Industria cervecera en Australia

Anuncio

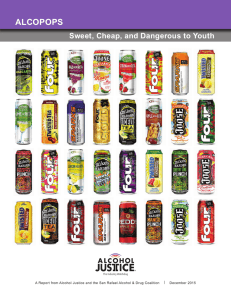

Introduction The brewing industry in Australia has been developed since the early years of its colonial history. The establishment and growth of cultivation of barley and hops and the setting up of factories to process the products and brew the beer have been employment and country income generators through years. Nowadays, the Australian market has more than 10 different major national brands that represent more than A$8 billion. However, the entrance of international brands that compete directly to the Australian beer market has been increasing in the past years. This paper aims to present an analysis of the brewing industry in Australia and make a recommendation to Grupo Modelo, a Mexican beer company, about whether or not to extend their current product line within Australia. Grupo Modelo is considered as the 8th most important brewery worldwide and its most important brand, Corona is ranked as the 5th more sold beer in the world. Corona was introduced to the Australian market 10 years ago and nowadays is considered one of the most recognized international brands in Australia. ECONOMIC CHARACTERISTICS OF THE BEER INDUSTRY • The Australian beer market was worth A$7.8 billion in 1999. • Annual beer consumption in Australia stood at almost 1.8 billion litres in 1999. • Advertising of alcoholic beverages is only permitted on television after 20.30hrs, during sporting events and on public holidays. • Queensland and West Australia are the fastest growing states in terms of population as Australians and new immigrants settle in warmer climates. • Margins are highest in the premium segment of the market, which is not value dependent and so does not encounter pricing pressure and in light beers where favourable taxation allows manufacturers to sell at a discount to regular beer while maintaining their profitability. It is also higher for bulk than for packaged beers, because competitive pressures force the manufacturer to absorb some of the higher costs of distribution and packaging. • Beer pricing in Australia was set by a regulatory body, the Price Surveillance Authority, which required that any price increases be submitted to and approved by the Authority. 1 MAJOR COMPETITORS IN THE INDUSTRY There are two major competitors in the Australian beer market. Carlton & United Breweries controlled by Foster's Brewing Group and Lion Nathan Breweries. A potential third major player, the Philippine San Miguel, made its entry through the acquisition of the small premium beer producer James Boag & Son (Tasmania). Foster's Brewing Group Is one of the most known brands in the world, being sold in more than 135 countries. The company used to limit its operations to the Australian market, but in the late 90s installed breweries in China, India and Vietnam. It licenses its brands to other producers to manufacture. Carlton & United Breweries It is the Australian brewing division of Foster's Brewing Group and its largest profit contributor. Producing more than half of the beer consumed in Australia, being the leader of all segments and market niches, and also well known because of the major investments to sponsor events such as the AFL and the Australian Formula One Grand Prix. Lion Nathan This is the second brewer in Australia after Carlton & United Breweries. It holds operations in four Australian states: Qld, NSW, SA and WA. This company holds the biggest market share in New South Wales, as well as the official sponsor of the Melbourne Cup horse race. Just like Foster's, Lion Nathan have built new breweries in China and other Asian countries. MAJOR STRATEGIES The main packaging material for beer is glass bottles and aluminium cans. However, the increased popularity of premium beer, which is sold exclusively in glass, contributed to the growth of this medium of packaging. Nevertheless, Carlton Cold released since 1996, a package in coated PET unbreakable bottles. The new format popularity has increased markedly since this time. Lion Nathan produced an interesting innovation when, in July 1999, launched a 700ml bottle of Hahn Premium, the first premium brand to be packaged in a bottle of this size. The rising popularity of premium ale has lead to an increase of sales of imported commodities. Therefore, all imported beers are sold in the premium category. Among those with distribution and contract brewing 2 agreements with major international brewing companies it is possible to mention: Lion Nathan and Foster's brewing Group. Carlton & United Breweries and Irish brewer Guinness strengthened their relationship through a second bulk brewing deal. A distribution strategy among alcoholic beverages is mainly based on the establishment of liquor retail outlets in conjunction with large supermarket chains. Another strategy for breweries companies is to implement price−cutting and massive marketing campaigns in order to reinforce their status in popular and premium sectors. MARKET SHARES In the late 90s, the Australian market was virtually a duopoly, controlled by Carlton & United Breweries and Lion Nathan. This duopoly covers the 95% of the total beer market (Carlton & United Breweries with 53% and Lion Nathan with 42%). The most popular beer brands in Australia are Victoria Bitter (Carlton & United Breweries), which held 18% 3 of the market in 1999, Foster's Light Ice (11% of sales in 1999) and Lion Nathan's Tooheys New (market share of 8% in 1999). However, Lion Nathan entered the Victorian market with an aggressive marketing campaign a few years ago with its products Tooheys New and the most recently launched Hahn Premium. COMPETITIVE CONDITIONS OVER THE RECENT PAST • Threat of new entrants Many international brands have entered into the Australian market. − Lion Nathan made an agreement in July 2000 with a German brewery to commercialise a German premium beer called Beck in the Australian market. In addition, Lion has a deal with a New Zealand beer brand Steinlager. − Carlton & United Breweries and Irish Brewer