CAPITULO 14 Ejercicios - Facultad de Contaduría y Administración

Anuncio

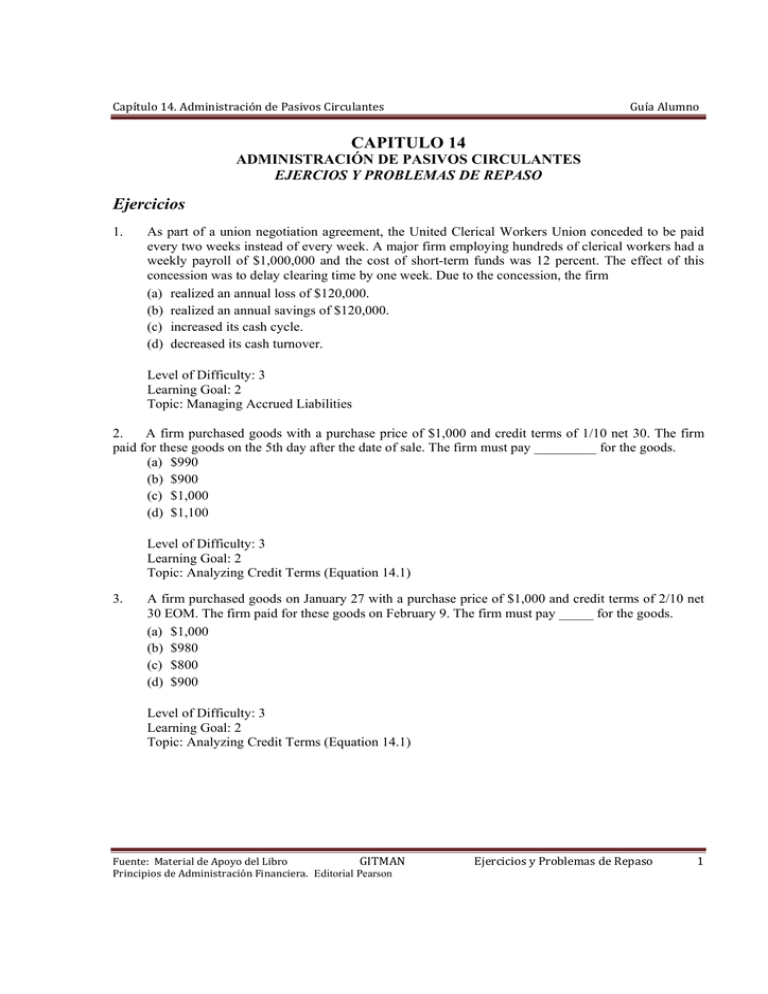

Capítulo 14. Administración de Pasivos Circulantes Guía Alumno CAPITULO 14 ADMINISTRACIÓN DE PASIVOS CIRCULANTES EJERCIOS Y PROBLEMAS DE REPASO Ejercicios 1. As part of a union negotiation agreement, the United Clerical Workers Union conceded to be paid every two weeks instead of every week. A major firm employing hundreds of clerical workers had a weekly payroll of $1,000,000 and the cost of short-term funds was 12 percent. The effect of this concession was to delay clearing time by one week. Due to the concession, the firm (a) realized an annual loss of $120,000. (b) realized an annual savings of $120,000. (c) increased its cash cycle. (d) decreased its cash turnover. Level of Difficulty: 3 Learning Goal: 2 Topic: Managing Accrued Liabilities 2. A firm purchased goods with a purchase price of $1,000 and credit terms of 1/10 net 30. The firm paid for these goods on the 5th day after the date of sale. The firm must pay _________ for the goods. (a) $990 (b) $900 (c) $1,000 (d) $1,100 Level of Difficulty: 3 Learning Goal: 2 Topic: Analyzing Credit Terms (Equation 14.1) 3. A firm purchased goods on January 27 with a purchase price of $1,000 and credit terms of 2/10 net 30 EOM. The firm paid for these goods on February 9. The firm must pay _____ for the goods. (a) $1,000 (b) $980 (c) $800 (d) $900 Level of Difficulty: 3 Learning Goal: 2 Topic: Analyzing Credit Terms (Equation 14.1) Fuente: Material de Apoyo del Libro GITMAN Ejercicios y Problemas de Repaso Principios de Administración Financiera. Editorial Pearson 1 Capítulo 14. Administración de Pasivos Circulantes Guía Alumno 4. The cost of giving up a cash discount under the terms of sale 1/10 net 60 (assume a 360-day year) is (a) 7.2 percent. (b) 6.1 percent. (c) 14.7 percent. (d) 12.2 percent. Level of Difficulty: 3 Learning Goal: 2 Topic: Cost of Giving up a Cash Discount (Equation 14.1) 5. The cost of giving up a cash discount under the terms of sale 5/20 net 120 (assume a 360-day year) is (a) 15 percent. (b) 18.9 percent. (c) 15.8 percent. (d) 20 percent. Level of Difficulty: 3 Learning Goal: 2 Topic: Cost of Giving up a Cash Discount (Equation 14.1) 6. A bank lends a firm $500,000 for one year at 8 percent and requires compensating balances of 10 percent of the face value of the loan. The effective annual interest rate associated with this loan is (a) 8.9 percent. (b) 8 percent. (c) 7.2 percent. (d) 7.0 percent. Level of Difficulty: 3 Learning Goal: 3 Topic: Compensating Balances and Effective Interest Rates (Equation 14.3) Fuente: Material de Apoyo del Libro GITMAN Ejercicios y Problemas de Repaso Principios de Administración Financiera. Editorial Pearson 2 Capítulo 14. Administración de Pasivos Circulantes Guía Alumno 7. A firm arranges a discount loan at a 12 percent interest rate, and borrows $100,000 for one year. The stated interest rate is _________ and the effective interest rate is _________. (a) 12.00%; 12.00% (b) 13.64%; 12.00% (c) 12.00%; 13.64% (d) 12.00%; 10.71% Level of Difficulty: 4 