BGAF Fund Termsheet (English / Español, A4)

Anuncio

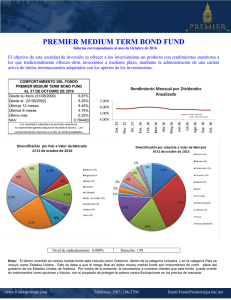

BAFFIN GLOBAL ALLOCATION FUND Ltd. A fund managed by Baffin Advisors LLC baffinadvisors.com The Fund Baffin Global Allocation Fund Ltd. is an exempted company, incorporated and existing under the laws of the Cayman Islands. The investment adviser of the Fund, Baffin Advisors LLC, is a NY based registered investment adviser with the U.S. Securities and Exchange Commission since August 2009. The Adviser is the portfolio manager of the Fund. All of the Fund’s custodial and bank accounts are held in US financial institutions. Subscriptions and redemptions are executed within the US financial system. Strategy Objectives The Fund’s investment objective is to preserve capital and generate attractive risk-adjusted returns over the medium-term. The Adviser will employ a global macro asset allocation investment strategy based on a fundamental medium-term view of the world, with an emphasis on diversification across geographic regions, currencies and asset classes. The Adviser’s analytical process is top-down in nature. The Funds primary investments are expected to include interests in index-tracking and other ETF, bonds, and currencies. Futures and options could be used for hedging purposes. The Adviser applies risk controls in the management of the Fund’s portfolio. The Adviser utilizes dynamic asset allocation by analyzing global information contemporaneously as events occur and assessing the consistency of a well structured view of the world with the composition of the Fund’s portfolio. Portfolio Manager Martin Anidjar’s academic background and his work experience enable him to provide best of breed investment management. His working experience both in trading and in research makes him exceptional in his understanding of all the dimensions involved in portfolio management. Mr. Anidjar set up and ran the emerging markets segment of a proprietary trading desk at UBS during 2007-2009 and he was a senior trader at the local markets trading desk of Morgan Stanley during 2005-2007. In terms of his research experience, Mr. Anidjar was responsible for JPMorgan’s Asia sovereign research strategy and later JPMorgan’s Latin Local Markets team during 1998-2004. Mr. Anidjar received his PhD in Economics from the University of Chicago in 1998. He received a magnacum-laude B.A. in Economics from Universidad de San Andrés in 1993. Other Details Prime Broker; Custodian................................................... Oppenheimer & Co. Inc. Administrator................................................................... Maples Fund Services (Cayman) Limited Auditor.............................................................................. Deloitte & Touche Fees Type of Shares Investment Range Annual Fee ISIN Class A U.S.$100,000 - 5,000,000 1.40% KYG0697M1024 Class B U.S.$5,000,000 - 10,000,000 1.00% KYG0697M1107 Class C U.S.$10,000,000 and more 0.75% KYG0697M1289 All shares have an additional 0.1% administrative fee. There are no other fees. All business expenses incurred in the organization and formation of the Fund will be borne by the Adviser. Subscription Fund shareholders will have the right to subscribe at no cost and redeem any or all of their Common Shares Redemption at no cost on a monthly basis. In addition, investors also have weekly liquidity upon request subject to a minimum redemption fee. Risk Factors An investment in the Common Shares is subject to various risks. Some of those risks are related to the risky nature of all securities, their volatility and liquidity; as well as other risks related to the Portfolio Manager decisions, such as the allocation decisions, instrument selection and timing. As in most other financial investments, there can be no assurance that the Fund will be profitable or that it will not incur losses. This document does not constitute an offer of investment advisory services by the Adviser or any of its affiliates. This document has been prepared for informational purposes only, and it is not intended to provide specific investment advice or recommendations to any particular recipient. This document does not constitute an offer of Common Shares in the Fund; any such offering will be made solely pursuant to the Fund’s explanatory memorandum. An investment in the