strengthened their deal in past years. The former company is brewing two brands in its Yatala, Brisbane brewery: Guinness and Guinness' Kilkenny. This decision was taken because in 1998/1999 Kilkenny brand grew significally and nowadays is considered as the second largest selling international beer in Australia, and Guinness as the first one. − Carlton & United Breweries distribute brands such as Corona, Heinekin, Miller and Stella Artois. − The main entry barriers for international brands are: ♦ Cost disadvantages ♦ Government policy ♦ Expected retaliation • Substitute products Nowadays, the beer industry has suffered a diversification of products being segmented in lager (premium, standard and economy categories), dark beer, and stout and non/low alcohol beer. This diversification has come from the development of premium brands and products with the variation of alcohol levels. Low−alcohol beverages are considered as substitute products of beer. Normally the beer contains between 2.5% and 5% of alcohol, while the price at public places is between A$3.5 and A$6. Based on these specifications some of the substitute products that could be found in the Australian market are: Coruba & Cola: Jim Beam white and cola; Stoli Lemon, cranberry and orange Ruski: Stolichnaya vodka and lemonade 4 cranberry juice or orange soda; Bacardi Breezer: White Bacardi and fruit juices. These products may decrease the possibility of success in the extension of Grupo Modelo line beer products. • Bargaining power of suppliers Considering that the Mexican beer will be imported as a finished good to Australia, it is important to understand the bargaining power of the Mexican suppliers. Suppliers of cans, glass, labels, taps and the raw materials to produce the beer will increase their bargaining power because as Grupo Modelo will require higher quantity of materials to fulfil both, the national and international demand. As a consequence, suppliers will need to increase their production levels and probably investment would be needed to deliver materials on time. In addition, if any material is scarce or it is not enough to fulfil the production levels its price may increase. So far, Grupo Modelo has not had any production problem to reach the market in 150 countries in which it has presence. In fact, by 1999 Grupo Modelo production capacity was 39.5 millions of hl, and it is estimated to achieve 60 millions of hl by 2004. • Bargaining power of buyers The actual distributor of Grupo Modelo products in Australia is Carlton & United Breweries, thus Grupo Modelo new brands must take advantage of Corona actual distribution channels. However, retailers will be looking for the benefits of selling the new brands, therefore, Grupo Modelo has to develop attractive promotional and pricing plans to be on the retailers' shelves. At the end, customers will be looking for higher quality, greater levels of service and lower prices (Hitt, Ireland and Hoskisson, 2001). • Intensity of Rivalry among competitors. Considering the classification of industries of Hitt et al (2001), the beer industry can be classified as one where there are numerous and equal balanced competitors. The Australian market has many brands, thus final consumers have broad alternatives. Besides, the differentiation in this sort of product is based just on flavour and taste. FACTORS CAUSING COMPETITIVE CONDITIONS TO CHANGE Opportunities and Risks Economical indicators The most important economic measures that expose the real economic growth and welfare distribution are the real GDP and the GDP per capita, which have steady decreased during the last five year. 5 The interest rate and the exchange rate determine the financial market stability and the purchase power of the currency. Nowadays, while the interest rate is low and stable, the exchange rate indicates strong volatility and weak parity. Australian trade among other countries represents an important issue for entering to the beer industry. The level of net imports and the explanation of it are factors that determine the openness of the economy. Nowadays, net imports has increase significantly. The most important Australia's trade partners are Japan and United States. The level of foreign investment in Australia is twice the Australian investment abroad (Market Information and Analysis Unit, DFAT, 31/03/01). 6 Demographic indicators • The resident population of Australia is 19,526,686 (March 2002). • Australia´s population is concentrated in the south−east and east coastal regions. Half the area of the continent contains only 0.3% of the population, and the most densely populated 1% of the continent contains 84% of the population. Population Distribution Source: Regional Population Growth, Australia and New Zealand (3218.0). While New South Wales remains the most populous State, with 6.5 million people at June 2000, the fastest growth has occurred in the Northern Territory and Queensland, with increases of 10.1% and 9.2% respectively in the five years to 2000. The annual growth rate of the population has declined from an average of 1.5 in the 80's to 1.25 in the 90's. The population has continued to age, which indicates a minimum intrinsic growth in the long term. Profile of Australian Population 1901−2000 7 8 From the previous chart it can be observed that the most significant group of actual beer consumers has increased in the latest 20 years. However, the potential beer consumers group has decreased during the same period. Annual beer consumption stood at almost 1.8 billion litres in 1999. Per capita beer consumption is high relative to most other countries, reflecting a climate and culture, which is conducive to beer consumption. However, per capita consumption was in decline until 1998, by more than the population growth and resulting in declining overall consumption. Socio−cultural indicators • Australia receives more world tourism than it generates (international visitors to Australia could grow up to 8.4 millions by year 2004). • During the past year, more than 6 million people attended to a sport