Asuntos que se someten a la aprobación del Consejo

Anuncio

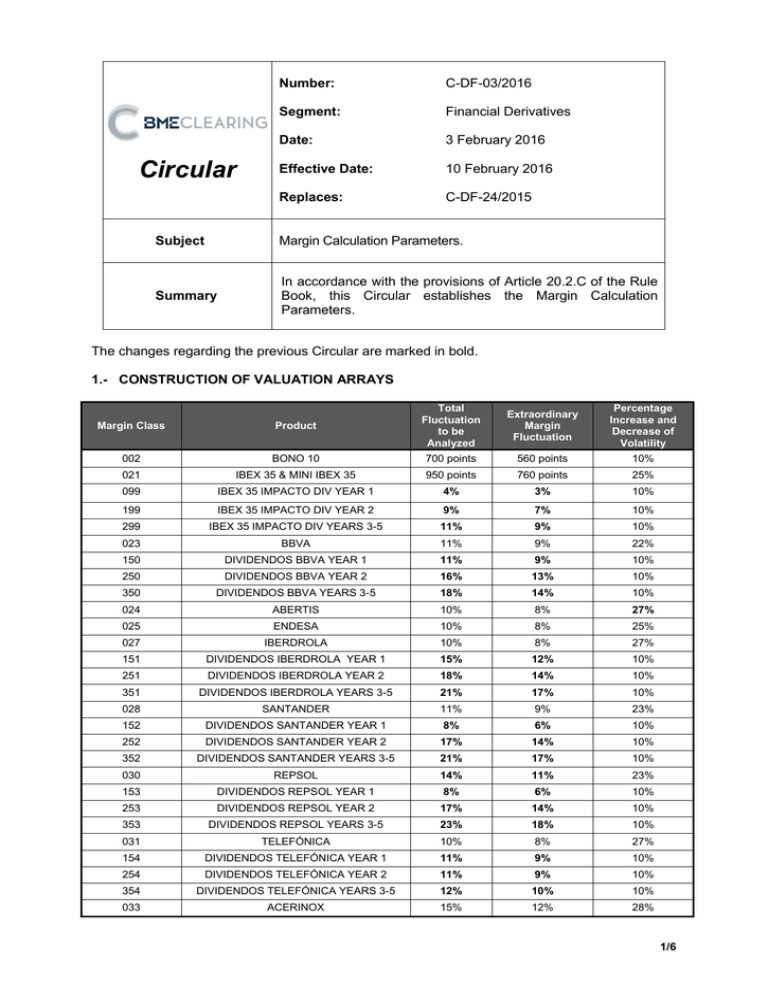

Circular Number: C-DF-03/2016 Segment: Financial Derivatives Date: 3 February 2016 Effective Date: 10 February 2016 Replaces: C-DF-24/2015 Subject Margin Calculation Parameters. Summary In accordance with the provisions of Article 20.2.C of the Rule Book, this Circular establishes the Margin Calculation Parameters. The changes regarding the previous Circular are marked in bold. 1.- CONSTRUCTION OF VALUATION ARRAYS Margin Class Product Total Fluctuation to be Analyzed Extraordinary Margin Fluctuation Percentage Increase and Decrease of Volatility 002 BONO 10 700 points 560 points 10% 021 IBEX 35 & MINI IBEX 35 950 points 760 points 25% 099 IBEX 35 IMPACTO DIV YEAR 1 4% 3% 10% 199 IBEX 35 IMPACTO DIV YEAR 2 9% 7% 10% 299 IBEX 35 IMPACTO DIV YEARS 3-5 11% 9% 10% 023 BBVA 11% 9% 22% 150 DIVIDENDOS BBVA YEAR 1 11% 9% 10% 250 DIVIDENDOS BBVA YEAR 2 16% 13% 10% 350 DIVIDENDOS BBVA YEARS 3-5 18% 14% 10% 024 ABERTIS 10% 8% 27% 025 ENDESA 10% 8% 25% 027 IBERDROLA 10% 8% 27% 151 DIVIDENDOS IBERDROLA YEAR 1 15% 12% 10% 251 DIVIDENDOS IBERDROLA YEAR 2 18% 14% 10% 351 DIVIDENDOS IBERDROLA YEARS 3-5 21% 17% 10% 028 SANTANDER 11% 9% 23% 152 DIVIDENDOS SANTANDER YEAR 1 8% 6% 10% 252 DIVIDENDOS SANTANDER YEAR 2 17% 14% 10% 352 DIVIDENDOS SANTANDER YEARS 3-5 21% 17% 10% 030 REPSOL 14% 11% 23% 153 DIVIDENDOS REPSOL YEAR 1 8% 6% 10% 253 DIVIDENDOS REPSOL YEAR 2 17% 14% 10% 353 DIVIDENDOS REPSOL YEARS 3-5 23% 18% 10% 031 TELEFÓNICA 10% 8% 27% 154 DIVIDENDOS TELEFÓNICA YEAR 1 11% 9% 10% 254 DIVIDENDOS TELEFÓNICA YEAR 2 11% 9% 10% 354 DIVIDENDOS TELEFÓNICA YEARS 3-5 12% 10% 10% 033 ACERINOX 15% 12% 28% 1/6 Margin Class Product Total Fluctuation to be Analyzed Extraordinary Margin Fluctuation Percentage Increase and Decrease of Volatility 034 BANCO POPULAR 14% 11% 15% 035 BANKINTER 12% 10% 18% 037 GAS NATURAL 10% 8% 21% 038 INDRA 12% 10% 18% 041 AMADEUS 10% 8% 24% 043 INDITEX 10% 8% 21% 155 DIVIDENDOS INDITEX YEAR 1 10% 8% 10% 255 DIVIDENDOS INDITEX YEAR 2 10% 8% 10% 355 DIVIDENDOS INDITEX YEARS 3-5 11% 9% 10% 045 ACS 12% 10% 25% 046 BANCO SABADELL 14% 11% 15% 047 G FERROVIAL 10% 8% 26% 048 ACCIONA 12% 10% 22% 050 SACYR VALLEH. 16% 13% 15% 051 FCC 19% 15% 15% 052 ENAGAS 10% 8% 25% 053 REE 10% 8% 20% 054 GAMESA 16% 13% 18% 056 MEDIASET 13% 10% 16% 057 CORP. MAPFRE 10% 8% 35% 058 ATRESMEDIA 15% 12% 18% 060 NH HOTELES 15% 12% 15% 067 BME 10% 8% 22% 068 GRIFOLS 10% 8% 23% 072 ARCELOR MITTAL 22% 18% 16% 073 TEC. REUNIDAS 10% 8% 18% 074 OBRASCON HUARTE 18% 14% 20% 076 EBRO FOODS 10% 8% 24% 078 IAG 14% 11% 20% 080 CAIXABANK 12% 10% 20% 081 BANKIA 15% 12% 16% 082 DIA 10% 8% 21% 084 ABENGOA B 50% 40% 19% 085 VISCOFAN 10% 8% 28% 087 AENA 15% 12% 25% NOTE: Stock Dividend