Theory of Interest and Life Contingencies, with Pension Applications A Problem-solving Approach by Michael M. Parmenter (z-lib.org)

Anuncio

ISBN 1-56698-333-9

P heory of Interest and

Life

Contingencies,

with Pension Applications:

A Problem-Solving Approach

Third Edition

\

Michael M.Parnnenter

Digitized by the Internet Archive

in

2012

http://archive.org/details/theoryofinterestOOparni

THEORY OF INTEREST

AND LIFE CONTINGENCIES

WITH PENSION APPLICATIONS

A Problem-Solving Approach

Third Edition

Michael M. Parmenter

ASA, Ph.D.

ACTEX

Publications

Winsted, Connecticut

To my Mother and

the

memory of my

Father

Copyright© 1988, 1999

by ACTEX Publications

No

portion of this

means without

book may be reproduced

in

any form or by any

the prior written permission of the copyright owner.

Requests for permission should be addressed to

ACTEX Publications

P.O.

Box 974

CT 06098

Winsted,

Manufactured

in the

United States of America

1098765432

Cover design by

MUF

Library of Congress Cataloging-in-Publication Data

Parmenter, Michael

M.

Theory of interest and

life

contingencies, with pension

applications: a problem-solving approach

/

Michael M. Parmenter.

cm.

p.

Includes index.

ISBN 1-56698-333-9

1.

2.

Insurance, Life~Mathematics~Problems, exercises, etc.

Interest-Problems, exercises,

exercises, etc.

HG8781.P29

I.

ets.

3.

Annuities-Problems,

Title

1999

368.2'2'011076-dc 19

ISBN: 1-56698-333-9

88-38947

TABLE OF CONTENTS

CHAPTER ONE

THEORY

INTEREST: THE BASIC

1.1

Accumulation Function

1

.2

Simple Interest

1

.3

Compound

1

.4

Present Value and Discount

4

6

Interest

1.5

Nominal Rate of Interest

1.6

Force of Interest

Exercises

1

1

9

13

16

22

CHAPTER TWO

INTEREST: BASIC APPLICATIONS 29

2.1

Equation of Value

2.2

Unknown Rate of Interest

2.3

Time-Weighted Rate of Return

Exercises

29

33

34

36

CHAPTER THREE

ANNUITIES

41

3.1

Arithmetic and Geometric Sequences

3.2

Basic Results

3.3

Perpetuities

3.4

Unknown Time and Unknown Rate of Interest

3.5

Continuous Annuities

3.6

Varying Annuities

Exercises

41

44

52

66

58

57

53

Table of Contents

iv

CHAPTER FOUR

AMORTIZATION AND SINKING FUNDS

4.1

Amortization

4.2

Amortization Schedules

4.3

Sinking Funds

4.4

Yield Rates

75

75

77

81

83

Exercises 85

CHAPTER FIVE

BONDS

93

Bond 93

5.1

Price of a

5.2

5.3

Book Value 96

Bond Amortization Schedules 98

5.4

Other Topics

Exercises

101

105

CHAPTER SIX

PREPARA TION FOR LIFE CONTINGENCIES

6.1

6.2

Probability and Expectation

6.3

Contingent Payments

Exercises

1 1

113

Introduction

1

14

119

123

CHAPTER SEVEN

LIFE TABLES AND POPULATION PROBLEMS 127

127

7.1

Introduction

7.2

Life Tables

7.3

7.4

Analytic Formulae for ^x 133

The Stationary Population 137

7.5

Expectation of Life

7.6

Multiple Decrements

Exercises

128

141

143

148

CHAPTER EIGHT

LIFE ANNUITIES

155

8.1

Basic Concepts

8.2

Commutation Functions

8.3

Annuities Payable m^^^y

8.4

Varying Life Annuities 173

Annual Premiums and Reserves

8.5

Exercises

1

8

155

161

1

66

178

Table of Contents

CHAPTER NEVE

LIFE INSURANCE 189

9.1

Basic Concepts

9.2

Commutation Functions and Basic

9.3

Insurance Payable at the

9.4

Varying Insurance

9.5

Annual Premiums and Reserves

Exercises 210

189

199

202

CHAPTER TEN

STATISTICAL CONSIDERATIONS 223

10.1

Mean Variance 223

10.2

Normal

10.3

Central Limit

10.4

Loss-at-Issue 235

Distribution

230

Theorem 233

Exercises 239

CHAPTER ELEVEN

MULTI-LIFE THEORY 243

11.1

Joint-Life Actuarial Functions 243

.2

Last-Survivor Problems

25

11.3

Reversionary Annuities

254

1 1

Exercises 256

CHAPTER TWELVE

PENSION APPLICATIONS

Exercises

263

269

ANSWERS TO THE EXERCISES

INDEX

297

Identities

Moment of Death

21

192

196

PREFACE

It is

in

impossible to escape the practical implications of compound interest

our

modem

The consumer

society.

is

faced with a bewildering choice

interest, and wishes to choose

on her savings. A home-buyer is

offered various mortgage plans by different companies, and wishes to

An investor seeks to

choose the one most advantageous to him.

purchase a bond which pays coupons on a regular basis and is

redeemable at some future date; again, there are a wide variety of

of bank accounts offering various rates of

the one

which

will give the best return

choices available.

Comparing possibilities becomes even more difficult when the

payments involved are dependent on the individual's survival. For

example, an employee is offered a variety of different pension plans and

must decide which one to choose. Also, most people purchase life

insurance at

some point

in their lives,

and a bewildering number of

different plans are offered.

The informed consumer must be able

in situations like

whenever

make an

those described above. In addition,

possible, she be able to

make

intelligent choice

it is

important

of mortgage payments

will, in fact,

that,

the appropriate calculations

For example, she should understand

herself in such cases.

series

to

why

a given

pay off a certain loan over a

certain period of time.

She should also be able to decide which portion

of a given payment

paying off the balance of the loan, and which

portion

is

simply paying interest on the outstanding loan balance.

is

The

first

goal of this text

is

to give the reader

enough information

make an intelligent choice between options in a financial

and can verify that bank balances, loan payments, bond

so that he can

situation,

coupons,

how

etc. are correct.

Too few people

in today's society

understand

these calculations are carried out.

In addition,

however,

we

are concerned that the student, besides

why they work. It

how to apply it; you

being able to carry out these calculations, understands

is

not enough to memorize a formula and learn

should understand

why

the formula

is

correct.

We

also wish to present

Preface

viii

the material in a proper mathematical setting, so the student will see

the theory of interest

Let

appears

me

is

explain

in the title

of

why

the phrase "Problem-Solving

We

this text.

will prove a very small

formulae can be applied to a wide variety of problems.

needed to take the data presented

many

it

texts,

large

these

Skill will

a particular problem and see

in

so the formulae can be used.

where a

Approach"

number of

how

formulae and then concentrate our attention on showing

rearrange

how

interrelated with other branches of mathematics.

how

be

to

This approach differs from

number of formulae

and the

are presented,

student tries to memorize which problems can be solved by direct

of

application

a

particular

We

formula.

wish

emphasize

to

understanding, not rote memorization.

