Performance informed budgeting in U.S. State governments

Anuncio

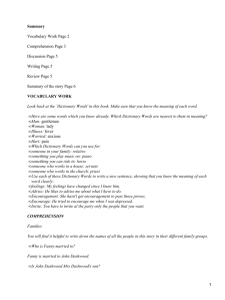

Presupuesto y Gasto Público 51/2008: 287-303 Secretaría General de Presupuestos y Gastos © 2008, Instituto de Estudios Fiscales Performance informed budgeting in U.S. State governments JUAN LUIS GÓMEZ KATHERINE G. WILLOUGHBY Georgia State University Recibido: Diciembre 2007 Aceptado: Enero 2008 Abstract Performance based budgeting (PBB) systems are ubiquitous - virtually all state governments in the United States have some sort of budgeting system that requires strategic planning, goal assessment, performance measurement, re­ porting and sometimes even program performance evaluation or auditing. This paper examines research about Uni­ ted States government efforts of the last decade to infuse budgeting with rationality through the application of per­ formance measurement. Findings indicate that these efforts have been successful in advancing communication and understanding among stakeholders about what governments do and how government operations are accomplished. Still, while PBB initiatives can add value to budgetary deliberations and support agency management, such reform does not displace the politics of the budgetary process. Key words: Performance-based budgeting, measurement, state governments, U.S. Resumen Los sistemas de presupuestación por resultados son característica común a la mayoría de los estados de EE.UU. Casi todos los gobiernos estatales incorporan ya a sus sistemas de presupuestación alguna modalidad de planificación es­ tratégica, evaluación de objetivos, mediciones de resultados, o incluso auditoría por resultados. Este trabajo evalúa las principales contribuciones en la investigación sobre los intentos de los gobiernos estatales en EE.UU. de incre­ mentar la racionalidad de sus procesos presupuestarios mediante la implementación de la medición de resultados. Nuestra conclusión es que estos esfuerzos han conseguido avanzar en la mejora de la comunicación y entendimiento entre los contribuyentes, el gobierno, y otras agencias públicas y privadas, acerca de cuáles son los objetivos guber­ namentales y cómo son alcanzados. A pesar del valor añadido de la presupuestación por resultados a las negociacio­ nes y procesos presupuestarios, esta reforma no ha conseguido eliminar la influencia de los aspectos puramente polí­ ticos en la presupuestación. Clasificación JEL: H1, H75, H83. 1. Introduction: Performance or results-based budgeting: concept and rationale A common thread of modern public budgetary reforms is improving the transparency and accountability of government - specifically by measuring and reporting on government performance and assessing the results of government operations and programs. In different 288 Juan Luis Gómez y Katherine G. Willoughby fashions, these reforms have aimed at improving the linkages between strategic planning and government performance. The emphasis on measuring performance, as Behn (2003) would argue, was not a goal in itself, but an avenue towards assisting managerial processes and governments’ accountability to their citizens. The focus of performance or results-based budgeting reforms varies widely across na­ tional and sub-national governments around the world. Shrinking national budgets due to in­ ternationally mobile (and thus elusive) tax bases, sustained international conflict, persistent poverty, population and health issues and environmental disasters all exert pressures on gov­ ernments to do more for less. Such pressures enhance the need to justify the efficiency, and often the existence, of public expenditure programs. In developing countries, the realization that large cash infusions from donors are unlikely to jump-start growth unless a good gover­ nance foundation is in place, has led donor agencies to request the development of perfor­ mance indicators and analysis of such measures associated with government programs. Do­ nors have also started to financially support the introduction of wide-ranging performance based budgetary reforms aimed at improving the accountability of the governments so sup­ ported. In the United States, the (GPRA 1993) implemented modern performance based bud­ geting (PBB) at the federal level in order to advance the accountability of the federal agen­ cies towards its citizens. In addition, such reform aims to improve the effectiveness of fed­ eral expenditure programs in general and in service delivery in particular. Finally, the GPRA seeks to improve the effectiveness of the oversight and decision making functions of Con­ gress (GPRA 1993). Federal efforts at a results oriented budgeting system to date have greatly enhanced the transparency of government operations at this level though have not ex­ tended past what is termed by Joyce (2003) as “performance informed budgeting”. That is, a direct relationship between performance and budget allocation is not clear, even though in­ formation about federal government program performance is much more pervasive and readily available to budgetary decision makers internal to government as well as stake­ holders (citizens, lobbyists, constituents and others) external to government. Coincidentally, state and local governments across the U.S. have implemented untold varieties of performance based budgeting reforms as well (Melkers and Willoughby 1998; Poister and Streib 1999). The net effects from the implementation of such systems in these sub-national governments are mixed. Primarily, governments that have implemented perfor­ mance related budgeting reforms experience enhanced communication among budgetary de­ cision makers and stakeholders about government programs and activities, greater comfort with measurement and quantifying what government does, and clearer knowledge about the linkages between program goals and the means to attain such goals. On the other hand, very little evidence exists that directly links program performance and its measurement with final appropriations. Here again, most of the reform efforts at the state and local levels in the United States can be labeled performance informed budgeting systems rather than perfor­ mance based budgeting systems. Melkers and Willoughby (2004) identify several important trends from their research of the last decade or so. First and foremost, the integration of PBB efforts has occurred along Performance informed budgeting in U.S. State governments 289 with other public management initiatives. Similar to what has occurred in the federal govern­ ment, many state efforts have been initiated with the intent to go beyond specific budget allo­ cation decisions. It is now common to find performance budgeting efforts linked to other public management initiatives, such as strategic planning. Strategic planning requires goal definition, which in turn sets the stage for the measurement of those program activities nec­ essary to reach such goals. Second, performance