event (Australian Bureau of Statistics) where the consumption of alcoholic beverages is very high. Political indicators • The Australian Government has recognised alcohol abuse as a major problem in Australian society. It has therefore imposed an excise charge on beer, according to alcohol content, the effect is that the lower the alcohol content of the beer, the less expensive it is. It is thought that this encourages consumption of lower−alcohol products in preference to full−strength beer. • A flat wholesale sales tax of 37% was levied on all beer sold in 1999. An excise duty is also levied in addition to this, the level of which depends on the alcohol content of the product. No excise is charged on beer with an alcohol content less than 1.15%. • A customs duty applies to all imported products. This duty is also levied according to alcohol content. For beer with alcohol content less than 1.15% the charge is 5%. • Industry sources predict that the Government's actions will cause the price of beer in horeca to rise by 9%, due to the imposition of the 10% GST on the service component. LIKELY FUTURE DEVELOPMENT OF THE INDUSTRY According to the forecast, Standard lager will retain its position as the largest sub−sector with an estimated consumption standing at 954 million litres in 2004. Standard lager is also the only sub−sector, which is expected to encounter reduced consumption over this period, as consumers increasingly choose the low− and mid−strength alcohol products from within the economy sub−sector, and premium products. The premium sub−sector was still underdeveloped in 1999 therefore it is expected that consumption of these products will continue to grow rising 111%, to reach 165 million litres by 2004. 9 All the brewing companies can be expected to invest considerable funds in promoting the premium sub−sector, particularly the large players. The economy lager sub−sector is also expected to continue its strong growth. By 2004, it is predicted that volume sales will be in the order of 817 million litres. Growth in the economy sub−sector is also being positively affected by government legislation and programmes, which encourage moderate alcohol consumption. Dark Beer and stout are expected to continue to increases in popularity as they are introduced to consumers through the numerous and expanding Irish and English theme hotels. These venues generally carry an array of imported beers, including stouts and dark beers, on tap, and promote them as a way of creating an atmosphere similar to a genuine English or Irish hotel. Growth in the consumption of these products is expected to increase by 42% and 19% respectively over the forecast period. A number of hotel chains have developed, based on these Irish and English themes, for example the Elephant and Wheelbarrow English theme pubs and Breidy Oreilly's Irish Pubs. CONCLUSION After analysing the competitive environment of the beer industry in Australia, we consider that Grupo Modelo has the opportunity of introducing and expanding its presence in this market. Although the industry has well defined competitors, the per capita consumption shows that Australians are likely to drink beer, thus new brands might find potential consumers. Furthermore, we consider that the reinforcement of Grupo Modelo presence in the Australian market is strategic because it represents a mean for entering the Asian market. Glossary Alcohol by volume (alc./vol.) This indicates the strength of a beer by the percentage of alcohol it contains, by volume. In Australia, this is the standard way of describing strength, and is required by law to be shown on the bottle or can. Ale. Beer made by the top fermentation process, and generally with less hops than other beers. Ale was the traditional Australian beer of the nineteenth century. Today, almost all beer produced in Australia is lager. Beer. Fermented liquor brewed from malt or from a mixture of malt substitutes and flavoured with hops or other bitters. In Australia the word beer in used in a very general sense to include ale, lager, pilsener, bitter, draught, stout and others. Bitter. A term used to describe a beer that has been well hopped to give it a bitter flavour. Draught. A term describing beer that nay be served directed from the barrel. This beer is generally drawn from a barrel under pressure, through pipes to a dispensing tap at a bar. Lager. The literal meaning is `storage'. Lager is beer made by the bottom fermentation process, and stored for conditioning at cold temperatures. Light beer. Beer with a reduced alcohol content; in Australia this is generally between 0.9% and 3.3% alc./vol. Pilsener. Named after the Czech town of Pilsen, where a light coloured, bottom fermented, lager style beer was first brewed. Premium. The sector is well defined in Australia with most products having the word premium in their name. 10 However, the ultimate determinant is price. Stout. A dark beer, sometimes top fermented, and made with highly roasted malt. Possibly because of the very dark colour almost black, stout may gove the impression of being a very strong beer, but generally stout is much the same strength as regular beers. Reference List Deutsher, K. (1999). The Breweries of Australia: A History. Singapore: Craft Print Pte. Ltd. Euromonitor International. Making Sense of Global Markets. http://www.euromonitor.com (Accessed 01/03/2002). Foster´s Corporate Website. http://www.fosters.com.au (Accessed 05/03/2002) Grupo Modelo. http://www.modelo.com.mx (Accessed 05/03/2002) Lion N Co. http://www.hahnpremium.com.au/ (Accessed (05/3/2002) Hitt, M., Ireland, D. & Hoskisson, R. (4th. Edition). Strategic Management, competitiveness and Globalization. Sourh Western College Publishing. Australia. 2001. Kevin Andrews and Michelle Curtis. Changing Australia: social, cultural and economic trends changing the nation. The Federation Press. Sydney, 1998. Michelle Innis (2001). Australia: Back to basics. Far Eastern Economic Review; v164, n35, p69. Tooheysnew. http://www.tooheysnew.com.au/ (Accessed 08/03/2002). 11