Quantitative Research

Anuncio

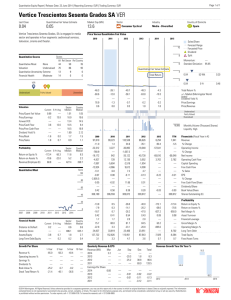

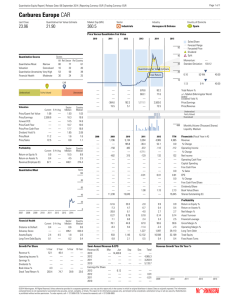

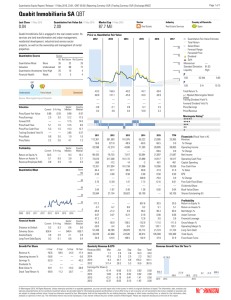

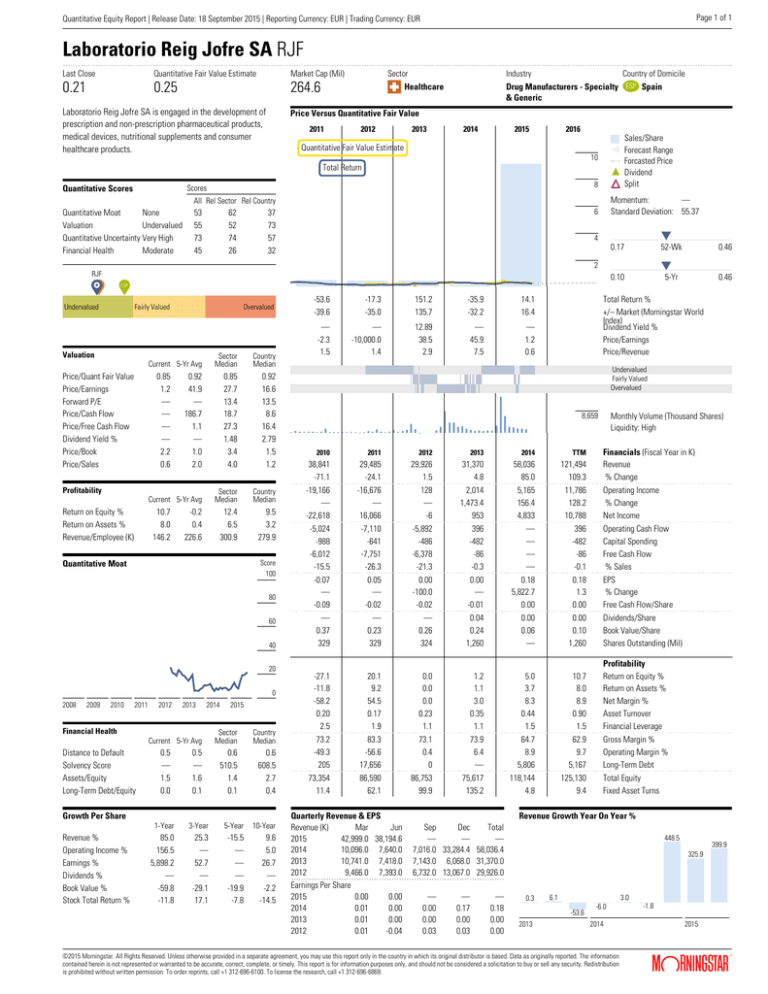

Page 1 of 1 Quantitative Equity Report | Release Date: 18 September 2015 | Reporting Currency: EUR | Trading Currency: EUR Laboratorio Reig Jofre SA RJF Last Close Quantitative Fair Value Estimate Market Cap (Mil) Sector 0.21 0.25 264.6 d Healthcare Laboratorio Reig Jofre SA is engaged in the development of prescription and non-prescription pharmaceutical products, medical devices, nutritional supplements and consumer healthcare products. Industry Country of Domicile Drug Manufacturers - Specialty ESP Spain & Generic Price Versus Quantitative Fair Value 2011 2012 2013 2014 2015 2016 Sales/Share Forecast Range Forcasted Price Dividend Split Quantitative Fair Value Estimate 10 Total Return Quantitative Scores 8 Scores Momentum: — Standard Deviation: 55.37 All Rel Sector Rel Country Quantitative Moat None Valuation Undervalued Quantitative Uncertainty Very High Financial Health Moderate 53 55 73 45 62 52 74 26 6 37 73 57 32 4 0.17 52-Wk 0.46 0.10 5-Yr 0.46 2 RJF d ESP Undervalued Fairly Valued Overvalued Valuation Sector Median Country Median 0.92 41.9 — 186.7 1.1 — 1.0 2.0 0.85 27.7 13.4 18.7 27.3 1.48 3.4 4.0 0.92 16.6 13.5 8.6 16.4 2.79 1.5 1.2 Current 5-Yr Avg Sector Median Country Median 12.4 6.5 300.9 9.5 3.2 279.9 Current 5-Yr Avg Price/Quant Fair Value Price/Earnings Forward P/E Price/Cash Flow Price/Free Cash Flow Dividend Yield % Price/Book Price/Sales 0.85 1.2 — — — — 2.2 0.6 Profitability Return on Equity % Return on Assets % Revenue/Employee (K) 10.7 8.0 146.2 -0.2 0.4 226.6 Score 100 Quantitative Moat 80 60 40 20 0 2008 2009 2010 2011 2012 2013 2014 Financial Health Current 5-Yr Avg Distance to Default Solvency Score Assets/Equity Long-Term Debt/Equity 2015 Sector Median Country Median 0.6 510.5 1.4 0.1 0.6 608.5 2.7 0.4 0.5 — 1.5 0.0 0.5 — 1.6 0.1 1-Year 3-Year 5-Year 10-Year 85.0 156.5 5,898.2 — -59.8 -11.8 25.3 — 52.7 — -29.1 17.1 -15.5 — — — -19.9 -7.8 9.6 5.0 26.7 — -2.2 -14.5 