based systems in states have withstood the test of changing lead­ ership. PBB initiatives in the states are legislatively stipulated in law during one session or mandated by the chief executive usually at the beginning of an administration, yet are imple­ mented over the course of several years and/or decades. While governors have changed and legislatures realized turnover in the states over the last decade or so, PBB systems have en­ dured and evolved. States now appear prepared to “stay the course” and continue enhancing their performance measurement systems for broader and better application (Melkers and Willoughby 2004). In this article, we briefly review the reform path of performance budgeting in the United States over the last half a century. Next, we summarize the status of the implementa­ tion of various systems at the state and local levels in the United States. We also examine PBB systems in specific states recognized as leaders in “budgeting for performance”. We conclude with an assessment of the usefulness of this reform effort to public budgeting in general as well as provide a prognosis for its utility for governments in the future. 2. Reasons for Budget Reform and a Focus on Performance in the United States 2.1. Main Reasons for Performance Measurement and Budgeting Performance-based budgeting (PBB) aims to link, in a binding and comprehensive way, strategic planning objectives, expenditure appropriations and expected results from government programs. The system requires the provision of quantifiable data that “provides meaningful information about program outcomes” (Willoughby and Melkers 2000, p. 106). It goes beyond the mere reporting of results to effectively establish a mechanism to evaluate progress towards the defined goals (Altmayer 2006). To do this, PBB has required increased attention to customer satisfaction, the empowerment of civil servants, and the use of private sector process-improvement techniques (Swiss 2005). Behn (2003) defines eight purposes for public managers to measure performance: eval­ uate, control, motivate, budget, promote, celebrate, learn, and improve. While most of the questions that Behn asks are fact based (How well is my agency performing? What is work­ ing and not working and why?), the question posed regarding budgetary uses of performance measurement remains quite value laden - on what programs, people or projects should my agency spend the public’s money? This question cannot be answered by attending to measures of performance alone. In the United States, the deliberative process of budget making 290 Juan Luis Gómez y Katherine G. Willoughby requires consensus about spending, agreement generated through a political process that can be informed by but may not hinge on performance information. Behn’s typology of perfor­ mance measurement uses illustrates the difficulty of implementing a system that is all things to all people. This typology effectively distinguishes the uses of performance measurement for management versus budgetary decisions. Performance measurement is very useful dur­ ing budget development and for justification purposes, during budget execution and even for auditing and evaluation purposes. Its weakest application is during the budget deliberation phase - during the highly politically charged period of legislative consideration of the budget for passage. Behn’s work illustrates the fact that PBB efforts of the last two decades have not arisen strictly out of managerial curiosity about how to do more with less. Citizens and therefore elected officials are clamoring to open up the budgeting process to greater scrutiny and so have pressed for a greater presence of performance measurement throughout the budget pro­ cess and particularly, stronger applicability during the budget deliberation phase. The federal government’s 1993 GPRA and subsequent additions and changes to this law now require agency and executive attention to the measurement and assessment of performance through the Program Assessment Rating Tool (PART) process, as well as a stronger role for Con­ gress in terms of performance oversight and program sunset provisions. GPRA requests federal agencies to produce a strategic plan, an annual performance plan, and an annual performance report to better inform congressional decision making and assist efficient budget allocation (GPRA 1993; Long and Franklin 2004). Agencies must submit performance plans to the executive Office of Management and Budget (OMB) re­ garding major activities and performance reports to Congress that include information com­ paring actual with planned performance, a discussion of success in meeting goals and remedial action taken if goals are not met. The Act further allows for pilot projects in performance budgeting by agency and program. GPRA reorganized the OMB with Resource Manage­ ment Offices (RMOs) that develop and support the President’s Budget and Management Agenda. These offices provide a nexus between Congress and federal agencies - supporting executive negotiations with Congress regarding federal fiscal policies and providing policy and management guidance to federal agencies. The subsequent Government Reorganization and Program Performance Improvement Act of 2005 created results and sunset commissions that review agency performance reporting and established an expedited congressional per­ formance review protocol. Though GPRA began during the Clinton Administration, the sub­ sequent Bush Administration has continued reform efforts using PART, with a view to­ wards systematizing and making increasingly transparent the process of assessing results (Mullen 2006). At the state and local levels in the United States, governments are being held to legisla­ tive requirements for a performance measurement and budgeting system, an executive man­ date for such a process, and/or both (Melkers and Willoughby 2004 and 2005). Also, these governments follow the concepts and standards promulgated by the Governmental Account­ ing Standards Board (GASB) that have added service efforts and accomplishments and other performance measurement and reporting recommendations to the traditional financial ones stipulated for these governments. Much of the emphasis on performance budgeting and re­ Performance informed budgeting in U.S. State governments 291 porting in the United States at all levels of government has been born out of public discontent with government operations and/or tax and service levels that in turn has fostered such stan­ dard setting and rule-making. 