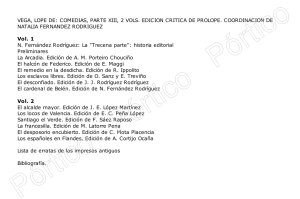

Bibliografía

Anuncio

Bibliografía Aizenman, J. (1998), “Buffer stocks and precautionary savings with loss aversion”, Journal of International Money and Finance, vol. 17, pp. 931-947. Alchian, A. (1950), “Uncertainty, evolution and economic theory”, Journal of Political Economy, vol. 58, No. 3, pp. 221-221. Altman E. (1981), Financial Handbook, Ronald Press Publication, quinta edición, Canada, cap 31, pp. 9 y 10. Arrow, K. (1982), “Risk Perception in Psychology and Economics”, Economic Inquirí, vol. 20, pp. 1-9. Bachelier, L. (1900). “Théorie de la Spéculation”, Tesis doctoral en Sciences Mathématiques, publicada en Annales de l’Ecole Normale Supérieure, tomo 17, 21-86. Bajaj, M., and A. Vijh, (1990), “Dividend clienteles and the information content of dividend changes,” Journal of Financial Economics, pp. 193-219. Bajaj, M., and A. Vijh, (1995), “Trading Behavior and the Unbiasedness of The Market Reaction to Dividend Announcements,” Journal of Finance, pp. 255-280. Bhardwaj, R. y Brooks, L. (1992), “The January anomaly: Effects of low share price, transaction cost and bid-ask bias”, The Journal of Finance , vol. 47, No. 2, pp. 553-575. Ball, R., Kothari, S., Shanken, J. (1995), “Problems in measuring portfolio performance: an application to contrarian investment strategies, Journal of Financial Economics, vol. 38, pp. 79-107. Bamber, L., (1987), “Unexpected earnings, firm size, and trading volume around quarterly earnings announcements,” The Accounting Review, pp. 510-532. Banz, R. (1981), “The relationship between return and market value of common stock”, Journal of Financial Economics, vol. 9, pp. 3-18. Barry, C. y Brown S. (1984), “Differential Information and the small firm effect”, Journal of Financial Economics, vol. 13, pp. 283-294. Barry C. y Brown, S. (1985), “Differential information and security market equilibrium”, The Journal of Financial and Quantitative Analysis, vol.20 No.4, pp. 407-422 Barry, C., Muscarella, J., y Vetsuypens, M., (1990), “Underwriter warrants, underwriter compensation, and the costs of going public”, Unpublished working paper, SMU and TCU. 1 Basu, S. (1977), “The investment performance of common stocks in relation to the price to earnings ratio: a test of the efficient market hypothesis”, Journal of Finance, vol. 32, pp. 663-682. Brealey R. y Myers S. (1998); Principio de finanzas corporativas, quita edición, McGraw Hill, España, pp. 28-30. Bulkley, G. y Harris R. (1997), “Irrational analyst expectations as a cause of excess of volatility in stock prices”, The Economic Journal, vol. 107, No. 441, pp. 359-371. Campbell, J. y Kyle, A. (1993), “Smart money, noise trading and stock price behavior”, The Review of Economic Studies, vol. 60, No. 1, pp. 1-34. Campbell, J. y Shiller R. (1988), “Stock prices, earnings and expected dividends”, Journal of Finance, vol. 43, pp. 661-76. Cárdenas, V. (2001), “Un análisis empírico de la hipótesis de martingala para el mercado global de capitales y del tipo de cambio”, Gaceta de Economía, Año 7, No. 13. pp.85 108. Chen, N., Roll, R. y Ross, S. (1986), “Economic forces and the stock market”, The Journal of Business, vol. 59, No. 3, pp. 383-403. Copeland, T. (1979), “Liquidity changes following stock splits”, Journal of Finance, vol. 34, pp. 115-141. Cowles, A. (1944), “Stock market forecasting”, Econometrica, vol. 12, pp. 206-214. Cross, F., (1973), “Behavior of stock prices on fridays and monday”, Financial Analysts Journal, vol. 29, pp. 67- 69. Damodaran, A. (1996), Investment valuation: tools and techniques for determining the value of any asset, Ed: John Wiley and Son. DeBond, W.(1992), “Earnings forecasts and share price reversal”, Charlottsville, Virginia: Foundation of Chartered Financial Analysis. DeBond, W. y Thaler, R. (1985), “Does the stock market overreact?”, Journal of Finance, vol. 40, pp. 793- 808. DeBond, W. y Thaler, R. (1990), “Do security analysts overreact?”, American Economic Review, vol. 80, pp. 52- 57. Dimson, E. (1988), Stock market anomalies. Ed: Cambridge University Press. 