To Acquire Florida`s Portfolio (Office Building) 07012015.pub

Anuncio

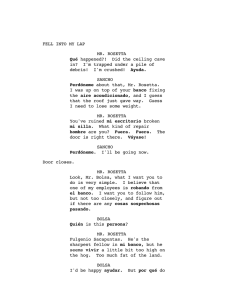

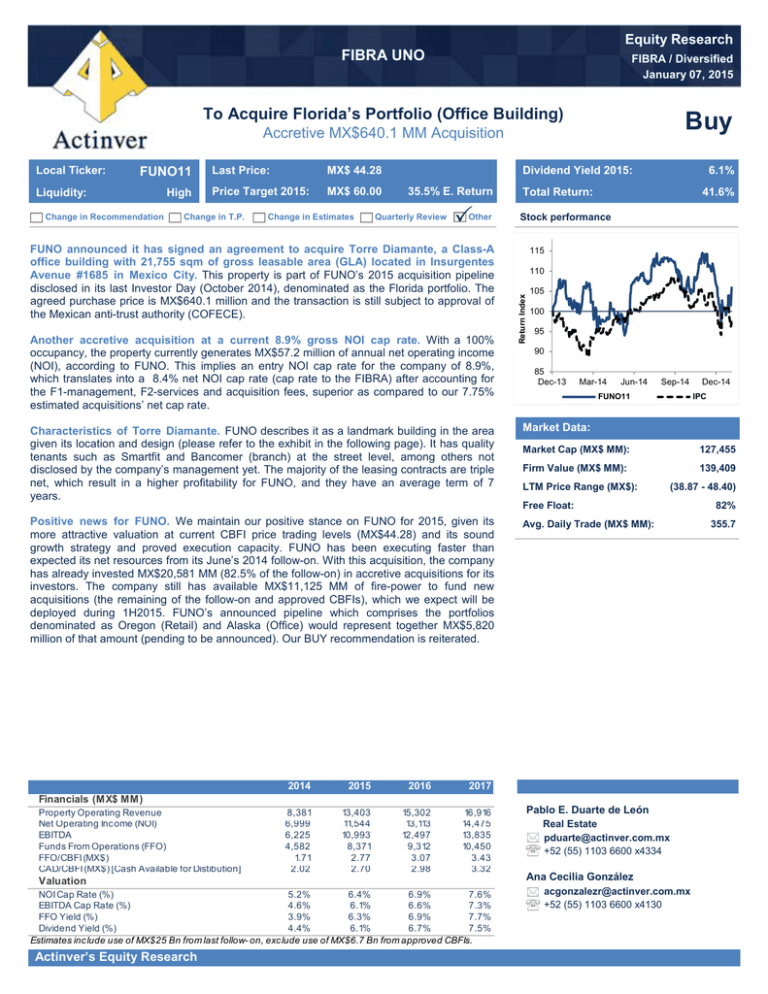

Equity Research FIBRA UNO FIBRA / Diversified January 07, 2015 To Acquire Florida’s Portfolio (Office Building) Buy Accretive MX$640.1 MM Acquisition FUNO11 Liquidity: Change in Recommendation High Last Price: MX$ 44.28 Price Target 2015: MX$ 60.00 Change in T.P. Change in Estimates Dividend Yield 2015: 35.5% E. Return Quarterly Review Other FUNO announced it has signed an agreement to acquire Torre Diamante, a Class-A office building with 21,755 sqm of gross leasable area (GLA) located in Insurgentes Avenue #1685 in Mexico City. This property is part of FUNO’s 2015 acquisition pipeline disclosed in its last Investor Day (October 2014), denominated as the Florida portfolio. The agreed purchase price is MX$640.1 million and the transaction is still subject to approval of the Mexican anti-trust authority (COFECE). Another accretive acquisition at a current 8.9% gross NOI cap rate. With a 100% occupancy, the property currently generates MX$57.2 million of annual net operating income (NOI), according to FUNO. This implies an entry NOI cap rate for the company of 8.9%, which translates into a 8.4% net NOI cap rate (cap rate to the FIBRA) after accounting for the F1-management, F2-services and acquisition fees, superior as compared to our 7.75% estimated acquisitions’ net cap rate. 41.6% Stock performance 115 110 105 100 95 90 85 Dec-13 Mar-14 Jun-14 Market Data: Positive news for FUNO. We maintain our positive stance on FUNO for 2015, given its more attractive valuation at current CBFI price trading levels (MX$44.28) and its sound growth strategy and proved execution capacity. FUNO has been executing faster than expected its net resources from its June’s 2014 follow-on. With this acquisition, the company has already invested MX$20,581 MM (82.5% of the follow-on) in accretive acquisitions for its investors. The company still has available MX$11,125 MM of fire-power to fund new acquisitions (the remaining of the follow-on and approved CBFIs), which we expect will be deployed during 1H2015. FUNO’s announced pipeline which comprises the portfolios denominated as Oregon (Retail) and Alaska (Office) would represent together MX$5,820 million of that amount (pending to be announced). Our BUY recommendation is reiterated. Avg. Daily Trade (MX$ MM): 2015 2016 2017 8,381 6,999 6,225 4,582 1.71 2.02 13,403 11,544 10,993 8,371 2.77 2.70 15,302 13,113 12,497 9,312 3.07 2.98 16,916 14,475 13,835 10,450 3.43 3.32 Sep-14 FUNO11 Characteristics of Torre Diamante. FUNO describes it as a landmark building in the area given its location and design (please refer to the exhibit in the following page). It has quality tenants such as Smartfit and Bancomer (branch) at the street level, among others not disclosed by the company’s management yet. The majority of the leasing contracts are triple net, which result in a higher profitability for FUNO, and they have an average term of 7 years. 