A

working knowledge of elementary calculus is essential for a

all the material. However, a large portion of

this book can be read by those without such a background by omitting

the sections dependent on calculus. Other required background material

such as geometric sequences, probability and expectation, is reviewed

thorough understanding of

when

it is

required.

Each chapter

exercises.

It

should be obvious that

to learn the material

number of examples and

in this text includes a large

is

for her to

Finally, let us stress that

the most

work

it

calculator (with a y^ button) and

is

all

way

for a student

the exercises.

assumed

knows how

our ability to use a calculator that

efficient

that every student has a

to use

it.

It is

because of

many formulae mentioned

in older

on the subject are now unnecessary.

This book is naturally divided into two parts. Chapters 1-5 are

concerned solely with the Theory of Interest, and Life Contingencies is

texts

introduced in Chapters 6-11.

In

Chapter

1

we

present the basic theory concerning the study of

is to give a mathematical background for this

and to develop the basic formulae which will be needed in the rest

of the book. Students with a weak calculus background may wish to

omit Section 1 .6 on the force of interest, as it is of more theoretical than

practical importance. In Chapter 2 we show how the theory in Chapter 1

can be applied to practical problems. The important concept of equation

interest.

Our goal here

area,

of value

is

introduced,

problems are presented.

concept of annuities.

emphasis

in this

and many worked examples of numerical

Chapter 3 discusses the extremely important

After developing a few basic formulae, our main

chapter

is

on practical problems, seeing

such problems can be substituted

in the basic

formulae.

how

It

data for

is

in this

Preface

ix

we have

section especially that

left

out

many of the formulae

presented

in other texts, preferring to concentrate on problem-solving techniques

rather than

rote memorization.

applications

of

material

the

Chapters 4 and 5 deal with further

in

Chapters

through

1

namely

3,

amortization, sinking funds and bonds.

Chapter 6 begins with a review of the important concepts of

probability and expectation, and then illustrates

combined with the theory of

tables, discussing

Chapter 8

how

interest.

life

how

probability can be

Chapter 7

they are constructed and

concerned with

is

In

how

annuities, that

we

introduce

life

they can be applied.

is

annuities

whose

payment are conditional on survival, and Chapter 9 discusses life

insurance. These ideas are generalized to multi-life situations in Chapter

10.

Finally, Chapter

1 1

demonstrates

how many of these

concepts are

applied in the extremely important area of pension plans.

Chapters

1

through 6 have been used for several years as the text

material for a one semester undergraduate course in the Theory of

Interest,

and

I

would

in earlier drafts.

Wanda Heath

who

thank those students

I

am

pointed out errors

deeply indebted to Brenda Crewe and

job of typing the manuscript, and to my

Narayanaswami, for his invaluable technical

for an excellent

Dr.

colleague.

like to

In addition,

P. P.

assistance.

Chuck Vinsonhaler, University of Connecticut, was

supportive of this project, and introduced

Publications, for

which

I

owe him

me

to the people at

strongly

ACTEX

Dick London did the

a great deal.

technical content editing, Marilyn Baleshiski provided the electronic

typesetting,

like

to

and Marlene Lundbeck designed the

thank them for taking such care

manuscript into what

I

hope

is

in

text's cover.

I

would

turning a very rough

a reasonably comprehensive yet friendly

and readable text book for actuarial students.

St.

John's,

Newfoundland

December, 1988

Michael M. Parmenter

PREFACE TO THE

REVISED EDITION

months since the original edition of this text was published,

number of comments have been received from teachers and students

In the fifteen

a

regarding that edition.

We

most of the comments have been quite

and we are making no substantial modifica-

are pleased to note that

complimentary to the

text,

tions at this time.

A

edition

given

significant,

is

in

rectified

that time

and thoroughly

justified, criticism

diagrams were not used to

of the original

illustrate the

examples

the second half of the text, and that deficiency has been

by the inclusion of thirty-five additional figures

in the

Revised

Edition.

Thus

it

is

fair to

say that there are no

new

topics contained in the

Revised Edition, but rather that the pedagogy has been strengthened.

For

this

reason

we

prefer to call the

new

printing a Revised Edition,

Second Edition.

In addition we have corrected the errata in the original edition.

would like to thank all those who took the time to bring the various

rather than a

We

errata to our attention.

February, 1990

M.M.P.

PREFACE TO THE

THIRD EDITION

It

now more

is

textbook.

than ten years since the original publication of this

In that time,

several very significant developments have

occurred to suggest that a

new

edition of the text

is

now

needed, and

those developments are reflected in the modifications and additions

made

in this

Third Edition.

First,

improvements

calculator

in

approaches to reach numerical

now

technology

In particular,

results.

us

give

many

better

calculators

include iteration algorithms to permit direct calculation of unknown

annuity interest rates and bond yield rates.

Accordingly, the older

approximate methods using interpolation have been deleted from the

text.

Second, with the discontinued publication of the classic textbook

Life Contingencies by C.W. Jordan, our text has become the only one

published in North America which provides the traditional presentation

of contingency theory. To serve the needs of those

traditional approach, including the use

deterministic

life

table model,

who

still

prefer this

of commutation functions and a

we have chosen

to include various topics

contained in Jordan's text but not contained in our earlier editions.

These include insurances payable

life

contingent

accumulation

at the

moment of death

functions

uniform seniority concept for use with

(Section

8.2),

(Section 9.3),

the

table

of

Makeham and Gompertz annuity

values (Section 11.1), simple contingent insurance functions (Section

11.1),

and an expansion of the material regarding multiple-decrement

theory (Section 7.6).

Third, actuaries today are interested in various concepts of finance

beyond those included

introduced

the

ideas

in traditional interest theory.

of real

modified duration, and so on,

rates

in this

of return,

Third Edition.

To

that

end

we have

investment duration,

Preface

12

new

edition provides a gentle introduction to the more

view

of contingency theory, in the completely new

modem stochastic

Chapter 10, to supplement the traditional presentation.

In connection with the expansion of topics, the new edition

Fourth, the

As

contains over forty additional exercises and examples.

numerical answers to the exercises have been

errata in the previous edition

thank everyone

who

made more

have been corrected.

We

well, the

precise and the

would

like to

brought such errata to our attention.

With the considerable modifications made in the new edition, we

is now appropriate for two major audiences: pension

actuaries, who wish to understand the use of commutation functions and

deterministic contingency theory in pension mathematics, and university

believe this text

students,

who

seek to understand basic contingency theory at an intro-

ductory level before undertaking a study of the more mathematically

sophisticated stochastic contingency theory.

As with

the original edition of this text, the staff at

Publications has been invaluable in the development of this

Specifically

I

would

like

to

new

ACTEX

edition.

thank Denise Rosengrant for her text

composition and typesetting work, and Dick London, FSA, for his

technical content editing.

