera, con negrita, con mayúscula la primera letra, acompañado por la numeración respectiva; su ubicación será usando las dos columnas de texto del documento y de ser necesario al final del mismo se especificarán notaciones con la finalidad de aclarar la información reflejada en los mismos. En el ejemplo se encuentra el formato y diseño de las tablas para su aplicación. Texto: titular 10 pts. negrita, cuerpo 10 pts. regular. Notas 10 pts. cursiva (titular) regular (cuerpo). Results Different components of transaction cost, viz. travel, documentation, information, enforcement and contract are presented in Table 2. There was little variation among the category of farmers, but the variation was higher across the institutions. The average travel cost worked out to be higher for a commercial bank borrower (` 69.79) than for a co-operative bank borrower (` 29.10) as almost all villages have cooperative banks and commercial banks operate for a cluster of villages. Though travel cost was found less for a co-operative bank borrower, the average number of visits were more (4.33) compared to a commercial bank borrower (2.49). The efficiency of KCC scheme was estimated by adopting two approaches, viz. cost of credit approach and number of KCC cards renewed in the particular year. In the case of documentation cost, the scenario was different. This cost was found to be almost 2.5 - times higher for a co-operative bank borrower (` 872) than a commercial bank borrower (` 355) due to the To analyze the determinants and their influence on the performance of KCC scheme, the ordinary least square model was applied. To work out the efficiency of KCC scheme, data related to number of KCC issued and number of KCC renewed per branch were collected from 10 commercial bank branches and 10 co-operative bank branches. The tabular analysis was carried out to estimate the percentage share of transaction cost, interest cost, total cost of credit and recovery per cent. I J For calculating cost of credit, interest cost and transaction/non-interest cost (travel, documentation, contract, etc.) were taken into account. The interest cost was calculated based on the interest rate charged by different financial institutions and data are presented in Table 1. The average amount borrowed per farmer in the case of commercial banks varied from ` 1,10,587 (small farmers) to ` 2,51,830 (large farmers). In the case of co-operative banks, the credit range was found to be lower (` 55,971 for small farmers and ` 1,36.289 for large farmers) than the commercial banks. The overall interest cost for the commercial bank was higher 7.76 per cent (` 14,068) than these of co-operative banks, 1.22 per cent (` 1,168). The interest rate was lower in co-operative banks because of the state policy of providing subsidized credit to farmers through cooperative banks. Table 1. Interest cost of credit incurred by different categories of farmers Particulars Small farmers (N*=45) Average amount borrowed (`) Average interest cost (`) 1,10,587 7,576 (6.85) Commercial banks Large All farmers farmers (N*=45) 2,51,830 20,559 (8.16) 1,81,209 14,068 (7.76) Small farmers (N*=45) Co-operative banks Large All farmers farmers (N*=45) 55,971 454 (0.81) 1,36,289 1,881 (1.38) 96,130 1,168 (1.22) Note: Figures within the parentheses indicate interest cost as per cent of amount borrowed. * N is number of sample respondents in respective categories of farmers 352 Guía de Elaboración Table 7. Factors behind the better performance of KCC scheme in financial institutions K Discusión: Es el análisis o interpretación que hace el autor de manera rigurosa de los resultados obtenidos en la investigación, además de contrastarlos con los resultados de otros autores. Es importante finalizar esta sección con un párrafo donde se reflejen las implicaciones prácticas o teóricas de la investigación. Texto: titular 12 pts. negrita, cuerpo 11 pts. regular. L Conclusiones: Aquí se indicará en forma lógica, concisa y en orden de importancia los hechos nuevos descubiertos y su aporte o contribución a la ciencia. Eventualmente, se podrán incluir recomendaciones, que constituyan la acción a seguir basándose en las conclusiones. Texto: titular 12 pts. negrita, cuerpo 11 pts. regular. Particulars Commercial bank KCC holders Coefficients t-stat Intercept Age Education Family size Land size Membership # R Adjusted R2 2 M Implicaciones de Política: Se describen las posibles implicaciones que la investigación pueden tener en mejorar la política pública agraria. Texto: titular 12 pts. negrita, cuerpo 11 pts. regular. 