Futures Intervals are applied to both contract sizes. Circular C-DF-03/2016 2/6 Comments on the above table For Class 021 the price fluctuation (up and down) is stated in price points. For the other Margin Classes the price fluctuation is stated as a percentage of the closing price of the Underlying asset, equal to the closing price of the respective future on expiration if available; If not, equal to the closing price of the shares on the Stock Exchange capitalized on the expiration date, less estimated dividends. For all Margin Classes the percentage increase and decrease of volatility is multiplied by the volatility. Number of columns Classes from 021 to 087: Classes 002, and from 099 to 355: 11 3 Interest Rate For each option contract, the interest rate corresponding to the number of days remaining between the valuation date and the option’s expiration date will be used. Time to Expiration Number of days between the session date and the option’s expiration date, taking an annual basis of 365 days, if the annualized period is greater than 365 days, and 360 days otherwise. Dividends When valuating American stock options MEFF will use the estimated dividends for each Underlying included from Classes 023 to 355. Options Contract Deltas A different delta for each volatility scenario and Underlying price is used for all Margin Classes. Options Pricing Model Class 021: Black option pricing model. Classes from 023 to 087: For American stock Options the Binomial option pricing model is used, considering a number of time steps equal to 50. For European stock Options included in these groups, the Black & Scholes option pricing model will apply. 2.- APPLICATION OF THE VALUATION ARRAYS TO OPEN POSITIONS Multiplier Classes 021 (IBEX 35), 099, 199, 299 (IBEX 35 DIV IMPACT) ) and 002 (BONO 10): 10 Class 021 (MINI IBEX 35): 1 Classes from 023 to 355 (Except Classes 099, 199 and 299): Circular C-DF-03/2016 Contract Nominal 3/6 3.- TIME SPREAD MARGINS Variable Time Spread Margin Products 2 BONO 10 Minimum spread margin 160 points 21 IBEX 35 & MINI IBEX 35 20 points 1.2 23 BBVA 0.20 euro 1.2 24 ABERTIS 0.23 euro 1.2 25 ENDESA 1.25 euro 1.2 27 IBERDROLA 0.2 euro 1.2 28 SANTANDER 0.23 euro 1.2 30 REPSOL 0.20 euro 1.2 31 TELEFÓNICA 0.34 euro 1.2 33 ACERINOX 0.38 euro 1.2 34 BANCO POPULAR 0.36 euro 1.2 Margin Class Circular C-DF-03/2016 Product Factor 1.2 35 BANKINTER 0.2 euro 1.2 37 GAS NATURAL 0.40 euro 1.2 38 INDRA 1.29 euro 1.2 41 AMADEUS 0.2 euro 1.2 43 INDITEX 0.2 euro 1.2 45 ACS 0.2 euro 1.2 46 BANCO SABADELL 0.2 euro 1.2 47 G FERROVIAL 0.23 euro 1.2 48 ACCIONA 8.87 euro 1.2 50 SACYR VALLEH. 