February, 1999

M.M.P

CHAPTER ONE

INTEREST: THE BASIC THEORY

ACCUMULATION FUNCTION

1.1

The simplest of all financial transactions is one in which an amount of

money is invested for a period of time. The amount of money initially

invested is called the principal and the amount it has grow^n to after the

time period

This

accumulated value

is

called the

is

a situation which can easily be described by functional

at that time.

which the principal has been

invested, then the amount of money at that time will be denoted by A{t).

This is called the amount function.

For the moment we will only

consider values ^ > 0, and we will assume that / is measured in years.

We remark that the initial value ^(0) is just the principal itself.

In order to compare various possible amount functions, it is

convenient mathematically to define the accumulation function from the

notation.

If

the length of time for

is

/

amount function

as a{t)

=

^rj^

just a constant multiple of a(t)

is

We

.

,

note that a{0)

namely A(t)

=

k

•

=

1

a{t)

and that A(t)

where k

is

= A{0)

the principal.

What

any function

functions are possible accumulation functions?

a(t)

=

which money

we would

increasing. Should a(t) be continuous? That depends

if a(t) represents the amount owing on a loan t years

with a{0)

1

could represent the

accumulates with the passage of time.

hope

that a(t)

on the

after

is

situation;

it

way

In theory,

has been taken out, then a(t)

in

Certainly, however,

may

be continuous

continues to accumulate for non-integer values of

t.

if interest

However,

if a{t)

amount of money in your bank account t years after the

deposit (assuming no deposits or withdrawals in the meantime),

represents the

initial

jump

The graph of such an a{t)

We will normally assume in this text that a{t) is

make allowances for other situations when they

then a{t) will stay constant for periods of time, but will take a

whenever

interest

is

paid into the account.

will be a step function.

continuous;

turn up.

it

is

easy to

Chapter

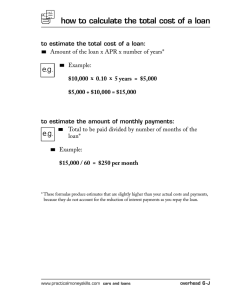

In Figure

1

.

1

we have drawn

accumulation functions which occur

1

graphs of three different types of

in practice:

a{t)

a{t)

a{t)

(0,1)

(0,1)

(0,1)

(b)

{a)

(c)

FIGURE

Graph

of

where the amount of

(a) represents the case

constant over each year.

interest

earned

On

we would hope

earned also increases;

where

to be in a situation

earned

is

amount

This makes more

increasing as the years go on.

is

interest

the other hand, in cases like (b), the

sense in most situations, since

larger, the interest

1.1

in

that as the principal gets

other words,

"interest earns interest".

we would like

many

There are

which look roughly like the graph in

the one which will be of greatest interest

different accumulation functions

(b),

but the exponential curve

is

to us.

We

interest

money

is

is

remarked

withdrawn between these time periods.

interest paid

the

same

earlier that a situation like (c)

If the

is

height.

However,

all

amount of interest increases

then we would expect the steps

if

paid

the

be of

as the

to get

and larger as time goes on.

have used the term interest several times now, so perhaps

We

time to define

if

amount of

constant per time period, then the "steps" will

is

accumulated value increases,

larger

can arise whenever

paid out at fixed periods of time, but no interest

it is

it!

Interest

This definition

is

= Accumulated

Value

not very helpful

—

Principal

in practical situations,

since

we

are generally interested in comparing different financial situations to

most profitable. What we require is a standardized

and we do this by defining the effective rate of

interest i (per year) to be the interest earned on a principal of amount 1

over a period of one year. That is,

determine which

measure for

is

interest,

i

=

a{\)-\.

(1.1)

The Basic Theory

Interest:

We

a{t), if

3

can easily calculate

we

recall that A(t)

=

using the amount function A{t) instead of

/

k

Thus

a(t).

Verbally, the effective rate of interest per year

earned

interest

one year divided by the principal

in

the year.

There

definition.

We

is

the

at the

amount of

beginning of

nothing sacred about the term "year" in this

is

can calculate an effective rate of interest over any time

period by simply taking the numerator of the above fraction as being the

earned over that period.

interest

More

we

generally,

define the effective rate of interest in the n^^

year by

- a{n-\)

a{n-\)

_ A{n)-A{n-\) _

~

A{n-\)

a{n)

^"~

Note

that

i\,

calculated by (1.3),

is

same

the

as

/

,,

^.

^^'^^

'

defined by either (1.1)

or (1.2).

Example

1.1

Consider the function

a{t)

=

(a)

Verify that

(b)

Show that a(t)

(c)

Is

(d)

Find the effective

(e)

Find

a{t)

(3(0)

is

=

/^

+ +

r

1.

1.

increasing for

all

/

>

0.

continuous?

rate

of interest

+

=

/

for a{t).

/„.

[Solution]

(a)

(b)

(c)

a(0)

-

(0)2 -f (0)

1

1.

Note that a'(/) = 2t-\-\ > for alU > 0, so a{t) is increasing.

The easiest way to solve this is to observe that the graph of a{t)

a parabola, and hence a{t)

is

that all polynomial functions are continuous).

(d)

i

.

= a{\)- 1=3-1=2.

^ a{n)-a{n-\) ^ n" ^

a{n-\)

«^

-

/7

+

1

is

continuous (or recall from calculus

n

+

-[{n-\f + {n-\)

(n-\f + (n-\)-\-\

\

-^ \}

Chapter

SIMPLE INTEREST

1.2

There are two special cases of the accumulation function

will

1

examine

The

closely.

sionally, primarily

first

of these, simple

between integer

second of these, compound

interest,

it

by

is

accumulation function and will be discussed

mind

some

that in both

of these cases

interest, is

interest periods, but will

mainly for historical purposes and because

is

a{t) that

used occa-

be discussed

easy to describe.

the

far

in the

a{t) is continuous,

we

The

most important

next section.

Keep

in

and also that there are

where modifications must be made.

Simple interest is the case where the graph oi a(t) is a straight line.

Since a(0) =1, the equation must therefore be of the general form

However, the effective rate of interest / is

a{t) = \ -\- bt for some b.

practical settings

given by

i

—

a{\)

—

1

=

Z?,

so the formula

•^f)=rt-f/r,

is

r>0.

(1.4)

\-\-it

(0,1)

[FIGURE

1.21

case (a) graphed in Figure

1.1.

Remarks

1.

This

is

of interest earned each year

is

In this situation, the

constant.

original principal earns interest

amount

In other words, only the

from year to year, and

interest

accumulated in any given year does not earn interest in future

years.

2.

The formula

^(0)

=

a(0)

equal to

k,

=

a{t)

=

the

1

.

\

+

it

More

amount

at

applies to the case

where the principal

generally, if the principal at time

time

/

will be A(t)

:=z

k(\

-\- it).

is

is

Interest:

The Basic Theory

We

rate

noted above that the "/"

of interest for this

+

\

in

=

in a{t)

\

-\-

-

+

\\

also the effective

it is

function. Note however

that

i{n-\)\

\+i(ri-\)

+

Observe

that

not constant.

is

z„

(1.5)

/(«-l)

In fact,

decreases as n gets

/„

which should not surprise us. If the amount of

accumulated value increases, then

clearly the effective rate of interest is going down.