2.2. Performance Based Budgeting in Historical Perspective Still, the drive towards budget reform is hardly a recent phenomenon. Very visible bud­ get reform at the federal level of the United States includes the recommendations of the Hoo­ ver Commission of 1949, an attempt to emphasize a focus on the expected outputs of govern­ ment programs, rather than the inputs required for program implementation. Although the reform fell short of providing a guiding framework for the use of output information for bud­ getary allocation, the information requirements outlined have remained a critical piece of federal budget presentation. President Lyndon Johnson’s Planning Programming Budgeting System (PPBS) in 1965 is another antecedent to current performance related reforms. PPBS aimed to provide a multi-year fiscal framework that allowed placing performance (still very much defined in terms of outputs) budgeting in a medium to long-term perspective. Strategic planning was a foundation of the PPBS and certainly carries over to current PBB systems; the process was highly “rational and comprehensive” in terms of requiring an articulation of goals and objec­ tives, methods to reach goals and an assessment of the benefits and costs associated with the defined methods of reaching goals. While perhaps appropriate for budgeting in the U.S. De­ partment of Defense (hardware intensive), this system was more difficult to implement throughout the federal government. An across the board application required of all agencies with little preparation, the comprehensive review of programs, problematic data collection, measurement and analyses, a strongly centralized, strategic focus on efficiency as a primary value and the virtual ignoring of the congressional role in budgeting doomed this practice as unwieldy, unrealistic, and so not used. The link between results and agency and even individual responsibility was made more explicit with the implementation of the Management by Objectives during the Nixon Presi­ dency (around 1973); goal setting again was an important component of this reform, but di­ rect accountability of managers to such goals was made explicit. President Jimmy Carter’s initiation of Zero Based Budgeting (ZBB) into federal budgeting (based on his application of the reform in Georgia while Governor) then turned a traditionally top down process upside down. Under this system, budgets are built from the ground up - program managers prepare decision packages indicating various levels of program production at differing levels of funding (perhaps 93, 95, 98 and/or 102 percent of current budget) and feed these decision packages up the chain of command for re-ranking and so on. A highly paper intensive, totally unrealistic reform, parts of this type of budget making does reverberate in current perfor­ mance based budgeting systems. Comparability, measurement and a focus on optimizing re­ sults from budgetary expenditures by presenting alternative funding levels is common prac­ tices in U.S. governments today (GAO 1997). 292 Juan Luis Gómez y Katherine G. Willoughby Thus, the PBB systems of today resonate with vestiges of past innovations - the need for strategic planning, the measurement of activities and outputs, comparability, and a con­ sideration of program results stem from past efforts that may have been overly ambitious for realistic implementation. For whatever reasons, PPBS, MBO and ZBB were not lasting, but components of each have held firm. And, as we will illustrate below, there remains no ideal type of budget reform. GPRA requested the linkage of performance requirements with strategic plans and pro­ vided for a staggered implementation process with pilot application. GPRA, however, is more comprehensive than many state initiatives - folding together strategic planning, perfor­ mance measurement, management improvements, benchmarking, performance budgeting, and results oversight as well as including a section that considers protocol for exceptions or waivers to requested reforms. GPRA also provided definitions for agencies along with re­ porting and other guidelines. Implementation of the Act is highly agency-specific, and criti­ cism has arisen regarding whether the top-down directions of the act allow for the flexibility required at the agency level for successful implementation (Long and Franklin 2004). PART may have assisted in improving rigor in the use of performance information by the OMB, but high quality performance data is rare and assessment efforts can be impaired by limited in­ formation (Mullen 2006). More generally, performance based budgeting reforms have been criticized for failing to establish a system of incentives that is well aligned with the objec­ tives of the reform. Instead, incentives traditional to input based budgeting systems remain in a reform environment, thereby hindering fully successful implementation of PBB systems (Swiss 2005). 3. State and Local Government Implementation of Performance Based Approaches to Budgeting: Evidence from the Field United States’ government consumption expenditures and gross investment equaled approximately $2.0 trillion (real dollars) in 2005, and state and local government expendi­ ture made up 63 percent of this total (U.S. Census Bureau 2007). These sub national govern­ ments account for an increasing share of the country’s public expenditure and government service delivery. Further, state and local governments in the United States have traditionally shown good flexibility for policy innovation, making them good piloting grounds for a vari­ ety of management and budgeting reforms. The Hoover Commission established at the fed­ eral level helped to ignite performance related reforms at the state level, with Maryland lead­ ing the way in 1949 (Jordan and Hackbart 1999). Across all states, however, budgeting reforms remain piecemeal and uneven, with frequent backsliding to counteract progress. Schick’s (1971) early assessment of the implementation of performance budgeting at the state level concludes that the resistance of state legislatures to anything other than line-item budgeting (that enhances legislative control of the budget) explains the limited success of the early performance budgeting reforms. It is important to note here a distinction between early performance budgeting initia­ tives (pre-1960s) and those of the last quarter of a century. The focus of earlier budget re­ Performance informed budgeting in U.S. State governments 293 forms, often termed activity based budgeting, was on program activities and not necessarily on the results of such activities. The more current performance based budgeting reforms in the United States have concentrated on program results; specifically the definition and mea­ surement of program outcomes. Essentially, budget reform has evolved to encompass exami­ nation of the inputs, activities, outputs and outcomes of government programs and services. Early efforts concentrated most heavily on the measurement of the efficiency of government operations with generally muted consideration of the results of such operations. The 1990s witnessed a flurry of research on state budgeting practices in comparison to the dearth of research evident in the previous two decades (Thurmaier and Willoughby 2001). An important body of that work has