ln(ˆ^ˆˆ

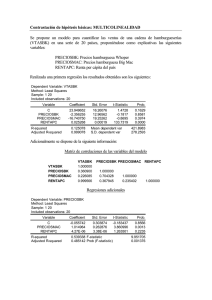

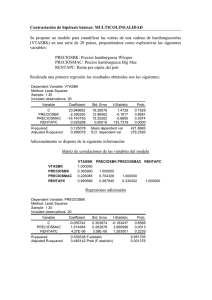

Anuncio

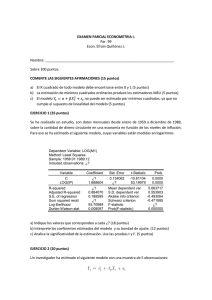

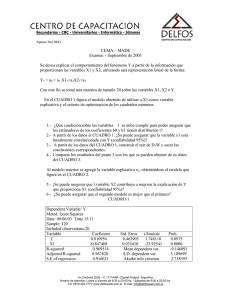

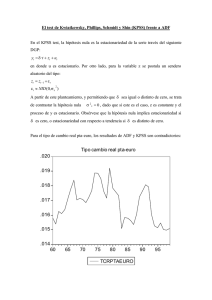

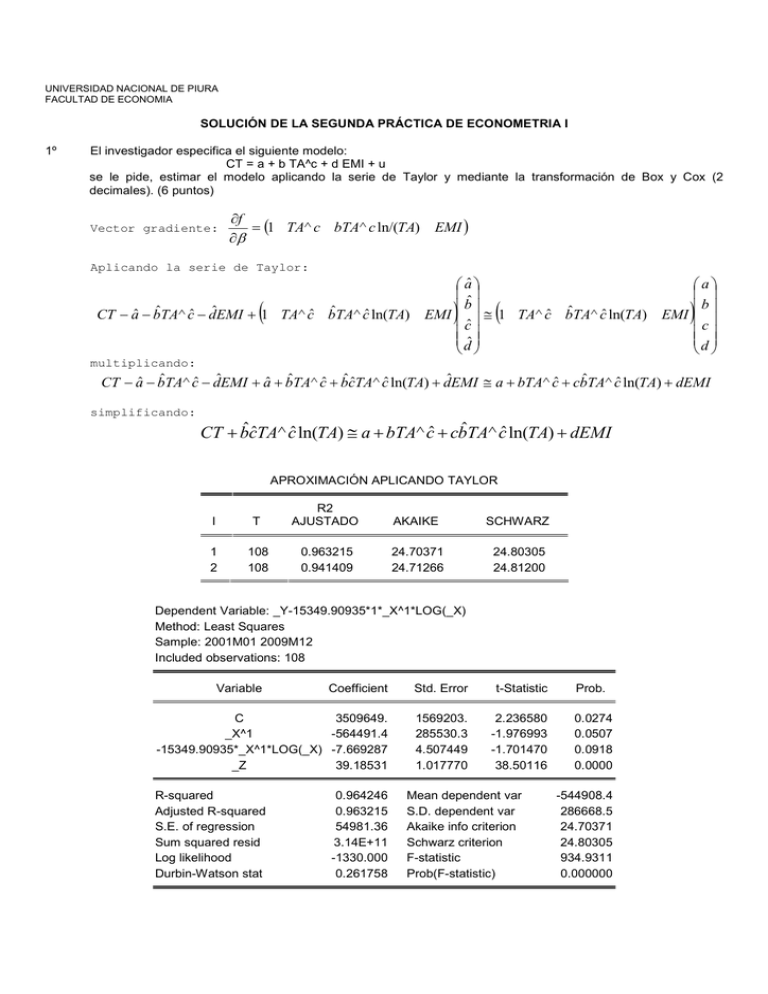

UNIVERSIDAD NACIONAL DE PIURA FACULTAD DE ECONOMIA SOLUCIÓN DE LA SEGUNDA PRÁCTICA DE ECONOMETRIA I 1º El investigador especifica el siguiente modelo: CT = a + b TA^c + d EMI + u se le pide, estimar el modelo aplicando la serie de Taylor y mediante la transformación de Box y Cox (2 decimales). (6 puntos) Vector gradiente: ∂f = (1 TA^ c bTA^ c ln/(TA) EMI ) ∂β Aplicando la serie de Taylor: aˆ a ˆ b b ˆ ˆ ˆ ˆ CT − aˆ − bTA^ cˆ − dEMI + 1 TA^ cˆ bTA^ cˆ ln(TA) EMI ≅ 1 TA^ cˆ bTA^ cˆ ln(TA) EMI cˆ c dˆ d ( ) ( ) multiplicando: CT − aˆ − bˆTA^ cˆ − dˆEMI + aˆ + bˆTA^ cˆ + bˆcˆTA^ cˆ ln(TA) + dˆEMI ≅ a + bTA^ cˆ + cbˆTA^ cˆ ln(TA) + dEMI simplificando: CT + bˆcˆTA^ cˆ ln(TA) ≅ a + bTA^ cˆ + cbˆTA^ cˆ ln(TA) + dEMI APROXIMACIÓN APLICANDO TAYLOR I T R2 AJUSTADO AKAIKE SCHWARZ 1 2 108 108 0.963215 0.941409 24.70371 24.71266 24.80305 24.81200 Dependent Variable: _Y-15349.90935*1*_X^1*LOG(_X) Method: Least Squares Sample: 2001M01 2009M12 Included observations: 108 Variable Coefficient Std. Error t-Statistic Prob. C 3509649. _X^1 -564491.4 -15349.90935*_X^1*LOG(_X) -7.669287 _Z 39.18531 1569203. 285530.3 4.507449 1.017770 2.236580 -1.976993 -1.701470 38.50116 0.0274 0.0507 0.0918 0.0000 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat 0.964246 0.963215 54981.36 3.14E+11 -1330.000 0.261758 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) -544908.4 286668.5 24.70371 24.80305 934.9311 0.000000 2 TRANSFORMACION DE BOX COX LANDA SR 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 1.9 2.0 3.23E+11 3.23E+11 3.24E+11 3.24E+11 3.24E+11 3.24E+11 3.25E+11 3.25E+11 3.25E+11 3.25E+11 3.26E+11 3.26E+11 3.26E+11 3.26E+11 3.27E+11 3.27E+11 3.27E+11 3.27E+11 3.28E+11 3.28E+11 3.28E+11 TRANSFORMACION DE BOX COX LANDA SR 0 -0.1 -0.2 -0.3 -0.4 -0.5 -0.6 -0.7 -0.8 -0.9 -1.0 -1.1 -1.2 -1.3 -1.4 -1.5 -1.6 3.23E+11 3.23E+11 3.23E+11 3.23E+11 3.22E+11 3.22E+11 3.22E+11 3.22E+11 3.22E+11 3.21E+11 3.21E+11 3.21E+11 3.21E+11 3.21E+11 3.21E+11 3.21E+11 3.20E+11 3 -1.7 -1.8 -1.9 -2.0 3.20E+11 3.20E+11 3.20E+11 3.20E+11 TRANSFORMACION DE BOX COX 2º LANDA SR 2.0 -2.1 -2.2 -2.3 -2.4 -2.5 -2.6 -2.7 -2.8 -2.9 -3.0 -3.1 -3.2 -3.3 -3.4 -3.5 -3.6 3.20E+11 3.20E+11 3.20E+11 3.20E+11 3.19E+11 3.19E+11 