0.33 euro 1.2 51 FCC 2.67 euro 1.2 52 ENAGAS 0.2 euro 1.2 53 REE 0.2 euro 1.2 54 GAMESA 0.2 euro 1.2 56 MEDIASET 0.37 euro 1.2 57 CORP. MAPFRE 0.2 euro 1.2 58 ATRESMEDIA 0.23 euro 1.2 60 NH HOTELES 0.38 euro 1.2 67 BME 0.82 euro 1.2 68 GRIFOLS 0.21 euro 1.2 72 ARCELOR MITTAL 2.08 euro 1.2 73 TEC. REUNIDAS 0.60 euro 1.2 74 OBRASCON HUARTE 0.2 euro 1.2 76 EBRO FOODS 0.2 euro 1.2 78 IAG 0.2 euro 1.2 80 CAIXABANK 0.2 euro 1.2 81 BANKIA 0.2 euro 1.2 82 DIA 0.2 euro 1.2 84 ABENGOA B 0.2 euro 1.2 85 VISCOFAN 0.95 euro 1.2 87 AENA 0.2 euros 1.2 4/6 Fixed Time Spread Margin Products Margin Class Product Spread Fixed Margin 99 IBEX 35 IMPACTO DIV YEAR 1 130 b.p. 199 IBEX 35 IMPACTO DIV YEAR 2 130 b.p. 299 IBEX 35 IMPACTO DIV YEARS 3-5 130 b.p. 150 DIVIDENDOS BBVA YEAR 1 0.05 euro 250 DIVIDENDOS BBVA YEAR 2 0.06 euro 350 DIVIDENDOS BBVA YEARS 3-5 0.07 euro 151 DIVIDENDOS IBERDROLA YEAR 1 0.03 euro 251 DIVIDENDOS IBERDROLA YEAR 2 0.05 euro 351 DIVIDENDOS IBERDROLA YEARS 3-5 0.06 euro 152 DIVIDENDOS SANTANDER YEAR 1 0.12 euro 252 DIVIDENDOS SANTANDER YEAR 2 0.25 euro 352 DIVIDENDOS SANTANDER YEARS 3-5 0.31 euro 153 DIVIDENDOS REPSOL YEAR 1 0.08 euro 253 DIVIDENDOS REPSOL YEAR 2 0.09 euro 353 DIVIDENDOS REPSOL YEARS 3-5 0.14 euro 154 DIVIDENDOS TELEFÓNICA YEAR 1 0.08 euro 254 DIVIDENDOS TELEFÓNICA YEAR 2 0.12 euro 354 DIVIDENDOS TELEFÓNICA YEARS 3-5 0.12 euro 155 DIVIDENDOS INDITEX YEAR 1 0.10 euro 255 DIVIDENDOS INDITEX YEAR 2 0.10 euro 355 DIVIDENDOS INDITEX YEARS 3-5 0.14 euro 4.- INTER-COMMODITY SPREAD CREDITS Inter-commodity spread credits, expressed as percentages, are shown in the following table: Priority Classes (Underlying) Deltas for 1 spread Margin Credit 1st IBEX 35 / BBVA 87 / 100,000 55% / 55% 2nd BBVA / BSAN 72 / 100 50% / 50% 3rd IBEX 35 / BSAN 75 / 100,000 50% / 50% 4th IBEX 35 / BANKINTER 61 / 100,000 30% / 30% 5th IBEX 35 / INDITEX 292 / 100,000 30% / 30% 6th IBEX 35 / MAPFRE 26 / 100,000 25% / 25% 7th CAIXABANK / B.SABADELL 48 / 100 25% / 25% 8th IBEX 35 / TELEFONICA 103 / 100,000 20% / 20% 9th IBEX 35 / B.SABADELL 22 / 100,000 20% / 20% 10th IBEX 35 / ACS 287 / 100,000 20% / 20% 11th B.SABADELL / BBVA 225 / 100 20% / 20% 12th B.SABADELL / BSAN 185 / 100 20% / 20% Circular C-DF-03/2016 5/6 5.- DETERMINATION OF THE INITIAL MARGIN AT ACCOUNT LEVEL Initial Margins are jointly calculated for all Margin Classes. 6.- INCREASE OF THE INITIAL MARGIN PARAMETERS DEPENDING ON THE RESULT OF THE RETROSPECTIVE TESTS According to Article 49 (EU) Regulation 648 / 2012, which defines the performance of back testing, developed in the BME CLEARING’s Back Testing Instruction, and Article 56 (1) of the Delegated Regulation (EU) 153 / 2013, if at any time the daily back tests performed would prove that the initial margin coverage does not reach the confidence level that the CCP must achieve, initial margin parameters included in this Circular can be immediately increased. Circular C-DF-03/2016 6/6