2014 6.1% Total Return: Return Index Local Ticker: Market Cap (MX$ MM): 127,455 Firm Value (MX$ MM): 139,409 LTM Price Range (MX$): (38.87 - 48.40) Free Float: Financials (MX$ MM) Property Operating Revenue Net Operating Inc ome (NOI) EBITDA Funds From Operations (FFO) FFO/CBFI (MX$) CAD/CBFI (MX$) [Cash Available for Distibution] Valuation NOI Cap Rate (%) 5.2% 6.4% 6.9% 7.6% EBITDA Cap Rate (%) 4.6% 6.1% 6.6% 7.3% FFO Yield (%) 3.9% 6.3% 6.9% 7.7% Dividend Yield (%) 4.4% 6.1% 6.7% 7.5% Estimates inc lude use of MX$25 Bn from last follow- on, exc lude use of MX$6.7 Bn from approved CBFIs. Actinver’s Equity Research Dec-14 IPC Pablo E. Duarte de León Real Estate [email protected] +52 (55) 1103 6600 x4334 Ana Cecilia González [email protected] +52 (55) 1103 6600 x4130 82% 355.7 Torre Diamante GBM Corp. Prisma Torre Diamante SFP Source: Google Earth, Actinver. Actinver’s Equity Research 2 Equity, Economic, Quantitative and Fixed Income Research Departments Equity Research Gustavo Terán Durazo, CFA Senior Analysts Martín Lara Head of EquityResearch (52) 55 1103-6600 x1193 [email protected] Telecommunications, Media and Financials (52) 55 1103-6600x1840 [email protected] (52) 55 1103-6600 x4134 [email protected] Consumption Carlos Hermosillo Bernal Pablo Duarte de León FIBRAs (REITs) (52) 55 1103-6600 x4334 [email protected] Ramón Ortiz Reyes Cement, Construction and Concessions (52) 55 1103-6600 x1835 [email protected] Federico Robinson Bours Carrillo Energy, Conglomerates, Industrial and Mining (52) 55 1103-6600 x4127 [email protected] Juan Ponce Telecommunications, Media and Financials (52) 55 1103-6600x1693 jponce@actinver,com.mx Ana Cecilia González Rodríguez FIBRAs (REITs) (52) 55 1103-6600x4136 [email protected] Enrique Octavio Camargo Delgado Energy, Conglomerates, Industrial and Mining (52) 55 1103-6600x1836 [email protected] José Antonio Cebeira González Consumption (52) 55 1103-6600x1394 [email protected] Junior Analysts Economic and Quantitative Research Ismael Capistrán Bolio Head of Economic and Quantitative Research Jaime Ascencio Aguirre Economy and Markets Santiago Hernández Morales Quantitative Research Roberto Ramírez Ramírez Quantitative Research Roberto Galván González Technical Research (52) 55 1103-6600 x1487 (52) 55 1103-6600 x793325 (52) 55 1103-6600 x4133 (52) 55 1103-6600x1672 (52) 55 1103 -66000 x5039 [email protected] [email protected] [email protected] [email protected] [email protected] Fixed Income Research Araceli Espinosa Elguea Head of Fixed Income Research (52) 55 1103 -66000 x6641 [email protected] Jesús Viveros Hernández Fixed Income Research (52) 55 1103 -66000 x6649 [email protected] (52) 55 1103-6600 x4132 [email protected] Mauricio Arellano Sampson Actinver’s Equity Research Fixed Income Research 3 Disclaimer Guide for recommendations on investment in the companies under coverage included or not, in the Mexican Stock Exchange main Price Index (IPC) • StrongBuywith an extraordinary perspective. According to the analyst, in the next twelve months, the valuations of stock and/or prospects for the sector are EXTREMELY FAVORABLE • Buy. According to the analyst, in the next twelve months, the stock’s valuation and / or prospects for the sector are VERY FAVORABLE • Neutral. According to the analyst, in the next twelve months, the valuation of stock and / or sector ARE NEUTRAL OR FAVORABLE but with a similar perspective to the IPC • Belowmarket. According to the analyst, in the next twelve months, the valuation of stock and / or sector outlook ARE NOT POSITIVE • Sell. According to the analyst, in the next twelve months, the valuation of stock and / or sector outlook ARE NEGATIVE, or likely to worsen • In reviewwith positive outlook • In review with negative or unfavorable perspective ImportantStatements. a) Of theAnalysts: “The analysts in charge of producing the Analysis Reports: Jaime Ascencio Aguirre; Mauricio Arellano Sampson; Enrique Octavio Camargo Delgado; Ismael Capistrán Bolio; Pablo Enrique Duarte de León; Araceli Espinosa Elguea; Roberto Galván