2 Elton, E., Gruber, M., y Rentzler, J. (1989), “New public offerings, information and investor rationality: The case of publicly offered commodity funds”, Journal of Business 62, pp. 1-15 Fama, E. (1970), “Efficient capital markets: a review of theory and empirical work”, Journal of Finance, 383-417. Fama, E. (1991), "Efficient Capital Markets II.", Journal of Finance, pp. 1575-1617. Fama, E., y French, K., (1988), "Dividend Yields and Expected Stock Returns", Journal of Financial Economics, vol. 22, pp. 3-25. Fama, E., y French, K., (1992), “The cross-section of expected stock returns”, Journal of Finance, vol. 47, pp. 427-465. Feliz, R. (1990), “¿Responde la bolsa a los fundamentos?”, Estudios Económicos, vol. 5, No. 2, pp. 335-358. Fields, M. (1934), “Security prices and stock exchange holidays in relation to short selling”, Journal of Business, vol. 7, pp. 328- 338. Finnerty, Joseph; (1993), Planning Cash Flow, Second Edition, Ed: American Management Association, USA, pp 5 y 90. Fisher, Irving, 1930, The Theory of Interest, MacMillan & Co., New York. Flood, R., (1990), “On testing for speculative bubble”, Journal of Economics Perspectives, vol. 4, pp. 85- 101. Fluck,, Z., Malkiel, B. y Quandt, R. (1997), “The predictability of stock returns: A crosssectorial simulation”, Review of Economics y Statistics, vol. 79, No. 2, pp. 176-183. Fosback, N. (1976), Stock Market Logic: A Sophisticated Approach to Profits on Wall Street, Institute for Econometric Research, Fort Lauderdale, FL. French, K., (1980), “Stock return and the Economics, vol. 8, pp. 55-69. Weekend Effect”, Journal of Financial French, K. y Roll, R. (1986), “Stock return variances: The arrival of Information and the reaction of traders”, Journal of Financial Economics, vol. 17, pp. 5-26. Gandar, J., Zubeer, R., O’Brien, T. y Russo B. (1988), “Testing rationality in the point spread betting market”, The Journal of Finance, vol. 43, No. 4, pp. 995-1008. Giles, C. y LeRoy S. (1991), “Econometric aspects of the Variance-Bound test: a survey”, Review of Financial Studies, vol. 4, pp.753-791. 3 Gordon M.. y Shapiro E. (1956), “Capital equipment analysis: the required rate of portfolio”; Management Science, vol. 3, pp. 102-100. Griffiths, M., y White, R. (1993), “Tax-induced trading and the turn-of-the-year anomaly: an intraday study”, Journal of Finance, vol. 48, pp. 575–598. Harrington D. y Wilson B. (1989); Corporate Financial Analysis, tercera edición, editoral: Dow Jones-Irving, USA, pp. 14-151. Hirshleifer, J., (1958), “On the Theory of Optimal Investment Decision,” Journal of Political Economy, vol. 66, no. 4, 329-352. Jackson, M., (1994), “The gordon Growth Model and the income approach to value”, The Appraisal Journal; vol. 62, No.1, pp. 124 . Jegadeesh, N. y Titman, S. (1993), “Returns to buying winners and selling losers: implications for stock market efficiency”, The Journal of Finance, vol. 48, No. 1, pp. 6591. Kahneman, D. y Tversky, A. (1973), “On the psychology of prediction”, Psychological Review, vol. 80, pp. 237 – 251. Kahneman, D. y Amos Tversky (1979), “Prospect Theory: An Analysis of Decision Under Risk”, Econometrica, pp. 263- 291. Keim, D. (1983), “Size-Related anomalies and stock market seasonality: further empirical evidence”, Journal of Financial Economics, vol. 12, pp. 13-32. Keim, D. (1989), “Trading patterns, bid-ask spreads and estimated security returns: The case of common stocks at calendar turning points”, Journal of Financial Economics, vol. 25, pp. 75-98. Lakonishok, J. y Levi, M. (1982), “Week-end effects on stock returns: a note”, Journal of Finance, vol. 37, pp. 883- 889. La Porta, R. (1996), “Expectations and the cross-section of stock return”, Journal of Finance (forthcoming). LeRoy, S. (1973), “Risk aversion and the maringale property of stock prices”, International Economic Review, vol. 46, No. 6, pp. 1429-1445. LeRoy, S. y Porter, R. (1981), “The present-value relation: tests based on implied variance bounds”, Econometrica, vol. 49, pp. 97−113. 