Clearly a{t) — 1 + /Y is a formula which works equally well for all

values of r, integral or otherwise. However, problems can develop

in practice, as illustrated by the following example.

larger, a fact

interest stays constant as the

Example

1.2

Assume Jack borrows 1000 from

15%

the bank on January

How much

simple interest per year.

does he

1996

1,

at

a rate of

owe on January

17,

1996?

Solution

The general formula

A{t)

=

amount owing

for the

1000(1 +.15/), but the problem

should be substituted into this formula.

is

An

at

time

general

in

t

is

what value of

to decide

obvious approach

is

t

to take

number of days which have passed since the loan was taken out and

number of days in the year, but should we count the

number of days as 16 or 17? Getting really picky, should we worry

about the time of day when the loan was taken out, or the time of day

the

divide by the

when we wish

to find the value

of the loan? Obviously, any value of/

only a convenient approximation; the important thing

consistent rule to be used in practice.

(a)

The

first

method

is

first.

owes 1000

+

In our case this

<")(3i)l

it is

it

we

use

,,

^.

(^•^)

•

365

is

have a

common:

number of days

counting the number of days

but not the

are

to

called exact simple interest, and with

t=

When

Two techniques

is

usual to count the last day,

would lead

1006.58.

Xo

t

=

^^P^ so Jack

Chapter

(b)

The second method is

Banker 's Rule), and with

1

called ordinary simple interest (or the

it

we

use

number of days

(1.7)

360

The same procedure

used for calculating the number of

= J^

360

/

1+(.15)(3^) -

1000

practice in

ordinary simple interest

is

we would have

days. In our case,

The common

as above

Canada

is

used

is

so the debt

is

1006.67.

to use exact simple interest,

in the

United States and

whereas

in international

D

markets.

1.3

COMPOUND INTEREST

The most important special case of the accumulation function a{t) is the

case of compound interest. Intuitively speaking, this is the situation

where money earns interest at a fixed effective rate; in this setting, the

one year earns interest itself in future years.

If / is the effective rate of interest, we know that a( 1 ) = 1 + /, so 1

becomes 1 + / after the first year. What happens in the second year?

Consider the 1 -h /as consisting of two parts, the initial principal 1 and

interest

earned

the interest

/

in

earned

in the first year.

The

the second year and will accumulate to

earn interest in the second year and will

amount

after

reasoning,

two years

we

is

1

principal

+

1

grow

+ + /(H- /) =

/

see that the formula for a(t)

«(/)

=

will earn interest in

+

+

z)^.

interest

will also

/)•

Hence the

By

continuing this

(l+/y. ^>o.

(h 1+0

[FIGURE

/

total

is

a(t)

(0,1)

to /(I

(1

1

The

/.

L3I

= (\+iy

(1.8)

The Basic Theory

Interest:

Remarks

1.

This

is

graph

2.

an example of the type of function shown

in

The formula

is

=

A{{))

equal to

3.

Figure

k,

Observe

More

a{t)

=

a{0)

the

=

(1 -f ij applies to the

More

1.

amount

time

at

case where the principal

generally, if the principal at time

t

will be A(t)

that the "/" in (1 -f ty

is

case

in this

same

the

is

/„

shouldn't be surprised, since this

pound

=

k(\

+

is

iy.

the effective rate of interest.

substituted into a(t)

it

was

fifty

—

(1

-\-

ty

.

we

years ago;

t,

We

for all positive integers n.

fits

with our idea

of interest

interest, the effective rate

Mathematically, any value of

than

of the

generally,

Hence,

4.

in part (b)

1.1.

is

constant.

whether integral or

This

is

com-

that, in

can be

not,

an easier task for us today

just have to press the appropriate

buttons on our calculators! Again, there are problems determining

what value of t should be used, but we can deal with them as we

did in the last section.

In practical situations,

sometimes used

however, a very different solution

case of compound interest. To find the

example) when Ms a fraction, first find the

integral values of / immediately before and

in the

amount of a loan

amounts for the

(for

immediately after the fractional value

interpolation

is

in question.

between the two computed amounts

Then use

linear

to calculate the

required answer.

This

is

equivalent to saying that

for integral values

values.

of r, and simple

In Figure

1.4,

whereas the dotted

interpolation

is

compound

interest

is

interest

the solid line represents a{t)

lines

indicate

used.

a{t)

FIGURE

1.4

the

is

used

used between integral

graph of

—

a{t)

{\

if

+

//,

linear

Chapter

As we

common

will see later, this

procedure benefits the lender

a financial transaction, and (consequently)

if

is

1

in

detrimental to the borrower

she has to repay the loan at a duration between integral values.

Example

1.3

Jack borrows 1000

15% compound

at

interest.

How much does he owe after 2 years?

How much does he owe after 57

(a)

(b)

between

interest

How much

(c)

How much

(d)

In

assuming compound

after

year and 57 days, under the same

1

in part (b)?

does he owe after

between

interpolation

(e)

owe

does he

assumption as

days,

integral durations?

how many years

1

year and 57 days, assuming linear

integral durations?

have accumulated to 2000?

will his principal

[Solution]

(a)

1000(1.15)2

(b)

The most

=

suitable value for

1000(1. 15)fi

1000(1. 15)^S

(c)

We

(d)

S7

/ is

^rzrc,

values

which

^

=

1000(1.15)2

is

1322.50.

^(2)— ^4(1)=

will

and the accumulated value

is

= 1022.07.

= 1175.38

=

must interpolate between ^(1)

A{2)=

f

1322.50.

accumulate

j(172.50)

=

172.50.

=

1150.00 and

57 days, assuming simple

in

26.94.

(1000)(1.15)

The difference between these

The portion of this difference

Thus the accumulated value

interest,

after

1

is

year

Observe that the

and 57 days is 1150.00 + 26.94= 1176.94.

borrower owes more money in this case than he does in part (c).

We

(e)

seek

/

such that 1000(1.15)^

=

2000, or that (1.15)^

=

2.

Using logs we obtain

'

To

close this section,

=

we

I^U3

will

=

D

'^9595 years.

compare simple

interest

and compound

graphs for

which gives the better return.

both simple interest and compound interest are drawn on the same set of

interest to see

axes.

In Figure 1.5,

The Basic Theory

Interest:

FIGURE

We know

1.5

+ ij is always concave

+ iy[ln{\ + /)]^, which is greater

that the exponential function (1

up (because the second derivative

than zero), whereas

+

1

// is

is (1

a straight line.

These

facts tell us that the

only points of intersection of these graphs are the obvious ones, namely

(0,1)

and

(1,

+

1

They

/).

also give us the

(l+/y<l+/Y,

two important

for

relationships

0</<l

(1.10)

/>1.

(1.11)

and

+ /y>l+//,

(l

Hence we conclude

first

that

compound

interest yields a higher return than

whereas simple interest yields more if

of these statements does not surprise us, since for

simple interest

The

>

for

if /

1,

r

< r < 1.