been devoted to the analysis of state reactions to fiscal crises, comparisons of behaviors of budgetary decision makers and budget reforms, specifically, and the status of the implementation of PBB systems and the results achieved by such reforms. Melkers and Willoughby (1998) were the first to report how widespread PBB requirements had become in the states; they reported that some form of performance based budgeting was required in 47 out of 50 states by 1996. Most of the states had implemented such requirements within a few years of the implementation of the federal 1993 GPRA. Yet, despite the widespread establishment of PBB requirements in state governments in the United States, implementation has varied widely across governments. Moreover, prog­ ress with implementation, even in states considered to have “high management capacity”, has been far from linear. In fact, research has shown that there exists no clear relationship be­ tween such variables as per capita income or population density and PBB implementation (Lee and Burns 2000). Research about PBB systems in local governments illustrates varied implementation as well (Poister and Streib 1999; Berman and Wang 2000). Aside from popular pressure on state and local governments to report on the results of government actions, what are other reasons to explain why PBB systems in these govern­ ments seem to endure? In principle, and under the traditional principal-agent model, we would expect the legislative branch of government to drive the implementation of perfor­ mance oriented budget reforms in order to exercise greater control over the executive branch. Moynihan (2005) finds evidence that PBB is used as a control tool by elected state represen­ tatives in this way, but also as an instrument to position themselves before the electorate as advocates of “good government” or enhanced government efficiency. In the same vein, Griz­ zle and Pettijohn (2002) argue that much of the value of PBB is as a symbol of commitment to public program spending results and accountability. On the other hand, much of the lasting power of this most recent round of budget re­ form (PBB) reflects movement away from understanding such reform as a means to cut bud­ gets. Research about PBB efforts in the states has concentrated on three other criteria: First, it is to be expected that the development and use performance measures will improve com­ munication between and among the executive branch, legislators and citizens (Lee 1997; Broom and McGuire 1995). Willoughby and Melkers (2000, p. 108) also argue that PBB may “support more effective coordination among different branches of government”, and “improve decision making generally”. This squares with efforts to better inform legislators on the results of government spending to support generating consensus about the budget. 294 Juan Luis Gómez y Katherine G. Willoughby Lastly, PBB may enhance managerial quality, assisting agencies to “clarify broad and ab­ stract management goals, monitor the achievement of these goals, detect operational prob­ lems and provide solutions” (Wang 2000). These aspects are considered below and then we turn to a briefing of state leaders in budgeting for performance. 3.1. PBB and Expenditure Allocation Current research unanimously fails to detect an overt link between the implementation of PBB and significant re-allocations within or changes to state expenditure levels (Wil­ loughby and Melkers 2000). In the late 1980s, Connelly and Tompkins (1989) found that the implementation of performance measures in Missouri did not explain variation in the gover­ nor’s recommendations or staffing levels. Jordan and Hackbart (1999) later found that only 13 states used performance funding, and for most of the 50 states, allocation decisions were hardly affected by performance reporting. In fact, “in those states undertaking performance funding, only a marginal share of the funds (estimated at 3 percent) were subject to the influ­ ence of performance evaluation” (Jordan and Hackbart 1999). Melkers and Willoughby (2001) found that the impact of PBB on budgetary appropriations may be somewhat greater in states where the system is a legislative rather than executive requirement. At the county and city level, budgeters’ views of the influences of performance budget­ ing on affecting budgetary allocations are mixed at best. Overall, performance measures seem to inform budgeting decisions but are far from counterbalancing the political nature of public budgeting. Melkers and Willoughby (2005) find that less than 50 percent of county and city officials agreed that performance measures were a vital decision aid on budgetary issues. In a national survey of counties with populations over 50,000 each, Berman and Wang (2000) found that about one third of the counties used performance measurement, a use that was highly and positively correlated with the counties’ managerial capacities. Similar findings are reported at the municipal level. A survey of officials from munici­ pal governments with populations of 20,000 or over showed that, despite widespread use of strategic planning (a key component of PBB) and good links between strategic planning and budget requests, just less than half (48 percent) of respondents considered that “performance data tied to strategic goals and objectives played an important role in determining the alloca­ tion of resources in their cities” (Poister and Streib 2005, p. 50). 3.2. PBB and Improved Decision Making In spite of the perceived lack of influence of PBB on budgetary allocations, surveys of budgeters in both the executive and legislative branches seem to provide evidence in favor of PBB; these systems improve decision making by providing performance information, com­ parisons and reflections about government performance (Melkers and Willoughby 2001). Research results are consistent across these branches of government. Although Joyce and Tompkins (2002) find that the use of performance information by the legislative branch is al­ Performance informed budgeting in U.S. State governments 295 most negligible and just somewhat better among budget officers in the executive branch, new research claims otherwise. Bourdeaux (2006) emphasizes the critical role of legislatures in effecting budget reform in the states and finds that “higher levels of legislative responsi­ bility for budgeting as well as legislative engagement in the oversight of performance mea­ surement are significantly associated with increased use of performance measures in making budgetary decisions at both the legislative and agency level”. Willoughby (2004), in a survey of executive and agency budgeters and staff, concurs that performance budgeting has fos­ tered better communication across offices, leading to improved service quality. Melkers and Willoughby (2001) also find that PBB assisted budget officers in obtaining a better under­ standing of state government operations. And, Melkers (2006) points to perceived enhance­ ment of communication within and across government agencies due to the use of perfor­ mance measures. Regarding the use of performance measures in local governments, Melkers and Wil­ loughby (2005) find more widespread use at the county rather than at municipal levels. Citi­ zen satisfaction surveys are a common outcome indicator that is used in the decision making process by these local governments. Also, like Jordan and Hackbart (1999), Melkers and Willoughby (2005) find that performance information at the sub national government level is most commonly used for budget development purposes. In terms of the kind of budgetary decisions the PBB is more likely to affect, Riverbank and Kelly (2006) argue that perfor­ mance measures at the municipal level are especially helpful to inform budget decision mak­ ers about new requests of program expansion. 