4 Malkiel., B. (2003), “The efficient Market Hypothesis and Its critics”, Journal of Economic Perspectives, vol. 17, No. 1, pp. 59-82. Mehra, R. y Prescott, E. (1985), “The equity risk premium: A puzzle”, Journal of Monetary Economics, vol. 15, pp. 145-161. Mejía, J., Grados, M. y Meunier, N. (1992), “La eficiencia del mercado accionario en México”, El Trimestre Económico, vol. 59, No. 234, pp. 339-371. Merrill, A. (1966), “Behavior of prices on Wall Street”, The Analysis Press, Chappaqua, N.Y. Modigliani, F. y Cohn R. (1979), “Inflation, Rational Valuation, and the Market,” Financial Analysts Journal, vol. 35, pp. 24–44. Myers, S. (1974), “Interactions of corporate financing and investment decisionsimplications for Capital Budgeting,” Journal of Finance, vol. 29, pp. 1-25. Pankoff, L. (1968), “Market effienciency and football betting”, Journal of Business, vol. 41, pp. 203-14. Parker, R. (1968), “Discounted Cash Flow in Historical Perspective,” Journal of Accounting Research, pp. 58-71. Peavy, J., (1990), “Returns on initial public offerings of closed-end funds”, Review of Financial Studies, vol. 3, pp. 695-708. Poterba, J. y Summers, L. (1988), “Mean Reversion in Stock Prices: Evidence and Implications”, Journal of Financial Economics, vol. 22, pp. 27-59. Reinganum, M. (1983), “The anomalous stock market behavior of small firm in January: empirical tests for tax-loss selling effects”, Journal of financial Economics, vol. 12, 89104. Richards, A. (1997), “Winner – Loser reversal in National Stock Market Indices: Can they be explained?”, Journal of Finance, vol. 52, No. 5, pp. 2129-2144. Ritter, J. (1984), “The costs of going public”, Journal of Financial Economics, vol. 19, pp. 269-281. Ritter, J. (1991), “The Long-Run performance of initial public offerings”, The Journal of Finance, vol. 46, No. 1, pp. 3-27. Robert A. (1990), “High stock returns before holidays: existence and evidence on possible causes”, The Journal of Finance, vol. 45, No. 5, pp. 1611-1626. 5 Roberts, H. (1967) “Statical versus clinical prediction of the stock market”, Center for Research in Security Prices, working paper, University of Chicago. Roll, R., (1983), “vas ist das?”, Journal of Portfolio Management, vol. 9, pp. 18- 28. Rubinstein, A. (2001), “A theorist's view of experiments”, European Economic Review, vol. 45, pp. 615- 628. Samuelson P. (1965), “Proof that properly anticipated prices fluctuate randomly”, Industrial Management Review, vol. 6, pp. 41-49. Schwert, G. (1989), “Business Cycles, Financial Crises and Stock Volatility”, CarnegieRochester Conference Series on Public Policy, 31,pp. 83-125. Schwert, G. (1990), “Stock volatility and the Crash of ´87”, The Review of Financial Studies, vol. 3, No. 1, pp. 77-102. Sharpe, W. (1964), “Capital Asset Prices: A theory of Market Equilibrium under Conditions of Risk”, The Journal of Finance, vol. 19, No. 3, pp. 425-442. Shiller , R. (1979) , “The Volatility of Long-term Interest Rate and Expectations Models of the Term Structure”, Journal of Political Economy, vol. 87, pp. 1190-1219. Shiller, Robert (1981) “Do Stock Price Move Too Much to be Justified by Subsequent Changes in dividends?, American Economic Review, vol. 71, pp. 421-436. Shiller, R. (1989), Market volatility. MIT Press. Shiller, R. (2000), Irrational Exuberance, Princeton University Press. Shiller, R., (2002), “The Irrational of Markets”, The Journal of Psychology and financial Markets, vol. 3, No. 2, pp. 87-93. Summers, L. (1986), “Does the stock market rationally reflect fundamental values?”, Journal of Finance, vol. 41, No. 3, pp. 591-601. Tinic, S., Barone-Adesi, G. y West, R. (1987), “Seasonality in canadian stock prices: a test of the “Tax-Loss-Selling” hypothesis”, The Journal of Financial and Quantitative Analysis, vol. 22, No. 1, pp. 51-63. Weil, P. (1989), “The equity premium puzzle and the risk-free rate puzzle”, Journal of Monetary Economics, vol. 24, pp. 401- 421. Weiss, A. (1989), The post-offering price performance of closed-end-funds, Financial Management, vol. 18, pp. 57-67. 6 West, K. (1988), “Bubbles, fads and stock price volatility test: a partial evaluation”, Journal of Finance, vol. 43, pp. 636-656. 7