> 1, we

have interest as well as principal earning interest in the (1 + ij case.

The second statement reminds us that, for periods of less than a year,

simple interest is more beneficial to the lender than compound interest, a

fact

which was

1.4

illustrated in

Example

PRESENT VALUE AND DISCOUNT

In Section

1

.

1

we

defined accumulated value at time

the principal accumulates to over

value

1.3.

t

/

years.

years in the past as the amount of

the principal over

of that which

/

we have been

PRESENT

VALUE

money

In other words, this

years.

t

We now

as the

amount

that will accumulate to

is

the reverse procedure

discussing up to now.

ACCUMULATED

VALUE

PRINCIPAL

[FIGURE

1.6]

that

define the present

Chapter

10

For example,

much money

+

1

/

Ho\f

over one

over a single year.

needed, at the present time, to accumulate to

1

We will denote this amount by v| and, recalling that v accumulates

Therefore

+ we have v( + /) =

year?

to v(

is

accumulates to

1

1

i),

1

1

1

.

(1.12)

These two accumulations are shown

Figure

in

1.7.

1

1+/

+/

1

-1

1

FIGURE

From now

that

we

are in a

on, unless explicitly stated otherwise,

compound

this case, the present value

We

summarize

(l+zy

1.7

this

where

interest situation,

of

1, r

years

in the past, will

on the time diagram shown

TT7

t

^"

in

^^

Figure

t

we

a{t)

will

=

be

assume

+

=

v^

In

ij.

(1

^^

.

1.8.

AMOUNT

'^'

TIME

FIGURE

Observe

expresses

Hence

(1

or future.

all

+

that,

since

v^

=

(1

+

1.8

i)~\

the

function a(t)

=

(1

+

these values, for both positive and negative values of

ij gives the value of one unit (at time 0) at

The graph

is

shown

in

Figure

1

.9.

<m

(1

IFIGURE

1.9l

+

0'

any time

/,

//

t.

past

The Basic Theory

Interest:

Example

1

1.4

The Kelly family buys a new house for 93,500 on May 1, 1996. How

much was this house worth on May 1, 1992 if real estate prices have

risen at a compound rate of 8% per year during that period?

Solution

We

seek the present value, at time

93,500(^y^)

interest is

is

-4, of 93,500

at

time

0.

This

of present values

calculation

the

to

now

=

a{t)

is

1

+

is

D

assumed instead of compound

years in the past

value

=

=68,725.29.

What happens

function

t

simple

The accumulation

interest?

Hence, the present value of one unit

it.

given by

if

x,

where x{\

+ //) =

1.

/

Thus the present

is

The time diagram

1

^

+

for this case

is

shown

in

Figure 1.10.

1

AMOUNT

^'

^'^

^Y

-^-10

^

I

I

you are asked

V^

TIME

t

1

FIGURE

In Exercise 15,

^

1.10

to sketch the graph

of this

situation.

Unlike the compound interest case, this graph changes dramatically as

passes through the point

it

(0, 1).

We now turn our attention to the concept of discount. For the

moment we will not assume compound interest, since any accumulation

function will be satisfactory.

Imagine that

accumulated to 112.

figure,"

100

is

We

invested,

and that one year

later

it

has

have been viewing the 100 as the "starting

and have imagined that

interest

of 12

is

added to

it

at the

end of

However, we could also view 112 as the basic figure, and

is deducted from that value at the start of the year. From

the latter point of view, the 12 is considered an amount oi discount.

Students sometimes get confused about the difference between

interest and discount, but the important thing to remember is that the

the year.

imagine that 12

only difference

is in

the point of view, not in the underlying financial

Chapter

12

transaction.

we have

In both situations

nothing can change

1

100 accumulating to 112, and

that.

Since discount focuses on the total at the end of the year,

it

is

natural to define the effective rate of discount, d, as

^=^^.

In other words, standardization

of a(0), as was done

More

is

(1.14)

achieved by dividing by a{\) instead

define the effective rate of interest

in (1 .2) to

/.

generally, the effective rate of discount in the n^^ year

is

given by

(Compare

this

with the definition of /„, given by (1.3).)

Now we

will derive

some basic

identity follows immediately

'^~

Since

1

+ >

/

^(1)-1 _

-

a{\)

this tells us that

1,

identities relating

this

identity

The

exact analogy of

1

is

d<

we

accumulating to

1

+

/

(11^)

-rt7--=^

we would

to

1

expect from the

over one year

/,

we

(118)

will be asked to derive other identities in the exercises

and to give verbal arguments

will be

in

support of them.

We

note that

any accumulation function. For the

assumed that a{t) = (1 + ij

identities derived so far hold for

it

the

obtain

i=\^^

of this section,

is

over the same period.

Solving either of the above identities for

The reader

j^.

obtain

— J accumulates

1

.J

i.

exactly what

fact that

One

/.

/

i-^=i-Ti/ =

definition of J.

to

(1+0-1 __

1+/ -.Uk;ti

Immediately from the above

Actually,

d

from the definition oi d, namely,

all

rest

The Basic Theory

Interest:

In Section

years

we learned that to find the accumulated

we multiply by (1 + //, whereas to find the

1.3

in the future

value

years in the past

/

13

(1.17) tells us that

we

—d=

\

.

multiply by

f_

•

.

{

Hence,

if

present and accumulated value are reversed:

by multiplying by

d

is

However,

.

value

/

present

identity

involved, the rules for

present value

is

obtained

—d)', and accumulated value by multiplying by

(1

1

Example

1000

is

1.5

to be

accumulated by January

1995, at a

1,

compound

rate

of

discount of 9% per year.

(a)

Find the present value on January

(b)

Find the value of / corresponding to

1992.

1,

d.

[Solution

753.57.

M

^= ^=0989.

^-^1-3^7

d ~ .91

(b)

Example

compound

August

1,

Solution

Some

D

1.6

Jane deposits 1000

I

=

1000(1 -.09)^

(a)

in a

interest is

bank account on August

7%

1,

1996.

per year, find the value of this deposit on

I

students think that the answer to this question should be 0,

cal sense,

we know

the correct answer

We

of

1994.

because the money hasn't been deposited yet! However,

1.5

If the rate

is

that

money has

1000

value

(y^j^ =

in

a mathemati-

at all times, past or future,

so

D

873.44.

NOMINAL RATE OF INTEREST

will

assume

otherwise, in

Example

all

a(t)

=

(1

+

// throughout this section and, unless stated

remaining sections of the book.

1.7

A man borrows 1000 at an effective

How much does he owe after 3 years?

rate

of interest of

2%

per month.

14

Chapter

1

Solution

I

What we want

is

amount of the debt

the

effective interest rate

is

Thus the answer

periods.

The

given per month, three years

is

1000(1.02)^^

point of the above example

is

=

Since the

after three years.