Learning Goal: 3 Topic: Computing the Effective Rate of Interest (Equation 14.4) 8. XYZ Corporation borrowed $100,000 for six months from the bank. The rate is prime plus 2 percent. The prime rate was 8.5 percent at the beginning of the loan and changed to 9 percent after two months. This was the only change. How much interest must XYZ corporation pay? (a) $2,476. (b) $5,417. (c) $18,212. (d) $21,500. Level of Difficulty: 4 Learning Goal: 3 Topic: Computing Loan Interest (Equation 14.3) 9. A firm has a line of credit and borrows $25,000 at 9 percent interest for 180 days or half a year. What is the effective rate of interest on this loan if the interest is paid in advance? (a) 4.7 percent. (b) 9.4 percent. (c) 9.9 percent. (d) 10.3 percent. Level of Difficulty: 4 Learning Goal: 3 Topic: Computing the Effective Rate of Interest (Equation 14.4) Fuente: Material de Apoyo del Libro GITMAN Ejercicios y Problemas de Repaso Principios de Administración Financiera. Editorial Pearson 3 Capítulo 14. Administración de Pasivos Circulantes Guía Alumno 10. A firm arranged for a 120-day bank loan at an annual rate of interest of 10 percent. If the loan is for $100,000, how much interest in dollars will the firm pay? (Assume a 360-day year.) (a) $10,000. (b) $30,000. (c) $3,333. (d) $1,000. Level of Difficulty: 4 Learning Goal: 3 Topic: Computing Loan Interest (Equation 14.3) 11. A firm has directly placed an issue of commercial paper that has a maturity of 60 days. The issue sold for $980,000 and has an annual interest rate of 12.24 percent. The value of the commercial paper at maturity is (a) $19,992. (b) $980,000. (c) $999,992. (d) $960,008. Level of Difficulty: 3 Learning Goal: 4 Topic: Commercial Paper 12. Tangshan Mining was extended credit terms of 3/15 net 30 EOM. The cost of giving up the cash discount, assuming payment would be made on the last day of the credit period, would be (a) 75.25%. (b) 18.56%. (c) 72.99%. (d) 37.12%. Level of Difficulty: 3 Learning Goal: 1 Topic: Cost of Giving Up a Cash Discount (Equation 14.1) 13. Tangshan Mining was extended credit terms of 3/15 net 30 EOM. The cost of giving up the cash discount, assuming payment would be made on the last day of the credit period, is 75.25 percent. If the firm were able to stretch its accounts payable to 60 days without damaging its credit rating, the cost of giving up the cash discount would only be (a) 18.81%. (b) 18.25%. (c) 21.90%. (d) 22.58%. Level of Difficulty: 4 Topic: Cost of Giving Up a Cash Discount (Equation 14.1) Fuente: Material de Apoyo del Libro GITMAN Ejercicios y Problemas de Repaso Principios de Administración Financiera. Editorial Pearson 4 Capítulo 14. Administración de Pasivos Circulantes Guía Alumno 14. Tangshan Mining was extended credit terms of 3/15 net 30 EOM. The cost of giving up the cash discount, assuming payment would be made on the last day of the credit period, would be _________. If the firm were able to stretch its accounts payable to 60 days without damaging its credit rating, the cost of giving up the cash discount would only be _________. (a) 72.99%; 18.81%. (b) 72.99%; 