3.3. PBB, Efficiency of Agency Programs and Enhancing Management Capacity Perceptions of the effect of PBB on improving the efficiency of agency programs are influenced somewhat on whether there exists a legislative or administrative requirement for PBB, with the former improving perceptions on the efficiency-enhancing potential of PBB (Melkers and Willoughby 2001). While research shows performance information is not ef­ fective for budget cutting purposes or for making significant re-allocations, there is work that substantiates its role in managing agencies and therefore the efficiency with which opera­ tions are conducted (Willoughby 2004). At the sub national level, Poister and Streib (2005) find that just about 56 percent of the municipal level staff surveyed used performance measures to assess project implementation. Recent examination of performance budgeting use by agencies in the State of Georgia indicates that “for agencies to conduct performance in­ formed budgeting, the focus needs to be on elevating managerial capacity to use perfor­ mance information, and improving measurement quality” (Lu 2007). This implies advance­ ments in the administration of agency programs and services - streamlining processes and supporting greater coverage of services to those in need. Moreover, Lu (2007) finds it crucial “to recognize that performance budgeting is a collaborative process in which each partici­ pant plays a valuable role”. Here again, the usefulness of PBB to opening up the communica­ tion flow among budgeting decision makers and stakeholders adds value to the decision making process. Clearer interpretation of government funding levels, program results ex­ 296 Juan Luis Gómez y Katherine G. Willoughby pected and targets to aspire to can help to generate consensus about budget shares during the deliberative process. A primary caveat of the literature about performance measurement usefulness regards the research evaluation efforts themselves. Overwhelmingly, available research on PBB im­ plementation and its impact has come from surveys of government budget officers and staff. The field faces important data limitations that deter certain quantitative analyses that would be appropriate to estimate the impact of the reform, such as panel datasets. Consistently, re­ searchers face the challenges of small sample sizes and/or the inconsistent nature of perfor­ mance data across states. Faced with these constraints, the profession has resorted to survey instruments of budget decision makers and stakeholders as a preferred methodology. The strength of this methodology is the examination of information from experts who are involved in a very repetitive process (annual or biennial budgeting) in which various stake­ holders hold specific roles - the executive proposes or recommends a budget, the legislature deliberates and disposes (passes a budget bill or bills), the executive manages and executes (spends) during the fiscal year and the legislature audits, evaluates and assesses once the budget year ends. In order to reduce potential biases of responses, much research continues that seeks data input from larger groups of budget stakeholders, across more governments and over time. One such study is the Government Performance Project (GPP), a periodic survey of the 50 states in the United States that assesses management capacity in the areas of budgeting and financial management, human resources, information and infrastructure. This research is examined below. Specifically, results from the 2004-2005 survey are presented that highlight state leaders in budgeting for performance. 4. Current Research about State Government PBB Systems: The Government Performance Project The survey methodology of the GPP is three fold: (1) academic researchers from four American universities gather information about state government management in each of the four areas noted above; (2) state government officials and staff complete an online survey re­ sponding to questions regarding their state’s practices in each of the four areas; and (3) jour­ nalists interview numerous executive and legislative officials, citizens and others in each state government to further flesh out practices, circumstances and problems that exist associ­ ated with management by the states in each of the four areas. The data gathering and analy­ ses are a year-long effort; assessment and grading of states is conducted following the analy­ sis period and takes several months. Results (grades for every state for each management area and overall) are presented in a spring edition of Governing and are posted online (for the most recent survey results, go to: www.gpponline.org) 1. The most recent survey of the 50 states regarding the management of information assessed most states at a “C” level (Govern­ ment Performance Project, 2005). Still, this study found that “technology now is part of a far larger process - gathering, analyzing and disseminating information, whether it is through e-government, strategic planning or managing for results”. Performance informed budgeting in U.S. State governments 297 Findings of the GPP highlight the successful components of the performance budgeting systems in the states today. For example, the State of Washington uses strategic planning particularly well to establish budgetary priorities. Washington’s “Priorities of Government (POG)” is a process to tease out what services citizens want from the state, prioritizes these services statewide, and then considers which services the state can afford. After a thorough examination of 1,400 state programs that involved numerous state officials and agency staff, the state developed less than a dozen statewide goals that could serve to focus budgetary de­ cisions. According to the GPP (2005), this effort has been “very promising”. “It does inform and drive the budget process, allowing lawmakers to focus on an agreed-upon list of prior­ ity-ranked services, and on delivering those services in the most efficient way”. This