36

is

interest

D

2039.89.

to illustrate that effective rates

of interest need not be given per year, but can be defined with respect to

any period of time. To apply the formulae developed to this point, we

must be sure

that

is

t

the

number of

effective interest

periods

in

any

particular problem.

many

In

real-life situations, the effective interest

year, but rather

fact hidden, as

you want

12%

some

it

period

might be to his benefit to do

When

per year.

so! For example, suppose

mortgage on a house and you discover a rate of

you dig a little, however, what you find out is that

which means that

the same thing? Not at

it

effective per half-year.

all.

what happens

=

Is that

to an investment

one

After

1.06.

(1.06)^

not a

to take out a

this rate is "convertible semiannually",

to

is

shorter period. Perhaps the lender tries to keep this

of

1

After half a year

.

(two

year

interest

So, over a one-year period, the

1.1236.

it

periods)

is

really

6%

Consider

has accumulated

it

has

amount of

become

interest

which means the effective rate of interest per year is

actually 12.36%. Although it may not be clear from the advertising,

many mortgage loans are convertible semiannually, so the effective rate

gained

.1236,

is

of interest

As

charges

rate

is

higher than the rate quoted.

another example, consider a well-known credit card which

1

8%

per year convertible monthly.

of interest

year,

1

is

R

jy =

1

This means that the actual

.015 effective per month.

will accumulate to (1.015)^^

interest per year is actually

=

Over the course of a

1.1956, so the effective rate of

19.56%.

The 18% in the last example is called a nominal rate of interest,

which means that it is convertible over a period other than one year. In

general,

we

convertible

of

^

use the notation

m

/^'"^

nominal rate of

to denote a

interest

times per year, which implies an effective rate of interest

per m^^ of a year. If

/

is

the effective rate of interest per year,

it

follows that

1+/-

jim)

1+V

ml

jt

(1.19)

The Basic Theory

Interest:

Example

1

5

1.8

Find the accumulated value of

000

1

after three years at a rate

of interest

of 24% per year convertible monthly.

SolutionI

This

2% effective per month, so the answer

namely 1000(1.02)^^ = 2039.89.

really

is

Example

1.7,

is

the

same

as

D

Remark

An

alternative

rate

of

method of solving Example

1

1.8 is to find

and then proceed as

interest per year,

+ -^ j -

1

would be 1000 (1.26824)^

= (l+.02)'2 = 2039.88.

Notice the difference of

.01 in the

1

in

=

Section

Of

in.

course, if

two answers. This

you use the memory

in

/,

time

preferable;

still

We

would

is

because

and some error

your calculator

unlikely that this type of error will occur. Nevertheless, the

is

the effective

.26824, and the answer

not enough decimal places were kept in the value of

crept

/,

1.3.

first

is

it

solution

on unnecessary calculations can be

spent

significant in examination situations.

It

will be extremely important in later sections

of the text to be

able to convert from one nominal rate of interest to another

convertible frequency

Example

If

z^^)

=

is

different.

Here

is

whose

an example of this.

1.9

.15, find the equivalent

nominal

rate

of interest convertible

semiannuallv.

[Solution

We have

(l

+

m

\ 2

V)

^

i}

^

'~^)

,

so

z^^)

^

2[(1.025)^

-

1]

=

.15378.

D

In the

same way

that

we

defined a nominal rate of interest,

we

could also define a nominal rate of discount, S"^\ as meaning an

Am)

effective rate of discount of ^^^^

identity (1.19),

it is

per m^" of a year.

Analogous

to

easy to see that

\^,d

m

(1.20)

Chapter

16

Since

1

—d

1+/ we

,

M

^

1

for all positive integers

Example

conclude that

=

+ ^m

1

\Jri

=

1_^

n

{\-d)-

(1.21)

^

m and n.

1.10

Find the nominal rate of discount convertible semiannually which

12%

equivalent to a nominal rate of interest of

is

per year convertible

monthly.

ISolutionI

12

d^^^

+

1

which we find

is

=

d^^'>

SO

\2

2(1

-

1

-

.942045)

^=

=

.

(l.Oir^

=

D

1591.

1

somewhat theoretical, and

Anyone wishing to proceed

note before starting this section that

independent of the rest of the

directly to

particular,

it is

text.

more practical problems can safely omit this

more background knowledge is required

understanding here than

is

Assume

jim)

we want

^

nominal rates

to find

_

calculate these values

which are shown

TABLE

m

fm)

We

equivalent to

f'"^

which comes from

l]^

in

is

/.

Table

full

=

.12,

and

The formula

is

used to

1.1.

1.1

2

5

10

50

.12

.1166

.1146

.1140

.1135

f"^"*

a

In

reading.

i

identity (1.19),

1

observe that

for

first

that the effective annual rate of interest

^[(i_f/)i/^

material.

required for any other section; students with

only a sketchy knowledge of calculus might omit this on

that

.942045, from

FORCE OF INTEREST

1.6

We

^

decreases as

m

gets larger, a fact

will be able to prove later in this section.

We

which we

also observe that the

The Basic Theory

Interest:

are decreasing very slowly as

/^^^

values of

17

along; in the language of calculus,

This

see

is,

what

in fact,

what the

derivation, so

limit

is

There

is.

=

is

further and further

we can

"

O'^'"

limit.

use L'Hopital's rule to

no need to assume

with arbitrary

Urn w[(l 4-

we go

seems to be approaching a

happening, and

we proceed

lim f^^

/^^'^

i

—

.\2

our

in

/.

l]

=

"^

^i^ ^^

"^

~

^

(1.22)

^^i

m

Since (1.22)

we

of the form ^,

is

take derivatives top and bottom,

cancel, and obtain

lim

w—>oo

since lim (\

+

/« =

=

iY^""

This limit

lim

w—>cx:

[(1

+

ly^""

ln(\-\-i)]=ln(\+

1.

called the force of interest and

is

(1.23)

/),

is

denoted by

6,

we

so

have

S-^TiTTTlf

In our example, 6

=

with the entries

Table

in

Intuitively,

6

/«(1.12)

=

1333.

.1

(1.24)

The reader should compare

this

1.1.

represents

a

nominal rate of interest which

is

more theoretical than practical

However, 6 can be a very good approximation for f"^^

convertible continuously, a notion of

importance.

when

m

is

large (for example, a nominal rate convertible daily),

and has

the advantage of being very easy to calculate.

We note that identity (1 .24) can be rewritten as

e^

\+i.

(1.25)

form is shown in the next example. Again we

the importance of being able to convert a rate of interest with a

The usefulness of

stress

=

given conversion

this

frequency to an equivalent rate with a different

conversion frequency.

18

Chapter

Example

1

1.11

A

loan of 3000 is taken out on June 23, 1997.

14%, find each of the following:

(a)

The value of the loan on June 23, 2002.

The value of

(b)

If the force

of interest

is

/.

(c)

The value of /^^^\

Solution

(a)

The value

5 years later is

obtain 3000(e^^)^

= e'4-

(b)

/

(c)

f

1

1

+

^ry

3000(1

+ if

e'^

=

6041.26.

e^"^,

SO

we havc

3000

Using

.

e^

—

\

-\- /,

we

=.15027.

<12)\12

/

=

=

)

1

+ =

/

P^^

=

\2{e^^'^^

-

\)

the result

=

D

.14082.