18.25%. (c) 75.25%; 21.90%. (d) 75.25%; 22.58%. Level of Difficulty: 4 Learning Goal: 1 Topic: Cost of Giving Up a Cash Discount (Equation 14.1) 15. Tangshan Mining borrowed $100,000 for one year under a line of credit with a stated interest rate of 7.5 percent and a 15 percent compensating balance. Normally, the firm keeps almost no money in its checking account. Based on this information, the effective annual interest rate on the loan is (a) 7.5% (b) 8.0% (c) 8.8% (d) 7.2% Level of Difficulty: 3 Learning Goal: 3 Topic: Lines of Credit with Compensating Balances (Equation 14.3) 16. Tangshan Mining borrowed $100,000 for one year under a line of credit with a stated interest rate of 7.5 percent and a 15 percent compensating balance. Normally, the firm keeps a balance of about $10,000 in its checking account. Based on this information, the effective annual interest rate on the loan was 8.89 percent. (a) 7.5% (b) 8.0% (c) 8.8% (d) 7.2% Level of Difficulty: 3 Learning Goal: 3 Topic: Lines of Credit with Compensating Balances (Equation 14.1) Fuente: Material de Apoyo del Libro GITMAN Ejercicios y Problemas de Repaso Principios de Administración Financiera. Editorial Pearson 5 Capítulo 14. Administración de Pasivos Circulantes Guía Alumno 17. Tangshan Mining borrowed $100,000 for one year under a revolving credit agreement that authorized and guaranteed the firm access to $200,000. The revolving credit agreement had a stated interest rate of 7.5 percent and charged the firm a one percent commitment fee on the unused portion of the agreement. Based on this information, the effective annual interest rate on the loan was (a) 7.5%. (b) 8.0%. (c) 8.5%. (d) 9.0%. Level of Difficulty: 3 Learning Goal: 3 Topic: Revolving Credit Agreements (Equation 14.1) 18. Tangshan Mining issued $1,000,000 of commercial paper for $992,500 for 45 days. Based on this information, the effective annual rate of interest on the commercial paper would be (a) 6.13%. (b) 6.29%. (c) 6.24%. (d) 6.08%. Level of Difficulty: 3 Learning Goal: 4 Topic: Commercial Paper (Equation 14.1) Problemas 1. ProntoPak Rapid Delivery Service is analyzing the credit terms of each of three suppliers, A, B, and C. Supplier A B C Credit Terms 1/15 net 40 2/10 net 30 2/15 net 35 (a) Determine the approximate cost of giving up the cash discount. (b) Assuming the firm needs short-term financing, recommend whether or not the firm should give up the cash discount or borrow from the bank at 10 percent annual interest. Evaluate each supplier separately. Level of Difficulty: 3 Learning Goal: 2 Topic: Cost of Giving Up a Cash Discount (Equation 14.1) Fuente: Material de Apoyo del Libro GITMAN Ejercicios y Problemas de Repaso Principios de Administración Financiera. Editorial Pearson 6 Capítulo 14. Administración de Pasivos Circulantes Guía Alumno 2. Mime Theatrical Supply is in the process of negotiating a line of credit with two local banks. The prime rate is currently 8 percent. The terms follow: Bank 1st National 2nd National Loan Terms 1 percent above prime rate on a discounted basis and a 20 percent compensating balance on the face value