Flash Note 24/06/2016 How to act? Some points I would like you to

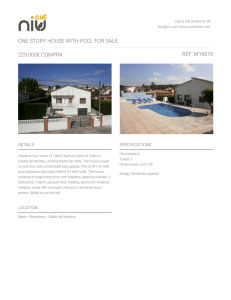

Anuncio

Flash Note 24/06/2016 Alex Fusté @AlexfusteAlex [email protected] How to act? Some points I would like you to bear in mind. Yes. The outcome of the referendum comes as a shock (rarely has a G7 currency collapsed by a -10% in a single trading session, as the pound did last night in Asia, to end at its lowest level against the US dollar since 1985). Whether the pound and the rest of financial assets will plunge further will depend on host of political developments (both in Britain and the rest of the EU). Of course, I’m referring to the negotiations to disconnect, and the terms of the agreement. If the negotiation lengthens, this will be bad sign and will end up affecting negatively the markets for longer. Nevertheless, these political events are as unpredictable as the referendum itself. As far as to the EU concept, I do not know whether this will mean a tightening of ties among the other EU countries. But if Brussels manages to achieve a clearer, tighter and transparent ties among the EU members, the Brexit could well end up being a kind of catalyst that will improve the European stage. The outcome will emerge only gradually in the months ahead. How to act? Rather than thinking on a strategic response (which in my humble opinion would not change much from our “stay in market but hedged through a dollarization of your portfolio and the use of long dated Treasury bonds by the same face value as in your risky positions” –a strategy that has worked pretty well today-) I stick now with the idea that maybe this is a time to behave tactically as well. After having protected positions in recent months, in the aftermath of today’s shock you should retain optionality to respond to whatever opportunities may emerge (for example, by unwinding some of the risky assets and the hedging assets as a way to raise cash). Este documento ha sido realizado por Andbank, principalmente para su distribución interna e inversores profesionales. Este documento no debe ser considerado como consejo de inversión ni una recomendación de compra de ningún activo, producto o estrategia. Las referencias a cualquier emisor o título, no pretenden ser ninguna recomendación de compra o venta de dichos títulos. Despite today’s dislocation in financial market, I just want you to keep this in mind: o Economic fundamentals around the world has been gradually improving since 2010, which means that a risk-on shift is fully justified under a strategic point of view. o Nevertheless, this risk-on thesis should be suspended temporarily right now. Prospects for trade, investment, banking stability, etc. will be affected in the upcoming weeks since the UK is a significant part of the global system. It is to be seen how this situation affects to the property values (to whom the British banking system is exposed). o It is politics, rather than economic data, that will set the course of financial markets. o At some point in time, these political and economic tensions will stabilize, and the “slap to Brussels” could ultimately have positive outcomes if new leaders and economic authorities come forward with more transparent and constructive ideas. Although, admittedly, these benefits may become apparent after some previous turbulence. In summary, remain protected (being in financial markets, but fully hedged through the instruments I’ve mentioned), but now with a higher degree of optionality (This is, unwinding a portion of your portfolio, both in the risky and the hedging part). Regards, Alex Fusté Chief Economist Andbank Este documento ha sido realizado por Andbank, principalmente para su distribución interna e inversores profesionales. Este documento no debe ser considerado como consejo de inversión ni una recomendación de compra de ningún activo, producto o estrategia. Las referencias a cualquier emisor o título, no pretenden ser ninguna recomendación de compra o venta de dichos títulos.