Remark

we tried to solve part (a) by first obtaining / = .15027 (as in

and then calculating 3000(1. 15027)^ we would get 6041.16, an

answer differing from our first answer by .10. There is nothing wrong

Note

that if

part (b)),

with this second method, except that not enough decimal places were

carried in the value of

/

an earlier admonition:

to guarantee an accurate answer.

Let us repeat

always wise to do as few calculations as

it

is

+

/T]

necessary.

Observe

that D[{\

the derivative with respect to

,

Let us see

=

why this

/.

=

{\

+

In {\

ij

Hence we see

-\- /),

where

happens to be

the derivative that Z)[a(0]

= Um

^(^

h-*Q

true.

-n

ha(,t)

(1.26)

Recall from the definition of

+ ^)-^W

h

^

3^

a{t+h)

a(0

stands for

that

;„(,+0=^^ = ^.

fact

D

-n

h

-

a{t)

^^-^'^

Interest:

The Basic Theory

-^^

The term

-rx

——

19

ajt^h)

over a very small time period

rate

the effective rate of interest

in (1.27) is just

a{t)

^

so

h,

-

corresponding to that effective

is

the nominal annual

which agrees with our

rate,

earlier

definition of ^.

The above analysis does more than

how

that,

however.

also indicates

It

the force of interest should be defined for arbitrary accumulation

functions.

First,

However,

to a constant

/„.

ln{\

-{-

is

i)

of compound

independent of

interest,

For arbitrary accumulation functions,

force of interest at time

.

we would normally

expect

For certain functions,

/.

corresponding

we

define the

by

/, (5/,

^-_

since

—

observe that 6

us

let

this is a special property

6t

^(^)

to

(1-28)

,

depend on

t.

more convenient

is

it

D[a{t)]

to use the equivalent

definition

6,

We also remark that,

=

since A{t)

D{ln{a{t))\

=

k

a(t)

,

it

(1.29)

follows that

6.= ^^=D[lr,(A(t))].

Example

Find

(1.30)

1.12

6t in

the case of simple interest.

ISolutionl

.

^t

—

D(\+it)

it

^it

1

l+/r

I

We now

have a method for finding the force of

any accumulation function

wish to derive a{t) from it?

To

start with, let

different variable,

/,

we

obtain

What

if

we

namely

r.

6r

=

interest, 6t,

are given

us write our definition of

derivative with respect to

to

a(t).

^^

D[ln{a{r)y\, where

6t

given

instead,

and

from (1.29) using a

D

now means

the

Integrating both sides of this equation from

20

Chapter

= [

6rdr

I

Jo

=

D[ln(a(r))]dr

1

ln{a{r))

Jo

= ln(a(t))-ln(am

=

=

since a(0)

and

1

/«

=

1

Then taking

0.

a(/)

Example

some

the antilog

(1.31)

we have

Jo'^^^^

(1.32)

1.13

Prove that

for

=

ln{a{t)\

if

a constant

is

(5

(i.e.,

independent of

then a{t)

r),

=

(1

+

ij

/.

Solution

\i6r

=

result

c,

is

hand side of (1.32)

the right

proved with

Example

=

i

e^

—

is

Jo^^^

z.z

=

e''

(ej. Hence the

D

\.

1.14

Prove that

A{t)

/

dt

6t

— A(n) - A(0) for any amount function A{t).

Jo

I

Solution!

The

left

["Ait)

Jo

hand side

dt

6,

=

is

["aH)

Jo

dt =

[^^1

A'}

L

J

rD[A(t)] dt

Jo

= A(t)

=

A(n)

— A{0)

as required.

D

The

identity

time

t

for the

represents the

in

amount of

number which

=

We now

(1 + /y.

6t

above example has an interesting verbal

dt represents the effective rate of interest at

"period of time"

infinitesimal

represents the total

a{t)

the

The term

interpretation.

is

amount of

interest

clearly equal to A(n)

return to the

It

is

dt.

interest earned in this period,

Hence A{t)6tdt

and

j^ A(t) St dt

earned over the entire period, a

— A(0).

compound

interesting to write

interest case

some of

where we have

the formulae already

For example S

developed as power series expansions.

=

ln(\-\-i)

becomes

6^i

L.

2

+

1

i_

3

_

+

L. 4_

4

(1.33)

Interest:

The Basic Theory

21

Convergence is a concern here, but as long as

the case, the above series does converge.

Another important formula was

- ^+f^ +

/•

Since

all

—

i

f^

—

e^

+

|

/

<

1

1,

1,

which

is

usually

which becomes

---.

(1.34)

terms on the right hand side are positive, this allows us to

conclude immediately that

converges for

Next

all

let

/

>

We

6.

note in passing that this series

(5.

us expand the expression

/

=

_

.

=

i

d{\

— d)~\

which

becomes

/-41 +^+^^+

(i^4- •••)

= ^ + ^^+

Again this shows us very clearly that / > d.

have |(i| < 1 for this series to converge.

yields an

amusing

the left

result:

also note that

(1.35)

we must

d =2

In fact, trying to put

is

i

=

.

_

^

=

—2, whereas

becomes 2 +

all of which are positive

+ +

Thus we have "proven" that —2 is a positive number!

Next let us expand f^^ as a function of /. From (1.19) we have

2^

the right hand side

terms.

hand side

We

c/^4- •••.

li^)

=

/^>

= m

m[(\

i

+/)^^^-

w

+

1],

'

are

we

•

,

so

2!

3!

'

2!

3!

Again, this converges for

Why

2^

|

/

1

<

interested in

1.

power

series expansions? Well,

we have

already seen that they sometimes allow us to easily conclude facts like

>

They also give us

means of calculating some of these functions, since often only

the first few terms of the series are necessary for a high degree of

accuracy. If you ask your calculator to do this work for you instead, it

will oblige, but the program used for the calculation will often be a

/

6 (although they certainly aren't needed for that).

a quick

variation of one of those described above.

22

Chapter

As

a final example,

let

us expand

^w

terms of 6.

in

d^"^"^

+ 0- ^

1

(1

1

We have

g-«.

(1.37)

so

= m

From

-('-(-fe)

6i

^

= m m

iW

=

+

this

(

6

2\m

we

<5\2

-

-)

(

<5\3

- -y

2!

3!

6'

V.rr?

(1.38)

2\m^

lim

easily see that

J^'"^

=

In other words, there

S.

need to define a force of discount, because

it

will turn out to

is

no

be the same

as the force of interest already defined.

EXERCISES

1.1

Accumulation Function;

1.3

Compound

1-1.

Alphonse has 14,000

(a)

1.2

Assuming

in

an account on January

simple

interest

accumulated value on January

(b)

Assuming compound

(d)

at

1,

interest

accumulated value on January

(c)

Simple Interest;

Interest

1,

8%

1,

per

1995.

year,

find

the

2001.

at

8%

per year,

find

the

2001.

Assuming exact simple interest at 8% per year, find the

accumulated value on March 8, 1995.