10.46* (0.59) -0.04** (0.15) -0.03** (0.04) 0.11** (0.09) 0.78* (0.06) 0.05** (0.04) Co-operative bank KCC holders Coefficients t-stat 17.81 -0.27 -0.81 1.23 14.19 1.41 9.95* (1.32) 0.03** (0.35) 0.09** (0.08) -0.29** (0.18) 0.98* (0.11) — 0.79 0.77 7.53 0.08 1.08 -1.63 9.16 — 0.52 0.48 Note: Figures within the parentheses indicate the respective standard errors # Membership to Vevasaya Sangh (farmers group) K Discussion The regression coefficient of commercial bank KCC holders showed that one year increase in the age of farmers would lead to 0.4 per cent decrease in loan amount under KCC scheme. Similarly, one per cent increase in education of farmers would lead to 0.3 per cent decrease in loan amount under KCC scheme. In the case of cooperative bank KCC holders, the regression results are opposite to that of commercial bank KCC holders. The age, education and land size were found positively significant, whereas family size was negatively significant. The regression coefficients of cooperative bank KCC holders show that one per cent increase in education of farmers would lead to 0.9 per cent increase in the loan amount. The regression coefficient of land size has shown a positive significance in both the financial institutions. It indicates that one per cent increase in land size would lead to an increase in loan amount by about 7.8 per cent in commercial banks and 9.8 per cent in cooperative banks borrowed under KCC scheme. Based on these results, we may conclude that the performance of KCC scheme was better in cooperative banks than in commercial banks. L Conclusions For sustainable development of agriculture, credit is a crucial input but access of resource-poor farmers to credit is limited. Hence, the Government of India has taken several steps to increase the flow of credit to the agricultural sector. One such measure was introduction of KCC scheme in the year 1998. This paper has evaluated the efficiency of KCC scheme in Karnataka. The study has revealed that the cost as percentage of loan amount was higher in borrowing from commercial banks than from co-operative banks. The number of KCCs renewed and recovery percentage of KCC loan was found to be slightly higher in cooperative banks as compared to commercial banks. It indicated that the efficiency of KCC scheme was higher in the case of cooperative banks than commercial banks. It was due to lower cost of credit and marginally higher renewal of KCCs. The study has also revealed that the recovery percentage was slightly higher in cooperative banks than in commercial banks. It could be due to the subsidy subvention scheme attached with co-operative banks. Policy Implications M Although the efficiency of KCC scheme has been found higher in cooperative banks, the loan amount was lower than by commercial banks in absolute value and even less than the scale of finance fixed by the district level technical committee. It may due to weak resource position of cooperative banks which does not allow to provide adequate loan amount to the farmers. 353 Guía de Elaboración N Reconocimientos: El autor (es) pueden reconocer o agradecer a las personas, instituciones (públicas o privadas), u organismos que crean pertinente realizarlo. Texto: titular 12 pts. negrita, cuerpo 11 pts. regular. Ñ Referencias: La lista de referencia deberá organizarse en orden alfabético por autor (es), seguido del año de publicación. Deben incluirse los nombres de todos los autores de la referencia bibliográfica citada. El orden de presentación de las referencias bibliográficas será el siguiente: Revista: Apellido del autor, Nombre o inicial, año de publicación, titulo del artículo en la revista, nombre de la revista, volumen, número y paginación correspondiente. Ejemplo: allow to provide adequate loan amount to the farmers. Hence, there is a strong need to strengthen the cooperative banking system by infusing more resources. N Acknowledgements The authors are grateful to the referee for valuable comments that helped to significantly improve the manuscript. The first author gratefully acknowledges the Indian Council of Agricultural Research, New Delhi, for providing financial support under the ICARJRF Fellowship Scheme for the period 2011-13. References Ñ Sajane, A.M., Basavaraja, H., Guledgudda, S.S., Patil, B.L., Mahajanshetty, S.B. and Bhat, A. R.S. (2011) Economic evaluation of Kisan Credit Card Scheme. Karnataka Journal of Agricultural Science, 24(2): 173176. Singh, S., Manjeet, K. and Kingra, H. S. (2009) Inadequacies of institutional agricultural credit system in Panjab state. Agricultural Economics Research Review, 22: 309318. Revised received: June, 2015; Accepted August, 2015 Otahola, V. y J. Imery. 1995. Selección masal con control biparental para prolificidad en maíz (Zea mays L.). SABER 7 (2): 63 – 69. Méndez-Natera, J. R.; O. H. Medina-Leota; J. F. Merazo-Pinto and J. E. Fendel-Alvarez. 1999. Effect of four tillage methods and two forms of urea placement in an Ultisol of savanna on vegetative and flowering traits of three sesame cultivars, Sesamum indicum L. Revista de La Facultad de Agronomía (LUZ) 16 (5): 463-475. Obras colectivas: Apellido del autor, Nombre o inicial, año de publicación, nombre del artículo, editor de la obra (Precedido de la palabra latina In), nombre de la obra, editorial, ciudad y paginación correspondiente. Ejemplo: Ortega, A.; S. K. Vasal; J. Mihl y C. Hershey. 1991. Mejoramiento de maíz resistente a los insectos. In: F. G. Maxwell y P. R. Jennings (EDS). Mejoramiento de plantas resistentes a insectos. Editorial LIMUSA. México. p. 391 – 442. Libros: Apellido del autor, Nombre o inicial, año de publicación, nombre de la obra, editorial, ciudad o país, número de páginas. Ejemplo: Hernández, F. J. 1997. El cultivo del algodonero. Ediciones de la Universidad Ezequiel Zamora. Barinas, Venezuela. 309 pp. Texto: titular 12 pts. negrita, cuerpo 10 pts. regular con sangría. Nombre de la publicación: 10 pts. cursiva. 354