González; Ana Cecilia González Rodríguez; Carlos Hermosillo Bernal; Santiago Hernández Morales; Martín Roberto Lara Poo; Ramón Ortiz Reyes; Juan Enrique Ponce Luiña; Federico Robinson Bours Carrillo; Gustavo Adolfo Terán Durazo; Jesús Viveros Hernández, declare”: b) 1. "All points of view about the issuers under coverage correspond exclusively to the responsible analyst and authentically reflect his vision. All recommendations made by analysts are prepared independently of any institution, including the institution where the services are provided or companies belonging to the same financial or business group. The compensation scheme is not based or related, directly or indirectly, with any specific recommendation and the remunerationis only received from the entity which the analysts provide their services. 2. "None of the analysts with coverage of the issuers mentioned in this report holds any office, position or commission at issuers underhis coverage, or any of the people who are part of the Business Group or consortium to which they belong. They have neither held any position during the twelve months prior to the preparation of this report. " 3. "Recommendations on issuers, made by the analyst who covers them, are based on public information and there is no guarantee of their assertiveness regarding the performance that is actually observed in the values object of the recommendation" 4. "Analysts maintain investments subject to their analysis reports on the following issuers: AC, ALFA, ALPEK, ALSEA, AMX,AZTECA, CEMEX, CHDRAUI, FEMSA, FIBRAMQ, FINDEP, FUNO, GENTERA, GFREGIO, GRUMA, ICA, IENOVA, KOF, LAB, LIVEPOL, MEXCHEM, OHLMEX,POCHTEC, TLEVISA,SORIANA, SPORTS, VESTA, WALMEX. On Actinver Casa de Bolsa, S.A. de C.V. Grupo Financiero Actinver 1. Actinver Casa de Bolsa, S.A. de C.V. GrupoFinanciero Actinver, under any circumstance shall ensure the sense of the recommendations contained in the reports of analysis to ensure future business relationship. 2. All Actinver Casa de Bolsa, SA de C.V. GrupoFinanciero Actinver business units can explore and do business with any company mentioned in documents of analysis. All compensation for services given in the past or in the future, received by Actinver Casa de Bolsa, SA de C.V. GrupoFinanciero Actinver by any company mentioned in this report has not had and will not have any effect on the compensation paid to the analysts. However, just like any other employee of Actinver Group and its subsidiaries, the compensation being enjoyed by our analysts will be affected by the profitability gained by Actinver Group and its subsidiaries. 3. At the end of each of the previous three months, Actinver Casa de Bolsa, SA de C.V. Actinver Financial Group, has not held any investments directly or indirectly in securities or financial derivatives, whose underlying are Securities subject of the analysis reports, representing one percent or more of its portfolio of securities, investment portfolio, outstanding of the Securities or the underlying value of the question, except for the following: * AEROMEX, BOLSA A, FINN 13, FSHOP 13, SMARTRC14. 4. Certain directors and officers of Actinver Casa de Bolsa, SA de C.V. GrupoFinanciero Actinver occupy a similar position at the following issuers: AEROMEX, MASECA, AZTECA, ALSEA, FINN, MAXCOM, SPORTS, FSHOP and FUNO. This report will be distributed to all persons who meet the profile to acquire the type of values that is recommended in its content. To see our analysts change of recommendations click here. Actinver’s Equity Research 4