Assuming compound interest at 8% per year, but linear

interpolation between integral durations, find the accumula-

ted value on February 17, 1997.

Interest:

1-2.

The Basic Theory

23

Mary has 14,000 in an account on January 1, 1995.

Assuming compound interest at 11% per

(a)

(b)

accumulated value on January 1, 2000.

Assuming ordinary simple interest at 11% per

accumulated value on April

(c)

Assuming compound

7,

find the

year,

year, find the

2000.

\\%

interest at

per year, but linear

interpolation between integral durations, find the accumula-

ted value on April 7, 2000.

1-3.

For the a{t) function given

all

1-4.

Consider the function

(a)

(b)

(c)

1-6.

+

yj\

{P

<

/„+i

/„

for

>

i

0,

t

>

0.

/.

1

0.

\

-\- it

for

1.

Show

<

that a(t)

+

is

Let a{t) be a function such that a(0)

=

=

(1

(a)

Prove that

(b)

Can you conclude

a{t)

(1

+

i)'

sufficiently large.

1

and

that ait)

=

(1

+ iy

constant for

/„ is

iY for all integers

Let A{t) be an amount function.

(a)

prove that

-\-2i)t^,

1

1

define /„

1-7.

=

a(r)

ift

(d)

1.1,

Show that a{0) = and ^(1) = +

Show that a(t) is increasing and continuous for / >

Show that a(t) < + /Y for < / < 1, but a(t) >

t>

1-5.

Example

in

positive integers n.

/

>

for all

all n.

0.

t

>

0?

For every positive integer

n,

= A(n) — A{n—\).

Explain verbally what

/„

represents

- A(0) = h + h +

(b)

Prove that A(n)

(c)

Explain verbally the result

(d)

Is

(a)

In

it

true that a{n)

how many

—

^(0)

=

---¥ h-

in part (b).

i^

+

ii

+

-

-\-

in? Explain.

years will 1000 accumulate to 1400 at

12%

simple interest?

(b)

At what

in

(c)

rate

of simple

interest will

1000 accumulate to 1500

6 years?

Repeat parts

of simple

(a)

and (b) assuming compound

interest.

interest instead

24

1-8.

Chapter

At a

1

certain rate of simple interest, 1000 will accumulate to 1300

after a certain period

at a rate

of time. Find the accumulated value of 500

of simple interest # as great over twice as long a period of

time.

1-9.

Find the accumulated value of 6000 invested for ten years,

compound

1

1%

interest rate

is

7%

per year for the

first

if

the

four years and

per year for the last six.

1-10.

Annual compound interest rates are 13% in 1994, 11% in 1995

and 15% in 1996. Find the effective rate of compound interest per

year which yields an equivalent return over the three-year period.

1-11.

At a

certain rate of compound interest, it is found that 1 grows to 2

X years, 2 grows to 3

years, and 1 grows to 5 in z years.

Prove that 6 grows to 1 in z — x —y years.

my

in

grows to ^ in X periods at compound rate / per period and 1

1

grows \o K'my periods at compound rate 2/ per period, which one

of the following is always true? Prove your answer.

X <2y

(a)

(b)

x = 2y

1-12. If

(c)

(d)

(e)

x>2y

y= vx

y>2x

1.4

Present Value and Discount

1-13.

Henry has an investment of 1000 on January

(a)

(b)

(c)

1-14.

present value on January

1,

at

a

1,

year,

find the

1989.

Assuming compound discount

present value on January

(c)

1998

rate

Mary has 14,000 in an account on January 1, 1995.

Assuming compound interest at 12%) per

(a)

(b)

1,

of discount d = .12.

Find the value of his investment on January 1, 1995.

Find the value of / corresponding to d.

Using your answer to part (b), rework part (a) using / instead

ofd. Do you get the same answer?

compound annual

at

12%

per year, find the

1989.

Explain the relative magnitude of your answers to parts (a)

and

(b).

Interest:

The Basic Theory

25

Sketch a graph oi a{t) with

1-15. (a)

extension to present value in

its

the case of simple interest,

why — it is not

past, when simple

Explain, both mathematically and verbally,

(b)

the correct present value

interest

t

years in the

1

assumed.

is

constant in the case of compound interest.

1-16.

Prove that dn

1-17.

Prove each of the following identities mathematically.

and

(a), (b)

is

give a verbal explanation of

(c),

For parts

how you can

see that

they are correct.

d=iv

(d)

^-}

(b)

d=\-v

(e)

d(\

+ {)=i(\-^)

(f)

iyj\

-d =

i-d=

(c)

1-18.

=

(a)

id

1

dyJX

+/

Four of the following five expressions have the same value (for

/

> 0). Which one is the exception?

ruAi-^'

d'

(^)

(TT^ (^)T^

(c)(/-cOa'

3

J

(d);^-/V

___

,-3

/^\ ;2.

(e)i'cl

1-19.

The interest on L for one year is 216. The equivalent discount on

L for one year is 200. What is Z?

1.5

Nominal Rate of Interest

1-20.

Acme

Trust offers three different savings accounts to an investor.

Account A:

compound

interest

at

12%

per year convertible

quarterly.

Account B:

compound

interest at

1 1

.97% per year convertible

5

times per year.

Account C:

compound discount

at

11.8% per year convertible

10 times per year.

Which account

account

is

most advantageous to the investor?

most advantageous to Acme Trust?

is

Which

26

Chapter

1

16% per year

How much does she owe after 21

takes out a loan of 3000 at a rate of

1-21. Phyllis

convertible 4 times a year.

months?

1-22.

The Bank of Newfoundland

offers a

12% mortgage

convertible

semiannually. Find each of the following:

(a)

(d)

1-23. 100

(a)

(b)

(b)^(^>

/•

The equivalent

grows to 107

The effective

P^

(c)/<^2)

effective rate of interest per month.

in

6 months. Find each of the following:

rate

of interest per half-year.

(d) J(3)

(c)

/

+

^

,(6)

1-24.

Find n such that

1

«

^

""

.

1

1-25. Express J^^^ as a function oi

1-26.

1-27.

Show

Prove that

1-28. (a)

(b)

1.6

that

vM +

/<^)c/(»>

Prove that

^^

>

f"^^

)

=

(

/<8)

+

1

^

P\

^

+

^

(

)

^

-

^

j

\/l

-d.

f^'>d^^\

-

d^"^^

=

^

^

Provethat^-^ =

.

i.

Force of Interest

1-29. Find the equivalent value

(a)

/=.13

(b)

d=A3

(c)

/<^)

(d)

J(5)

= .13

= .13

of (5

in

each of the following cases.

Interest:

The Basic Theory

1-30. In Section 1.3,

Show

1-31.

that

Assume

(a)

+

1

it

was shown

—

//

27

{\-\-iy is

Show

maximized

of interest

that the force

<

that for

is

at

<

/

=

/

+

/y

—

In b].

1, (1

4[/«

/

<

1

+

it.

doubled.

that the effective annual interest rate

more than

is

doubled.

Show

(b)

that the effective annual discount rate

is

less than

doubled.