Common Shares of the Fund is suitable only for qualified investors that fully understand the risks of such an investment. Before making an investment in the Common Shares of the Fund, investors are advised to thoroughly and carefully review the Fund’s explanatory memorandum with their financial, legal and tax advisors to determine whether an investment is suitable for them. BAFFIN GLOBAL ALLOCATION FUND Ltd. Un fondo gestionado por Baffin Advisors LLC baffinadvisors.com El Fondo Baffin Global Fund Ltd. es una compañía exenta, incorporada y existente bajo las leyes de las Islas Cayman. La Administradora del Fondo, Baffin Advisors LLC, está basada en Nueva York y se encuentra registrada ante la SEC (Securities and Exchange Commission) desde Agosto del 2009. Todas las cuentas bancarias y de custodia del Fondo se encuentran en instituciones financieras de Estados Unidos. Asimismo, las subscripciones y retiros del Fondo son ejecutados dentro del sistema financiero de Estados Unidos. Estrategia Objetivos El objetivo de inversión del Fondo es preservar el capital y generar en el mediano plazo retornos de capital atractivos, ajustados por el riesgo. La Administradora empleará una estrategia de inversión basada en “global macro asset allocation”, el enfoque comienza con el análisis de la macro global, las grandes tendencias, y culmina en la selección de instrumentos. La Administradora del Fondo ejecuta una visión de mediano plazo con un marcado énfasis en la diversificación regional, monedas y tipos de activos. El proceso analítico es “top down”. El Fondo invertirá en activos líquidos y eficientes, principalmente en índices y ETF, monedas, commodities, futuros y opciones. La Administradora cuenta con fuertes controles de riesgo en el manejo del Fondo, utiliza una estrategia de inversión dinámica analizando la información mundial y re-evaluando las implicancias para el manejo del portafolio y su composición de activos. Portfolio Manager Martín Anidjar posee una excelente combinación de solidez académica y desempeño en el mundo de las finanzas internacionales. En particular, su experiencia en trading y en research lo dotan de una comprensión de todas las dimensiones necesarias para la administración de fondos. Martín Anidjar lideró un negocio propietario de trading de mercados emergentes de UBS entre 2007-2009 y se desempeñó como un senior trader de mercados locales en Morgan Stanley durante 2005-2007. Martín Anidjar fue responsable de cubrir research y estrategia soberana asiática en JPMorgan y luego, lideró el equipo de mercados locales de latinoamérica de JPMorgan 1998-2004. Martín Anidjar recibió su Doctorado en Economía de la Universidad de Chicago en 1998, y su Licenciatura en Economía ‘magna cum laude’ en la Universidad de San Andrés en 1993. Otros Aspectos Prime Broker; Custodio................................................... Oppenheimer & Co. Inc. Administrador (NAV, entradas y salidas)............................ Maples Fund Services (Cayman) Limited Auditor.............................................................................. Deloitte & Touche Costos Clase de Acciones Rango de Inversión Comisión Anual ISIN Clase A U.S.$100.000 - 5.000.000 1,4% KYG0697M1024 Clase B U.S.$5.000.000 - 10.000.000 1,0% KYG0697M1107 Clase C U.S.$10.000.000 o más 0,75% KYG0697M1289 Todas las acciones están sujetas a un gasto administrativo de 0,1%. No existen costos adicionales. Todos los gastos relacionados a la organización y creación del Fondo son costeados por la Administradora, Baffin Advisors LLC. Entrada y Salida Los inversores podrán comprar acciones sin incurrir costos de entrada. También podrán venderlas sin costos de salidas mensualmente. Además, los inversores podrán liquidar sus acciones en períodos semanales con un costo mínimo nominal. Riesgos Invertir en Acciones Ordinarias de un Fondo de Inversiones, conlleva diversos riesgos. Algunos relacionados con la naturaleza, léase rendimiento, volatilidad y liquidez, de los activos e instrumentos financieros en los que invertirá el Fondo; y otros relacionados con las decisiones de inversión que tome el Portfolio Manager del Fondo (selección de tales activos y timing de tales decisiones). De allí que no se pueda garantizar que el Fondo será rentable o que no incurrirá en pérdidas. Por favor, referirse al aviso legal del otro lado de la hoja.