process not only brought about greater transparency of government operations, but had real budget­ ary implications as well. “The initial endeavor closed the state’s $2.5 billion budget gap, and POG was used again in 2004 to inform the state’s next biennial budget planning process”. Louisiana is a long time user of performance measures and has had a statutorily re­ quired performance based budgeting system in use for a decade. This state’s Performance Accountability System (LaPAS) is “an electronic database that tracks agencies’ goals, stan­ dards, measures, and output and outcome information. Agencies must use the system to file quarterly performance reports, so the database serves as the depository of official perfor­ mance information. By focusing on the private-sector habit of quarterly targets and quarterly results, agencies more clearly see the cyclical changes in their performance. If actual perfor­ mance deviates by 5 percent from goals, the agency must explain the discrepancy to the Of­ fice of Planning and Budget. By law, performance measures figure into the appropriations process as much as money does”. This system is user friendly; much effort has gone into keeping data fresh and making data preparation and presentation an automatic practice throughout the budget process. Such a system enhances management capacity as well as transparency of process. Frequently comparing performance with goals allows problems to be caught more quickly, often before they become critical and/or unmanageable. For exam­ ple, the GPP illustrates that Louisiana’s “Department of Wildlife and Fisheries, in early 2004, noticed an increase in fatal boating accidents during the agency’s quarterly reporting. After analyzing the causes of the accidents, the agency devoted more personnel to boater ed­ ucation and a safety campaign in the media”. And because agency performance information is available online, citizens have current data available about state operations virtually at the touch of a button. South Carolina, Iowa and Minnesota are a few of the other states that received high marks from the GPP for budgeting for performance and/or the use of performance measure­ ment for management purposes. South Carolina’s performance budgeting system is framed by a strategic planning component, a reporting component and a somewhat novel, monitor­ ing component. Just as Washington’s POG sets the stage for measuring and tracking perfor­ mance toward goals, South Carolina’s Budgeting for Results system establishes “statewide goals, identifies strategies to achieve those goals and establishes indicators to measure per­ formance or progress towards these established goals”. And, like Louisiana, this state has a requirement that cost and performance data be available to a number of internal state budget decision makers; this is data that becomes available throughout the budget process. For ex­ 298 Juan Luis Gómez y Katherine G. Willoughby ample, “data from accountability reports may find its way into budget requests prepared by agencies, that are then reviewed by State Budget Office and then within budget recommen­ dations of the Governor to the legislature”. South Carolina’s legislators probably take more advantage of performance data than the typical legislator in other states. According to the GPP, at the time of the 2004 survey, state officials in South Carolina reported “that the legis­ lature is increasingly using the accountability reports as they become more refined”. A third important component of South Carolina’s Budgeting for Results is the existence of a guber­ natorial appointed commission (Management Accountability and Performance Commission) comprised of “public and private sector individuals that looked at performance in different areas of government”. This commission generates reports and recommendations about state performance that may also be included in the budget. Iowa and Minnesota have very transparent budget systems, given each state’s attention to interaction with citizens regarding performance and budget making and monitoring. Re­ sults Iowa is the state’s performance measurement website where information is presented about state programs and activities, goal attainment, and details about both advancements and backsliding of operations. This website “is organized into five overarching areas the state is focusing on: New Economy, Education, Health, Safe Communities, and Environ­ ment. Within each of those areas, agencies have identified specific targets and measures. For each of those, there are three sections: “Measure”, “Why This Is Important”, and “What We’re Doing About This”. (All these targets are also searchable by department.) First intro­ duced in December 2003 and updated quarterly, Results Iowa offers a clear, concise, easily comprehensible way to view state performance”. Iowa also engages “charter agencies” that operate outside the usual appropriations pro­ cess. These agencies are exempted from many state bureaucratic rules and regulations in ex­ change for agency generation of certain negotiated program results. Essentially, the state is holding specified agencies accountable for results, not rules. Since the initial inception of charter agencies in Iowa (there are six agencies today), the state has continued to support flexibility of operations to these agencies. For example, in 2004, Iowa exempted charter agencies from the requirement of seeking Executive Council approval for out-of-state travel, attendance at conventions, and memberships in professional organizations; in 2005 agencies were exempted from across-the-board budget cuts through fiscal year 2006; and in 2006, charter agencies were exempted from Executive Council approval on leases and asset sales under $50,000. Minnesota’s performance oriented website, Department Results, is like Iowa’s in its comprehensiveness, and it mirrors Louisiana’s efforts by requiring at least twice yearly post­ ings of performance metrics by departments. The website explains goals, the importance of goals, strategies for reaching goals and measures of progress. Like Results Iowa, Minnesota provides ample contact information and the ability of citizens to interact with the state about not only the information presented, but about performance, meeting goals and what those goals should be. Each of the state systems highlighted above illustrate performance oriented budgeting practices that advance government budgeting transparency and accountability. These sys­ Performance informed budgeting in U.S. State governments 299 tems provide information that is open to scrutiny by numerous stakeholders. Requirements for measurement development, presentation, re-evaluation, explanation and reporting neces­ sitate attention by agency staff, budgeters, the chief executive and policy analysts, as well as legislative fiscal staff and sometimes the legislators themselves. In addition, citizens are of­ ten included in the loop, either through the provision of this information online, in paper re­ ports, or via participation in budgeting through service on commissions, boards or other ad­ visory mechanisms. Current performance based budgeting systems have extended the usefulness of measurement by requiring the quantification of program outputs and (admit­ tedly less frequently) longer term outcomes and results. GPP results indicate that “more and more states are now engaged in gathering and utilizing data to create useful performance in­ formation”. 