of the loan. 2 percent above prime rate and a 15 percent compensating balance. (a) Calculate the effective interest rate of both banks. (b) Recommend which bank’s line of credit Mime Theatrical Supply should accept. Level of Difficulty: 3 Learning Goal: 3 Topic: Computing the Effective Interest Rate (Equation 15.3 and Equation 15.4) 3. A&A Company purchased a new machine on October 20th, 2003 for $1,000,000 on credit. The supplier has offered A&A terms of 2/10, net 45. The current interest rate the bank is offering is 16 percent. (a) Compute the cost of giving up cash discount. (b) Should the firm take or give up the cash discount? (c) What is the effective rate of interest if the firm decides to take the cash discount by borrowing money on a discount basis? Level of Difficulty: 3 Learning Goal: 3 Topic: Cost of Giving Up a Cash Discount (Equation 14.1) 4. General Aviation has just sold an issue of 30-day commercial paper with a face value of $5,000,000. The firm has just received $4,958,000. What is the effective annual interest rate on the commercial paper? Level of Difficulty: 3 Learning Goal: 4 Topic: Computing the Effective Interest Rate (Equation 14.3) Fuente: Material de Apoyo del Libro GITMAN Ejercicios y Problemas de Repaso Principios de Administración Financiera. Editorial Pearson 7 Capítulo 14. Administración de Pasivos Circulantes Guía Alumno 5. A&A Apple Company would like to manufacture and market a new packaging. A&A has sold an issue of commercial paper for $1,500,000 and maturity of 90 days to finance the new project. Compute the annual interest rate on the issue of commercial paper if the value of the commercial paper at maturity is $1,650,000. Level of Difficulty: 3 Learning Goal: 4 Topic: Computing the Effective Interest Rate (Equation 14.3) 6. Giant Feeds, Inc. is considering obtaining funding through advances against receivables. Total annual credit sales are $600,000, terms are net 30 days, and payment is made on the average of 30 days. Western National Bank will advance funds under a pledging arrangement for 13 percent annual interest. On average, 75 percent of credit sales will be accepted as collateral. Commodity Finance offers factoring on a nonrecourse basis for a 1 percent factoring commission, charging 1.5 percent per month on advances and requiring a 15 percent factor’s reserve. Under this plan, the firm would factor all accounts and close its credit and collections department, saving $10,000 per year. (a) What is the effective interest rate and the average amount of funds available under pledging and under factoring? (b) Which plan do you recommend? Why? Level of Difficulty: 4 Learning Goal: 5 Topic: Computing the Effective Interest Rate 7. Discuss and contrast the three types of loans discussed in the text that use inventory as collateral: floating inventory liens, trust receipt inventory loans, and warehouse receipt loans. Level of Difficulty: 3 Learning Goal: 6 Topic: The Use of Inventory as Collateral Fuente: Material de Apoyo del Libro GITMAN Ejercicios y Problemas de Repaso Principios de Administración Financiera. Editorial Pearson 8