Growth Per Share Revenue % Operating Income % Earnings % Dividends % Book Value % Stock Total Return % -53.6 -39.6 -17.3 -35.0 151.2 135.7 -35.9 -32.2 14.1 16.4 — -2.3 1.5 — -10,000.0 1.4 12.89 38.5 2.9 — 45.9 7.5 — 1.2 0.6 Total Return % +/– Market (Morningstar World Index) Dividend Yield % Price/Earnings Price/Revenue Undervalued Fairly Valued Overvalued Monthly Volume (Thousand Shares) Liquidity: High 8,659 Financials (Fiscal Year in K) Revenue % Change 2010 2011 2012 2013 2014 TTM 38,841 -71.1 29,485 -24.1 29,926 1.5 31,370 4.8 58,036 85.0 121,494 109.3 -19,166 — -22,618 -16,676 — 16,066 128 — -6 2,014 1,473.4 953 5,165 156.4 4,833 11,786 128.2 10,788 -5,024 -988 -6,012 -15.5 -7,110 -641 -7,751 -26.3 -5,892 -486 -6,378 -21.3 396 -482 -86 -0.3 — — — — 396 -482 -86 -0.1 Operating Cash Flow Capital Spending Free Cash Flow % Sales -0.07 — -0.09 0.05 — -0.02 0.00 -100.0 -0.02 0.00 — -0.01 0.18 5,822.7 0.00 0.18 1.3 0.00 EPS % Change Free Cash Flow/Share — 0.37 329 — 0.23 329 — 0.26 324 0.04 0.24 1,260 0.00 0.06 — 0.00 0.10 1,260 -27.1 -11.8 -58.2 0.20 2.5 20.1 9.2 54.5 0.17 1.9 0.0 0.0 0.0 0.23 1.1 1.2 1.1 3.0 0.35 1.1 5.0 3.7 8.3 0.44 1.5 10.7 8.0 8.9 0.90 1.5 Profitability Return on Equity % Return on Assets % Net Margin % Asset Turnover Financial Leverage 73.2 -49.3 205 83.3 -56.6 17,656 73.1 0.4 0 73.9 6.4 — 64.7 8.9 5,806 62.9 9.7 5,167 Gross Margin % Operating Margin % Long-Term Debt 73,354 11.4 86,590 62.1 86,753 99.9 75,617 135.2 118,144 4.8 125,130 9.4 Quarterly Revenue & EPS Revenue (K) Mar Jun 2015 42,999.0 38,194.6 2014 10,096.0 7,640.0 2013 10,741.0 7,418.0 2012 9,466.0 7,393.0 Earnings Per Share 2015 0.00 0.00 2014 0.01 0.00 2013 0.01 0.00 2012 0.01 -0.04 Operating Income % Change Net Income Dividends/Share Book Value/Share Shares Outstanding (Mil) Total Equity Fixed Asset Turns Revenue Growth Year On Year % Sep Dec Total — — — 7,016.0 33,284.4 58,036.4 7,143.0 6,068.0 31,370.0 6,732.0 13,067.0 29,926.0 — 0.00 0.00 0.03 — 0.17 0.00 0.03 — 0.18 0.00 0.00 448.5 399.9 325.9 0.3 6.1 3.0 -53.6 2013 -6.0 2014 ©2015 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. -1.8 2015 ® ß