5. Conclusions about PBB Usefulness to Governments The GPP findings square well with a decade’s worth of research conducted by Melkers and Willoughby (2004) and summarized in their report: Staying the Course: The Use of Per­ formance Measurement in State Governments. These authors acknowledge that performance informed budgeting systems are pervasive in state governments in the United States. All states today have some sort of PBB requirement, either legislatively imposed through law or mandated by the chief executive. And, these systems continue to evolve. As illustrated above with state leaders in budgeting for performance, systems often have been in place for several decades but continue to be tweaked - states add, drop or change requirements and processes in order to continue to advance the usefulness of performance information to the manage­ ment of and budgeting for public programs and services. Perhaps because of the continual evolution of PBB systems in the states, Melkers and Willoughby find that the most success­ ful and enduring PBB efforts are neither comprehensive nor comprehensively applied. Often measurement of program performance and results occurs on a rotating basis or using a lim­ ited number of measures. In any case, it is critical to the success of these systems that pro­ cesses advance incrementally and that agencies are allowed, even encouraged, to tweak the system along the way. While the benefits of using PBB are more directly attributable to management practice than budgetary outcomes, advancements realized in communication among state govern­ ment budgeting decision makers are worth noting. Research acknowledges that different stakeholders within and outside of government hold different interpretations of budgetary terms, starting points, goals and results expected. Yet, performance information and its re­ porting can provide these same stakeholders with common ground when deliberating about the conduct and cost of government operations. This supports improved accountability. And clear and timely communication about government performance with citizens heightens transparency. PBB efforts in the states to date have excelled in advancing communication and understanding about measurement and performance of government operations; thereby supporting more focused conversation about program efficiency and effectiveness. 300 Juan Luis Gómez y Katherine G. Willoughby There are some enduring problems with the applicability of PBB by governments, how­ ever. Having appropriate measures of program outcomes without appropriate measures of inputs can “deep six” a PBB system. This attests to the need for full cost accounting of in­ puts. State governments are all over the map when it comes to generating and using cost data - some states indicate healthy use of such data by both the executive and legislative branches of government. Some states require that 100 percent of state agencies allocate indirect costs; other states indicate very minimal use of cost data and have no requirements for the alloca­ tion of indirect costs except that required to meet federal funding requirements. Related to the problems with generating good cost data is the difficulty in measuring results and making sure that measures are reliable and valid. Essentially, measurement must always be ques­ tioned, reported and evaluated. Melkers and Willoughby (2004) also find that the use of performance measures for benchmarking among state PBB systems “is still in its infancy”. Probably the most difficult component of a performance based initiative is the determination of targets or goals with which program performance can be compared. Setting targets too low may suppress agency performance; unrealistically high targets can be demoralizing and/or can paint a false picture of poor performance and inefficient operations. Also, governments in the United States re­ quire agreement on targets and this can be as problematic as setting the benchmarks them­ selves. Ambiguous legislation that creates programs versus the specificity required to man­ age/conduct programs are reasons for strong and sustained leadership, communication and a strategic plan that has support from both branches of government. The development, evalua­ tion, reassessment and agreement about program targets must be nurtured for PBB to be suc­ cessful. Finally, Melkers and Willoughby (2004) find and the GPP acknowledges as well, that the legislative branch of government lags the executive branch in its use of performance in­ formation when making budget decisions. Most state agency staff and program managers are comfortable with performance measurement information, given years of development and reporting requirements and by virtue of their role in the production of government services and activities. On the other hand, legislators remain tied to constituency needs and demands; in any given year caught up in “hot potato” issues that may or may not comprise a significant portion of the government’s budget. State legislatures have also been slower to professional­ ize fiscal staff and budget making protocols and processes internally that would support the examination and use of performance information by members when making decisions about appropriations. The GPP finds that “legislators who pay attention to performance informa­ tion are more the exception than the rule”. One problem is that legislators are operating on chronic information overload. For example, a public sector consultant in Michigan told the story of visiting a state representative who showed the consultant “two large crates sitting at his front door. It was the lawmaker’s mail, legislative analyses and bill drafts for the day. It made [the consultant] wonder how any lawmaker can digest it all”. So, while performance information may be required to be developed and reported by law or mandate, and may be used well by the executive branch, both for management purposes as well as when develop­ ing the budget, such information may be ignored or misinterpreted when it crosses the street to the legislature. Performance informed budgeting in U.S. State governments 301 Ultimately, using performance information for budgeting is a difficult task that requires comparisons across a variety of programs that may not seem or be comparable. How does one compare public programs regarding education and health with defense? How can and