Canada Financial Report

Anuncio

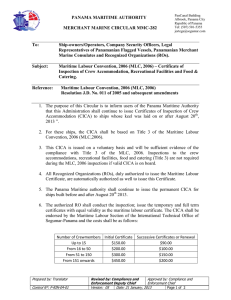

Canada Financial Report Luis Erausquin Granados Fachhochschule Wiesbaden-University of Applied Sciences Canada´s Financial Progress in an International Context Table of contents: 1. Introduccion & overview 2. Regular framwork 3. Budgetary Balance, Financial Requirements/Surplus & National Accounts Budget Balance. 4. Canada´s Financial Progress in an International Context Introduccion & overview • Follow the anglo-saxon model in financial reporting • Share the U.K. as former colonial power • More developed accountancy professsion than credit-based – CICA (Canadian Institute of chartered accountants) – CGAAC (Certified general accountancts associatio) – SMAC (Society of management accountants) Coordiantion between autonomous procincial institutes Small role in standart setting than CICA Regulatory framework • Resembles: – U.K.: Importance of company law – U.S.A. :securities commision • Cananda as a federation: – Division of power under constitution – .Provincial securities commision (e..g. S.E.C.) • Developing of accounting rules in six phases * – 1864/1946: Main influences. Market & traditions from U.K. – 1946/1967: Technical expertise • In 1946 CICA established and Accountaing & Auditing Research Committe recogniced into CICA handbook containing recomendations. – 1967/1973: Establishment of permanent bureaucracy: • Recomendations (1946) were given recognitions in the 1970s by securities comissions and federal and provincial legislatures – In Canada Securities Adminidtrators .National Policy Statement – Canada business Corporation Acts (1975):Transferred requierements to fianancial statements from the bodz of Act to Regulatory Section. – 1973/1981: Ontario Securities Act 1978 and other provincial legislation contain the same requierement.Canadian legislation requires financial statementsto be in concordance with CICA handbook. – 1981/1990: In 1988 as result of criticism of slowness standar settings process CICA established an Emergencing Issues Committe (EIC). – Since 1990: Current situacion is that Canada standars are developed by CICA´s Accounting Standards Board (1991) as succesor to Accounting Standards Committe • Board comprises: 13 part-time voluntieer voting members,including accountants in public practices, comerce, fiannce and education • Not less than 2/3 of Board´d members are CICA members. Budgetary Balance, Financial Requirements/Surplus & National Accounts Budget Balance • Federal Govenment´s Fiscal Measures: – Two based on Public Accounts(1): • Budgetary Balance:include all financial transactions between government and habilities incurried during the year for which no cash payment has been made. • Financial Requirements surplus – One on the sistem of National Accounts(2): – Porpouse of Public Account(1): • Provide information to Parlament in government´s Financial activities as requiered under the financial Administration Act. • Based On general accepted accounting principles for public sectors and auited by Auditor General of Canada – Diferences between budgetary balance and financial requierements/surples (1): the treatment of federal government employee´s pension account • Budgetary balance includes the total annual pension related obligations • Finacial requierements/surplus includes only the benefits paid out in that year less employee premiums paid – Primary objetive of National Account(2):To measure current economic production and income • The curent National Accounting and fiancial requierements/surples treat the transaction of federal goverment employee´s pension accounts similarly • National Accounting Balances used for international fiscal comparison by the Organisation for Economics Cooperation and development and international Monetary Found • The National Accounting provide a constistent framework for comparition of fiscal position of the various levels of government of Canada Each of three measures provide important complementar perspectives on the Government´s Fiscal Position Canada´s Financial Progress in an International Context Overview: • Compare Canada´financial position with that of the Group of Seven(U.S.A, U.K, France, Germany, Japan & Italy) tend to complicate international finance comparition: – Diferences in accounting methods among countries afect compativility of data – Financial responsabilities are distributed aming various levels of government in each country Significant budget Surpluses for Canada: • Following the recesion of 1990´s total government sector deficit peaked at 8 % of gross domestic producction (GDP) in 1992,compared to G-7 average deficit-to-GDP ratio of 4,5 • Subsequent deficit reduction effors by all levels of Canada government resulted in a total government budget suplus in 1997 • Canada´s budget improvement over 1992-1999 surpassed that of all other G-7 countries Fasten decline in program Spending: • Between 1992 and 1999 Canada implemented the largest revolution in program spending relative to GDP of any G-7 countries. Dropped 8.5% percentaje compared to 1.5 for G-7 (See Chart A 4.3) Sharp Decline in Cnada´s Net Debt-to GDP Ratio • Over last years Canada experienced the sahrpest decline in the debt to GDP ratio of the G-7.In 1999 Canada´s debt to GDP ratio was 10% above the G-7 average. • A further reduction in debt burden remain a kez objection of Canada garnnmet´s fiscal policy Bibliography Nobes,Chritopher/Parker, Robert; Comparative International Accounting Hemel Hempstead:Prentice Hall Europe:6th edition 2000 Fabozzi, Frank/ Modigliani, Franco Financial Markets & institutions Prentice Hall Europe:1996 Radebaugh, Lee/ Gray, Sindney International accounting and multinational enterprise John Wiley & Sons Inc.,New York 1993 Internet - http://www.fin.gc.ca - http:// www.canada-es.org