3.19E+11 3.19E+11 3.19E+11 3.19E+11 3.19E+11 3.19E+11 3.19E+11 3.19E+11 3.19E+11 3.19E+11 3.19E+11 El investigador especifica el siguiente modelo: CT = a E^(b SPREAD) + c EMI + u se le pide, estimar el modelo por mínimos cuadrados no lineales y máxima verosimilitud. (4 puntos) Dependent Variable: CT Method: Least Squares Sample: 2001M01 2009M12 Included observations: 108 Variable Coefficient Std. Error t-Statistic Prob. C EMI 130027.9 39.32318 13680.41 1.087786 9.504679 36.14974 0.0000 0.0000 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat 0.924972 0.924264 62790.46 4.18E+11 -1345.372 0.168739 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) 573724.7 228161.7 24.95134 25.00101 1306.804 0.000000 4 Dependent Variable: CT Method: Least Squares Sample: 2001M01 2009M12 Included observations: 104 Convergence achieved after 23 iterations CT =C(1)*EXP(C(2)*SPREAD)+C(3)*EMI C(1) C(2) C(3) R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Coefficient Std. Error t-Statistic Prob. 46229.92 0.001510 42.18189 11948.94 0.000283 0.918779 3.868955 5.338812 45.91080 0.0002 0.0000 0.0000 0.956722 0.955865 48783.92 2.40E+11 -1268.744 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion Durbin-Watson stat 576072.3 232211.5 24.45661 24.53289 0.390209 System: MV Estimation Method: Full Information Maximum Likelihood (Marquardt) Sample: 2001M01 2009M12 Included observations: 104 Total system (balanced) observations 104 Convergence achieved after 16 iterations C(1) C(2) C(3) Coefficient Std. Error z-Statistic Prob. 130027.8 0.000440 37.55821 23617.71 0.000248 1.227542 5.505522 1.772307 30.59626 0.0000 0.0763 0.0000 Log Likelihood Determinant residual covariance -1286.597 3.26E+09 Equation: CT =C(1)*EXP(C(2)*SPREAD)+C(3)*EMI Observations: 104 R-squared 0.938993 Mean dependent var Adjusted R-squared 0.937785 S.D. dependent var S.E. of regression 57920.23 Sum squared resid Durbin-Watson stat 0.193173 3º Obtener los efectos de SPREAD y TA sobre el crédito total. (3 puntos) APROXIMACION DE TAYLOR: 576072.3 232211.5 3.39E+11 5 EEMI = 39.18531 ETA = c(2)*c(3)*ta^(c(3)-1) = 8.71E-06. MCNL: EEMI = 42.18189 ESPREAD = c(1)*c(2)*exp(c(2)*spread) = 152.5652 MV: EEMI = 70.87313 ESPREAD = c(1)*c(2)*exp(c(2)*spread) = 70.87313 4º Comente y fundamente su respuesta. (7 puntos) 4.1. La estimación por mínimos cuadrados no lineales y máxima verosimilitud son equivalentes. 4.2. Todo modelo no lineal se estima por mínimos cuadrados después de transformarlo en lineal.