should good performance be rewarded? Should poor performance be punished with reduced budgets? How much time should agencies have to realize targeted results? These are ques­ tions that need to be addressed by two branches of government that must first agree on a pro­ cess for the development and consideration of the performance information. As has been shown here, much progress has been made in the American governments toward this end. Most importantly, perhaps, these governments are comfortable with systems that are not comprehensive, not perfect, ever changing, yet demanding of action. Each state leader noted here characterizes modern PBB efforts at their best - those that require consistent attention to the results of government operations by stakeholders both internal and external to govern­ ment. Note 1. All references to GPP 2005 results and quotes in this manuscript are available by going online to <www.gpponline.org> and accessing the «Information» tab. Information about specific states mentioned here can be accessed by tapping onto individual states from the map of the United States provided on the GPP ho­ mepage. Bibliography Altmayer, C. (2006): “Moving to Performance-Based Budgeting”, Government Finance Review, June, vol. 22, núm. 3, pp. 8-14. Behn, R. D. (2003): “Why Measure Performance? Different Purposes Require Different Measures”, Public Administration Review, vol.63, núm. 5, pp. 586-606. Berman, E. and Wang, X. (2000): “Performance Measurement in U.S. Counties: Capacity for Reform”, Public Administration Review, vol. 60, núm. 5, pp. 409-420. Bourdeaux, C. (2006): “Do Legislatures matter in Budgetary Reform?”, Public Budgeting and Fi­ nance, vol. 26, núm. 1, pp. 120-142. Broom, C.A. and McGuire, L. A. (1995): “Performance-Based Government Models: Building a Track Record”, Public Budgeting and Finance, vol. 15, núm. 4, pp. 3-17. Connelly, M. and Tompkins (1989): “Does Performance Matter? A Study of State Budgeting”, 295-296; U.S. General Accounting Office, Performance Budgeting State Experiences and Implica­ tions for the Federal Government. GAO/AFMD-93-41. G.A.O. (U.S. General Accounting Office) (1997): “Performance Budgeting: Past Initiatives Offer In­ sights for GPRA Implementation”, Report to Congressional Committees. GAO/AIMD-97-46. Government Performance Project (2005): “Grading the States”, online at: www.gpponline.org 302 Juan Luis Gómez y Katherine G. Willoughby Grizzle, G.A. and Pettijohn, C.D. (2002): “Implementing Performance-Based Budgeting: A Sys­ tem-Dynamics Perspective”, Public Administration Review, vol. 62, núm. 1, pp. 51-62. Jordan, M.M. and Hackbart, M.M. (1999): “Performance Budgeting and Performance Funding in the States: A Status Assessment”, Public Budgeting and Finance, vol. 19, núm. 1, pp. 68-88. Joyce, P. G. (2003): Linking Performance and Budgeting: Opportunities in the Federal Budget Process. Washington, D.C. IBM Center for the Business of Government, October. Joyce, P. and Tompkins, S. (2002): “Using performance information for budgeting: Clarifying the framework and investigating recent state experience”, In Meeting the challenges of perfor­ mance-oriented government, ed. Kathryn Newcomer, Cheryl Broom Jennings, and Allen Lomax, 61-96. Washington DC: American Society for Public Administration. Lee, R.D. (1997): “A Quarter Century of State Budgeting Practices”, Public Administration Review, vol. 57, núm. 2, pp. 133-140. Lee, R.D. and Burns, R.C. (2000): “Performance Measurement in State Budgeting: Advancement and Backsliding from 1990 to 1995”, Public Budgeting and Finance, vol. 20, núm. 1, pp. 38-54. Long, E. and Franklin, A. (2004): “The Paradox of Implementing the Government Performance and Results Act: Top-Down Direction for Bottom-Up Implementation”, Public Administration Review, vol. 64, núm. 3, pp. 309-319. Lu, Y. (2007): “Performance Budgeting: The Perspective of State Agencies”, Public Budgeting and Fi­ nance, vol. 27, núm. 4, pp. 1-17. Melkers, J. (2006): “On the Road to Improved Performance”, Public Performance and Management Review, vol. 30, núm.1, pp. 73-95. Melkers, J. and Willoughby, K. (1998): “The State of the States: Performance-Based Budgeting Re­ quirements in 47 out of 50”, Public Administration Review, vol. 58, núm.1, pp. 66-73. Melkers, J. and Willoughby, K. (2001): “Budgeters’ Views of State Performance-Budgeting Systems: Distinctions across Branches”, Public Administration Review. vol. 61, núm. 1, pp. 54-64. Melkers, J. and Willoughby, K. (2004): Staying the Course: The Use of Performance Measurement in State Governments. Washington, D.C. IBM Center for the Business of Government, November. Melkers, J. and Willoughby, K. (2005): “Models of Performance-Measurement Use in Local Govern­ ments: Understanding Budgeting, Communication, and Lasting Effects”, Public Administration Re­ view, vol. 65, núm. 2, pp. 180-190. Moynihan, D. P. (2005): “Why and How Do State Governments Adopt and Implement ‘Managing for Results’ Reforms?”, Journal of Public Administration Research and Theory, vol. 15, núm. 2, pp. 219-243. Mullen, P.R. (2006): “Performance-Based Budgeting: The Contribution of the Program Assessment Rating Tool”, Public Budgeting and Finance, vol. 26, núm. 4, pp. 79-89. Poister, T.H. and Streib, G. (1999): “Performance Assessment in Municipal Government”, Public Ad­ ministration Review, vol. 59, núm. 4, pp. 325-335. Poister, T. H. and Streib, G. (2005): “Elements of Strategic Planning and Management in Municipal Government: Status after Two Decades”, Public Administration Review, vol. 65, núm. 1, pp. 45-56. Performance informed budgeting in U.S. State governments 303 Riverbank, W. C. and Kelly, J. M. (2006): “Performance Budgeting in the Municipal Government”, Public Performance and Management Review, vol. 30, núm. 1, pp. 35-46. Schick, A. (1971): “From Analysis to Evaluation”, The ANNALS of the American Academy of Political and Social Science, vol. 394, núm. 1, pp. 57-71 Swiss, J. (2005): “A Framework for Assessing Incentives in Results-Based Management”, Public Ad­ ministration Review, vol. 65, núm 5, pp. 592-602. Thurmaier, K. and Willoughby, K. (2001): Policy and Politics in State Budgeting. New York. M.E. Sharpe. U.S. Bureau of Census (2007): Statistical Abstract “Table 419. Real Government Consumption Expen­ ditures and Gross Investment in Current and Real (2000) Dollars by Level of Government and Type: 2000 to 2005”, p. 266. Accessed on December 10, 2007 from: http://www.census.gov/prod/ 2006pubs/07statab/stlocgov.pdf. Wang, X. (2000): “Performance Measurement in Budgeting: A Study of County Governments”, Public Budgeting and Finance, vol. 20, núm. 3, pp. 102-118. Willoughby, K.G. (2004): “Performance Measurement and Budget Balancing: State Government Per­ spective”, Public Budgeting and Finance, vol. 24, núm. 2, pp. 21-39. Willoughby, K. and Melkers, J. (2000): “Implementing PBB: Conflicting Views of Success”. Public Budgeting and Finance, vol. 20, núm. 1, pp. 105-120.