payment systems - Banco Central del Ecuador

Anuncio

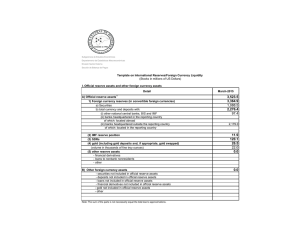

UNIFIED SYSTEM FOR REGIONAL COMPENSATION PAYMENT SYSTEMS The payment system is an operational network. The payment system is the infrastructure established to effect the transfer of monetary value between countries discharging mutual obligations. It is mainly used for transfering values from international trade fast and efficiently. The payment transactions are accumulated in the accounts of each country. At the end of a given period (previously agreed) all the transactions are settled across accounts showing a surplus or defict balance for each country. REGIONAL PAYMENT SYSTEMS Latin American Integration Association It is a payment mechanism that lies within this international and regional organization formed by 12 countries from South America. This mechanism allows electronic funds transfering. The funds come from international trade. Features: • The commercial operation is agreed in USD. • The final settlement between Central Banks is done in USD. • There might be a comission fee. It depends on each country s policy. System in local Currencies It is a payment mechanism signed between Argentina and Brazil. It allows argentinian and brazilian exporters and importers to transfer funds electronically. Features: • The Commercial operation is agreed in local currency of the exporting country. • The final settlement between Central Banks is done in USD . • Fees are charged to authorized entities when it comes to returns. General Benefits Reduces the time For international payments (in real time) Allows the use of the local currency in their Payments and collections of Foreign trade Simplifies the Commercial and Financial Transactions between importer and Exporter Provides security In the settlement of Payments through a Robust and reliable system Eliminates Transaction costs and Mitigate currency risks Supports the insertion of SMES and associative Enterprises with Foreign trade Helps to optimize the Cash flows of the Business STRUCTURE AND OPERATION SCHEME System Structure Regional Monetary Council Unit of Account “sucre” Agent Bank – Clearing House For the exclusive use of the Central Banks of the member countries Reserve Fund and Regional Convergence Central Banks DETALLE PARA REALIZAR OPERACIONES POR EL SUCRE Importer and Exporter agree the transaction (currency; method of payment, other terms and conditions). Importer and Exporter sign the commercial contract: including the payment through SUCRE clause, or proforma invoice issued by the exporter which shall be submitted by the importer to the Authorized Bank. Importer and Exporter obtained the permits required in their countries to foreign trade operations . SETTLEMENT PAYMENT IN LOCAL CURRENCY VENEZUELA BOLIVIA, CUBA, ECUADOR, NICARAGUA 3 TRANSFER IN “SUCRES” (XSU) CENTRAL BANK OF VENEZUELA 4 2 SEND THE BOLÍVARES TO THE CENTRAL BANK OF VENEZUELA CONVERTS THE XSU IN LOCAL CURRENCY AND DEPOSITS THEM IN THE ACCOUNT OF THE EXPORTER VENEZUELAN AUTHORIZED BANK AUTHORIZED BANKS IN BOLIVIA, CUBA, ECUADOR, NICARAGUA 5 1 PAYMENT IN BOLÍVARES VENEZUELAN IMPORTER CENTRAL BANK OF BOLIVIA, CUBA, ECUADOR, NICARAGUA PAYS IN BOB,, NIO, USD (LOCAL CURRENCY FROM EACH COUNTRY) BOLIVIAN, CUBAN, NICARAGUAN OR ECUATORIAN EXPORTER AUTHORIZED BANKS TO OPERATE IN THE SUCRE SYSTEM 1. Banco del Pichincha 2. Banco Capital 3. Banco de Machala 4. Banco Sudamericano 5. PRODUBANCO 6. Banco Internacional 7. Banco Nacional de Fomento 8. Banco del Pacífico 9. Banco Central del Ecuador 10. Banco Amazonas 11. PROMERICA 12. Cooperativa de Ahorro y Crédito de la Cámara de Comercio de Ambato 13. Cooperativa de Ahorro y Crédito “El Discapacitado” 14. Financiera de la República, FIRESA In an import operation creates a debit authorization (resource mobilization) EVOLUTION OF THE OPERATIONS EVOLUTION OF THE OPERATIONS 2013 SUCRE: Transfers channelled by Ecuador Period 2010 – 2013, in millons of USD 834.7 822.9 219.1 2.5 2010* 75.7 43.2 4.7 2011 POR EXPORTACIONES 5.6 2012 POR IMPORTACIONES */Ecuador started its operations in the SUCRE on July 6th, 2010 2013 CONTACT US Verónica Coronel [email protected] (02) 2572-522 ext. 2564 Romeo Carrión [email protected] (02) 2572-522 ext. 2119 Carolina Garzón [email protected] (02) 2572-522 ext. 4042 Ilich Aguirre [email protected] (02) 2572-522 ext. 2880 www.bce.ec